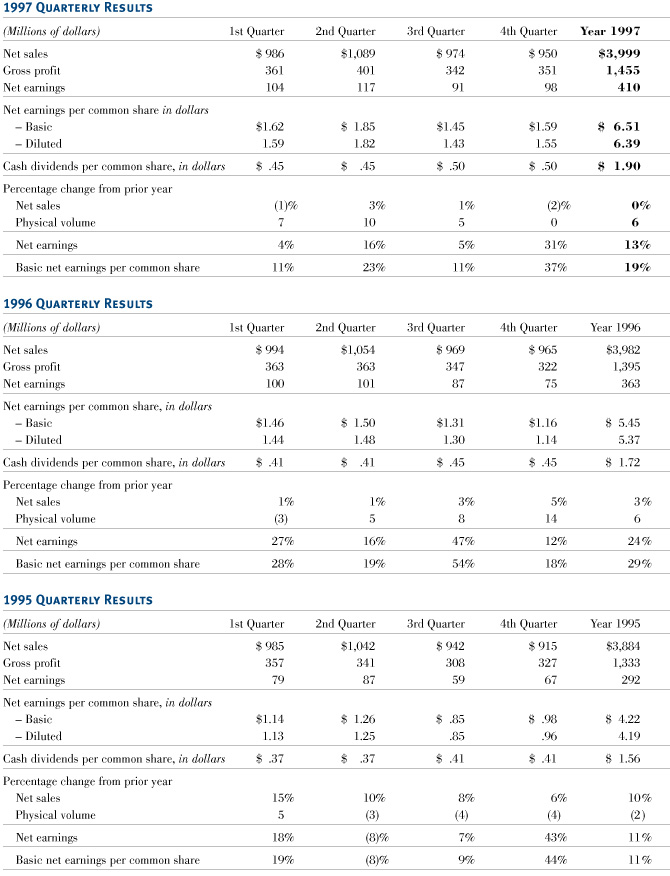

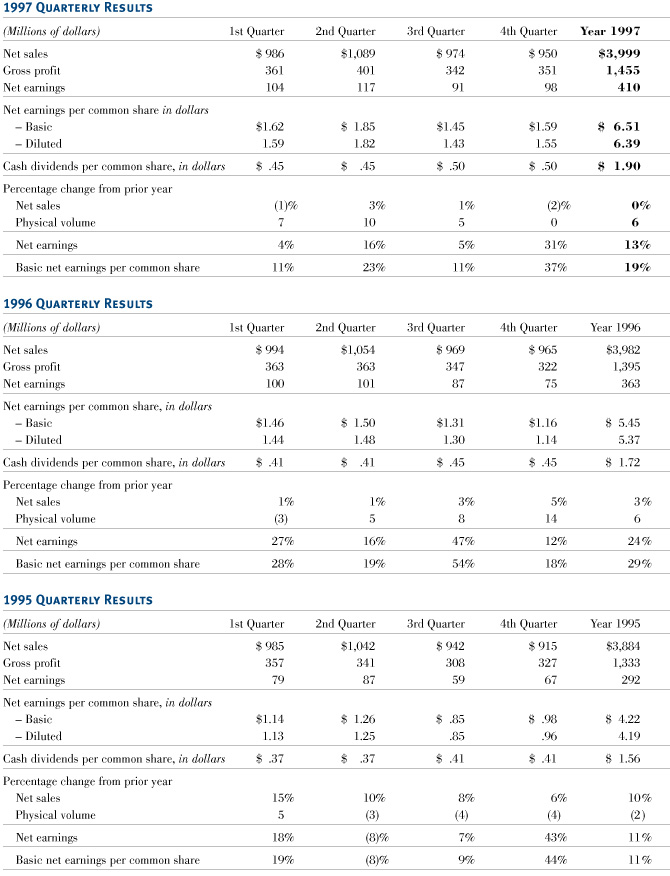

Earnings of $104 million in the first quarter of 1997 were up 4% from last year's strong first quarter results of $100 million. Basic earnings per common share were $1.62, compared to earnings of $1.46 per common share in 1996. Though volume increased by 7%, sales of $986 million were down 1% from last year's sales of $994 million because of weaker currencies in Europe and Japan, 2% lower selling prices, lower-priced product mix and the formation of the RohMax joint venture. Earnings increased as a result of higher volume, 2% lower raw material costs, good internal cost control and earnings from affiliates versus losses in 1996. In addition to higher earnings, the per-share increase reflects the impact of the company's common share repurchase program in the first and all subsequent quarters in 1997.

Second quarter 1997 earnings were $117 million, up 16% from last

year's results of $101 million. Basic earnings per common share of

$1.85 rose 23% from $1.50 per common share in 1996. Volume increased

10% in the quarter as a result of strong growth in Polymers, Resins

and Monomers, Plastics and the Electronic Chemicals businesses. Sales

of $1,089 million were 3% above

the prior year period, due to higher volume balanced by weaker

currencies in Japan and in Europe, slightly lower selling prices and

the exclusion of sales of businesses accounted for through joint

ventures. Earnings increased as a result of higher volume and

earnings from affiliates compared with losses in the prior year.

Offsetting these increases were an increase in selling,

administrative and research expenses and the absence of a

non-recurring $10 million ($.15 per common share) retroactive tax

credit on sales outside the United States recorded in the second

quarter of 1996.

Third quarter 1997 earnings were $91 million, up 5% from last

year's earnings of $87 million. Basic earnings per common share

of $1.45 rose 11% from $1.31 per common share in 1996. Volume

increased 5% in the quarter as a result of strong demand in Polymers,

Resins and Monomers and Performance Chemicals. The latter segment's

performance was helped largely by the Electronic Chemicals

businesses. Despite good volume growth, sales of $974 million were

just 1% above the prior-year period, reflecting weaker currencies in

Japan and in Europe and moderately lower selling prices. Earnings

increased as a result of higher volume, smooth plant operations,

earnings from affiliates and lower interest expense.

Earnings in the fourth quarter of 1997 were $98 million, 31%

higher than last year's results. Basic earnings per common share were

$1.59, compared to $1.16 in 1996. Fourth quarter 1997 earnings

include a gain of $16 million after tax, or $.26 per common share,

the net result of remediation settlements with insurance carriers.

The 1996 results included a net after-tax charge of $.09 per common

share for plant writedowns and restructuring charges, net of a gain

on the sale of land. Volume for the quarter was essentially unchanged

compared to the strong volume growth reported in the 1996 period.

Volume gains in Performance Chemicals and Agricultural Chemicals were

balanced by decreases in Plastics and in Polymers, Resins and

Monomers in the most recent period. Sales decreased 2% to $950

million, due to flat volume and unfavorable currency impacts versus

1996. Regional earnings also were affected by 10% weaker currencies

in Europe and an 8% weaker Japanese yen.

Return to Financial Table of Contents