![]() VS reached new heights in 1998 by virtually every measure, including customers served,

prescriptions filled, stores operated, sales and earnings generated, and return to shareholders.

We are particularly proud that we achieved excellent financial results and maintained our focus

during a year of tremendous activity for CVS, as we successfully integrated our acquisitions of

Revco D.S., Inc. and Arbor Drugs, Inc.

VS reached new heights in 1998 by virtually every measure, including customers served,

prescriptions filled, stores operated, sales and earnings generated, and return to shareholders.

We are particularly proud that we achieved excellent financial results and maintained our focus

during a year of tremendous activity for CVS, as we successfully integrated our acquisitions of

Revco D.S., Inc. and Arbor Drugs, Inc.

![]()

Our commitment to serving our customers has led to results that are at the forefront of our

industry. Total sales in 1998 reached a record $15.3 billion, an increase of 11.1% from the

$13.7 billion reported in 1997. On a comparable store basis, sales rose a healthy 10.8%,

with pharmacy same store sales climbing 16.5%.

Operating profit, before the effect of non-recurring charges, advanced a robust 20.7% to $940.5 million in 1998, driven by higher comparable store sales and a continued expansion in our operating margin. Gross margin management continues to be a challenge in today’s managed care environment. We continue to take a firm position with third party payors to ensure acceptable levels of reimbursement, and we are proactively working with our managed care partners to align incentives to lower costs and improve care. We are pleased to report that there are signs that the pressure on our pharmacy margin is beginning to ease.

Cost control has always been a key priority for CVS and 1998 was no exception. Our investments in technology, as well as synergy savings from the acquisitions and the leveraging of our exceptionally strong sales growth, have enabled us to decrease our total selling, general and administrative expense (SG&A) as a percent of sales by approximately 300 basis points over the last five years. Currently at 20.9%, our goal is to reduce our total SG&A as a percent of sales to less than 20% over the next two years. We currently have two major initiatives under way, which we believe will enable us to lower costs and improve inventory turns as well as in-stock positions. Our Rx Delivery and Merchandise Transaction System initiatives will help us continue to enhance our competitive cost structure.

Earnings from continuing operations, excluding the effect of non-recurring items, increased 21.7% in 1998 to $510.1 million, or $1.26 per diluted share, from $419.2 million, or $1.05 per diluted share, in 1997. With these results, CVS generated a five-year compounded annual earnings growth rate from continuing operations of nearly 28%.

With a debt to total capital ratio of 25.4% at year-end, our balance sheet continues to improve. As such, Standard and Poor’s recently upgraded our credit ratings, which will result in real economic savings. Our financial strength in large part reflects our aggressive capital management program. We build our capital investment plans to take advantage of the opportunities we believe offer the greatest potential returns. With the substantial 1998 investments surrounding the Revco and Arbor acquisitions behind us, we expect to generate significant free cash flow in 1999 and beyond.

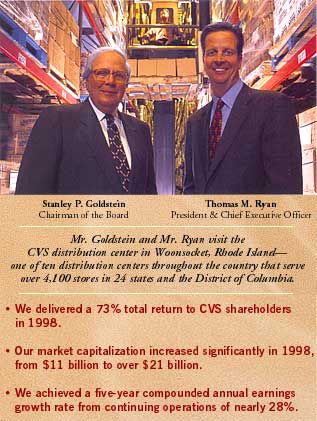

CVS’ strong financial performance has translated into excellent returns for our shareholders.

CVS delivered a 73% total return to shareholders in 1998. That compares to an increase of 18%

for the Dow Jones Industrial Average and 29% for the S&P 500 for the year. Our market

capitalization grew dramatically, from $11 billion at year-end 1997 to more than $21 billion

at year-end 1998. Reflecting the significant increases in CVS’ stock price, our Board of

Directors approved, on May 13, 1998, a 2-for-1 stock split, effective June 15, 1998. Also at

that time, the Board approved an increase in CVS’ annual cash dividend to $0.23 per share (on

a post-split basis), underscoring the Board’s optimism for CVS’ continued growth prospects.

CVS’ strong financial performance has translated into excellent returns for our shareholders.

CVS delivered a 73% total return to shareholders in 1998. That compares to an increase of 18%

for the Dow Jones Industrial Average and 29% for the S&P 500 for the year. Our market

capitalization grew dramatically, from $11 billion at year-end 1997 to more than $21 billion

at year-end 1998. Reflecting the significant increases in CVS’ stock price, our Board of

Directors approved, on May 13, 1998, a 2-for-1 stock split, effective June 15, 1998. Also at

that time, the Board approved an increase in CVS’ annual cash dividend to $0.23 per share (on

a post-split basis), underscoring the Board’s optimism for CVS’ continued growth prospects.

In October 1998, based on our strong real estate pipeline and solid financial position, we

decided to ramp up our new store program. Under our accelerated plan, we opened a record 382

new or relocated stores in 1998. Our plans call for the opening of 440 new or relocated stores

in 1999. We anticipate that most of these will be in existing markets. We already operate in

many fast-growing markets and enjoy the #1 position in six of the top ten drugstore

markets in the U.S. We also plan to announce our entry into two new markets in 1999 and to add

at least one new market each year thereafter.

![]()

The acquisition of Revco in May 1997 was a milestone event for our company, doubling our

revenues and nearly tripling our store base. Since that time, we have been working diligently

to integrate the two companies smoothly and take advantage of the enormous potential of our

combined organization—all while maintaining our standards of excellence in serving customers.

We gave change a good name by converting all Revco stores to CVS stores. We completed all systems conversions; remerchandised all Revco stores to be compatible with CVS; and remodeled approximately 1,900 Revco stores to "look and feel" like CVS—all within a 16-month period. We are extremely proud of these tremendous accomplishments. More importantly, customers are responding to what CVS has to offer. Revco’s solid pharmacy franchise continues to show strong growth and the front-store business is consistently improving, achieving double-digit same store sales increases in December. We expect to see further improvements as our front store strategies continue to take hold.

![]()

While integrating Revco, we simultaneously forged ahead with the acquisition of Arbor, which

we completed in March 1998. The acquisition provided us with the #1 market share position in

metropolitan Detroit, the nation’s 4th largest drug retail market. We are pleased with our

progress on the integration of Arbor. All of Arbor’s back-end and store systems were completely

converted to CVS’ systems by November and we closed the Arbor headquarters in December. We

achieved $20 million in partial synergy savings in 1998 and we are on track to achieve $30

million in annual synergy savings, beginning in 1999. We are currently testing new store

layouts based on the roll-out of "best practices" from CVS and Arbor.

![]()

As we look ahead, we are very confident about the future of CVS. Industry dynamics are highly

favorable. The American population is aging, with many "baby boomers" now in their fifties and

requiring a greater number of prescriptions. The increased use of pharmaceuticals in managed

care as the first line of defense for healthcare, as well as the large number of successful

new prescription drugs, bodes well for a growing demand for pharmacy services.

Although we are proud of our past accomplishments, we continually search for new and innovative ways to make our stores the preferred place to shop. Since many of the products we feature are carried by other retailers, our strategy has long been to differentiate CVS through exceptional service and by re-inventing convenience. Everything we do is aimed at making life easier for our customers. Convenience starts with location, and we strive for the best sites with the easiest access. Making it easier for our customers also means offering our Rapid Refill™ system, drive-thru pharmacy, one-hour photo, and other convenience services. For some customers, ordering a prescription refill on the Internet is preferable, so we now offer that option as well. Furthermore, we have over 700 extended-hour or 24-hour stores to help us "bring the care back to healthcare."

We are highly optimistic about our prospects for growth. Our financial position is solid; our strategic direction is clearly mapped to capitalize on our vibrant industry; and we have key competitive advantages, including market leadership positions, a proven ability to execute at retail, expertise serving managed care organizations, and state-of-the-art technology systems. Most of all, we have an outstanding team in place. Our 97,000 associates are among the best in the healthcare retailing industry. They care about our customers and have fully embraced our Company’s mission. We are proud of their accomplishments and thank them all for their extraordinary efforts in 1998.

We welcomed a new member to our Board during 1998. Eugene Applebaum, formerly Chairman, President and Chief Executive Officer of Arbor, joined our Board of Directors upon completion of the Arbor acquisition. We want to thank the entire CVS Board of Directors for their wise counsel throughout the challenging past year.

Finally, we thank our shareholders, customers, suppliers and other partners for their strong support. Consistent with our goal of making life easier for our customers, we are also focused on convenience for our shareholders. In that regard, our new transfer agent, The Bank of New York, offers a Dividend Reinvestment and Direct Stock Purchase Plan. Further, we have re-designed our Web site to provide easy access to more information about CVS.

We are in the midst of the most significant growth period in the history of our company. 1998 was an eventful and successful year for CVS Corporation. Due to the hard work of our devoted associates, our company is extremely well positioned. We look forward to the future, its challenges and opportunities for growth.

Sincerely,

|

Stanley P. Goldstein

|

Thomas M. Ryan

|

|

| January 27, 1999 |

| As this report was going to press, CVS announced that Stanley P.Goldstein, CVS' founder, will be retiring from his position as Chairman of the Board. Effective April 14, 1999, Thomas M. Ryan will assume the title of Chairman of the Board, while continuing to serve as Chief Executive Officer. Charles C. Conaway, currently the Executive Vice President and Chief Financial Officer, will become President and Chief Operating Officer. |

Download this section in PDF format.

|

|

|

|

|

copyright

©1998 CVS/pharmacy, Inc.

|