Financial Summary

|

|

Year ended December 31, |

|

|

|

| (dollars in millions) |

|

1997 |

|

1996 |

|

|

|

|

|

|

|

|

|

|

| Operating revenue |

|

$2,609.5 |

|

$2,542.3 |

| Operating income (a) |

|

130.4 |

|

156.4 |

| Interest and debt expense |

|

227.1 |

|

261.6 |

| Net income (loss) |

|

(134.5 |

) |

(85.5 |

) |

| EBITDA (b) |

|

296.9 |

|

286.3 |

|

|

|

|

|

| Net cash flows provided by operating activities |

|

76.0 |

|

19.5 |

|

|

|

|

|

| Number of restaurants: |

|

|

|

|

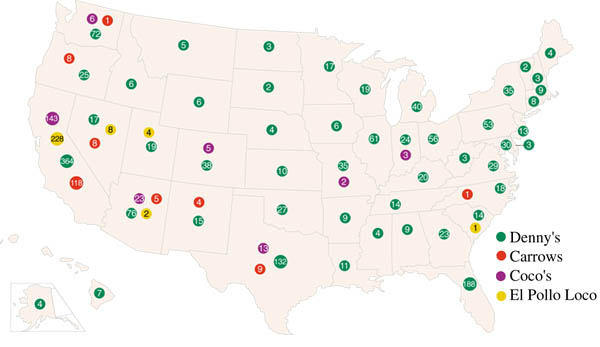

| Denny’s |

|

1,652 |

|

1,596 |

| Carrows |

|

154 |

|

160 |

| Coco’s |

|

493 |

|

466 |

| El Pollo Loco |

|

247 |

|

241 |

| Quincy’s (c) |

|

180 |

|

199 |

| Hardee’s (c) |

|

557 |

|

580 |

|

|

|

|

|

|

|

3,283 |

|

3,242 |

| Restaurants by ownership: |

|

|

|

|

| Company-owned |

|

2,047 |

|

2,112 |

| Franchised |

|

912 |

|

817 |

| Licensed |

|

324 |

|

313 |

|

|

|

|

|

|

|

3,283 |

|

3,242 |

|

|

(a) |

Operating income for the year ended December 31, 1997 reflects a

provision for restructuring charges of $10.5 million and a charge for impaired assets of

$15.1 million. |

|

|

(b) |

EBITDA is defined by the Company as operating income before

depreciation, amortization and charges for restructuring and impairment. |

|

|

(c) |

The Quincy's division was sold June 10, 1998. The Hardee's division

was sold April 1, 1998. |

To Our Shareholders

James B. Adamson

Chairman, CEO and President |

|

We embarked on a new beginning in January of this year as we became a new company with

$1 billion less debt and the financial flexibility to pursue growth opportunities and

respond more effectively to changing consumer tastes. To reflect this new era, we changed

our name to Advantica Restaurant Group, Inc. Derived from the words "advantage"

and "America," Advantica conveys the competitive edge we are striving to build

at each of our restaurant brands. It also reflects that we are a pure restaurant company.

Advantica serves America, with nearly two million customers visiting our restaurants

daily.

Despite the onerous capital structure under which we have operated, we have improved

the efficiency of our operating structure, shed non-core operations, added exciting new

restaurant concepts and made significant progress on diversity issues. We have also made

progress in many of our consumer ratings as measured by independent market research. With

our financial restructuring now behind us and freedom from much of the enormous debt that

hampered our company since the 1989 leveraged buyout, our challenge now is to accelerate

brand building enhancements in our businesses and provide the very best customer service

to achieve a future of consistent profitability and long-term growth.

1997 Results

Our 1997 cash flow performance was substantially in line with our business plan. For

the year ended December 31, 1997, EBITDA increased to $296.9 million, compared with $286.3

million in 1996. Total revenue increased to $2.61 billion, versus $2.54 billion in the

prior year. While overall comparable store sales were disappointing during 1997, we

anticipated much of this weakness. Sales declines at Denny's were the result of a

fundamental shift in pricing strategy. Because a price-only value strategy is not

sustainable in the long run, we made a decision to significantly increase Denny's pricing

in late 1996, placing more emphasis on the other elements of "value" provided to

the customer such as better product quality, service and image. At our other core brands,

El Pollo Loco recorded a modest increase in comparable sales in 1997, while Coco's and

Carrows comparable sales were flat to slightly down.

Denny's greatly expanded the presence of its brand during 1997 by opening a record 77

new franchised restaurants. We are excited about this franchising momentum and believe

that it will carry into 1998.

Business Portfolio Changes

Already in 1998 we have moved quickly to address the two underperforming brands in our

business portfolio. On April 1, 1998, the Company completed the sale of its 557-unit

Hardee's franchise subsidiary to CKE Restaurants, Inc. for $427 million. The sales price

included $381 million in cash plus the assumption of $46 million in certain debt

obligations by CKE. Nearly one-half of the cash proceeds were used to further reduce debt,

and the remaining funds are targeted for reinvestment in our existing restaurants and

possible acquisitions of other restaurant brands. This divestiture, at a very attractive

price, was an outstanding opportunity for Advantica and is consistent with our desire to

only operate brands we control.

We also have begun streamlining our Quincy's portfolio of restaurants to improve

Advantica's overall profitability. During the fourth quarter of 1997, the predecessor

company recorded $25.6 million in special charges primarily related to the closure or sale

of 88 Quincy's restaurants during 1997 and 1998. This restructuring of Quincy's will allow

management to direct effort and resources to restaurants in stronger trade areas and to

eliminate underperforming and non-strategic units.

Strategies for 1998 and Beyond

We are focused on improving the key financial measures that will influence Advantica's

future investment performance -- comparable store sales, margin improvement and new

restaurant growth. To drive sales, we are placing emphasis on providing customers with a

restaurant experience that delivers the food quality and service they demand, supported by

marketing and image initiatives which make our brands distinctive in the marketplace. All

incentive plans for 1998 have a significant component tied to comparable sales growth. In

addition, we are re-engineering back-of-the-house processes in our restaurants and

improving information technology to achieve margin improvement.

We are very excited about a number of new programs underway at Denny's, including the

design and upcoming testing of a new image repositioning project, new building design

prototypes and the Denny's Classic Diner concept. We look forward to generating new

top-line growth from expansion of our franchising programs at Denny's, Coco's and El Pollo

Loco, as well as the resumption of company-owned restaurant development at Denny's and El

Pollo Loco. Quincy's will continue the conversion of restaurants to a full-service format

in additional markets in 1998. The acquisition of Coco's and Carrows continues to be a

very positive move for our company, both financially and strategically. We will continue

to fine-tune the positioning of these two strong brands during 1998.

Strengthening Leadership

A redeployment of key members of our senior management team was recently announced to

more effectively utilize their talents. Ronald B. Hutchison was appointed Chief Financial

Officer; Craig S. Bushey, President of Coco's and Carrows; and Mark L. Shipman, Executive

Vice President of Acquisitions and Development. During 1997, Nelson J. Marchioli joined

the Company as President of El Pollo Loco, replacing John A. Romandetti, who was appointed

President of Denny's.

Advantica also welcomes a new board of directors, reflecting the Company's new

ownership structure. The new Advantica board members are Robert H. Allen, Ronald E.

Blaylock, James J. Gaffney, Irwin N. Gold, Robert E. Marks, Charles F. Moran and Donald R.

Shepherd. They join former board members Vera King Farris and Elizabeth A. Sanders. We

also welcome Darrell Jackson and Raul R. Tapia as new board members of FRD Acquisition

Co., the parent company of Coco's and Carrows. We look forward to the advice and counsel

of our board members in achieving our goal of building Advantica into a great restaurant

company.

We expect the competitive environment to remain very aggressive in 1998. With a

stronger capital structure and business portfolio in place, we are better equipped with

the resources needed to compete effectively. Our priorities are to deliver more consistent

execution in our restaurants and to enhance the brand positioning of each of our concepts.

We appreciate the hard work of our employees, the patronage of our

customers and the tremendous support from our suppliers and investors. That we were able

to move through the 1997 restructuring process so quickly and successfully is testimony to

the great effort and commitment of our employees and investors. With all of us working

together, we can make Advantica the best restaurant company in the industry.

|

James B. Adamson

Chairman, CEO and President

April 22, 1998 |

From its humble beginning in 1953 as a single doughnut shop in

Lakewood, California, Denny's has grown into America's largest full-service family

restaurant chain and the most recognized name in family dining. During 1997, Denny's U.S.

systemwide sales reached a record level of $1.87 billion. With over 1,650 restaurants,

Denny's appeals to a wide spectrum of customers and offers a relaxed dining atmosphere

with moderately priced food and quick, efficient service 24 hours a day for breakfast,

lunch, dinner and "late night." Simply put, Denny's serves any meal, anytime.

From its humble beginning in 1953 as a single doughnut shop in

Lakewood, California, Denny's has grown into America's largest full-service family

restaurant chain and the most recognized name in family dining. During 1997, Denny's U.S.

systemwide sales reached a record level of $1.87 billion. With over 1,650 restaurants,

Denny's appeals to a wide spectrum of customers and offers a relaxed dining atmosphere

with moderately priced food and quick, efficient service 24 hours a day for breakfast,

lunch, dinner and "late night." Simply put, Denny's serves any meal, anytime.

As the only family restaurant chain with a broad national presence, Denny's enjoys

particular advantages over smaller chains and independent operators. These advantages

include high brand awareness, extensive research and development capabilities, and

purchasing and advertising economies of scale. Denny's has strong brand equity in its

breakfast business and has defined itself as the value leader in full-service dining. The

value positioning at Denny's is expanding to emphasize not only pricing, but also great

service, excellent product quality and menu innovation in an inviting atmosphere. Denny's

has enhanced consumers' perception of value with the introduction of themed, higher

quality products such as "America's Favorite Omelets," "Major League

Burgers" and "Signature Skillets." Marketing activities during 1998 will

reinforce the "value leader" positioning while also conveying the brand's

distinct personality and breakfast heritage. Additionally, Denny's plans to add more

"kid appeal" to its children's menu and intensify marketing efforts targeted at

rapidly growing segments of our population such as African-American, Asian-American and

Hispanic consumers.

Denny's has recently taken many other steps to improve performance and enhance the

quality, service and value delivered to its customers. These steps include the rollout of

new point-of-sale technology, a simpler management structure, enhanced service training

and new management incentive plans. During 1998, Denny's will begin testing a new image

repositioning program in several markets which is designed to improve curb appeal, make

the brand more distinctive and improve investment returns.

During 1997, Denny's opened 77 new franchised units, an all-time record in its 44-year

history. Denny's franchisees opened two new Denny's Classic Diners that feature an upbeat,

nostalgic look and feel that appeals to younger customers, while retaining Denny's core

brand equities. The Classic Diner features a 1950s-60s atmosphere with stainless steel,

neon lighting, jukebox music, new uniforms and a "diner" menu tailored to create

an energized dining experience. Company and franchise development of this concept will be

accelerated during 1998, as will development of traditional Denny's restaurants in three

new prototype designs. Franchising will continue to be the primary growth vehicle of the

Denny's brand with several hundred new restaurant openings planned over the next five

years.

Since 1969, Carrows has been offering distinctive family dining

in a vintage Americana atmosphere -- wholesome, relaxed and familiar-- at a good value.

Carrows specializes in made-to-order food using homestyle recipes and served in generous

portions, accompanied by appetizing side dishes such as stuffing, creamed spinach and

homemade mashed potatoes. A regional full-service chain, Carrows consists of 140

company-owned and 14 franchised restaurants operating primarily in seven western states.

Since 1969, Carrows has been offering distinctive family dining

in a vintage Americana atmosphere -- wholesome, relaxed and familiar-- at a good value.

Carrows specializes in made-to-order food using homestyle recipes and served in generous

portions, accompanied by appetizing side dishes such as stuffing, creamed spinach and

homemade mashed potatoes. A regional full-service chain, Carrows consists of 140

company-owned and 14 franchised restaurants operating primarily in seven western states.

Carrows appeals strongly to families with children as well as to mature adults -- two

groups expected to grow rapidly into the next century. The menu is always current, but not

trendy, and is revised regularly to emphasize the foods that customers most demand.

Carrows offers high-quality breakfasts priced to compete with fast-food competitors, and

lunch and dinners that rival the quality of casual-themed dinner houses, but at lower

cost.

After the May 1996 acquisition by Advantica, the chain began enhancing brand awareness

and differentiation. Significant improvements were made to its marketing strategy and

menu. These changes enhanced perceived value to the customer, as well as service, by

greatly reducing operating complexity in the restaurant. The brand building effort has

recently been followed by limited franchising of Carrows restaurants.

Coco's began operations in 1948 as The Snack Shop in Corona Del

Mar, California, just as eating out was becoming a form of entertainment in our culture.

By continuing to offer great food, service and ambiance at reasonable prices, Coco's has

established itself at the top rung of the family dining segment with 178 company-owned and

17 franchised bakery restaurants located primarily in the western United States, as well

as 298 international units operating primarily in Japan and South Korea.

Coco's began operations in 1948 as The Snack Shop in Corona Del

Mar, California, just as eating out was becoming a form of entertainment in our culture.

By continuing to offer great food, service and ambiance at reasonable prices, Coco's has

established itself at the top rung of the family dining segment with 178 company-owned and

17 franchised bakery restaurants located primarily in the western United States, as well

as 298 international units operating primarily in Japan and South Korea.

The Coco's experience appeals to a contemporary customer who is quality-conscious and

seeks a wide variety of innovative entrees and bakery items not typically offered at

family restaurants. The typical customer has a moderate to relatively high income and is

25-54 years of age. The brand has developed a strong customer base through a creative

menu, supported by strong product development and execution capabilities, high-quality

food and consistent "dinnerhouse style" service. The menu includes delicious

food items like fresh fish, salads, Italian specialties, smothered steak and fresh pies.

Coco's recently began repositioning to better compete with casual dining restaurants,

focusing on a more upscale dining experience. This repositioning plan includes minor decor

changes, more impactful advertising, a better focused menu and emphasis on the bakery as a

point of difference.

With an appealing contemporary menu positioning, Coco's has laid the foundation for

further expansion. Coco's plans to emphasize franchising as a means of facilitating growth

of the brand during 1998 and beyond.

El Pollo Loco (pronounced "L - Po-yo Lo-co" -- Spanish

for "The Crazy Chicken") began two decades ago in Guasave, Mexico, where Pancho

Ochoa started a small restaurant serving flame-broiled chicken from his mother's old

family recipe. The restaurants were soon all over Mexico, and in 1980, El Pollo Loco came

to the United States, serving its delicious flame-broiled chicken with hot tortillas,

freshly made salsa and a variety of side dishes. Today, El Pollo Loco is the nation's

leading quick-service restaurant chain specializing in flame-broiled chicken, with 247

restaurants principally located in California, Arizona, Nevada and Texas.

El Pollo Loco (pronounced "L - Po-yo Lo-co" -- Spanish

for "The Crazy Chicken") began two decades ago in Guasave, Mexico, where Pancho

Ochoa started a small restaurant serving flame-broiled chicken from his mother's old

family recipe. The restaurants were soon all over Mexico, and in 1980, El Pollo Loco came

to the United States, serving its delicious flame-broiled chicken with hot tortillas,

freshly made salsa and a variety of side dishes. Today, El Pollo Loco is the nation's

leading quick-service restaurant chain specializing in flame-broiled chicken, with 247

restaurants principally located in California, Arizona, Nevada and Texas.

El Pollo Loco offers unique-tasting and high-quality products which help position the

brand as "Superior Fast Food at a Competitive Price." The brand appeals to

consumers seeking a "healthful" fast-food alternative, as well as Mexican food

enthusiasts. El Pollo Loco's extensive, multi-lingual advertising and marketing program

includes television and radio commercials that target diverse ethnic groups. The

restaurants are designed to facilitate customer viewing of the preparation of the

flame-broiled chicken, and the food is served quickly, but prepared slowly, using fresh

ingredients. Fresh chicken is carefully marinated in seasoned fruit juices, then slowly

cooked over an open flame until crispy on the outside and tender and flavorful on the

inside. Vine-ripened tomatoes are used to make fresh salsa several times a day, while hot

tortillas and a selection of freshly prepared beans, rice, corn on the cob, potato salad

and coleslaw are served on the side. New menu items such as Lemon Pepper Chicken, Smokey

Black Beans, Pollo Bowls and a wide variety of burritos are also offered.

Much of the brand's growth can be attributed to successful menu positioning, new

product offerings and dual branding with the complementary Fosters Freeze®

dessert line. The excellent positioning of the brand was further demonstrated during 1997

as the chain experienced record U.S. systemwide sales of $235 million.

Based on El Pollo Loco's continued success and superior brand positioning, Advantica

plans to accelerate expansion of the brand through both company and franchise development

in the southwestern United States. Expansion is targeted in existing markets to attain

critical advertising mass and in new markets where consumer demographics are similar to

those in successful existing markets.

Community Commitment

At Advantica, we strongly believe we have a responsibility to give back to our

neighborhoods and communities. The Company and its employees are involved in a number of

ongoing community initiatives including the United Way, school fund raisers, food drives,

disaster relief and other events where our restaurant and support employees volunteer

their time and resources.

Children and Youth

We believe it is particularly important to invest in our children and youth, who are

the future of America. Since the formation of the Denny's/Save the Children partnership in

1995, Denny's, our flagship restaurant concept, has raised over $2.5 million for Save the

Children, a national charity that helps at-risk, disadvantaged children and families. The

funds underwrite a number of self-help community programs throughout the United States.

Most initiatives target the needy, particularly in rural and inner-city areas across the

country, addressing such varied and critical needs as maternal and infant health care for

pregnant teenagers and other expectant mothers; the education and employment of refugee

parents; and the funding of small enterprise projects for single mothers who need a

financial base to support their children.

Denny's is in its third year as a national sponsor of the Harlem Globetrotters Tour. On

the multiple-city tour, the legendary Globetrotters team conducts pre-game interactive

ball clinics for youth from Save the Children programs and youth affiliated with NAACP

branches. The basketball clinics are not just fun and games. Each clinic features powerful

"stay-in-school" and "stay drug-free" messages for the hundreds of

young participants.

Community Partnerships

Advantica-Hardee's launched "Benefits Nights" in the Fall of 1996. This

initiative raised over $550,000 during 1997 for participating schools, universities,

churches, daycare centers and other community organizations. Participating schools or

community organizations received 20% of all incremental sales at restaurants holding a

Benefit Night that evening. Some restaurants had as many as ten events a month. The money

raised was used to fund special needs of the school or organization, such as sports

equipment, computers and field trips.

Last year marked Advantica's most successful year ever as a corporate contributor to

the local United Way campaign. Eighty-three percent of Spartanburg support center

employees participated in the campaign. These investments make a meaningful difference in

people's lives and help strengthen our community's social and economic structure for now

and for tomorrow.

Diversity Commitment

Advantica believes that strength is derived from the diversity of our customers,

employees, suppliers, franchisees and other partners across the country. Numerous

community leaders and civil rights groups have cited Advantica for its work in building a

highly diverse, multicultural organization. The Company has won a number of national

awards for its diversity work, including the 1997 Minority Business Development Award from

the NAACP. Currently, minorities and women comprise one-third of Advantica's Board of

Directors and 25% of its senior management. Minorities make up 27% of Advantica's overall

management. In the purchasing arena, the Company posted over $125 million in contracts

with minority suppliers in 1997, a twelve-fold increase since 1993. There were no

contracts with minority suppliers in 1992. More than one-third of Denny's franchised

restaurants and over half of El Pollo Loco franchised restaurants are minority-owned. In

marketing and advertising, Advantica restaurant concepts spend a total of $15 million

annually in targeting the fast growing minority consumer markets.

Annual

Report on Form 10-K (click here)

Directors

James B. Adamson (1, 2)

Chairman, President and CEO,

Advantica Restaurant Group, Inc. Robert H. Allen (1, 2)

Marketing Consultant,

R.H. Allen Associates

Ronald E. Blaylock (1, 2)

President and CEO,

Blaylock and Partners, L.P.

Vera King Farris (1, 2)

President,

The Richard Stockton College

of New Jersey

|

James J. Gaffney (1, 2)

Chairman,

Maine Investments Limited Irwin N. Gold (1, 2)

Senior Managing Director and Director,

Houlihan, Lokey, Howard and Zukin, Inc.

Darrell Jackson ( 2)

President,

Sunrise Enterprise of Columbia, Inc.

Robert E. Marks (1, 2)

President,

Marks Ventures, Inc. |

Charles F. Moran (1,

2)

Retired Senior Vice President,

Sears, Roebuck and Co. Elizabeth A. Sanders (1, 2)

Management Consultant,

The Sanders Partnership

Donald R. Shepherd (1, 2)

Retired Chairman,

Loomis, Sayles & Company, L.P.

Raul R. Tapia ( 2)

Senior Partner,

Murray, Scheer, Montgomery,

Tapia & O'Donnell |

(1) Director, Advantica Restaurant Group, Inc.

(2) Director, FRD Acquisition Co. (parent company of Coco's/Carrows)

Corporate Officers

James B. Adamson

Chairman, CEO and PresidentCraig S. Bushey

Executive Vice President and

Coco's/Carrows President

Ronald B. Hutchison

Executive Vice President and

Chief Financial Officer

Nelson J. Marchioli

Executive Vice President and

El Pollo Loco President

Edna K. Morris

Executive Vice President and

Quincy's President

Rhonda J. Parish

Executive Vice President,

General Counsel and Secretary

John A. Romandetti

Executive Vice President and

Denny's President

Mark L. Shipman

Executive Vice President,

Acquisitions and Development

|

Paul R. Wexler

Executive Vice President,

Procurement and DistributionStephen W. Wood

Executive Vice President,

Human Resources and Corporate Affairs

Janis S. Emplit

Senior Vice President,

Information Systems

Andrew F. Green

Senior Vice President, Planning

and Corporate Controller

Robert M. Barrett

Vice President and

Assistant General Counsel

Fred S. Efird

Vice President,

Consumer Research

Jane P. Gannaway

Vice President,

Engineering Services

Kenneth E. Jones

Vice President and Treasurer

|

Ross B. Nell

Vice President, TaxJoseph M. Smith

Vice President,

Creative Services and Support Services

Linda G. Traylor

Vice President,

Human Resources Planning

and Development

|

Corporate Information

Corporate Offices:

Advantica Restaurant Group, Inc.

203 East Main Street

Spartanburg, SC 29319

(864) 597-8000 Independent Auditors:

Deloitte & Touche LLP

Greenville, SC

Transfer Agent for Common Stock and Warrants:

For information regarding change of address or other matters concerning your shareholder

account, please contact the transfer agent directly at:

Continental Stock Transfer & Trust Co.

Two Broadway

New York, NY 10004

(212) 509-4000

(800) 509-5586

Bond Trustees:

11 1/4 Senior Notes due 2008

U.S. Bank Trust, National Association

Corporate Trust Department

P.O. Box 64111

180 East Fifth Street

St. Paul, MN 55101

(800) 934-6802

12.5% FRD Senior Notes due 2004

The Bank of New York

Fiscal Agencies Department (101B-7E)

P.O. Box 11265

101 Barclay Street

New York, NY 10286

(800) 548-5075 |

Stock Listing Information:

Advantica common stock and warrants are listed on The Nasdaq Stock Market SM under the symbols DINE and DINEW, respectively. For

Financial Information:

Call (864) 597-8641, or write to:

Investor Relations Department

Advantica Restaurant Group, Inc.

203 East Main Street, P-11-3

Spartanburg, SC 29319

Investor information such as Advantica

news releases, earnings releases, links to

SEC filings and stock quotes may also be accessed through Business Wire's Corporate News

On the Net web site at:

http://www.businesswire.com/cnn/dine.htm

Investor Inquiries:

Larry Gosnell

Director of Investor Relations

(864) 597-8658

Annual Meeting:

Thursday, June 18, 1998

9:00 a.m. EDT

The St. Regis Hotel

Two East 55th Street at Fifth Avenue

New York, NY 10022 |

![]()

![]()

![]()

![]()

![]()

![]()

![]()

From its humble beginning in 1953 as a single doughnut shop in

Lakewood, California, Denny's has grown into America's largest full-service family

restaurant chain and the most recognized name in family dining. During 1997, Denny's U.S.

systemwide sales reached a record level of $1.87 billion. With over 1,650 restaurants,

Denny's appeals to a wide spectrum of customers and offers a relaxed dining atmosphere

with moderately priced food and quick, efficient service 24 hours a day for breakfast,

lunch, dinner and "late night." Simply put, Denny's serves any meal, anytime.

From its humble beginning in 1953 as a single doughnut shop in

Lakewood, California, Denny's has grown into America's largest full-service family

restaurant chain and the most recognized name in family dining. During 1997, Denny's U.S.

systemwide sales reached a record level of $1.87 billion. With over 1,650 restaurants,

Denny's appeals to a wide spectrum of customers and offers a relaxed dining atmosphere

with moderately priced food and quick, efficient service 24 hours a day for breakfast,

lunch, dinner and "late night." Simply put, Denny's serves any meal, anytime.  Since 1969, Carrows has been offering distinctive family dining

in a vintage Americana atmosphere -- wholesome, relaxed and familiar-- at a good value.

Carrows specializes in made-to-order food using homestyle recipes and served in generous

portions, accompanied by appetizing side dishes such as stuffing, creamed spinach and

homemade mashed potatoes. A regional full-service chain, Carrows consists of 140

company-owned and 14 franchised restaurants operating primarily in seven western states.

Since 1969, Carrows has been offering distinctive family dining

in a vintage Americana atmosphere -- wholesome, relaxed and familiar-- at a good value.

Carrows specializes in made-to-order food using homestyle recipes and served in generous

portions, accompanied by appetizing side dishes such as stuffing, creamed spinach and

homemade mashed potatoes. A regional full-service chain, Carrows consists of 140

company-owned and 14 franchised restaurants operating primarily in seven western states.  Coco's began operations in 1948 as The Snack Shop in Corona Del

Mar, California, just as eating out was becoming a form of entertainment in our culture.

By continuing to offer great food, service and ambiance at reasonable prices, Coco's has

established itself at the top rung of the family dining segment with 178 company-owned and

17 franchised bakery restaurants located primarily in the western United States, as well

as 298 international units operating primarily in Japan and South Korea.

Coco's began operations in 1948 as The Snack Shop in Corona Del

Mar, California, just as eating out was becoming a form of entertainment in our culture.

By continuing to offer great food, service and ambiance at reasonable prices, Coco's has

established itself at the top rung of the family dining segment with 178 company-owned and

17 franchised bakery restaurants located primarily in the western United States, as well

as 298 international units operating primarily in Japan and South Korea.  El Pollo Loco (pronounced "L - Po-yo Lo-co" -- Spanish

for "The Crazy Chicken") began two decades ago in Guasave, Mexico, where Pancho

Ochoa started a small restaurant serving flame-broiled chicken from his mother's old

family recipe. The restaurants were soon all over Mexico, and in 1980, El Pollo Loco came

to the United States, serving its delicious flame-broiled chicken with hot tortillas,

freshly made salsa and a variety of side dishes. Today, El Pollo Loco is the nation's

leading quick-service restaurant chain specializing in flame-broiled chicken, with 247

restaurants principally located in California, Arizona, Nevada and Texas.

El Pollo Loco (pronounced "L - Po-yo Lo-co" -- Spanish

for "The Crazy Chicken") began two decades ago in Guasave, Mexico, where Pancho

Ochoa started a small restaurant serving flame-broiled chicken from his mother's old

family recipe. The restaurants were soon all over Mexico, and in 1980, El Pollo Loco came

to the United States, serving its delicious flame-broiled chicken with hot tortillas,

freshly made salsa and a variety of side dishes. Today, El Pollo Loco is the nation's

leading quick-service restaurant chain specializing in flame-broiled chicken, with 247

restaurants principally located in California, Arizona, Nevada and Texas.