![]()

Note 19: Stock Compensation Plans

In October 1995, the Financial Accounting Standards Board

issued Statement No. 123, "Accounting for Stock-Based

Compensation," which became effective in 1996. The statement

encourages the fair value based method which recognizes

compensation expense equal to the fair value of the

stock-based compensation at the date of the grant. As an

alternative, the statement allows companies to continue to

apply APB Opinion No. 25 and related Interpretations, which

for certain types of stock-based compensation, does not

result in a charge to earnings.

The company has elected to continue to apply the

provisions of APB Opinion No. 25. Accordingly, no

compensation expense has been recognized for the fixed stock

option plans. For restricted stock awards, compensation

expense equal to the fair value of the stock on the date of

the grant is recognized over the five-year vesting period.

Total compensation expense for restricted stock was $1

million in each of the years ended December 31, 1997, 1996

and 1995. Had compensation expense for the company's fixed

stock option plans been determined in accordance with SFAS

No. 123, the company's net earnings would have been reduced

to $407 million in 1997, $361 million in 1996 and $291

million in 1995. Basic earnings per common share would have

been reduced to $6.46, $5.41 and $4.20 in 1997, 1996 and

1995, respectively.

Non-Employee Directors'

Stock Plan of 1997

Additionally, directors receive dividend equivalents on

each share of deferred stock, payable in deferred stock,

equal to the dividend paid on a share of common stock. Fixed Stock Option

Plans The Black-Scholes option pricing model was used to

estimate the fair value for each grant made during the year.

The following are the weighted-average assumptions used for

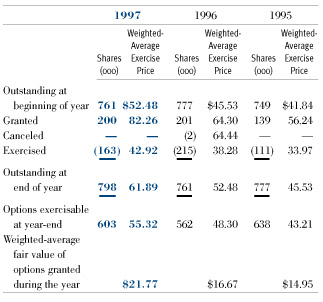

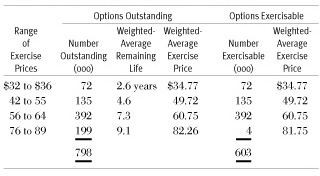

all shares granted in the years indicated: The following table summarizes information about stock

options outstanding and exercisable at December 31,

1997:

Restricted Stock Plan of

1992 for Non-Employee Directors

Non-employee directors were given an initial

grant of common stock equal to $25,000 when they were first

elected to the board and every fifth year thereafter. The

shares vest 20% for each year of service. The plan covers an

aggregate 50,000 shares of common stock. In 1996, 419 shares

with a total value of $24,983 were issued in connection with

the election of a new member to the board. Non-employee

directors could also elect to receive their board and

committee retainers in restricted stock. These shares are

immediately vested. In 1996, 1,413 shares at a

weighted-average grant-date fair value of $64.88 per share

were granted in payment of board and committee retainers. In

1997, no further shares were issued under this Plan and,

because of a change in directors' compensation, no further

awards are contemplated.

Non-employee directors compensation was changed

effective January 1, 1997. Under the 1997 Non-Employee

Directors Stock Plan, directors receive half of their annual

retainer in deferred stock. Each share of deferred stock

represents the right to receive one share of company common

stock upon leaving the board. Directors may also elect to

defer all or part of their cash compensation into deferred

stock. Annual compensation expense is recorded equal to the

number of deferred stock shares awarded multiplied by the

market value of the company's common stock on the date of

award.

The company has granted stock options to key

employees under its Stock Option Plans of 1984 and 1992.

Options granted pursuant to the plans are priced at the fair

market value of the common stock on the date of the grant.

Options vest after one year and most expire 10 years from

the date of grant. The Stock Option Plan of 1992, as amended

in 1994, limits the number of options that can be granted to

any one individual within a five-year period to 100,000

shares. Under this plan, the company may grant options for

up to 2.5 million shares of common stock. The status of the

company's stock options is presented below:

Return to Financial Table of Contents