153 East 53rd Street, 57th Floor

New York, New York 10022-4624

42, rue Saint-Dominique

75007 Paris, France

Parkstraat 83

2514 JG The Hague

The Netherlands

To Be Held April 13, 2005

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| By order of the Board of Directors, Ellen Summer Secretary |

||||||||||

|

Please sign, date and promptly return the enclosed

proxy card in the enclosed envelope, or grant a proxy and give voting

instructions by telephone or internet, so that you may be represented

at the meeting. Instructions are on your proxy card or on the voting

instruction card included by your broker. Brokers cannot vote for

|

||||||||||

| PROXY STATEMENT |

||||||||||

| March 15, 2005 |

||||||||||

| General This proxy statement is furnished in connection with the solicitation by the Board of Directors of Schlumberger Limited (Schlumberger N.V.) (“Schlumberger” or the “Company”) of proxies to be voted at the 2005 Annual General Meeting of Stockholders. The approximate mailing date of this proxy statement is March 15, 2005. Business at the meeting is conducted in accordance with the procedures determined by the Chairman of the meeting and is generally limited to matters properly brought before the meeting by or at the direction of the Board of Directors or by a stockholder in accordance with specified requirements requiring advance notice and disclosure of relevant information. Proxies and Voting Procedures Each stockholder of record at the close of business on March 2, 2005 is entitled to one vote for each share registered in the stockholder’s name. A stockholder of record is a person or entity who held shares on that date registered in its name on the records of EquiServe Trust Company, N.A. (“EquiServe”), Schlumberger’s stock transfer agent. Persons who held shares on the record date through a broker, bank or other nominee are considered beneficial owners. On March 2, 2005, there were 589,591,456 outstanding shares of common stock of Schlumberger, excluding 77,514,559 shares held in treasury.

|

||||||||||

| 1. Election of Directors |

||||||||||

| It is intended to fix the number of directors at 12

and to elect a Board of Directors of 12 members, each to hold office

until the next Annual General Meeting of Stockholders and until a

director’s successor is elected and qualified or until a director’s

death, resignation or removal. Each of the nominees, except Michael

E. Marks and Rana Talwar, is now a director and was previously elected

by the stockholders. Unless instructed otherwise, the proxies will

be voted for the election of the 12 nominees named below. If any nominee

is unable or unwilling to serve, proxies may be voted for another

person designated by the Board of Directors. The Board knows of no

reason why any nominee will be unable or unwilling to serve if elected. |

||||||||||

| Nominee, Age and Five-Year Business

Experience |

Director Since |

||||

JOHN DEUTCH, 66; Institute Professor, Massachusetts Institute of Technology, |

|||||

|

1997 1987 1993 |

- | |||

JAMIE S. GORELICK, 54; Partner, Wilmer Cutler Pickering Hale and Dorr LLP, an |

|||||

|

2002 | ||||

| ANDREW GOULD, 58; Chairman and Chief Executive Officer since February 2003,

|

2002 | ||||

TONY ISAAC, 63; Chief Executive, The BOC Group plc, an international group with four

|

2003 | ||||

ADRIAN LAJOUS, 61; Senior Energy Advisor, McKinsey & Company, Houston, Texas,

|

2002 | ||||

ANDRE LEVY-LANG, 67; Independent Investor since November 1999; Chairman of the

|

1992 | ||||

MICHAEL E. MARKS, 54; Chief Executive Officer of Flextronics, an electronics

|

— | ||||

|

1988 | ||||

TORE I. SANDVOLD, 57; Chairman, Sandvold Energy AS, an advisory company in the

|

2004 | ||||

NICOLAS SEYDOUX, 65; Chairman, Gaumont, a French filmmaking enterprise, Paris. aligng(8) (10) |

1982 | ||||

LINDA GILLESPIE STUNTZ, 50; Partner, Stuntz, Davis & Staffier P.C., a law firm,

|

1993 | ||||

RANA TALWAR, 56; Chairman, Sabre Capital Worldwide Inc., Tortola, BVI, a private

|

— | ||||

| (1) | Mr. Deutch is a director of Citigroup, a banking

and insurance organization, where he serves on its Audit, Public Affairs

and Governance and Nominating Committees; Cummins Inc., a manufacturer

of diesel engines and components, where he serves on its Technology,

Finance and Governance and Nominating Committees; and Raytheon Corporation,

a defense technology company, where he serves on its Governance and

Nominating and Public Affairs Committees. Mr. Deutch’s adult son,

Paul Deutch, is employed by a unit of Schlumberger. The employment

of Mr. Deutch’s son was not influenced by John Deutch’s position as

a director of the Company. |

| (2) | Ms. Gorelick is a director of United Technologies

Corporation, a provider of high technology products and services,

where she serves on its Audit, Finance and Public Issues Review Committees

and serves on the boards of the John D. and Catherine T. MacArthur

Foundation and the Carnegie Endowment for International Peace. She

is a member of the Council on Foreign Relations. |

| (3) | Mr. Gould is a director of Rio Tinto plc and Rio

Tinto Limited, a mineral resources group, and is a member of its Audit

and Remuneration Committees. |

| (4) | Mr. Isaac is a director of International Power plc

and is Chairman of its Audit Committee and serves on its Remuneration

and Appointments Committees. |

| (5) | Mr. Lajous is Chairman of Oxford Institute for Energy

Studies, Oxford, U.K.; Senior Energy Advisor at Morgan Stanley, London;

and was a Senior Fellow at the Kennedy School of Government, Harvard

University, 2003 – 2004. |

| (6) | Mr. Lévy-Lang is a director and member of the Compensation

Committee of AGF, a French insurance company, a director and member

of the Audit and Compensation Committees of SCOR, a French reinsurance

company, a director and member of the Nominating Committee of Dexia,

a Belgian financial services company, and a director of Paris-Orleans,

a holding company for the Rothschild Group of Companies. |

| (7) | Mr. Marks is a director at SanDisk, a memory products

company headquartered in California, and a member of its Compensation

and Corporate Governance Committees and a director of KLA Tencor,

a semiconductor fabrication equipment company headquartered in California,

where he serves on its Compensation and Corporate Governance Committees. |

| (8) | Mr. Primat and Mr. Seydoux are cousins. |

| (9) | Mr. Sandvold is a director of Teekay Shipping Corporation,

a leading provider of international crude oil and petroleum product

transportation services, where he is a member of its Audit Committee,

and also serves on the boards of Lambert Energy Advisory Ltd., E.on

Rührgas Norge AS, Energy Policy Foundation of Norway Stavanger University

and Offshore Northern Seas (ONS). |

| (10) | Mr. Seydoux is a director of Arte, a Franco-German

TV company. |

| (11) | Mrs. Stuntz is a director of Raytheon Company, a

defense technology company, where she is a member of its Audit Committee. |

| (12) | Mr. Talwar is a director of Pearson PLC, an international

media company in London, and a member of its Personnel, Nominating

and Treasury Committees; a director of Fortis, an integrated financial

services provider in Belgium and the Netherlands, and a member of

its Risk and Capital Committees; Chairman of Centurion Bank, India,

a director of Moscow Bank for Reconstruction and Development, a member

of the Governing Body of the London Business School and the Indian

School of Business and a director of the National Society for the

Prevention of Cruelty to Children in the U.K. |

| Beneficial

Ownership of Common Stock |

|||

| Name and

Address |

Number of Shares |

Percentage of Class |

|

| FMR Corp. (1) 85 Devonshire Street Boston, Massachusetts 02109 |

42,414,209 | 7.19% | |

| Capital Research and Management Company (2) 333 South Hope Street Los Angeles, CA 90071 |

38,442,700 | 6.52% | |

| (1) | Based on an amendment to a Statement on Schedule

13G dated February 14, 2005. Such filing indicates that FMR Corp.

has sole voting power with respect to 2,670,818 shares and sole dispositive

power with respect to 42,414,209 shares. FMR Corp. is the parent of

Fidelity Management & Research Company, investment adviser to the

Fidelity group of investment companies. The filing indicates that

the common stock was acquired in the ordinary course of business and

not for the purpose of changing or influencing the control of the

Company. |

| (2) | Based on a Statement on Schedule 13G dated February

9, 2005. Such filing indicates that Capital Research and Management

Company acts as investment adviser to various investment companies

registered under Section 8 of the Investment Company Act of 1940.

The filing indicates that the common stock was acquired in the ordinary

course of business and not for the purpose of changing or influencing

the control of the Company. |

| Name | Shares | ||

| Dalton Boutte | 143,703 | (1) | |

| John Deutch | 5,600 | (2) | |

| Xavier Flinois | 16,347 | ||

| Jamie S. Gorelick | 2,400 | (3) | |

| Andrew Gould | 906,420 | (4) | |

| Tony Isaac | 0 | (5) | |

| Adrian Lajous | 3,300 | (6) | |

| André Lévy-Lang | 7,500 | ||

| Michael E. Marks | 0 | ||

| Satish Pai | 74,963 | (7) | |

| Jean-Marc Perraud | 167,832 | (8) | |

| Didier Primat | 17,660,628 | (9) | |

| Tore I. Sandvold | 2,000 | ||

| Chakib Sbiti | 144,757 | (10) | |

| Nicolas Seydoux | 239,660 | (11) | |

| Linda Gillespie Stuntz | 8,800 | (12) | |

| Rana Talwar | 0 | ||

| All directors, director nominees and executive officers as a group (24 persons) | 20,059,180 | (13) | |

| (1) | Includes 137,869 shares which may be acquired by Mr. Boutte within 60 days through the exercise of stock options. |

| (2) | Includes 600 shares owned by Mr. Deutch’s wife, as to which he disclaims beneficial ownership, and excludes 500 shares which he deferred receipt under the Stock and Deferral Plan for Non-Employee Directors. |

| (3) | Excludes 2,500 shares which she deferred receipt under the Stock and Deferral Plan for Non-Employee Directors. |

| (4) | Includes 794,540 shares which may be acquired by Mr. Gould within 60 days through the exercise of stock options. |

| (5) | Excludes 2,500 shares which he deferred receipt under the Stock and Deferral Plan for Non-Employee Directors. |

| (6) | Held through a limited liability company in which Mr. Lajous has an indirect interest. |

| (7) | Includes 71,745 shares which may be exercised by Mr. Pai within 60 days by the exercise of stock options. |

| (8) | Includes 152,633 shares which may be acquired by Mr. Perraud within 60 days through the exercise of stock options. |

| (9) | Includes 560,000 shares as to which Mr. Primat shares investment power and 4,499,008 shares held for account of the minor children of Mr. Primat as to which he has joint voting and investment power. |

| (10) | Includes 139,257 shares which may be acquired by Mr. Sbiti through the exercise of stock options. |

| (11) | Excludes 15,364 shares owned by Mr. Seydoux’s wife, as to which he has no voting and investment power. |

| (12) | Includes 3,000 shares as to which Mrs. Stuntz shares voting power and 300 shares owned by a minor child in a trust for which Mrs. Stuntz serves as trustee. |

| (13) | Includes 1,895,933 shares which may be acquired by

executive officers as a group within 60 days through the exercise

of stock options and excludes 5,500 shares for which directors deferred

receipt under the Stock and Deferral Plan for Non-Employee Directors. |

|

|

| * | Chair |

Nominating and Governance Committee

The Nominating and Governance Committee is comprised of five independent directors, who meet the independence requirements of the New York Stock Exchange’s listing standards. The Nominating and Governance Committee assists the Board in identifying individuals qualified to become directors under criteria approved by the Board. The Nominating and Governance Committee recommends to the Board the number and names of persons to be proposed by the Board for election as directors at the annual general meeting of stockholders and may also recommend to the Board persons to be appointed by the Board or to be elected by the stockholders to fill any vacancies which occur on the Board. The Nominating and Governance Committee is responsible for periodically reviewing director compensation and benefits, reviewing corporate governance trends, and recommending to the Board any improvements to the Company’s corporate governance guidelines as it deems appropriate. The Nominating and Governance Committee also recommends directors to serve on and to chair the Board Committees and leads the Board’s appraisal process. The Nominating and Governance Committee operates pursuant to a written charter, which is available on the Company’s website at www.slb.com/ir. Stockholders may also obtain a copy of the charter without charge by writing to the Secretary of the Company at 153 East 53rd Street, 57th Floor, New York, New York, 10022-4624.

Finance Committee

The Finance Committee advises the Board and senior management on various matters, including dividends, financial policies and the investment and reinvestment of funds. The Finance Committee periodically reviews the administration of the Schlumberger employee benefit plans and those of its subsidiaries. In addition, the Finance Committee recently revised its charter expressly to include the review of financial risk management, financial aspects of acquisitions submitted to the Board, and the Investor Relations and Stockholder Services of the Company. The Finance Committee operates pursuant to a written charter, which is available on the Company’s website at www.slb.com/ir. Stockholders may also obtain a copy of the charter without charge by writing to the Secretary of the Company at 153 East 53rd Street, 57th Floor, New York, New York, 10022-4624.

Technology Committee

The Technology Committee advises the Board and senior management on various matters, including the quality and relevance of programs dealing with scientific research, development, information and manufacturing technology, and also advises on research strategy and university relationships. The Technology Committee operates pursuant to a written charter, which is available on the Company’s website at www.slb.com/ir. Stockholders may also obtain a copy of the charter without charge by writing to the Secretary of the Company at 153 East 53rd Street, 57th Floor, New York, New York, 10022-4624.

Director Independence

The Board of Directors had determined that each director and nominee is independent, as defined for purposes of the New York Stock Exchange’s listing standards, other than Mr. Gould, who is Chairman and Chief Executive Officer of Schlumberger. In making this determination, the Board affirmatively determined that each independent director or nominee had no material relationship with Schlumberger or management, and that none of the express disqualifications contained in the NYSE rules applied to any of them. As contemplated by NYSE rules, the Board has adopted categorical standards to assist it in making independence determinations, under which relationships that fall within the categorical standards are not required to be disclosed in the proxy statement and their impact on independence need not be separately discussed. The Board, however, considers all material relationships with each director in making its independence determinations. A relationship falls within the categorical standards if it:

| • | Is a type of relationship addressed in Section 303A 2(b) of the NYSE Listed Company Manual, but under those rules does not preclude a determination of independence; or | |

| • | Consists of charitable contributions by the Company to an organization where a director is an executive officer and does not exceed the greater of $1 million or 2% of the organization’s gross revenue in any of the last 3 years. |

Director Nominations

In obtaining the names of possible nominees, the Nominating and Governance Committee makes its own inquiries and will receive suggestions from other directors, management, stockholders and other sources, and its process for evaluating nominees identified in unsolicited recommendations from security holders is the same as its process for unsolicited recommendations from other sources. In the case of Mr. Marks and Mr. Talwar, who are being nominated as directors for the first time this year, both were recommended by one of the director search firms retained by the Nominating and Governance Committee. All potential nominees must be considered by the Nominating and Governance Committee before being contacted by other Company directors or officers as possible nominees and before having their names formally considered by the full Board. The Nominating and Governance Committee will consider nominees recommended by security holders who meet the eligibility requirements for submitting stockholder proposals for inclusion in the next proxy statement and submit their recommendations in writing to Chair, Nominating and Governance Committee, care of the Secretary, Schlumberger Limited, 153 East 53rd Street, 57th Floor, New York, New York 10022-4624 by the deadline for such stockholder proposals referred to at the end of this proxy statement. Unsolicited recommendations must contain all of the information that would be required in a proxy statement soliciting proxies for the election of the candidate as a director, a description of all direct or indirect arrangements or understandings between the recommending security holder and the candidate, all other companies to which the candidate is being recommended as a nominee for director, and a signed consent of the candidate to cooperate with reasonable background checks and personal interviews, and to serve as a director of the Company, if elected.

Stockholder Communication with Board Members

The Board has established a process for security holders to send communications, other than sales-related communications, to one or more of its members. Any such communication should be sent by letter addressed to the member or members of the Board to whom the communication is directed, care of the Secretary, Schlumberger Limited, 153 East 53rd Street, 57th Floor, New York, New York 10022-4624. All such communications will be forwarded to the Board member or members specified.

Director Presiding at Executive Sessions

The Board of Directors schedules executive sessions without any management members present in conjunction with each regularly scheduled Board meeting, and at the request of a director. Mr. Nicolas Seydoux, Chair of the Nominating and Governance Committee, presides at these executive sessions of non-management directors.

Director Attendance at Annual General Meeting

The Board’s policy regarding director attendance at the Annual General Meeting of Stockholders is that directors are welcome to attend, and that the Company will make all appropriate arrangements for directors that choose to attend. In 2004, Messrs. Gould and Seydoux attended the Annual General Meeting.

Corporate Governance Guidelines and Code of Ethics

Copies of Schlumberger’s Corporate Governance Guidelines and Schlumberger’s Code of Ethics are available at the Company’s corporate governance website located at www.slb.com/ir. Stockholders may also obtain copies of Schlumberger’s Corporate Governance Guidelines and Schlumberger’s Code of Ethics without charge by writing to the Secretary of the Company at 153 East 53rd Street, 57th Floor, New York, New York, 10022-4624.

SUBMITTED BY THE AUDIT COMMITTEE OF THE SCHLUMBERGER

BOARD OF DIRECTORS

| Jamie S. Gorelick | André Lévy-Lang, Chair | ||

| Tony Isaac | Linda G. Stuntz | ||

| Adrian Lajous | |||

Summary of Cash and Certain Other Compensation

The following table shows the compensation paid by the Company and its subsidiaries to the Chief Executive Officer, the next four most highly compensated executive officers as at December 31, 2004, and to one other person who served as an executive officer during the year but who was not an executive officer as of December 31, 2004 (the “named officers”), for the fiscal years ending December 31, 2004, 2003 and 2002.

| Long Term Compensation |

|||||||||

| Annual Compensation | Awards | ||||||||

| Name and Principal Position | Year | Salary ($)(4) |

Bonus ($)(4) |

Securities Underlying Options (#) (5) |

All

Other Compensation ($) (6) |

||||

| A. Gould | 2004 | 1,500,000 | 2,100,000 | 415,000 | 157,500 | ||||

| Chairman and | 2003 | 1,500,000 | 1,125,000 | 300,000 | 108,000 | ||||

| Chief Executive Officer | 2002 | 966,667 | 300,000 | 300,000 | 124,700 | ||||

| C. Sbiti (1) | 2004 | 618,047 | 848,269 | 90,000 | 61,561 | ||||

| Executive Vice President | 2003 | 559,284 | 629,195 | 100,000 | 49,452 | ||||

| J.-M. Perraud | 2004 | 600,000 | 858,000 | 50,000 | 59,100 | ||||

| Executive Vice President and | 2003 | 550,000 | 385,000 | 60,000 | 38,040 | ||||

| Chief Financial Officer | 2002 | 430,395 | 84,000 | 50,000 | 30,301 | ||||

| X. Flinois (2) | 2004 | 48,574 | 1,165,756 | 0 | 0 | ||||

| Former Executive Vice President | 2003 | 520,325 | 472,195 | 0 | 0 | ||||

| Dalton Boutte (3) | 2004 | 519,125 | 555,464 | 50,000 | 30,857 | ||||

| Executive Vice President | |||||||||

| Satish Pai (1) | 2004 | 470,541 | 448,455 | 30,000 | 53,673 | ||||

| Vice President Oilfield Technologies | |||||||||

| 1) | Messrs. Sbiti and Pai are paid in Euros. | ||||||||||

| 2) | Mr. Flinois was paid in Pounds Sterling. In connection with the sale of the Sema business, Mr. Flinois left the Company and received a transaction bonus. | ||||||||||

| 3) | Mr. Boutte is paid in Pounds Sterling. | ||||||||||

| 4) | Salary and bonus amounts include cash compensation earned and received and any amounts deferred under the Schlumberger Restoration Savings Plan. | ||||||||||

| 5) | The Company has granted no stock appreciation rights or restricted stock. | ||||||||||

| 6) | The 2004 amounts disclosed in this column

include:

|

| (a)($) | (b)($) | (c)($) | (d) ($) | (e) ($) | |||||

| Mr. Gould | 12,300 | N/A | 72,600 | 72,600 | N/A | ||||

| Mr. Sbiti | N/A | 61,561 | N/A | N/A | N/A | ||||

| Mr. Perraud | 12,300 | N/A | 23,400 | 23,400 | N/A | ||||

| Mr. Flinois | N/A | 0 | N/A | N/A | N/A | ||||

| Mr. Boutte | 6,150 | N/A | 22,657 | N/A | 2,050 | ||||

| Mr. Pai | 12,300 | 4,079 | 16,539 | 20,755 | N/A |

The Company’s matching credits under the Schlumberger Restoration Savings Plan are vested one-third at two years of service, two-thirds at three years, fully at four years or upon the earliest of age 60, death or change of control. The amounts accumulated under the Schlumberger Restoration Savings Plan and the International Staff Profit Sharing Plan will be paid upon the satisfaction of certain conditions on termination or retirement, death, disability or in the case of the Schlumberger Restoration Savings Plan, a change in control.

The following table sets forth certain information concerning options granted during 2004 to the named executive officers. Any value realized upon exercise of the options will depend upon the market price of Schlumberger common stock at the time the option is exercised relative to the exercise price of the option.

| Individual Grants | |||||||||

| Name | Number

of Securities Underlying Options Granted (#) (1) |

%

of Total Options Granted to Employees in Fiscal Year |

Exercise Price ($/SH) (2) |

Expiration Date |

Grant

Date Present Value ($)(3) |

||||

| A. Gould | 415,000 | 14.02 | 55.90 | 01/21/14 | 4,477,850 | ||||

| C. Sbiti | 90,000 | 3.04 | 65.235 | 07/21/14 | 1,143,000 | ||||

| J.-M. Perraud | 50,000 | 1.69 | 65.235 | 07/21/14 | 635,000 | ||||

| X. Flinois | 0 | — | — | — | — | ||||

| D. Boutte | 50,000 | 1.69 | 65.235 | 07/21/14 | 635,000 | ||||

| S. Pai | 30,000 | 1.01 | 65.235 | 07/21/14 | 381,000 | ||||

| (1) | The Company has not granted any stock appreciation rights.

Options listed above become exercisable in installments of 25% each

year following the date of grant. The gain on each option grant is

capped at 125% of the exercise price. All outstanding stock options

become fully exercisable prior to liquidation or dissolution of the

Company or prior to any reorganization, merger or consolidation of

the Company where the Company is not the surviving corporation unless

such merger, reorganization or consolidation provides for the assumption

of such stock options. |

| (2) | The exercise price of the options is equal to the average

of the high and the low per share prices of the common stock on the

options’ dates of grant and may be paid in cash or by tendering

shares of common stock. Applicable tax obligations may be paid in

cash or by the withholding of shares of common stock. |

| (3) | The following assumptions were used to calculate the

grant date present value under the Black-Scholes method: |

| Assumption | January 21, 2004 | July 21, 2004 | |||

| Expected Life of Option | 4.5 years | 4.5 years | |||

| Risk Free Rate | 2.88 | % | 3.73 | % | |

| Volatility | 31.38 | % | 27.75 | % | |

| Dividend Yield | 1.51 | % | 1.54 | % | |

| Stock Price Appreciation Cap | 125 | % | 125 | % | |

| 4-Year Graded Vesting Discount | 92.72 | % | 92.72 | % | |

| (includes 3% Annual Forfeiture Rate) |

Stock Option Exercises and

December 31, 2004 Stock Option Value Table

| Name | Shares

Acquired on Exercises (#) |

Value Realized ($)(1) |

Number

of Securities Underlying Unexercised Options at FY-End (#) Exercisable / Unexercisable |

Value

of Unexercised In-The-Money Options at FY-End ($) (2) Exercisable / Unexercisable |

|||||||

| A. Gould | 0 | — | ___630,790 | 915,000 | 6,762,845 | 12,942,850 | |||||

| C. Sbiti | 17,584 | 575,085 | 119,257 | 208,000 | 1,480,896 | 2,542,900 | |||||

| J-M. Perraud | 0 | — | 150,633 | 143,000 | 2,557,722 | 1,424,050 | |||||

| X. Flinois | 56,720 | 711,473 | 0 | 0 | — | — | |||||

| D. Boutte | 11,870 | 319,592 | 127,869 | 174,000 | 1,028,780 | 1,875,750 | |||||

| S. Pai | 2,198 | 61,603 | 66,745 | 119,200 | 605,218 | 1,217,190 | |||||

| (1) | Market value of stock on date of exercise less exercise price. |

| (2) | Closing price of stock on December 31, 2004 ($66.95) less exercise price. |

Pension Plans

Schlumberger and certain of its subsidiaries maintain pension plans for employees, including executive officers, providing for lifetime pensions upon retirement after a specified number of years of service. Employees may participate in one or more pension plans in the course of their careers with the Company or its subsidiaries, in which case they become entitled to a pension from each plan based upon the benefits accrued during the years of service related to each plan. These plans are funded on an actuarial basis through cash contributions made by the Company or its subsidiaries. Certain plans also permit or require contributions by employees.

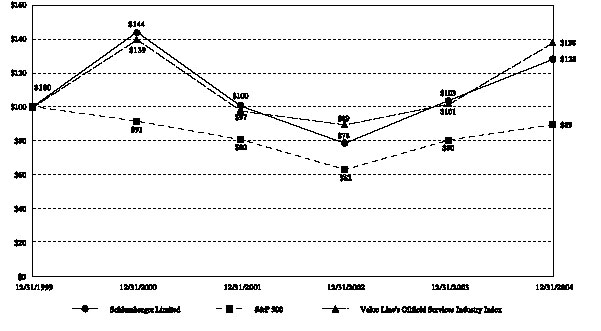

The following graph compares the yearly percentage change in the cumulative total stockholder return on Schlumberger common stock, assuming reinvestment of dividends on the last day of the month of payment into common stock of Schlumberger, with the cumulative total return on the published Standard & Poor’s 500 Stock Index and the cumulative total return on Value Line’s Oilfield Services Industry Group over the preceding five-year period. The following graph is presented pursuant to Securities and Exchange Commission rules. Schlumberger believes that while total stockholder return is an important corporate performance indicator, it is subject to the vagaries of the market. In addition to the creation of stockholder value, the Schlumberger executive compensation program is based on financial and strategic results and the other factors set forth and discussed in the Compensation Committee Report beginning on page 14.

AMONG SCHLUMBERGER LIMITED, S&P 500 INDEX AND VALUE LINE’S OILFIELD

SERVICES INDUSTRY INDEX

The Compensation Committee is comprised of four directors who meet the independence requirements of the New York Stock Exchange’s listing standards.

Philosophy of Compensation Principles

The Company’s compensation philosophy is to provide programs that maintain the short- and long-term motivation of our employees, insuring that cash compensation is directly related to performance through financial and non-financial objectives. The Company manages this through an annual objectives-setting process and review, which extends globally through the entire exempt population. The Company’s long-term compensation (stock options) is tied to stockholder interests through plan design. Additionally, the Company maintains a stock purchase plan designed to allow all employees, where permitted by local law, to own equity in the Company.

| • | maintain good governance practices; | |

| • | encourage motivation of short-and long-term performance; and | |

| • | align plan benefits with stockholder interests. |

Components of Compensation

Base Salary

| • | Base salary range midpoints are targeted to be at the median of the comparator markets (as described below) | |

| • | Base salaries are reviewed annually |

| • | Annual performance-based cash incentives are targeted to be above the median of the comparator market in years of excellent or outstanding performance. | |

| • | In years of less than excellent performance, we expect our total

cash compensation to be at or below the median of the comparator market. |

| • | Stock options are awarded annually to retain high value employees and to reward a specific achievement. The use of stock options has long been a vital component of our overall compensation philosophy. | |

| • | Stock options are granted with an exercise price equal to the fair market value on the date of grant; vest 25% annually over four years; and have a ten-year life. The gain on appreciation for all options granted since July 2003 is capped at 125% of the price on the date of grant. | |

| • | Exempt employees are eligible for stock options. Company management conducts a review annually to identify high value employees and those who have made a significant achievement or received a key promotion during the year. Recommending an employee for a stock option grant at Schlumberger is a highly selective and discretionary process. Each grant typically includes fewer than 10% of our exempt population. Nominations are based on performance and results. | |

| • | Option grants are based on performance, potential impact on the

Company, support of long-term retention, comparison to the competitive

market and internal peer jobs. The Committee approves the size of

each general grant and approves by name each recommendation of 5,000

shares or more. The Committee also reviews key statistics of each

general grant, including nationality and gender diversity. |

Selection of Market Comparator Companies

The Committee approves the companies used in the executive competitive analysis, which are recommended by the Committee’s outside consultants. In 2005, the Committee approved changes in the peer groups to reflect changes in business as a result of certain divestitures made by the Company.

| • | The first peer group includes 26 companies in the oil services, exploration and production, refining and pipeline industries, including 11 direct competitors in the oilfield services industry, which are part of the Value Line comparator companies. These 26 companies have median revenues and assets similar to Schlumberger. | |

| • | The second peer group includes 89 companies of similarly sized revenues

($5-$25 billion, median revenue $10 billion). However, excluded from

this peer group are companies from industry sectors that are least

comparable to Schlumberger’s areas of focus and do not have a global

presence. |

The Committee has set January as the time each year that executive compensation will be reviewed, including base salary, annual performance-based cash incentives and stock option awards. Special stock option grants may be awarded for specific achievements and promotions during the quarterly Compensation Committee

meetings of the Board.

Compensation Elements for Executive Officers

Base Salary

Each executive officer position is compared to similar jobs in industry-specific comparator companies and to the broader group of comparator companies of similar revenue size, as explained above. A base salary increase is awarded according to individual performance against objectives, comparison to internal peer positions, the Company’s relative performance during the year and competitive market movement. A base salary is generally set for a number of years.

Annual Performance-Based Cash Incentives

At the executive officer level, the annual performance-based cash incentive program is a combination of financial and personal objectives. Award opportunities vary by position and are expressed as a percentage of base salary. One-half of an executive’s incentive is a combination of financial objectives relating to the executive’s business group and the Company’s overall performance, such as EPS. A minimum performance level is set, below which no incentive is paid for this half of the bonus opportunity. For executive officers (and certain other high level management positions), if the financial performance exceeds preset, approved objectives, this half of the award can increase from 100% to up to 200% of the incentive opportunity for this half of the award (increasing the total annual incentive opportunity to 150% of the total award). The second half of the incentive is related to personal objectives that may include market share, acquisitions, divestitures, growth or any relevant business priority. Each executive officer’s performance results and recommended incentive payout are reviewed and approved by the Compensation Committee.

Long-Term Incentives

Stock options are a key element of executive compensation. The size of the grant is based on performance, significant promotion, comparison of competitive market practices for similar-size jobs, as well as total career grants compared with internal peer jobs.

Ownership Guidelines (For Executive Officers and other Key Staff Positions)

The Committee and management believe strongly in linking stockholder and executive values, so stock ownership guidelines were established in 2004. The guidelines include ownership requirements for the CEO at 5 times base salary; Executive Vice Presidents at 3 times base salary; Officers at 1.5 times base salary and key staff positions at 1 times base salary. In addition, each executive under the guidelines must hold in shares at least 30% of their gain on the stock option exercise for a period of six months. Those who do not meet the guidelines after the six-month period must continue to hold the shares until the guidelines are met. There is no specified timeline to achieve the guidelines, as many of our executives hold their options for the life of the grant.

Personal Benefits for Executive Officers

Schlumberger executives enjoy the same benefits other employees are offered, including medical exams and supplemental plans chosen and paid for by employees who want the additional coverage.

Compensation for Named Officers

Base Salary

Mr. Perraud was awarded a base salary increase in 2004. Mr. Pai’s base salary was adjusted when he transferred from the US to the Paris Headquarters, based on conversion from USD to the Euro. Messrs. Perraud and Pai are positioned between the 50th and the 75th percentiles of the comparator market. Messrs. Sbiti and Boutte have not received an increase in base salary since 2003.

Annual Performance-Based Cash Incentives

Incentives are paid in February for the prior year’s performance against agreed-to objectives. These objectives include specific goals for the financial performance of the officer’s business group, the overall Company performance and several personal objectives. The financial half of the performance-based cash incentives for Messrs. Sbiti, Boutte and Pai were a combination of financial measures for their groups and EPS for Schlumberger. Their awards are commensurate with the financial performance of their businesses as measured against their goals and the corporate EPS goal, which was exceeded. The second half of their incentive focused on business objectives for Oilfield Services, WesternGeco and the Technologies Group of Oilfield Services, respectively.

Stock Options

Messrs. Sbiti, Perraud, Boutte and Pai were granted capped stock options in 2004 and 2005 with vesting over four years and a ten-year term.

Compensation for Chief Executive Officer and Chairman of the Board

Mr. Gould’s base salary was set at $1,500,000 in 2003, when he became CEO of the Company. He did not receive a base salary increase in 2004. In years when the Company’s performance significantly exceeds expectations, Mr. Gould’s incentive opportunity can reach a maximum level of 150% of base salary. Early each year the Compensation Committee approves the objectives the CEO will work toward during the year. In 2004, the financial half of the performance-based incentive was an EPS goal, which was exceeded.

SUBMITTED BY THE COMPENSATION COMMITTEE OF THE SCHLUMBERGER

BOARD OF DIRECTORS

| Linda G. Stuntz, Chair | Adrian Lajous | ||

| Jamie S. Gorelick | Nicolas Seydoux |

2. Financial Statements

| • | to allow formations of legal entities more easily; | |

| • | to allow for the choice of language, currency and capital structure; | |

| • | to allow more flexibility in management structures; | |

| • | to provide for minority stockholder and creditor protection; and | |

| • | to facilitate compatibility with Anglo-American legal systems. |

| • | amendments required in order to comply with the recent changes in Netherlands Antilles law; and | |

| • | amendments that we are voluntarily adopting in order to (1) take advantage of the flexibility provided by the recent changes in the Netherlands Antilles law, or (2) clarify or update certain provisions of the Articles of Incorporation, which have not been amended since 2001. |

| • | The provision relating to our domicile is being revised to reflect the Island territory within the Netherlands Antilles where we maintain our corporate seat. [Section 1.3] | |||||

| • | The provision relating to share capital is being revised to reflect new nomenclature used in the revised Netherlands Antilles law. The terms “authorized,” “issued” and “paid-up” capital are no longer used, and a new term “nominal capital” has been introduced. The term “nominal capital” means the sum of the par values of all of the issued and outstanding shares of capital stock at any time. [Sections 4.1, 4.3 and 4.5] We are also amending other provisions to maintain the present limit on the Board’s ability to issue common shares, preferred shares, options and warrants. We are not increasing the number of shares of capital stock that the Board may issue from those in effect prior to adoption of the revised Netherlands Antilles law, which remains at 1.5 billion shares of common stock and 200 million shares of preferred stock. | |||||

| • | The provision requiring that 20% of our “authorized capital” be duly issued and fully paid is being deleted. The revised Netherlands Antilles law no longer recognizes the term “authorized capital.” [Former Section 4.2] In addition, the provisions limiting our right to repurchase our capital stock would be revised to eliminate this 20% requirement and to clarify that such repurchases may occur so long as our “equity” (i.e., our net asset value) before and after the repurchase at least equals the nominal capital (i.e., the aggregate par value of our outstanding shares) and one common share remains outstanding. The revised restrictions are similar to provisions contained in the corporation law of many U.S. states. [Section 6.1] | |||||

| • | We are adding a provision providing that the initial issuance of shares occurs by deed (i.e., a written instrument) signed by Schlumberger and the party taking the share. [Section 4.2] | |||||

| • | We are adding a provision to reflect that Schlumberger cannot issue shares to itself. [Section 4.2] | |||||

| • | The provision regarding the contents of our stockholders’ register are being modified to reflect requirements under the revised Netherlands Antilles law, which have become more detailed than as reflected in the current Articles of Incorporation. [Section 7.3] | |||||

| • | The provisions relating to the procedures to effect transfers of shares are being revised to reflect new share transfer procedures. If shares are listed on a stock exchange, such transfers may be effected in accordance with the rules, procedure or system applied by the exchange. Accordingly, our common shares, which are listed on the New York Stock Exchange, may be transferred pursuant to normal New York Stock Exchange trading mechanisms. If shares are not so listed, transfers must be made by a deed of transfer (i.e., a written instrument) signed by the transferor and the transferee, which transfer will then need to be acknowledged by or served upon Schlumberger. [Section 7.5] These changes would also be applicable in the event of a division of joint ownership. [Section 7.7] | |||||

| • | The provision relating to suspension and dismissal of directors by the stockholders is being amended to reflect that a suspension terminates under the revised Netherlands Antilles law if the person concerned has not been dismissed by the stockholders within two months after the day of suspension. [Section 8.3] | |||||

| • | We are adding a provision to provide that records and other data carriers used in relation to attendance of and voting at general meetings shall be kept during a period of 10 years or for the period required by applicable law. [Section 12.1] | |||||

| • | The provisions relating to stockholder meetings would be revised as follows: | |||||

|

||||||

| • | The provision limiting distributions of profits in the event of losses that are not covered by reserves is being deleted, as it no longer reflects the revised Netherlands Antilles law. [Former Section 17.3] In its place, we are adding a provision providing that distributions can only occur if our equity at least equals the nominal capital and as a result of the distribution will not fall below the nominal capital. [Section 17.5] The new provision is similar to provisions contained in the corporation law of many U.S. states. | |||||

| • | The provisions relating to stockholder action by written consent

are being deleted because the revised Netherlands Antilles law only

allows such action if all stockholders cast a vote, which is impracticable

in the context of a publicly traded company. [Former Sections 20.1

and 20.2] |

The following resolutions, which will be presented to the Annual General Meeting of Stockholders, will adopt the proposed mandatory amendments to the Articles of Incorporation:

| RESOLVED, that the mandatory amendments to the Articles of Incorporation

of Schlumberger N.V. be, and they hereby are, adopted to read in their

entirety as described in Schlumberger’s Proxy Statement dated March

15, 2005 and in the form presented to this meeting; and further RESOLVED, that each lawyer of STvB Advocaten (Curaçao) N.V., Netherlands Antilles counsel to Schlumberger, is authorized to execute and file in the Netherlands Antilles the notarial deed of amendment effectuating such amendments. |

Voluntary Amendments

The amendments we are voluntarily proposing to adopt are as follows:

| • | The provisions of our Articles of Incorporation relating to seat transfer are being revised to authorize the Board to move our corporate seat, or to convert Schlumberger to a legal entity under the laws of another jurisdiction, as, when and in the manner permitted by the laws of the Netherlands Antilles. The new provision is in addition to the current provisions which allow the Board to move our corporate seat under a specific ordinance. [Section 1.4] This amendment will give us added flexibility to change our jurisdiction of organization and our corporate form if such changes are warranted, subject to any necessary approvals that at the time are required under Netherlands Antilles or other applicable law or regulation. | |

| • | The provision stating that stockholders do not have preemptive rights to acquire shares issued in the future would be revised to clarify that Schlumberger can enter into contractual agreements providing for preferential and preemptive purchase rights with respect to shares of our capital stock and to options, warrants or rights to purchase such shares. [Article 5] Language in Schlumberger’s current Articles of Incorporation is not entirely clear but could be read to preclude contracts granting stockholders the right to buy securities. This was not the intent of the current provisions, and this amendment will clarify any such ambiguity. | |

| • | We are adding a provision confirming that a right of usufruct or a right of pledge may be vested on the shares in accordance with the revised Netherlands Antilles law, but that Schlumberger is only obligated to recognize the registered stockholder as owner of the shares for all purposes. [Section 7.6] This amendment confirms provisions of Netherlands Antilles law regarding the allocation of economic benefits attendant to the ownership of shares, but clarifies that Schlumberger need only look to the registered holder for voting and other purposes. | |

| • | The provisions relating to our management would be revised: [Articles 8 and 9] |

| • | to clarify that the Board can appoint directors to fill vacancies on the Board in between annual general meetings; | ||

| • | to clarify the authority of the Board to adopt and amend By-laws setting forth the functions and authority of each of the directors, the division of tasks, the designation and authority of one or more committees of the Board and the way of taking action; | ||

| • | to clarify that the Board can limit the management authority of one or more directors; and | ||

| • | to clarify that the Chairman, Vice-Chairman and specified officers so authorized by the Board may represent and bind Schlumberger acting alone. |

| These amendments will enable Schlumberger to manage its business more effectively and confirm practices regarding the delegation of powers and responsibilities, while also confirming various historical corporate governance practices. | ||

| • | The provisions relating to indemnification would be modified to confirm that Schlumberger’s power to indemnify officers, directors and others is subject to any prohibitions required by applicable law. [Sections 10.1 and 10.2] This amendment would remove any implication that Schlumberger intends to indemnify its officers, directors and others where prohibited by law. | |

| • | The provisions relating to stockholder meetings would be revised to provide that annual general meetings can be held in Curaçao or anywhere in the Netherlands Antilles as permitted under the revised Netherlands Antilles law (the Articles of Incorporation currently provide that such meetings must be held on Curaçao, Bonaire, St. Eustatius, Saba or the Dutch part of St. Maarten). [Section 11.1] This amendment will give Schlumberger added flexibility in determining where to hold stockholder meetings. | |

| • | The provision regarding closing our stock transfer books and setting the record date would be expanded to clarify that it applies for purposes of determining stockholders entitled to receive distributions or allotment of any rights (the Articles of Incorporation currently refer only to the receipt of dividends) or to exercise of rights in respect of any change, conversion or exchange of shares. [Section 12.3] This amendment will remove possible ambiguity with respect to holders entitled to receive distributions and allotments of rights or to exercise certain other rights. | |

| • | We would add a provision to provide that no legal entity over which we exercise control can vote our shares other than in a fiduciary capacity. [Section 13.6] This provision is consistent with provisions that exist in Delaware and many U.S. states. | |

| • | The provision requiring that the annual accounts be prepared within eight months after the end of the fiscal year and submitted to the stockholders for approval would be revised to change the time for preparation of the accounts to the period allowed under applicable law, which is currently six months from the end of the year (subject to an extension of six months by action at a general meeting of stockholders due to special circumstances) as provided under Netherlands Antilles law. [Section 16.1] This amendment will enable Schlumberger to delay the release of its financial statements (to the extent such delay is approved by its stockholders) as contemplated by Netherlands Antilles law. | |

| • | We would add a provision to provide that one person, or any two or more legal entities belonging to the same group, holding shares representing at least 90% of our equity can require the remaining stockholders to transfer their shares to such 90% stockholder in accordance with the revised Netherlands Antilles law. [Article 20] This provision is somewhat similar to statutes that exist in Delaware and most U.S. states, which typically require ownership of 90% of a company’s outstanding equity in order to effect a “short-form” merger. In order to effect a compulsory share transfer, Schlumberger would have to institute an action in a Netherlands Antilles court and pay the transferring stockholders the value of the shares to be transferred as determined by the judge (based on the advice of one or three experts). A judge can deny a request for a compulsory share transfer if a stockholder would suffer serious material damage through the transfer. | |

| • | The official version of the Articles of Incorporation would be prepared

in English rather than Dutch, as it is no longer a requirement of

the revised Netherlands Antilles law that the Articles of Incorporation

be prepared in Dutch. [Article 22] We believe that the presentation

of the Articles of Incorporation in English is more practical given

that it is the more commonly used and understood language in the financial

markets. |

| RESOLVED, that the voluntary amendments to the Articles of Incorporation

of Schlumberger N.V. be, and they hereby are, adopted to read in their

entirety as described in Schlumberger’s Proxy Statement dated March

15, 2005 and in the form presented to this meeting; provided, however,

that if both the mandatory amendments and the voluntary amendments

are adopted, then the Articles of Incorporation of Schlumberger N.V.

will be amended to read in their entirety as set forth in Appendix

1 to Schlumberger’s Proxy Statement dated March 15, 2005 and in the

form presented to this meeting; and further RESOLVED, that each lawyer of STvB Advocaten (Curaçao) N.V., Netherlands Antilles counsel to Schlumberger, is authorized to execute and file in the Netherlands Antilles the notarial deed of amendment effectuating such amendments. |

The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote is required for the adoption of the foregoing resolutions for proposal 3(a) and proposal 3(b). Brokers do not have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a non-vote. Accordingly, abstentions and broker non-votes will have the same effect as no votes.

Recommendation of the Board

The Board recommends that you vote “FOR” the approval of the amendments to the Articles of Incorporation.

The 2005 Plan provides for the grant to our employees of stock options covering 9,000,000 shares of our common stock. A stock option gives the holder the right to purchase a specified number of shares of stock, at a fixed exercise price, in the future. We have historically used stock options as our primary form of equity compensation, and we intend to continue to use stock options as our primary form of equity compensation.

| • | retain employees with a high degree of training, experience and ability; | |

| • | attract new employees whose services are considered unusually valuable; | |

| • | encourage the sense of proprietorship of such persons; and | |

| • | promote the active interest of such persons in our development and

financial success. |

Our compensation philosophy is to pay for performance through competitive compensation programs that relate directly to our short and long-term goals, and to reward executives, managers and professionals who achieve these goals. We believe the following factors are important to an understanding of our equity-based compensation program and the merits of the 2005 Plan:

| • | We believe stock options, which have been a part of our equity compensation program for over 46 years, provide a significant incentive to our employees for improved performance. We believe that stock options enable us to attract and retain employees who are critical for our development and financial success, while also aligning those employees’ interests with those of our stockholders. Since a stock option derives its value from an increase in the price of the underlying stock after the date of grant, employees are rewarded only upon improved stock price performance. | |

| • | Our stock option plans, including the 2005 Plan, have been designed to minimize the risk of potentially adverse equity-based compensation practices. Our stock option plans, including the 2005 Plan, do not permit the following activities: |

| • | granting of stock options at a price below the fair market value on the grant date; | ||

| • | repricing, or reducing the exercise price of a stock option; | ||

| • | substituting a new option grant with an exercise price lower than the exercise price of an outstanding option grant; or | ||

| • | reload grants. |

| • | The 2005 Plan does not permit accelerated vesting. The Compensation Committee does not have the power to accelerate the vesting of awards granted under the 2005 Plan. | |

| • | We have capped the per-share gain an employee can realize from the exercise of stock options. Beginning with stock options granted in July 2003, we have “capped” the per-share gain that can be realized on the exercise of a stock option to 125% of the original exercise price. Although the 2005 Plan does not require us to continue this practice, we do not currently intend to change this practice. | |

| • | We were an early adopter of Statement of Financial Accounting Standards No. 123 (“SFAS 123”), “Accounting for Stock-Based Compensation.” In the third quarter of 2003, we adopted SFAS 123 for stock option expenses, retroactive to January 1, 2003. Under SFAS 123, compensation expense associated with stock options is measured at the grant date based on the value of the award and is recognized over the vesting period. Under Accounting Principles Board Opinion No. 25 (APB 25), which we used prior to adopting SFAS 123, no compensation expense was recognized when stock options are granted. | |

| • | We do not believe the “overhang” from stock option plans is significant. We maintain three stock option plans that have previously been approved by our stockholders. Under those plans 30,062,025 shares are reserved for issuance in respect of outstanding options and 5,006,110 shares are reserved for future grants, which reflects “overhang” of approximately 6.0%. If the 2005 Plan is approved, an additional 9,000,000 shares would be available for future grants and “overhang” would increase to approximately 7.5%. We define “overhang” as the total number of shares related to options granted but not yet exercised, plus shares available for grant, divided by total shares outstanding at the end of the reporting period. We do not include shares issuable under our discounted stock purchase plan when calculating our overhang. | |

| • | We believe our average three-year “burn rate” is reasonable. Our average three-year burn rate is approximately 0.8%. We calculate “burn rate” as the total number of equity awards (all in the form of stock options) granted in any given year divided by the number of common shares outstanding. The number of equity awards used in the burn rate calculation is not discounted by cancelled or forfeited options or shares acquired or retained by us. We do not include shares issuable under our discounted stock purchase plan when calculating our burn rate. | |

| • | We believe our average three-year dilution due to the exercise of stock options is reasonable. Our average three-year dilution due to the exercise of stock options is approximately 0.2%. We calculate “dilution” as the number of shares of our common stock issued during a year due to the exercise of stock options, less common shares reacquired by us during the year, divided by the total shares outstanding at the end of such year. If continued, our share buyback program, which was approved by the Board of Directors in July 2004 and expires in December 2006, could reduce dilution. During 2004, we issued 5,490,068 shares of our common stock upon the exercise of stock options (net of shares reacquired in payment of the exercise price of such stock options) and repurchased 5,148,200 shares of our common stock, which resulted in 2004 dilution of 0.06%. | |

| • | We have established stock ownership guidelines for executive officers. In 2004, we established executive stock ownership guidelines to align the interests of our executives with those of our stockholders and to promote our commitment to sound corporate governance. The ownership guidelines specify a number of shares that each executive officer is expected to own (approximately one to five times the executive’s annual base salary, depending on the executive’s scope of responsibilities). The ownership guidelines also require our executives, when they exercise a stock option, to retain at least 30% of the difference between the market price and the exercise price in shares of common stock for a period of six months. After the six-month period, the executive must continue to hold the shares, unless the executive holds a number of shares equal to or greater than the guideline amount divided by the stock price on that day. The ownership guidelines also prohibit speculative trading activity in our stock by our executives. |

Key Terms

The following is a summary of the key provisions of the 2005 Plan.

| Plan Term: | Options may be granted under the 2005 Plan on or before January

20, 2015. |

|||||||||||||||||||||||||

| Eligible Participants: | All employees of Schlumberger and our subsidiaries who are executive,

administrative, professional or technical personnel and who have responsibilities

affecting the management, direction, development and financial success

of the company and our subsidiaries. The Compensation Committee will determine which employees will participate in the 2005 Plan. As of January 1, 2005, approximately 10,000 employees are optionees under our stock option plans. |

|||||||||||||||||||||||||

| Ineligible Participants: | The following persons are not eligible to participate in the 2005

Plan:

|

|||||||||||||||||||||||||

| Shares Authorized: | 9,000,000, subject to adjustment to reflect stock splits, reorganizations

and similar events. The shares subject to issuance under the 2005 Plan consist of authorized and unissued shares or previously issued shares reacquired and held by us or any subsidiary. Under the following circumstances, shares that were once subject to issuance upon the exercise of stock options may again become available for future option grants under the 2005 Plan:

|

|||||||||||||||||||||||||

| Shares Authorized Under 2005 Plan as a Percent of

Outstanding Common Stock: |

1.5% |

|||||||||||||||||||||||||

| Shares Authorized Under All Option Plans as a Percent

of Outstanding Common Stock: |

6.0% |

|||||||||||||||||||||||||

| Award Types: | Non-qualified and incentive stock options. |

|||||||||||||||||||||||||

| Award Terms: |

Stock options will have a term no longer than 10 years. |

|||||||||||||||||||||||||

| Vesting: | Stock options will never vest or become exercisable unless the optionee

remains employed by us or a subsidiary for at least one year after

the grant date. Otherwise, vesting is determined by the Compensation

Committee (subject to specific provisions on death, termination of

employment or retirement). Please read “Vesting and Exercise of Stock Options” below for more information. |

|||||||||||||||||||||||||

| Not Permitted: |

|

Vesting and Exercise of Stock Options

Vesting

Subject to specific provisions on death, termination of employment and retirement (described below), the Compensation Committee will determine at the time of grant when each stock option will vest, provided that no stock option may vest less than one year from the date of grant. The Compensation Committee’s current practice is to grant options that vest in four equal annual installments beginning on the first anniversary of the grant date.

Exercise Price

The exercise price of stock options granted under the 2005 Plan may not be less than the fair market value (the mean between the high and low sales prices on the New York Stock Exchange on the grant date) of the common stock on the date of grant. As of March 2, 2005, the mean between the high and low sales prices of Schlumberger common stock on the New York Stock Exchange was $75.015 per share.

Option Term

The option term may not be longer than 10 years.

Payment of Purchase Price

The purchase price to be paid upon exercise of a stock option may be paid, subject to the rules established by the Compensation Committee, as follows:

| • | in cash or by certified check; | |

| • | by the tender or delivery of shares of our common stock with a fair market value at the time of exercise equal to the total option price; or | |

| • | by a combination of the preceding methods. |

Termination of Employment and Subsequent Events

The following is a summary of consequences in the event an option holder’s employment is terminated (other than due to retirement):

| Event | Consequences | |

Termination of employment with consent of Schlumberger and not for cause |

The Compensation Committee may permit stock options to be exercised at any time within three months after termination, provided that stock options may be exercised only before their expiration and only to the extent they are exercisable on the date of termination. |

|

Death while employed by Schlumberger or after termination of employment but prior to full exercise of stock options that were exercisable on the date of such termination |

Stock options may be exercised before expiration of their term by a person entitled to do so under the option holder’s will or the laws of descent and distribution, but only if such exercise occurs within 60 months after death (or, if earlier, the date of termination of employment) and only to the extent they are exercisable on the date of death. |

|

Termination of employment for cause or without the consent of Schlumberger (other than due to death). |

The option holder’s rights terminate immediately. |

Retirement and Subsequent Events

The following is a summary of consequences in the event an option holder’s employment is terminated due to retirement:

| Event | Consequences | |

Termination of employment due to retirement |

Stock options will be exercisable at any time during the 60-month period after termination by retirement or during the remainder of the option period, whichever is shorter (the “post-retirement exercise period”), but only to the extent they are exercisable on the date of termination. |

|

| Death after retirement during post-retirement exercise period | Stock options may be exercised during a 60-month period after the date of retirement by a person entitled to do so under the option holder’s will or the laws of descent and distribution, provided that the stock options may be exercised only before their expiration and only to the extent they were exercisable on the date of death. |

Transferability

Stock options granted under the 2005 Plan are not assignable or otherwise transferable except by will or the laws of descent and distribution.

Administration

The Compensation Committee, which is made up of at least three directors who meet the applicable independence requirements of the New York Stock Exchange and all other applicable laws and regulations, will administer the 2005 Plan. The Compensation Committee has full power and authority to:

| • | interpret the 2005 Plan and supervise its administration; | |

| • | determine the persons to whom stock options will be granted; | |

| • | determine, subject to certain limitations, the number of shares to be covered by each stock option; | |

| • | determine whether stock options will be designated “incentive stock options” or “non-qualified stock options”; and | |

| • | determine all other terms of each stock option consistent with the provisions of the 2005 Plan. |

Amendment or Termination

The Board of Directors may amend, alter, suspend or discontinue the 2005 Plan at any time as permitted by law, provided that the Board of Directors may not amend the 2005 Plan without the approval of the stockholders:

| • | if, except as described below under “Adjustments,” the amendment would permit the decrease of the purchase price of a stock option after the grant date or grant to the holder of an outstanding stock option a new stock option with a lower exercise price in exchange for an outstanding stock option; or | |

| • | if the amendment or alteration would constitute a material revision to the 2005 Plan requiring stockholder approval under applicable legal requirements or the applicable requirements of the New York Stock Exchange or such other securities exchange on which our common stock is listed. |

Adjustments

In the event of any subdivision or consolidation of shares or other capital readjustment, or the payment of a stock dividend or other increase or reduction of the number of shares of our common stock outstanding without compensation therefor in money, services or property, then the number of shares subject to the 2005 Plan will be proportionally adjusted and the number of shares with respect to which stock options granted under the 2005 Plan may thereafter be exercised shall:

| • | in the event of an increase in the number of outstanding shares, be proportionately increased, and the cash consideration (if any) payable per share shall be proportionately reduced; and | |

| • | in the event of a reduction in the number of outstanding shares, be proportionately reduced, and the cash consideration (if any) payable per share shall be proportionately increased. |

U.S. Federal Income Tax Consequences

The following discussion of tax consequences relates only to U.S. federal income tax matters. The tax consequences of participating in the 2005 Plan may vary according to country of participation. Also, the tax consequences of participating in the 2005 Plan may vary with respect to individual situations and it should be noted that income tax laws, regulations and interpretations thereof change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

Required Vote

A majority of the votes cast is required for approval of the 2005 Plan, provided that the total vote cast on the proposal represents over 50% of all outstanding shares. Brokers do not have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a non-vote on this proposal. Broker non-votes and abstentions could prevent the total votes cast on the proposal from representing over 50% of the outstanding shares, but will not otherwise have an effect on the vote.

Recommendation of the Board

The Board of Directors recommends that you vote “FOR” the Schlumberger 2005 Stock Option Plan.

We are requesting that our stockholders vote in favor of approving an amendment to the Schlumberger Discounted Stock Purchase Plan (as amended, the “DSPP”), which would increase the number of shares available for purchase under the DSPP by 6,000,000 shares. The proposed amendment was approved by the Board on January 20, 2005 and, if approved by our stockholders, will be effective as of January 20, 2005. No other changes are being made to the DSPP.

Purpose of the DSPP and Proposed Amendment

The DSPP is designed to encourage and assist all employees of Schlumberger and its subsidiaries to acquire an equity interest in Schlumberger through the purchase of common stock. The proposed amendment is designed to insure that a sufficient number of shares will be available under the DSPP for future purchase periods. A total of 1,444,434 shares currently remain available for purchase under the DSPP; during 2004, a total of 1,362,419 shares were purchased under the DSPP. If the proposed amendment is approved, an aggregate of 7,444,434 shares will be available for purchase under the DSPP.

Administration

The DSPP is administered by a committee of at least three persons appointed by the Board (the “DSPP Committee”). The DSPP Committee has the full power and authority to:

| • | employ and compensate agents for the purpose of administering the accounts of participating employees; | |

| • | construe and interpret the DSPP; | |

| • | determine all questions of eligibility; and | |

| • | compute the amount and determine the manner and time of payment of all benefits. |

Key Terms

The following is a summary of the key provisions of the DSPP Plan.

| Eligible Participants: | All employees of Schlumberger and its subsidiaries, including officers,

are eligible to participate in the DSPP, except as described below

under “Ineligible Participants.” As of January 1, 2005, there were

approximately 44,520 employees who were eligible to participate in

the DSPP. |

|||||||

| Ineligible Participants: | The following employees are not eligible to participate in the DSPP

(unless otherwise required by applicable law):

|

|||||||

| Shares Available for Issuance Under the DSPP: |

1,444,434 shares currently remain available for purchase under the

DSPP. If the proposed amendment is approved, an aggregate of 7,444,434

shares will be available for purchase under the DSPP. The number of shares available for issuance under the DSPP is subject to adjustment to reflect stock splits, reorganizations, mergers and similar events. |

|||||||

| Purchase Periods: | There are two purchase periods each calendar year: January 1 to

June 30 and July 1 to December 31. |

|||||||

| Purchase Price: | The cost to a participant for shares of our common stock purchased

during a purchase period is equal to 92.5% of the lower of:

“Fair market value” is determined by averaging the highest and lowest composite sale prices per share of our common stock on the New York Stock Exchange Composite Transactions Quotations on a date. |

|||||||

| Method of Payment: | Each DSPP participant may make contributions through payroll deductions

from one to ten percent of his or her eligible compensation. A participant’s

contributions, together with interest on such contributions and dividends

on shares held in the DSPP, where applicable, are used to purchase

shares of common stock at the end of each purchase period. If a participant’s contributions during a purchase period exceed $11,250, or if the purchase of shares with such allocations would exceed the share limitations discussed above under “Ineligible Participants,” such excess amounts will be refunded to the participant as soon as practicable. A participant may not purchase shares of our common stock under the DSPP having a fair market value in excess of $25,000 per year. |

|||||||

| Withdrawal of Shares: | A participant may elect to withdraw previously purchased shares

held in his or her account at any time (without withdrawing from the

DSPP). |

|||||||

| Termination of Rights to Participate in the DSPP: |

The right to participate in the DSPP terminates immediately when

a participant ceases to be employed by us for any reason (including

death, unpaid disability or when the participant’s employer ceases

to be a subsidiary) or the participant otherwise becomes ineligible

or withdraws his or her contributions from the DSPP. |

|||||||

| Modification and Termination of the DSPP: |

Subject to limited exceptions, the Board may amend or terminate

the DSPP at any time. No amendment will be effective unless within

one year after it is adopted by the Board it is approved by the holders

of a majority of the votes cast at a meeting if such amendment would

otherwise cause the rights granted under the DSPP to purchase shares

of our common stock to fail to meet the requirements of Section 423

of the Code. Section 423 currently requires stockholder approval of

a plan amendment that would (1) change the number of shares subject

to the DSPP, or (2) change the class of employees eligible to participate

in the DSPP. |

The following discussion of tax consequences relates only to U.S. federal income tax matters. The tax consequences of participating in the DSPP may vary according to country of participation. Also, the tax consequences of participating in the DSPP may vary with respect to individual situations and it should be noted that income tax laws, regulations and interpretations thereof change frequently. Participants should rely upon their own tax advisors for advice concerning the specific tax consequences applicable to them, including the applicability and effect of state, local and foreign tax laws.

| • | the excess of the fair market value of the common stock on the date of disposition over the price paid for the common stock; or | |

| • | the fair market value of the common stock on the Enrollment Date multiplied by the original 7.5% discount. |

Plan Benefits

Since participation in the plan is voluntary and we are unable to predict the future value of our common stock, we cannot currently determine the benefits or amounts that will be received in the future by any person or group under the DSPP. The following table sets forth the number of shares purchased under the DSPP during 2004 by our Chief Executive Officer, the named executive officers, executive officers as a group and all employees as a group, including all current officers who are not executive officers.

| Name and Position |

Dollar Value ($) |

Number of Shares |

|||

| A. Gould, Chairman and Chief Executive Officer | — | 0 | |||

| C. Sbiti, Executive Vice President | — | 0 | |||

| J. M. Perraud, Executive Vice President and Chief Financial Officer | — | 0 | |||

| X. Flinois, Former Executive Vice President | — | 0 | |||

| D. Boutte, Executive Vice President | — | 0 | |||

| S. Pai, Vice President | 9,492 | 180 | |||

| All executive officers as a group | 153,166 | 2,867 | |||

| All non-executive officer employees as a group | 73,568,164 | 1,359,552 |

Required Vote

A majority of the votes cast (excluding abstentions) which are represented in person or by proxy is required for approval of the amendment to the DSPP.

Recommendation of the Board

The Board of Directors recommends that you vote “FOR” the amendment to the Schlumberger Discounted Stock Purchase Plan.

Equity Compensation Plan Information

The table below sets forth the following information as of the end of Schlumberger’s 2004 fiscal year for (i) all compensation plans previously approved by our stockholders and (ii) all compensation plans not previously approved by our stockholders. The table does not reflect shares of our common stock reserved for issuance under the 2005 Stock Option Plan or in connection with the January 2005 amendment to the Schlumberger Discounted Stock Purchase Plan, both of which are being submitted for stockholder approval at the Annual General Meeting.

| (a) | (b) | (c) | ||||

| Plan category |

Number of securities