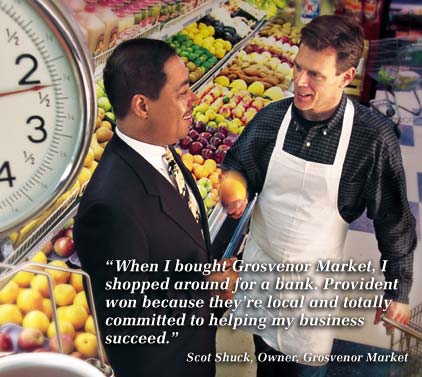

| One of Provident’s prime objectives is to grow and retain its small business relationships in the Maryland/Virginia area. In Rockville, Maryland, Senior Vice President Eric Dawes, newly appointed manager of Provident’s Small Business Center, confers with Scot Shuck, owner of Grosvenor Market. |

In a rising interest rate environment, Provident’s Consumer Lending Group focused its efforts on maximizing technology and simplifying processes to deliver its loan products. The goal was to provide customers with choice, convenience and flexibility. More choices for today’s consumer Provident generated over $11 million in consumer loan applications from the Internet in 2000. Beginning in March, customers could apply online for auto, boat, unsecured personal loans and lines of credit. These additions, together with our online home equity loan, provide a full array of consumer loan products that are easily accessible to our customers. Paperless transactions at reduced cost Provident introduced an unsecured loan program with the nation’s largest credit card issuer, MBNA. The new program provides a paperless application via the Internet with a quick credit turnaround, usually within 15 minutes. The benefits include reduced overhead and competitively priced loans for our customers. Provident’s personal touch Providing superior customer service is what we’re known for at Provident. When Bonnie Gorman of Rockville applied for a home equity loan, she had no idea that Community Banking Officer Sandy Dasler would personally deliver the paperwork to her home. “Sandy took care of everything,” said Bonnie. “I never knew the process could be so simple and yet so beneficial to my financial needs.” Gearing for long-term earnings 2000 was a year of repositioning for Provident, with an emphasis on deploying resources to our most profitable core business operations. We sold our check cashing operation, closed the indirect auto lending function and restructured the mortgage lending business. Provident now focuses on serving the mortgage needs of retail customers through an alliance with a national lender. This partnership fits strategic initiatives to reduce costs while providing premier service to our customers. Avenues for growth Provident also took steps in 2000 to become a significant player in the small business banking arena. A new small business unit was created and staffed with highly experienced employees from the organization. An expanded product mix will enable Provident to meet a complete range of financial needs for the small business customer. |

|

||||||||||||

|

|

|||||||||||||