![]()

Note 18: Stockholders' Equity

The company has the authorization to issue up to 25

million shares of preferred stock. The outstanding preferred

stock was issued in connection with the acquisition of

Shipley Company in 1992. The company may issue up to an

additional 124,535 of these preferred shares for the

exercise of outstanding Shipley stock options. This

preferred stock pays an annual cumulative dividend of $2.75

per share. It has antidilution protection against stock

splits, stock dividends and certain issuances of additional

securities and extraordinary dividends. This preferred stock

is convertible at any time at the holder's option into Rohm

and Haas common stock at the rate of .7812 shares of common

stock for each share of preferred stock. Holders of the

preferred stock are entitled to one vote per share. The

company has the option to redeem the preferred stock on or

after June 12, 1999, at a fixed redemption price of $50.62,

payable in Rohm and Haas common stock. The redemption price

reduces each year to a final price of $50 on or after June

12, 2002.

Dividends paid on ESOP shares, used as a source of funds

for meeting the ESOP financing obligation, were $11 million

in 1997 and $10 million in 1996. These dividends were

recorded at net of the related U.S. tax benefits. The number

of ESOP shares not allocated to plan members at December 31,

1997 and 1996 were 4.7 million and 4.9 million,

respectively.

The company recorded compensation expense of $6 million

in 1997, $6 million in 1996 and $5 million in 1995 for ESOP

shares allocated to plan members. The company expects to

record annual compensation expense at approximately this

level over the next 23 years as the remaining $139 million

of ESOP shares are allocated. The allocation of shares from

the ESOP is expected to fund a substantial portion of the

company's future obligation to match employees savings plan

contributions as the market price of Rohm and Haas stock

appreciates.

Purchases of treasury stock in 1997 totaled 2,552,151

shares, compared with 4,430,971 and 515,138 shares in 1996

and 1995, respectively. In October 1997, the company largely

completed the repurchase of 3.5 million shares of common

stock authorized under the second buyback program, and

received board approval on October 24, 1997, for a third

buyback program of another 3.0 million shares.

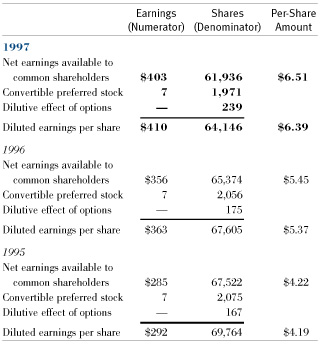

The reconciliation from basic to diluted earnings per

share is as follows:

Return to Financial Table of Contents