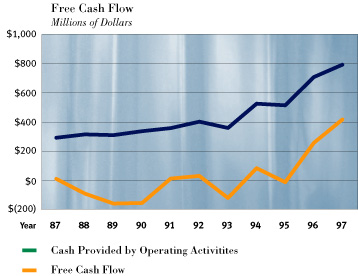

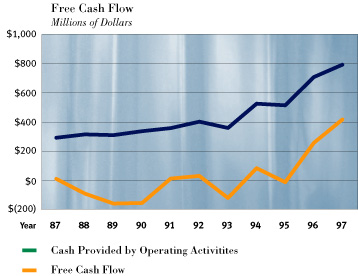

Cash Flow Cash provided by operations for 1997 was $791 million. The resulting free cash flow of $416 million was used to reduce debt, invest in joint ventures and to fund the company's stock repurchase program. Free cash flow is cash provided by operating activities less fixed asset spending and dividends. The company has an "A" debt rating and adequate financial resources available to provide cash required for future operations.

Financing Total borrowings at year-end 1997 were $606 million, down $101 million from the prior year. At the end of 1997, the debt-to-equity ratio, calculated without the reduction to stockholders' equity for the ESOP transaction, was 31%, compared with 38% at the end of 1996 and 36% at the end of 1995.

Environmental There is a risk of environmental damage in chemical manufacturing operations. The company's environmental policies and practices are designed to ensure compliance with existing laws and regulations and to minimize the possibility of significant environmental damage. These laws and regulations require the company to make significant expenditures for remediation, capital improvements and the operation of environmental protection equipment. Future developments and even more stringent environmental regulations may require the company to make additional unforeseen environmental expenditures. The company's major competitors are confronted by substantially similar environmental risks and regulations.

The company is a party in various government enforcement and private actions associated with former waste disposal sites, many of which are on the U.S. Environmental Protection Agency's (EPA) Superfund priority list. The company is also involved in corrective actions at some of its manufacturing facilities. Accruals for expected future remediation costs are in accordance with the provisions of the American Institute of Certified Public Accountants' Statement of Position 96-1, "Environmental Remediation Liabilities," adopted in 1997, which requires an accrual to be recorded when it is probable a liability has been incurred and costs are reasonably estimable. The company considers a broad range of information when determining the amount of the accrual, including available facts about the waste site, existing and proposed remediation technology and the range of costs of applying those technologies, prior experience, government proposals for this or similar sites, the liability of other parties, the ability of other principally responsible parties to pay costs apportioned to them and current laws and regulations. These accruals are updated quarterly as additional technical and legal information becomes available. Major sites for which reserves have been provided are: the non-company-owned Lipari, Woodland and Kramer sites in New Jersey, and Whitmoyer in Pennsylvania and company-owned sites in Bristol and Philadelphia, Pennsylvania, and in Houston, Texas. In addition, the company has provided for future costs at approximately 80 other sites where it has been identified as potentially responsible for cleanup costs and, in some cases, damages for alleged personal injury or property damage.

The amounts charged to earnings before tax for environmental

remediation, net of insurance recoveries, were $27 million and $45

million in 1996 and 1995, respectively. Remediation related

settlements with insurance carriers, a $20 million charge resulting

from an unfavorable arbitration decision relating to the Woodlands

sites, and other waste remediation expenses resulted in a net gain of

$13 million in 1997. The charge in 1995 included $26 million for

additional potential liability related to the cleanup of the

Whitmoyer waste site as a result of an adverse court ruling in that

year. The company appealed that ruling and, during 1996, the United

States Court of Appeals for the Third Circuit ruled in the company's

favor by reversing the 1995 judgment of the Federal District Court

regarding indemnification of SmithKline Beecham (SKB) for cleanup of

the Whitmoyer site. Rohm and Haas and SKB have agreed to an interim

cost sharing arrangement; however, the company will not make any

adjustment to its environmental remediation reserves until a final,

court-approved arrangement is negotiated.

The reserves for remediation were $147 million and $139 million at December 31, 1997 and 1996, respectively, and are recorded as "other liabilities" (current and long-term). The company is in the midst of lawsuits over insurance coverage for environmental liabilities. It is the company's practice to reflect environmental insurance recoveries in the results of operations for the quarter in which the litigation is resolved through settlement or other appropriate legal process. Resolutions typically resolve coverage for both past and future environmental spending. Insurance recoveries receivable, included in accounts receivable, net, were $19 million at December 31, 1997 and $48 million at December 31, 1996 resulting from collections of $88 million during 1997 and new settlements of $59 million.

In addition to accrued environmental liabilities, the company has reasonably possible loss contingencies related to environmental matters of approximately $65 million at December 31, 1997 and 1996. Further, the company has identified other sites, including its larger manufacturing facilities in the United States, where additional future environmental remediation may be required, but these loss contingencies are not reasonably estimable at this time. These matters involve significant unresolved issues, including the number of parties found liable at each site and their ability to pay, the outcome of negotiations with regulatory authorities, the alternative methods of remediation and the range of cost associated with those alternatives. The company believes that these matters, when ultimately resolved, which may be over an extended period of time, will not have a material adverse effect on the consolidated financial position or consolidated cash flows of the company, but could have a material adverse effect on consolidated results of operations in any given year because of the company's obligation to record the full projected cost of a project when such costs are probable and reasonably estimable.

In 1995, a lawsuit was filed against the company and other defendants, seeking class action certification for property damage, personal injury and medical monitoring allegedly related to contamination of the Lipari landfill, nearby streams and Lake Alcyon in Pitman, New Jersey. In 1996 and 1997, the plaintiffs withdrew property damage and personal injury claims. The company believes it has substantial defenses to this lawsuit; financial impact, if any, is indeterminable at this time.

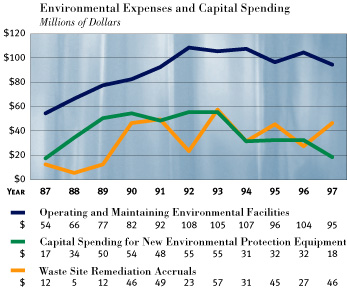

Capital spending for new environmental protection equipment was

$18 million in 1997. Spending for 1998 and 1999 is expected to be

approximately $28 million and $21 million, respectively. Capital

expenditures in this category include projects whose primary purpose

is pollution control and safety, as well as environmental aspects of

projects in other categories on page 29 which are intended primarily

to improve operations or increase plant efficiency. The company

expects future capital spending for environmental protection

equipment to be consistent with prior-year spending patterns. Capital

spending does

not include the cost of environmental remediation of waste disposal

sites.

Cash expenditures for waste disposal site remediation were $37 million in 1997, $58 million in 1996 and $51 million in 1995. The expenditures for remediation are charged against accrued remediation reserves. The cost of operating and maintaining environmental facilities was $95 million, $104 million and $96 million in 1997, 1996 and 1995, respectively, and was charged against current-year earnings.

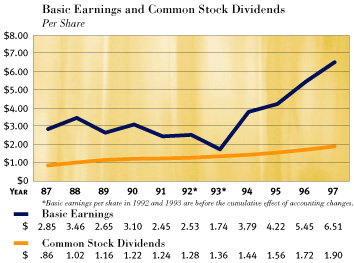

Dividends Total

common stock dividends paid in 1997 were $1.90 per share, compared to

$1.72 per share in 1996 and $1.56 per share in 1995. The company's

common stock dividend payout is targeted at approximately 35% of

trend-line earnings. Common stock dividends have been paid each year

since 1927. The common stock dividend payout has increased annually

every year since 1977. Total preferred dividends paid were $2.75 per

share in 1997, 1996 and 1995.

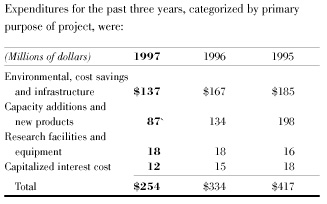

Additions to Land, Buildings and

Equipment Fixed asset additions in 1997 were $254

million, down $80 million from the prior year's spending level.

Additions in 1997 included new facilities in Europe and Asia,

completion of the capacity-related projects at Houston, Texas and

expansion in electronic chemicals. Additions in 1996 included new

emulsion facilities in Thailand, Indonesia and Houston, Texas, and

capacity expansion for acrylic acid and butyl acrylate ester at

Houston, Texas. The company has budgeted capital expenditures in 1998

of approximately $325 million. Spending for environmental protection

equipment, which is included in several of the categories on the

chart shown below, was $18 million in 1997 and $32 million in 1996

and 1995.

Acquisitions and Divestitures In 1997, the company purchased a 26% interest in Rodel, Inc. for approximately $68 million. Rodel is a privately held, Delaware-based leader in precision polishing technology serving the semiconductor, memory disk and glass polishing industries. The investment is accounted for on the equity basis with Rohm and Haas's share of earnings reported as equity in affiliates. The excess of the company's investment in Rodel over its share in the related underlying equity in net assets is being amortized on a straight-line basis over the estimated life of the investment.

In December 1997 and January 1998, the company signed agreements in principle to sell its 50% interest in the RohMax joint venture to its partner, Röhm GmbH, and its 50% interest in the AtoHaas joint venture to Elf Atochem. The pending sales, subject to negotiations, are expected to result in a one-time after-tax gain of approximately $100 million.

On July 3, 1996, the company completed the formation of RohMax, a 50-50 joint venture with Röhm GmbH for the research, manufacture and sale of petroleum additives. The company contributed its petroleum additives inventory, manufacturing and research assets in the United States, Canada and France to the joint venture. Röhm GmbH contributed the assets of its related petroleum additives business in Germany to RohMax. The company's share of RohMax's earnings have been reported using the equity method since July 1996.

Stock Repurchases The 3.5 million share repurchase program approved in October of 1996 by the board of directors was largely completed in October of 1997. Since the company continued to have strong cash flow and a debt-to-equity ratio below 40%, the board of directors approved an additional buyback program in October 1997 authorizing the purchase of up to 3 million shares of common stock over the next two years. These shares represent approximately 5% of the 61 million shares outstanding as of December 31, 1997. From year-end 1995 through year-end 1997, the company repurchased 7 million shares, or approximately 11% of common shares outstanding, at a cost of $518 million. During 1997, the company repurchased 2,551,151 shares of its common stock at a total cost of $216 million, compared to 4,430,971 shares in 1996 at a cost of $302 million. There were 60,875,649 and 63,144,751 common shares outstanding at December 31, 1997 and 1996, respectively.

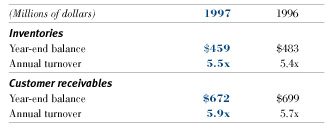

Working capital (the

excess of current assets over current liabilities) was $547 million

at year-end 1997, down $23 million from 1996. Accounts receivable

from customers decreased $42 million and inventory decreased $24

million. Days sales outstanding were 60 days, down from 64 days at

the end of 1996. Days cost of sales in ending inventory was 66 days,

down from 68 days at the end of 1996. Details about two major

components of working capital at the end of 1997 and 1996 follow:

Net Fixed Assets

Investments in net fixed assets is summarized below:

These annual turnover figures were calculated by dividing annual sales (for customer receivables and net fixed assets) or cost of goods sold (for inventories) by the year-end balance. Days sales outstanding was calculated by dividing ending customer receivables by daily sales, and days cost of sales in ending inventory was calculated by dividing ending inventory by daily cost of sales.

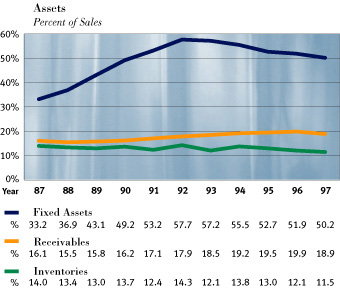

The graph below presents the trend of receivables, inventories and net fixed assets as a percent of sales.

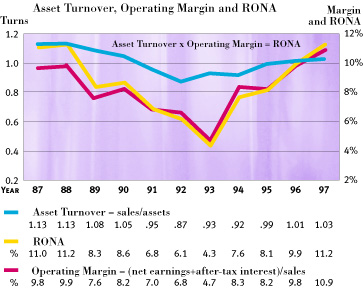

Asset turnover equals sales divided by year-end total assets. Asset turnover has shown steady improvement, increasing from a low of .87 times in 1992 to 1.0 in 1996 and 1997. The graph below shows asset turnover, operating margin and return on net assets (RONA) for the past eleven years.

Return on net assets (RONA) equals net earnings plus after-tax interest expense, divided by year-end total assets. RONA was 11.2% in 1997, 9.9% in 1996 and 8.1% in 1995. The 1997 amount rounds to 10.8% when calculated without the beneficial effects of fourth quarter 1997 environmental insurance recoveries.

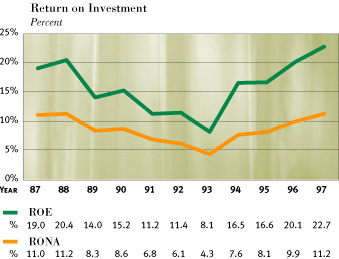

Return on common stockholders'

equity (ROE) is obtained by dividing net earnings less

preferred stock dividends by average year-end common stockholders'

equity. Average year-end common stockholders' equity is calculated

without the reduction for the ESOP transaction. ROE was 23% in 1997,

20% in 1996 and 17% in 1995.

The return on investment graph shows these measures for the past eleven years.

Year 2000 During 1996 management initiated an enterprise-wide program to prepare the company's computer systems and applications for the year 2000 and, in 1997, began assessing supply chain and customer implications. The company expects a significant proportion of the total effort to represent the redeployment of existing information technology resources. In addition, consulting and other expenses related to software application and facilities enhancements necessary to prepare the systems for the year 2000 are expected to be incurred over the next two years. Through the end of 1997 the costs were immaterial. All of these costs, which are not expected to exceed $15 million, will be charged to expense as incurred.

Recent Accounting Standards In March 1995, the Financial Accounting Standards Board issued Statement No. 121, "Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of." This statement requires that long-lived assets be reviewed for impairment whenever events indicate that the carrying amount of an asset may not be recoverable. The adoption of this accounting standard in 1996 did not have a material impact on the company's financial position or results of operations.

In October 1995, the Financial Accounting Standards Board issued

Statement No. 123, "Accounting for Stock-Based Compensation," which

became effective in 1996. The statement encourages the fair value

based method which recognizes compensation expense equal to the fair

value of the stock-based compensation at the date of the grant. As an

alternative, the statement allows companies to continue to apply APB

Opinion No. 25 and related Interpretations, which for certain types

of stock-based compensation, does not result in a charge to earnings.

The company has elected to continue to apply the provisions of APB

Opinion No. 25. Accordingly, no compensation expense has been

recognized for the fixed stock option plans. Details about the

company's stock option plans are included in Note 19, Stock

Compensation Plans.

In October 1996, the American Institute of Certified Public Accountants issued Statement of Position 96-1 (SOP 96-1), "Environmental Remediation Liabilities," which became effective in 1997. The statement provides authoritative guidance regarding the recognition, measurement, display and disclosure of environmental remediation liabilities. The company's adoption of this accounting guidance in 1997 did not have a material impact on the company's financial position or results of operations.

In 1997, the company adopted Statement of Financial Accounting

Standards No. 128, "Earnings Per Share," which requires computation

and presentation of basic and dilutive earnings per share. Basic

earnings per share (EPS) excludes dilution and is computed by

dividing net income available for common shareholders by the weighted

average number of common shares outstanding for the period. Diluted

EPS reflects the potential dilution that could occur if securities or

other contracts to issue common stock were exercised or converted.

For the years presented, the company's basic earnings per share is

equal to earnings per share reported under the previous accounting

standards. Dilutive earnings per share is slightly lower than basic

earnings per share, primarily due to the impact of convertible

preferred stock.

In June 1997, the Financial Accounting Standards Board issued Statement No. 130, "Reporting Comprehensive Income," which establishes standards for reporting and display of comprehensive income and its components in a financial statement that is displayed with the same prominence as other financial statements. Comprehensive income as defined includes all changes in equity (net assets) during a period from nonowner sources including net income, foreign currency related items and unrealized gain/loss on certain securities. The disclosures prescribed by this standard must be made beginning in the first quarter of 1998. If this standard had been applied in 1997, the company's 1997 comprehensive income would have been $23 million lower than net earnings primarily reflecting the foreign currency translation adjustment resulting from reductions in the U.S. Dollar book value of assets in Japan where the Japanese yen weakened 10% during the year.

Also in June 1997, the Financial Accounting Standards Board issued Statement No. 131, "Disclosures about Segments of an Enterprise and Related Information," which establishes standards for the reporting of information about operating segments in annual financial statements. The company is assessing its current business segment reporting to determine changes in reporting required under this new standard. The disclosures prescribed by the statement are required for the company's 1998 annual report with application to interim periods permitted.

Return to Financial Table of Contents