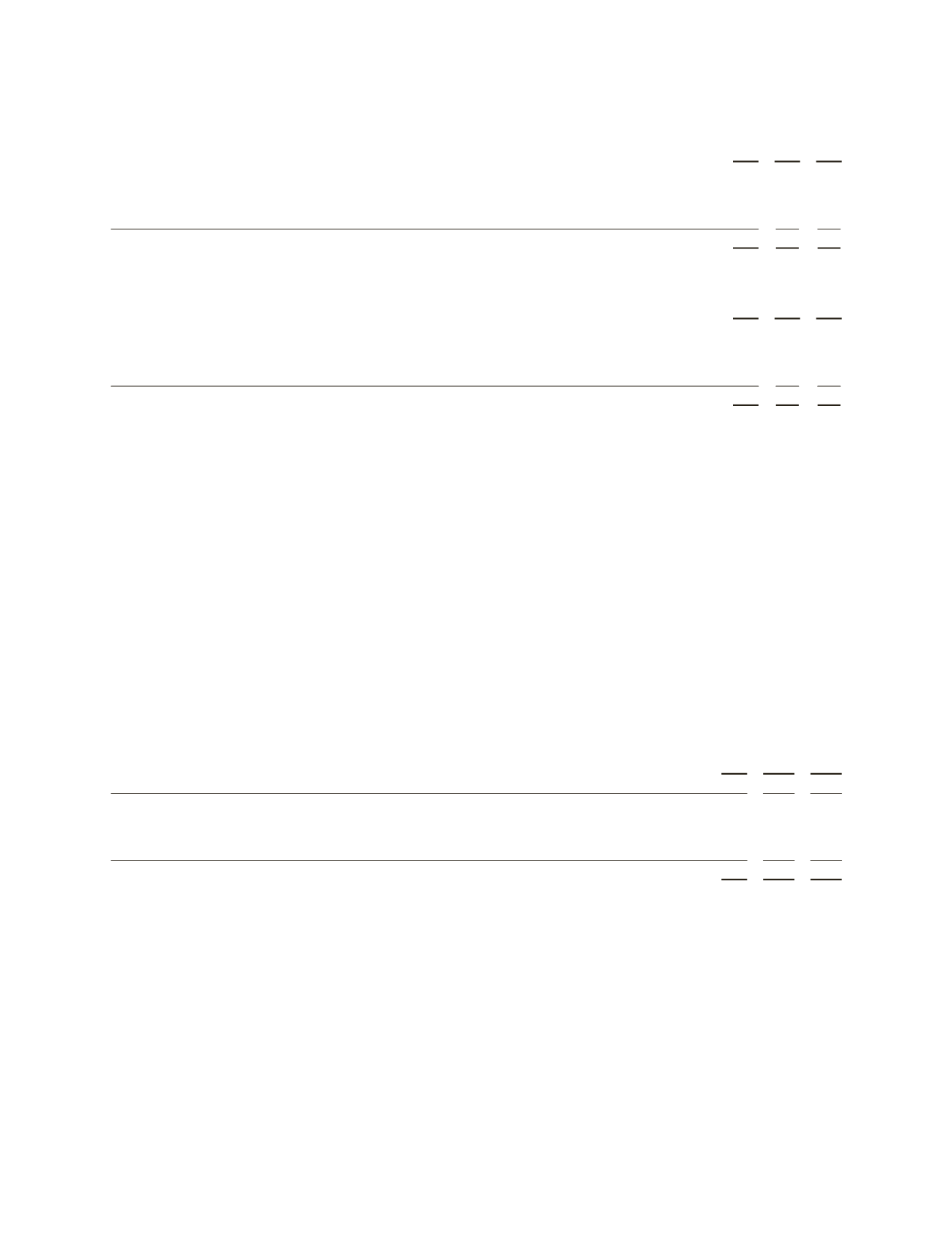

Interest and other income

includes the following:

(Stated in millions)

2012 2011 2010

Interest income

$ 30

$ 40 $ 50

Equity in net earnings of affiliated companies:

M-I SWACO

–

– 78

Others

142

90

87

$172

$130 $215

Allowance for doubtful accounts

is as follows:

(Stated in millions)

2012 2011 2010

Balance at beginning of year

$177

$185 $160

Provision

37

37

38

Amounts written off

(10)

(45) (13)

Divestiture of business

(2)

–

–

Balance at end of year

$202

$177 $185

Discontinued Operations

During the second quarter of 2012, Schlumberger sold its Wilson distribution business to National Oilwell Varco Inc.

(“NOV”) for $906 million in cash. A pretax gain of $137 million ($16 million after-tax) was recognized in connection

with this transaction.

During the third quarter of 2012, Schlumberger completed the sale of its 56% interest in CE Franklin Ltd. to NOV for

$122 million in cash. A pretax gain of $30 million ($12 million after-tax) was recognized in connection with this

transaction.

As Wilson and CE Franklin comprised Schlumberger’s previously reported Distribution segment, the results of this

entire segment have been classified as discontinued operations in the

Consolidated Statement of Income

.

During the second quarter of 2011, Schlumberger completed the divestiture of its Global Connectivity Services

business for $385 million in cash. An after-tax gain of $220 million was recognized in connection with this transaction,

and is classified in

Income from discontinued operations

in the

Consolidated Statement of Income

. The historical

results of this business were not significant to Schlumberger’s consolidated financial statements and, as such, have not

been reclassified to discontinued operations.

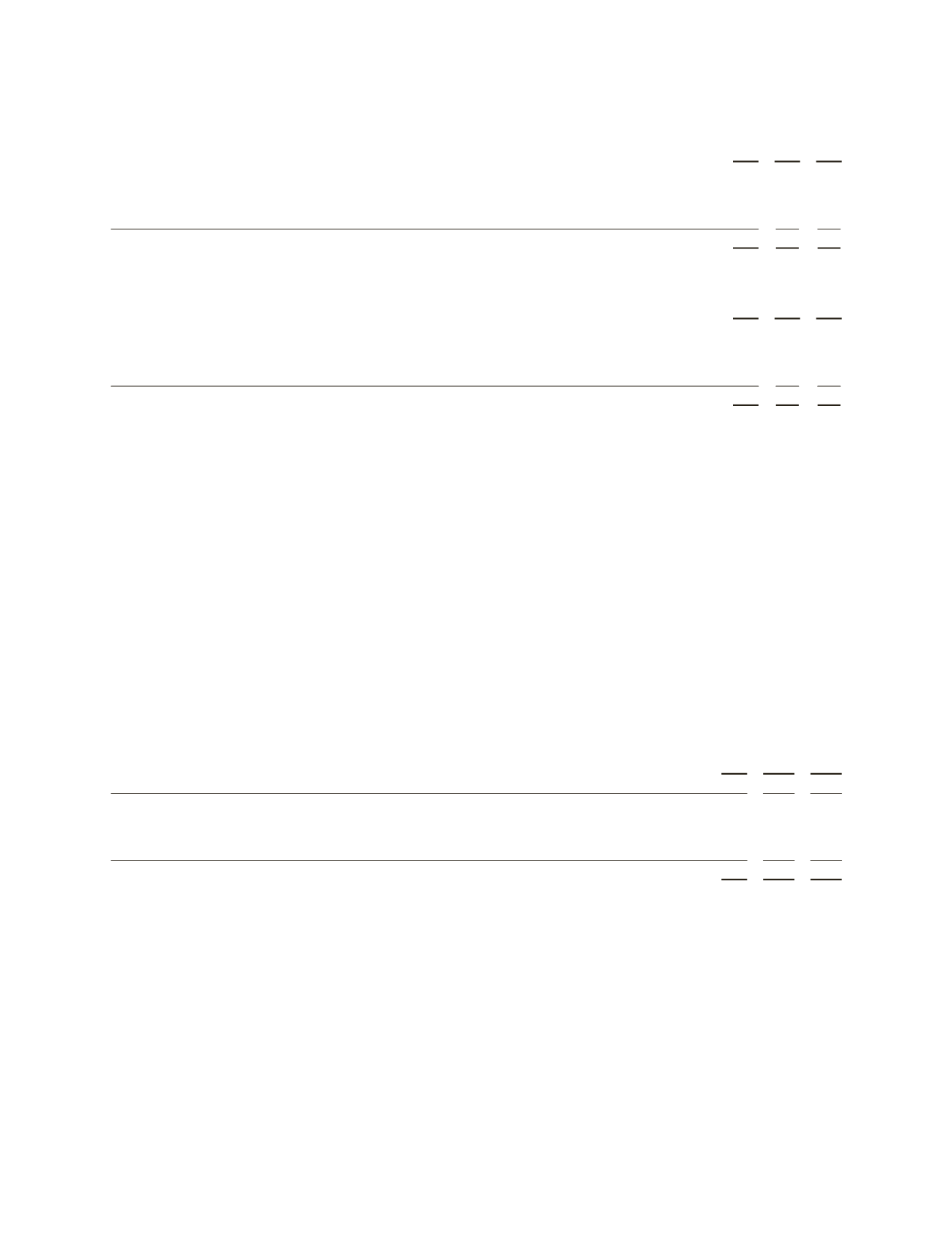

The following table summarizes the results of these discontinued operations:

(Stated in millions)

2012 2011 2010

Revenue

$982

$2,581 $1,908

Income before taxes

$ 43

$ 99 $ 24

Tax expense

(15)

(36)

(11)

Net income attributable to noncontrolling interests

(5)

(6)

(1)

Gain on divestitures, net of tax

28

220

–

Income from discontinued operations

$ 51

$ 277 $ 12

64