![]()

Note 8: Employee Benefits

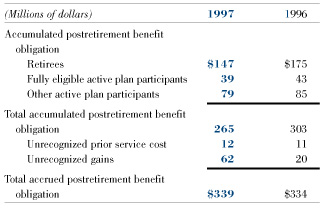

The company provides health care and life insurance benefits for substantially all of its domestic retired employees, for which the company is self-insured. In general, employees who have at least 15 years of service and are 60 years of age are eligible for continuing health and life insurance coverage. Retirees contribute toward the cost of such coverage. The status of the plans at year end was as

follows:

|

|

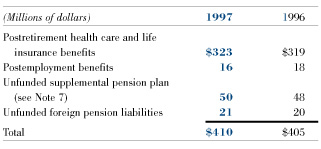

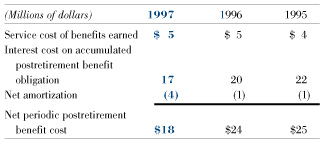

The accrued postretirement benefit obligation is recorded in "accrued liabilities" (current) and "employee benefits" (non-current). Net periodic postretirement benefit

cost includes the following components:  The calculation of the accumulated postretirement benefit obligation assumes 6% and 10% annual rates of increase in the health care cost trend rate for 1997 and 1996, respectively. The company's plan limits its cost for health care coverage to an increase of 10% or less each year, subject ultimately to a maximum cost equal to double the 1992 cost level. Increases in retiree health care costs in excess of these limits will be assumed by retirees. The change in the annual rates of increase reflects lower expected health care inflation, improved health care utilization and lower per capita cost experience. This change resulted in a decrease of approximately $8 million in 1997 postretirement and postemployment benefit costs and a $28 million decrease in the 1997 accumulated postretirement benefit obligation. A one percentage point increase in the annual health care cost trend rate would increase the accumulated postretirement benefit obligation by approximately $7 million, with an immaterial effect on annual postretirement benefit cost. The weighted average discount rate used to estimate the accumulated postretirement benefit obligation was 7% at December 31, 1997 and 1996. |

Return to Financial Table of Contents