The unfunded liability represents the difference between the plan assets and the projected benefit obligation

(“PBO”). The PBO represents the actuarial present value of benefits based on employee service and compensation and

includes an assumption about future compensation levels. The accumulated benefit obligation represents the actuarial

present value of benefits based on employee service and compensation, but does not include an assumption about

future compensation levels.

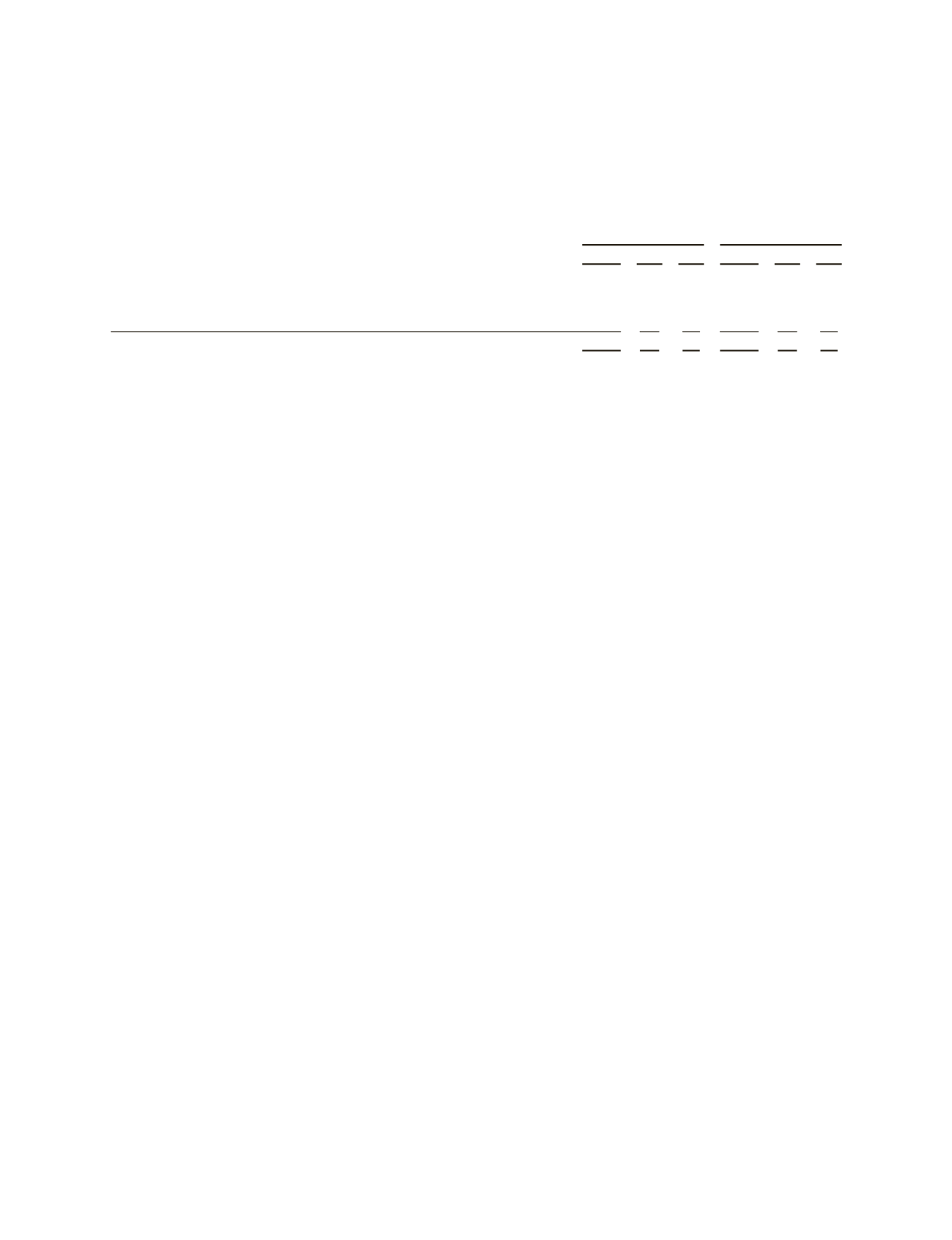

The weighted-average allocation of plan assets and the target allocation by asset category are as follows:

US

International

Target 2012 2011 Target 2012 2011

Equity securities

45 – 55% 47%

47%

50 – 70% 56%

51%

Debt securities

33 – 45 42

39

25 – 40 35

38

Cash and cash equivalents

0 – 3 2

6

0 – 3 3

4

Alternative investments

0 – 10 9

8

0 – 20 6

7

100% 100%

100%

100% 100%

100%

Schlumberger’s investment policy includes various guidelines and procedures designed to ensure that assets are

prudently invested in a manner necessary to meet the future benefit obligation of the pension plans. The policy does

not permit the direct investment of plan assets in any Schlumberger security. Schlumberger’s investment horizon is

long-term and accordingly the target asset allocations encompass a strategic, long-term perspective of capital markets,

expected risk and return behavior and perceived future economic conditions. The key investment principles of

diversification, assessment of risk and targeting the optimal expected returns for given levels of risk are applied. The

target asset allocation is reviewed periodically and is determined based on a long-term projection of capital market

outcomes, inflation rates, fixed income yields, returns, volatilities and correlation relationships. The inclusion of any

given asset class in the target asset allocation is considered in relation to its impact on the overall risk/return

characteristics as well as its impact on the overall investment return. As part of its strategy, Schlumberger may utilize

certain derivative instruments, such as options, futures, swaps and forwards, within the plans to manage risks

(currency, interest rate, etc.), as a substitute for physical securities or to obtain exposure to different markets.

Asset performance is monitored frequently with an overall expectation that plan assets will meet or exceed the

weighted index of its target asset allocation and component benchmark over rolling five-year periods.

The expected long-term rate of return on assets assumptions reflect the average rate of earnings expected on funds

invested or to be invested. The assumptions have been determined by reflecting expectations regarding future rates of

return for the portfolio considering the asset allocation and related historical rates of return. The appropriateness of

the assumptions is reviewed annually.

The fair value of Schlumberger’s pension plan assets at December 31, 2012 and 2011, by asset category, are

presented below and were determined based on valuation techniques categorized as follows:

Š

Level One: The use of quoted prices in active markets for identical instruments.

Š

Level Two: The use of quoted prices for similar instruments in active markets or quoted prices for identical or

similar instruments in markets that are not active or other inputs that are observable in the market or can be

corroborated by observable market data.

Š

Level Three: The use of significantly unobservable inputs that typically require the use of management’s

estimates of assumptions that market participants would use in pricing.

60