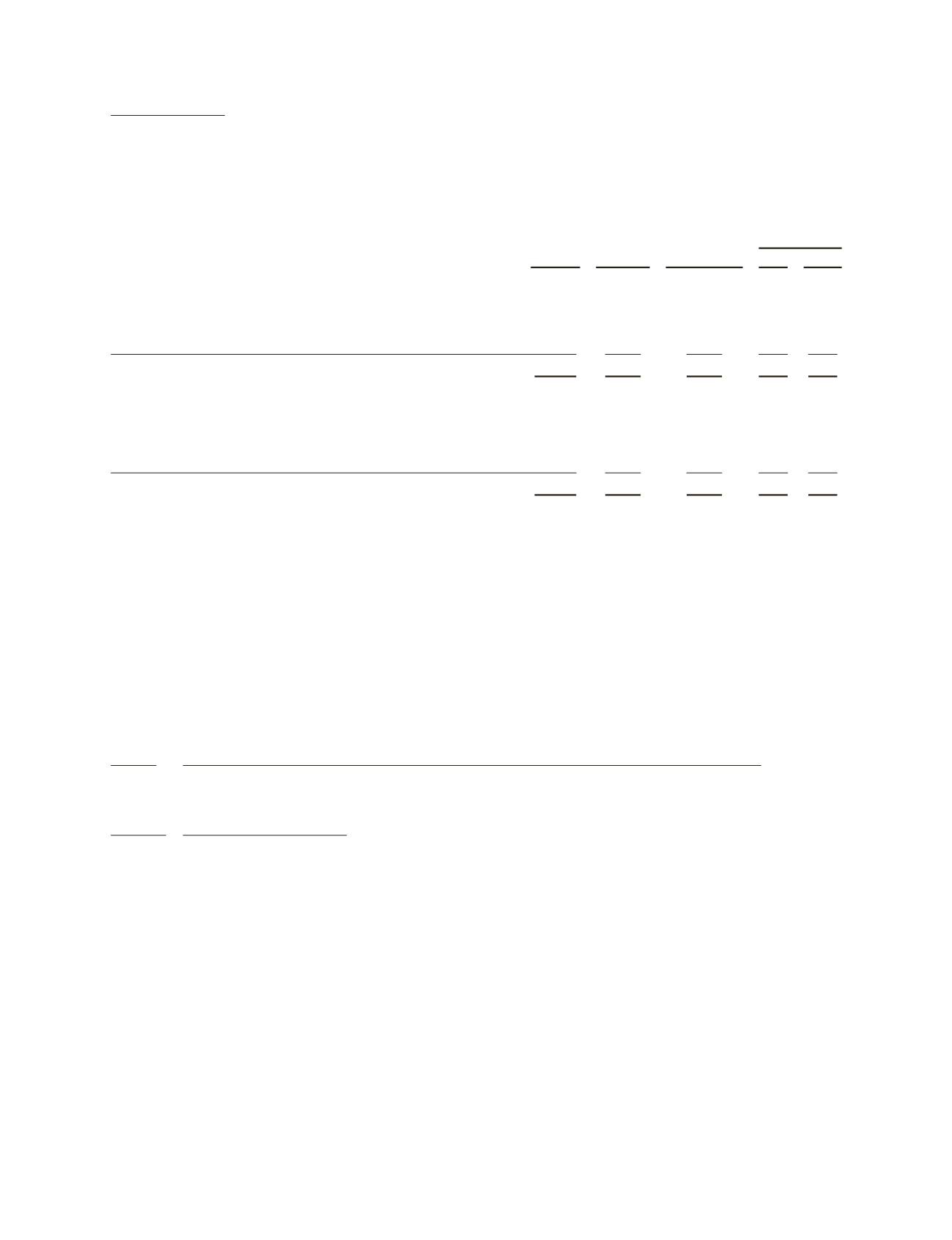

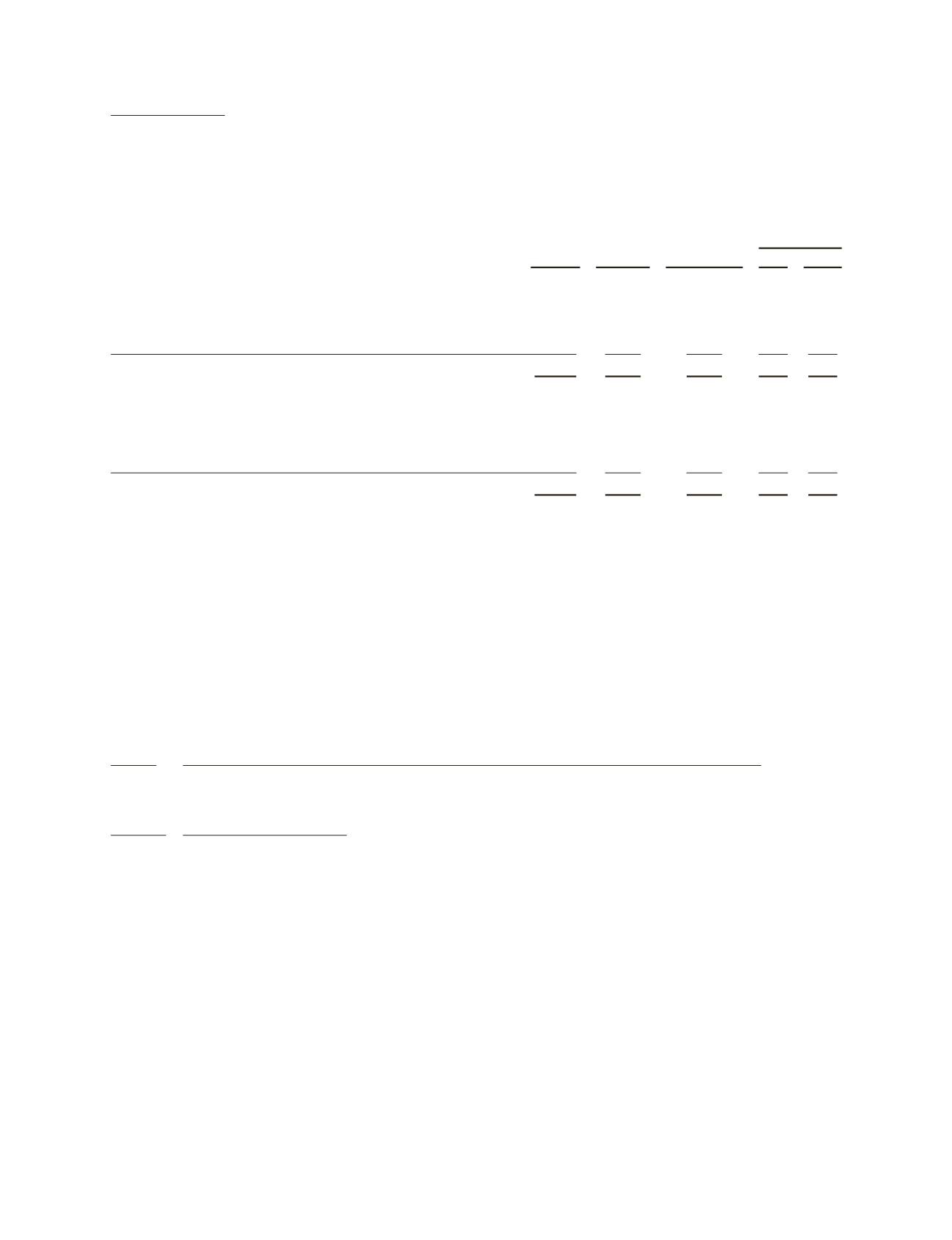

Quarterly Results

(Unaudited)

The following table summarizes Schlumberger’s results by quarter for the years ended December 31, 2012 and 2011.

(Stated in millions except per share amounts)

Gross

Net Income

attributable to

Earnings per

share of

Schlumberger

2

Revenue

2

Margin

1

,

2

Schlumberger

2

Basic Diluted

Quarters-2012

First

(3)

$ 9,918 $2,107

$1,301

$0.98 $0.97

Second

(4)

10,448

2,286

1,403

1.05 1.05

Third

(5)

10,608

2,322

1,424

1.07 1.07

Fourth

(6)

11,174

2,377

1,362

1.03 1.02

$42,149 $9,093

$5,490

$4.13 $4.10

Quarters -2011

First

(7)

$ 8,122

$ 1,639

$ 944

$ 0.69 $ 0.69

Second

(8)

8,990

1,965

1,339

0.99

0.98

Third

(9)

9,546

2,102

1,301

0.97

0.96

Fourth

(10)

10,301

2,304

1,414

1.06

1.05

$ 36,959

$ 8,010

$ 4,997

$ 3.70 $ 3.67

1.

Gross margin equals

Revenue

less

Cost of revenue

.

2.

Amounts may not add due to rounding.

3.

Net income in the first quarter of 2012 includes after-tax charges of $13 million.

4.

Net income in the second quarter of 2012 includes after-tax charges of $21 million.

5.

Net income in the third quarter of 2012 includes after-tax charges of $28 million.

6.

Net income in the fourth quarter of 2012 includes after-tax charges of $77 million.

7.

Net income in the first quarter of 2011 includes after-tax charges of $28 million.

8.

Net income in the second quarter of 2011 includes after-tax charges of $64 million.

9.

Net income in the third quarter of 2011 includes after-tax charges of $23 million.

10.

Net income in the fourth quarter of 2011 includes after-tax charges of $80 million.

* Mark of Schlumberger

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Schlumberger has carried out an evaluation under the supervision and with the participation of Schlumberger’s

management, including the Chief Executive Officer (“CEO”) and the Chief Financial Officer (“CFO”), of the

effectiveness of Schlumberger’s “disclosure controls and procedures” (as such term is defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”)) as of the end of the period covered by this

report. Based on this evaluation, the CEO and the CFO have concluded that, as of the end of the period covered by this

report, Schlumberger’s disclosure controls and procedures were effective to provide reasonable assurance that

information required to be disclosed in the reports that Schlumberger files or submits under the Exchange Act is

recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange

Commission’s rules and forms. Schlumberger’s disclosure controls and procedures include controls and procedures

designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is

accumulated and communicated to its management, including the CEO and the CFO, as appropriate, to allow timely

decisions regarding required disclosure. There has been no change in Schlumberger’s internal control over financial

reporting that occurred during the fourth quarter of 2012 that has materially affected, or is reasonably likely to

materially affect, Schlumberger’s internal control over financial reporting.

67