![]()

Note 5: Income Taxes

|

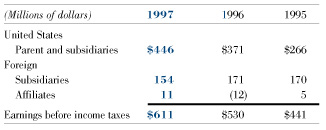

Earnings before income taxes earned

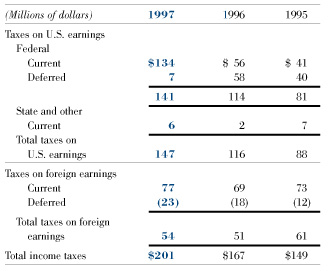

within or outside the United States are shown below:  The provision for income taxes is

composed of:  Cash payments of income taxes were $181 million, $120 million and $111 million in 1997, 1996 and 1995, respectively. Deferred income taxes reflect

temporary differences between the valuation of assets and

liabilities for financial and tax reporting. Details at

December 31, 1997, and 1996 were:

|

|

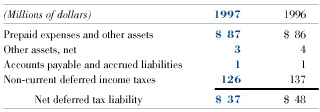

Deferred taxes, which are

classified into a net current and non-current balance by tax

jurisdiction, are presented in the balance sheet as

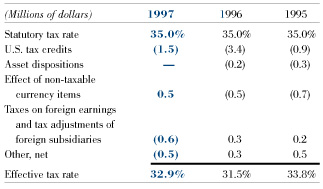

follows:  The valuation allowance was reduced by $1 million in 1997 and $2 million in 1996 due to usage of tax credit carryforwards and net operating loss carryforwards. The effective tax rate on income

differs from the U.S. statutory tax rate due to the

following:  At December 31, 1997, the company had no research tax credit carryforwards. Foreign tax credit carryforwards of $13 million are available to reduce future U.S. income tax payments through 2002 and alternative minimum tax credit carryforwards of $1 million are available to reduce future U.S. regular income tax payments over an indefinite period. In addition, the company has net operating loss carryforwards of $3 million to offset future foreign taxable income through 2002. Provision for U.S. income taxes, after applying statutory tax credits, was made on the unremitted earnings of foreign subsidiaries and affiliates which have not been reinvested abroad indefinitely. Unremitted earnings, after provision for applicable foreign income taxes, were approximately $366 million at December 31, 1997. If the foreign subsidiary and affiliate earnings were remitted as dividends, the amount of additional U.S. income taxes, after applying statutory tax adjustments, would not be material. |

Return to Financial Table of Contents