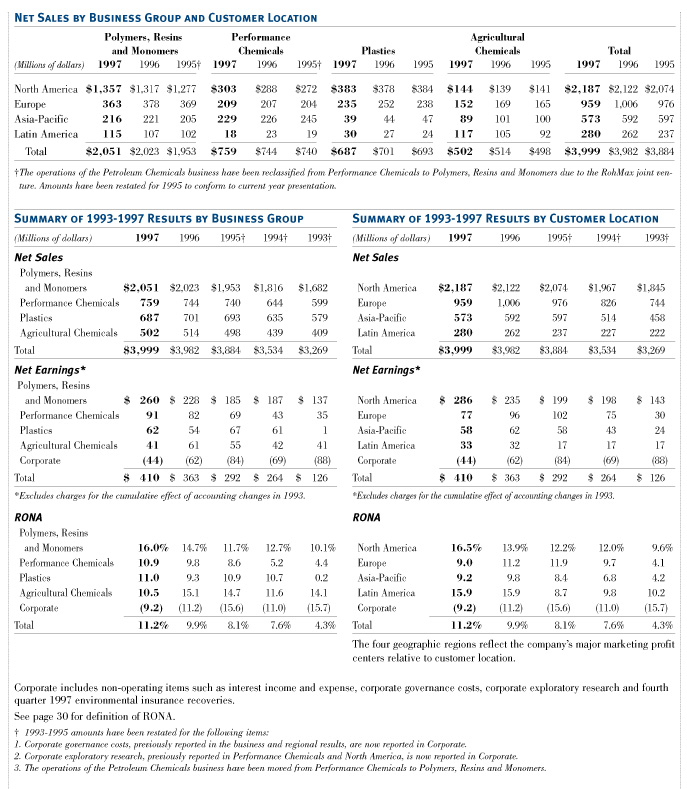

The company's operations are organized by worldwide business groups. A description of each business group's operations can be found in the summary chart at the beginning of this report.

Polymers, Resins and Monomers (PRM) reported 1997 earnings of $260 million, up 14% from 1996. Excluding the effect of the former Petroleum Chemicals business, sales were up 4% on an 8% volume increase. Volume growth was evident in all regions and reflected strong performances in the paper, adhesives and coatings markets. Earnings increased largely as a result of volume. The positive effects, however, were held back by one percent lower selling prices and weaker currencies, the dollar value of which declined an average of 9% in Europe and 10% in Japan during the year.

PRM 1996 earnings of $228 million increased 23% over 1995. Sales increased 7% and volume grew 8%, excluding the impact of the Petroleum Chemicals operations which became part of the RohMax joint venture on July 3, 1996 (see Liquidity section). Volume growth reflected strong performances in the coatings and construction markets in all regions. Earnings increased due to volume growth and lower raw material prices, but were reduced by lower selling prices, startup expenses associated with a new emulsion facility in Houston, Texas, a $7 million after-tax charge for a plant writedown in the U.S., and restructuring costs in Japan.

Performance Chemicals reported 1997 earnings of $91 million, up 11% from 1996 earnings of $82 million. Sales increased 2% on volume growth of 4%. Because of weaker currencies in Europe and in the Asia-Pacific regions, the volume increase did not result in comparable sales growth. Increased earnings are a result of double-digit volume growth in Electronic Chemicals, which includes a contribution from Rodel, Inc. a 1997 investment. Also contributing was volume growth and operating improvements in Ion Exchange Resins. The discontinuation of the Biocides joint venture with Dead Sea Bromine reduced sales and earnings.

Performance Chemicals reported 1996 earnings of $82 million, up 19% from 1995 earnings of $69 million. Sales increased 3% and volume grew 2%, excluding the effect of the sale in 1995 of Plaskon, a small electronic chemicals subsidiary. Sales were up because of a higher-priced product mix, offset by lower selling prices and weaker currencies in Europe and Japan. Volume gains were restrained by lower shipments by Shipley Company in North America due to a slowdown among suppliers in the electronics industry during the middle of the year. Performance Chemicals earnings growth was fueled by a turnaround of Ion Exchange Resins, which reported earnings in 1996 compared to losses in 1995. This improvement is due to a significant reduction in operating costs, higher volume and declining raw material prices, though selling prices continued to be lower than the prior year. Performance Chemicals earnings were reduced by lower selling prices, higher operating costs due to the startup of a new biocides production facility, unfavorable currency movements, increased competition and higher operating costs in Europe for Shipley Company.

Plastics earnings of $62 million in 1997 were up 15% from 1996, the improvement largely a result of modest losses from AtoHaas Europe, compared with significant losses reported in 1996. Though volume increased 4%, sales decreased 2%, reflecting decreased selling prices and weaker currencies in Europe. Continuing pricing pressure in most plastics sectors also dampened Plastics' earnings recovery. In 1997 AtoHaas Europe was affected by a $4 million after-tax write-off of start-up expenses for a plant in Italy.

Plastics 1996 earnings were $54 million, down 19% from 1995. Though volume increased 6%, sales grew only 1%, reflecting lower selling prices and weaker currencies in Europe and Japan. The earnings decline was due to losses from AtoHaas Europe resulting from weak market conditions characterized by lower volume, falling prices and higher raw material prices. The company's share of AtoHaas Europe's losses also included $4 million of costs related to restructuring operations. AtoHaas Americas had flat results due to falling selling prices, higher operating costs and a $2 million after-tax charge for a plant writedown in the U.S. Plastics Additives reported earnings growth fueled by a strong performance in Europe where volume was up and unit operating costs and selling and administrative costs were below 1995 levels.

Agricultural Chemicals earnings in 1997 were $41 million, 33% lower than 1996. Sales and volume decreased 2% from 1996. The volume decrease was due primarily to weather-related lower Dithane fungicide shipments in all regions except Latin America. Sales of other Agricultural Chemical product lines showed growth. The earnings decrease was largely a result of lower volume, weaker currencies in Europe and Japan and the absence of a $6 million after-tax gain from the sale of land in Japan in 1996.

Agricultural Chemicals earnings in 1996 were $61 million, 11% higher than 1995. Sales increased 3%, due to 7% higher volume, offset by a lower-priced product mix and weaker currencies in Europe and Japan. Volume rose due to increased shipments of Dithane fungicide in Asia-Pacific and Latin America. Goal herbicide had higher volume in North America due to approval for use on additional crops. The earnings improvement reflects higher volume and selling prices, lower operating costs and a $6 million after-tax gain on the sale of land in Japan previously used for agricultural research. Weaker currencies in Japan and Europe and higher selling, administrative and research costs to support new product development and market introductions held back earnings growth.

Corporate expenses

totaled $44 million in 1997, compared with $62 million in 1996 and

$84 million in 1995. Included in the 1997 results is an after-tax

gain of $16 million, the net result of remediation settlements with

insurance carriers during the fourth quarter. The 1995 period

included an after-tax charge of $17 million for additional potential

liability related to the cleanup of the Whitmoyer waste site.

Interest expense was flat in 1997 compared to 1996 and 1995.

Summary of Consolidated Results

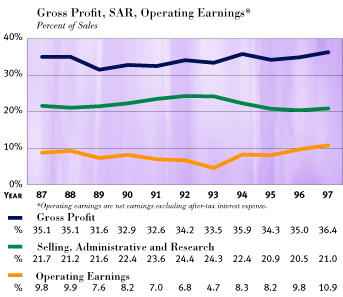

The graph above shows the historical trend of gross profit, selling, administrative and research expenses and operating earnings as a percent of sales.

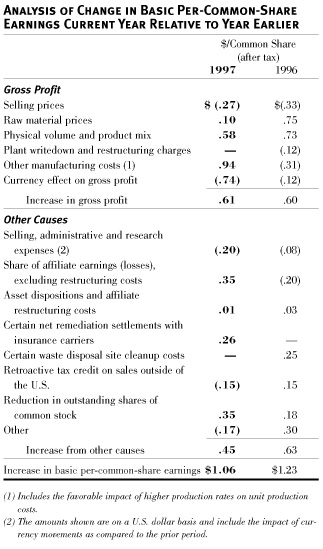

An analysis of gross profit changes is summarized on a basic per-share basis in the table Analysis of Change in Basic Per-Common-Share.

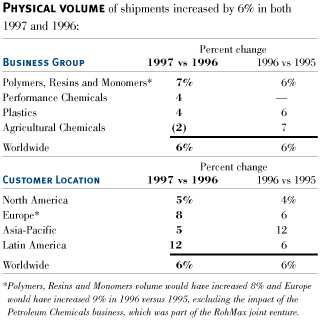

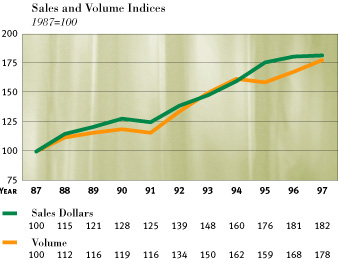

Net sales of $3,999 million were essentially the same as in 1996, the net result of 6% volume gains, one percent lower selling prices, 9% weaker currencies in Europe, a 10% weaker Japanese yen and the absence of Petroleum Chemicals sales which were part of the RohMax joint venture in 1997. Volume growth was strong in all regions, with all businesses contributing except Agricultural Chemicals. Sales in 1996 of $3,982 million were 3% higher than 1995 due to 6% volume gains, offset by 1% lower selling prices and a 15% weaker Japanese yen. Volume grew due to strengthening economies around the world and the resurgence of the construction and automotive markets. All regions and most businesses contributed to the 1996 volume growth.

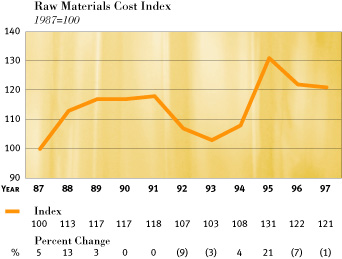

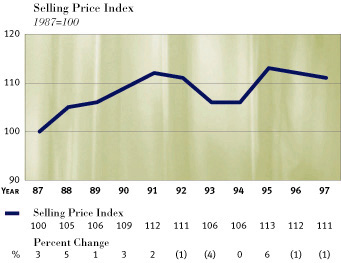

Raw material prices remained stable in 1997. They declined throughout the first three quarters of 1996, until natural gas and oil prices increased in the fourth quarter of that year. Prices for raw materials, including styrene, propylene, acetone and butanol, were down 1%, net, in 1997 compared to decreases of 7% in 1996 and increases of 18% in 1995, excluding currency impacts. The 1995 increases were caused by tightness of petrochemical supply which eased during 1996. The charts below and on page 26 identify year-to-year changes for average unit raw material costs and average unit selling prices based on the company's product mix.

Gross profit increased to $1,455 million in 1997, up 4% from 1996. The gross profit margin was 36%, 35% and 34% in 1997, 1996 and 1995, respectively. The gross profit margin increased in 1997 because of higher volume but was negatively affected by one percent lower selling prices and unfavorable currency impacts. Total gross profit increased in 1996 to $1,395 million, up 5% from 1995. The gross profit margin increased in 1996 because of declining raw material prices and higher volume. One percent lower selling prices, a plant writedown in the U.S. and restructuring costs in Japan hurt margins in 1996.

Selling, administrative and research (SAR) expenses in 1997 and 1996 were up 3% each year, excluding the impact of currency movements and the effect of the RohMax joint venture (see Liquidity section). Spending increased due to higher selling expenses, higher bonus expense, insurance costs and the cost of new product introductions.

Interest expense of $39 million in 1997 was flat compared to 1996 and 1995.

Share of affiliate net

earnings were $11 million in 1997, compared to losses of

$12 million in 1996 and $5 million in 1995. Nineteen ninety-seven

earnings were a result of the RohMax joint venture, the contribution

of Rodel, Inc. and improved results from AtoHaas Europe. During 1996,

AtoHaas Europe experienced operating losses because of weak market

conditions characterized by lower volume, falling selling prices and

increasing raw material prices. The 1996 losses of the

AtoHaas Europe business also included $4 million of write-

offs and costs related to the restructuring of its operations.

Other income, net was $22 million, compared to net other expenses of $4 million in 1996 and $48 million in 1995. The current year includes pre-tax income of $26 million, the net effect of remediation settlements with insurance carriers during the fourth quarter. Nineteen ninety-six included a gain of $10 million on the sale of land in Japan and $6 million of royalty income, offset by $8 million of severance and early retirement costs and $5 million of minority interest losses. The 1995 period included $26 million for additional potential liability related to the cleanup of the Whitmoyer waste site, $16 million for severance and early retirement costs, and $4 million for the settlement of litigation.

The effective tax rates were 33% in 1997, 32% in 1996 and 34% in 1995. The 1996 period included a $10 million retroactive tax credit on sales outside the United States.

Return to Financial Table of Contents