![]()

Note 6: Industry Segment Reporting and Information about Foreign Operations

|

Rohm and Haas Company is a multinational manufacturer of specialty chemicals. The company's principal lines of business, listed in order of their relative size based on sales, are Polymers, Resins and Monomers (PRM); Performance Chemicals; Plastics, and Agricultural Chemicals. PRM and Plastics major markets are in North America and Europe. Performance Chemicals products are sold mainly in North America, Europe and Asia-Pacific. These three businesses sell their products to other manufacturers who produce end products sold to consumers and other industrial concerns. Agricultural Chemicals is the most global of the company's businesses, with sales occurring almost evenly throughout the four regions. These products are sold to growers of high-value specialty agricultural crops. In accordance with the provisions of SFAS No. 14, the following tables present information for the years 1995-1997 related to the company's results in the four industry segments described above. The company defines the industry segment for each product shipment (including intermediates) by the customer's use of the product shipped. Therefore, no inter-segment sales or eliminations are shown. In computing each segment's identifiable assets, production facilities that are shared by more than one segment are allocated to each segment on an annual utilization basis. All information presented for 1995 has been restated for the following items:

|

|

|

|

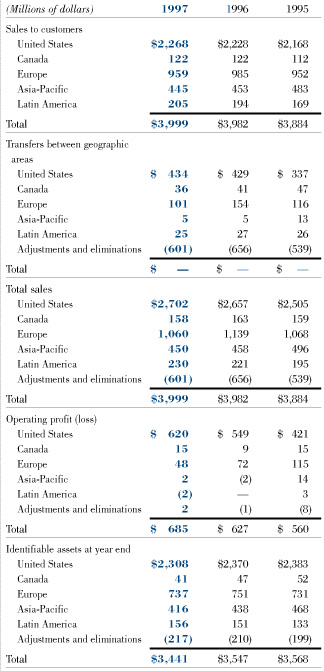

In addition, the tables below provide information

pertaining to the company's operations in different

geographic areas, in accordance with SFAS No. 14. Transfers

between geographic areas are accounted for at market

prices.  United States export sales to customers were $203 million in 1997, $230 million in 1996 and $206 million in 1995. |

|

Total operating profit and total identifiable assets for

both the segment and geographic results are reconciled below

to consolidated earnings before income taxes and

consolidated total assets. General corporate expense

represents interest income earned by general corporate

assets, offset by the portion of total expenses incurred at

corporate headquarters that do not relate directly to the

operations of any geographic area or industry segment.

General corporate assets primarily include cash and cash

equivalents, advances to unconsolidated subsidiaries and

affiliates and capitalized interest. Corporate capital

additions include capitalized interest cost. The

reconciliation of operating profits and identifiable assets

to consolidated totals is as follows:

The data presented above differ in certain ways from the company's results by business group and customer location presented on page 23. The customer location data on page 23 reflect the company's major marketing profit centers relative to customer location, while the above data are categorized by the geographic location from which the goods were shipped. Other differences include the manner of directly assigning or allocating certain parts of research expense, interest income and expense, other income and expense and equity in affiliates. In addition, the earnings data on page 23 are on an after-tax basis. In June 1997, the Financial Accounting Standards Board issued Statement No. 131, "Disclosures about Segments of an Enterprise and Related Information," which establishes standards for the reporting of information about operating segments in annual financial statements. The company is assessing its current business segment reporting to determine if changes in reporting will be required in adopting this new standard. The disclosures prescribed by the statement are required for the company's 1998 annual report with application to interim periods permitted. |

Return to Financial Table of Contents