DEAR SHAREHOLDERS

On behalf of all of us at The John Nuveen Company, I am very pleased to report on the record results and significant accomplishments achieved in 1998.

First, 1998 marked another year of record earnings — led, in large part, by accelerating growth in products and services added since 1996.

These results reflect the impact of our new strategic direction and the investments we made in new products, new services and new ideas during the year.

We are executing a strategic transformation of our Company, a process that is having a positive impact on every part of our operations.

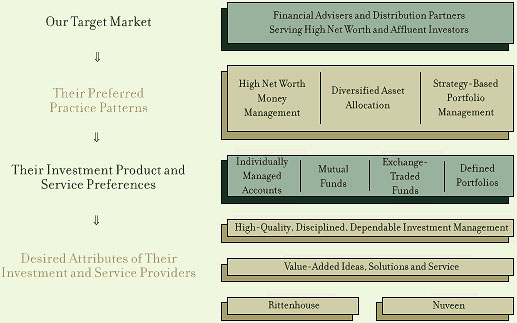

Our strategy is both simple and compelling, with two central tenets:

The first is to continue leveraging our heritage of high-quality, long-term oriented investment expertise through a broad range of relationships with financial advisers who serve affluent investors.

The second is to provide exceptional value to financial advisers by recognizing and serving their diverse needs. We are now organized around distinct lines of business — individually managed accounts, mutual funds, defined portfolios and exchange-traded funds — that reflect the business practices and service requirements of our key customers.

Consistently meeting our investment standards and providing exceptional value to financial advisers is the goal of every portfolio manager, sales representative and customer service person within the firm, and of all the rest of us who stand behind these front line contacts.

This strategy provides a connecting link between our history and our increasing role as a provider of investment solutions to financial advisers looking to help their clients sustain the wealth of a lifetime.

We define premier as being considered by leading brokerage firms and financial advisers to be one of their best and most trusted management partners. It means a constant, unwavering commitment to the highest standards of quality and dependability in all aspects of our business.

In particular, this emphasis on quality and dependability is driving force behind our product selection and development. It also underlies our affiliation with a select group of seasoned investment managers chosen for their specialization in a particular asset class or investment style, and their sharing of our underlying commitment to quality, dependable performance and rigorous research.

|

INVESTING IN OUR BUSINESS TO ENHANCE OUR PERFORMANCE |

|

| |

"Throughout 1998...sales momentum increased in every product category...more than two-thirds of 1998 sales were in equity-based products that have been added to the Company's product line since 1996."

|

|

|

|

|

| |

Quarterly sales show dramatic growth

|

|

|

| |

Equity-based products dominated 1998 sales

|

|

|

|

Today, these managers include Rittenhouse Financial Services for our large-cap, growth-oriented individually managed accounts, mutual funds and defined portfolios; Institutional Capital Corporation for our value-oriented mutual funds; and Nuveen Advisory Corporation, for our fixed-income mutual funds, managed accounts and defined portfolios.

Looking more specifically at our defined portfolios, this commitment to quality and dependability also has led to the introduction of equity investments using criteria developed with well-known equity research firms, including Standard & Poor's and Dow Jones, to select securities whose performance we believe will withstand the test of time.

Our continued success also rests on identifying and delivering distinct, compelling, tangible value to our most important customers - the financial advisers who work with affluent and high net worth investors.

Value manifests itself in several ways. One of the most important, and most visible, is the quality and dependability of our product performance. Exceptional value is built upon a foundation of consistently competitive investment performance.

For example, as of December 31, 44% of our 57 exchange-traded funds had four- or five-star ratings from Morningstar. Most of these 57 funds were trading at higher premiums or smaller discounts than their peers, creating more than $500 million in additional market value for Nuveen fund shareholders.

Eleven Nuveen exchange-traded and open-end funds recently were recognized by Lipper as being the No. 1 fund in their peer group in total return over the preceding one-, five- or ten-year periods.

The Rittenhouse model equity portfolio, consisting of well-established industry leaders with outstanding long-term records, posted a total return of 28.25% for 1998, comparing well with an S&P 55 return dominated by high tech stocks. This represented Rittenhouse's 15th positive year in a row.

Five of our sector defined portfolios posted returns of more than 30% in the first three months of their existence.

This consistently strong performance creates value, and has a direct impact on product sales. Throughout 1998, total sales of funds, accounts and portfolios reached more than $7.7 billion, a 156% increase over 1997 and one of our best years ever. Sales momentum increased in every product category.

New investment opportunities also can create value. In 1998, we introduced a variety of funds and portfolios designed to help advisers address specific investor needs for more balance and diversity in their holdings. These new offerings included:

Mutual Funds

Rittenhouse Growth Fund

European Value Fund

Defined Portfolios

Dow 5 and Dow 10 Portfolios

Rittenhouse Concentrated Growth Portfolio

10 Industry Sector Portfolios

|

INVESTING IN HIGH VALUE, HIGH GROWTH MARKET SEGMENTS |

|

| |

"Our primary focus remains on those advisers who work with investors seeking to sustain wealth for themselves and their families...As our country ages and grows wealthier, we believe financial advisers are well positioned to help their clients through the challenges ahead."

|

|

|

|

|

| |

Our target investor market is growing much faster than the general population

|

|

|

| |

Adviser-assisted investors are more confident of their investment success

|

|

|

|

We also took significant steps to align our internal organization in ways that help us deliver added value to financial advisers. One example is the restructuring of our investment management activities by combining the expertise of our portfolio managers and research analysts. By establishing integrated teams, each specializing in a particular type of investment or region of the country, we are better positioned to identify and take rapid advantage of market opportunities as they arise.

In addition, we have almost completed the consolidation of all customer servicing activities. By combining all customer records within one organization, our customer service representatives have increased abilities to call up entire account histories, answer a variety of questions easily and provide faster service without the need to transfer callers.

Our investment banking operations also made significant strides in 1998, focusing on our proven strength in fashioning innovative financings and establishing relationships with a variety of agencies and authorities that represent significant future opportunities.

Our primary focus remains on those advisers who work with investors seeking to sustain wealth for themselves and their families. We have found that our individual managed account services at Rittenhouse and Nuveen Asset Management are attractive particularly to advisers working with clients with between $1 million and $10 million to invest. Our mutual funds and defined portfolios are focused primarily on helping advisers serve the needs of those with investment portfolios averaging more than $250,000.

During the 1990s, it is estimated that the affluent market grew five times faster than the population as a whole. We believe this market will continue to grow by as much as 50% over the next 10 years. As our country ages and grows wealthier, investors will be faced with increasingly complex tax, retirement and estate planning issues that will require careful, integrated solutions. We believe professional advisers are well positioned to help their clients through the challenging questions that lie ahead.

Prosperity in any business is ultimately defined by earnings growth. This is a truism we recognize and a shareholder expectation we are committed to satisfy.

|

INVESTING IN A CUSTOMER-FOCUSED STRATEGY |

|

| |

"To stand out, we must offer exceptional value to financial advisers by recognizing and serving their diverse needs...We are now organized around distinct lines of business...that reflect the business practices and service requirements of our key customers."

|

|

|

|

| |

We are committed to working with our customers in ways that meet their needs and business practices.

|

|

|

|

One result of our pattern of record earnings is that last year our operating margin exceeded 50%. Our returns on total shareholders' equity of just over 25% is right in line with our 25-year historical average. In addition to continued revenue growth, we remain committed to the rigorous cost controls that make these types of results possible in a period when we also are investing to grow our businesses.

Over time, we believe stock prices tend to track with earnings growth. Our goal is to provide steady, predictable earnings growth that demonstrates clearly and consistently that our business development strategies are producing excellent results.

In addition to share price, dividends remain an important part of shareholder return. In 1998, we were able to raise our quarterly dividend by 13%, maintaining our pattern of raising the dividend every year since our initial public offering in 1992.

We are especially proud of our ability to raise our dividend consistently over the past three years while investing more than $400 million in business acquisitions, share repurchases, infrastructure improvements and new product introductions. We will continue to look for ways to combine our capital, our products, and our distribution strategy to grow earnings and dividends consistently.

The heart of any organization is its base of professional, dedicated employees, and we maintain a keen interest in their growth and development. For this reason, we are supplementing our ongoing technical training with management and leadership training with management and leadership training programs designed to build the skills needed to take full advantage of our opportunities.

The record results, the growing array of products, the quality service and the exciting opportunities now before us can all be traced to the continued dedication and hard work of the men and women who comprise all the different parts of The John Nuveen Company. Their increased productivity and efficiency allowed us to achieve this outstanding performance. Without their efforts, our Company would not enjoy the advantages we have today.

READY FOR OUR SECOND CENTURY

Our Company celebrated its 100th birthday in November, capping a century of achievement that provides a solid financial and cultural foundation for future growth.

A century of existence might cause some companies to believe they have seen it all and have all the answers. While we're proud of our corporate achievements, we know that our continued success depends on our continued evolution. Our first 100 years shows a continuous commitment to new business growth initiatives. We will maintain this commitment as we enthusiastically embark on our second century.

Sincerely,

Timothy R. Schwertfeger

Chairman and Chief Executive Officer

For more complete information on Nuveen investments, including charges and expenses, please view a prospectus by clicking on the Prospectus button at the bottom of this screen. Please read it carefully before you invest or send money. The content of this site, including but not limited to the text and images herein and their arrangement, are Copyright ©1998 by John Nuveen & Co. Incorporated. All rights reserved.

|

![]()

![]()

![]()

![]()

![]()