PMI’s cigarette shipment volume in the EU Region declined by 5.2% to 223.0 billion units, mainly reflecting a lower total market, driven by the impact of tax-driven pricing and/or adverse economic conditions, particularly in Greece, Poland and Spain.

PMI’s cigarette shipment volume in the EU Region declined by 5.2% to 223.0 billion units, mainly reflecting a lower total market, driven by the impact of tax-driven pricing and/or adverse economic conditions, particularly in Greece, Poland and Spain.

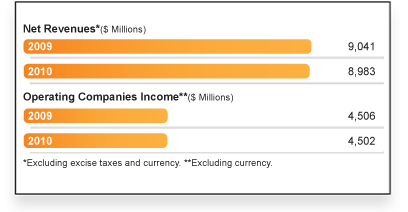

Net revenues, excluding excise taxes, decreased by 2.5% to $8.8 billion.

Net revenues, excluding excise taxes, decreased by 2.5% to $8.8 billion.

Excluding the unfavorable impact of currency of $172 million and acquisitions, net revenues, excluding excise taxes, decreased by 0.7%, primarily reflecting higher pricing of $391 million more than offset by unfavorable volume/mix of $452 million.

Excluding the unfavorable impact of currency of $172 million and acquisitions, net revenues, excluding excise taxes, decreased by 0.7%, primarily reflecting higher pricing of $391 million more than offset by unfavorable volume/mix of $452 million.

Reported operating companies income declined by 4.3% to $4.3 billion.

Reported operating companies income declined by 4.3% to $4.3 billion.

Excluding the unfavorable impact of currency of $191 million and acquisitions, reported operating companies income was essentially flat, primarily reflecting higher pricing, which offset unfavorable volume/mix.

Excluding the unfavorable impact of currency of $191 million and acquisitions, reported operating companies income was essentially flat, primarily reflecting higher pricing, which offset unfavorable volume/mix.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 0.2 percentage points to 50.4%.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 0.2 percentage points to 50.4%.

PMI’s market share was stable or improved in a number of markets, notably Belgium, Denmark, Estonia, Hungary, Latvia, the Netherlands, Norway, Poland, Sweden and Switzerland.

PMI’s market share was stable or improved in a number of markets, notably Belgium, Denmark, Estonia, Hungary, Latvia, the Netherlands, Norway, Poland, Sweden and Switzerland.

PMI’s cigarette shipment volume in the EEMA Region declined by 3.2% to 289.3 billion units, principally due to tax-driven price increases, particularly in Romania, Turkey and Ukraine.

PMI’s cigarette shipment volume in the EEMA Region declined by 3.2% to 289.3 billion units, principally due to tax-driven price increases, particularly in Romania, Turkey and Ukraine.

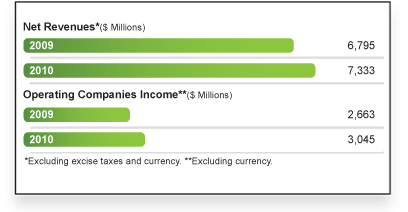

Net revenues, excluding excise taxes, increased by 9.0% to $7.4 billion.

Net revenues, excluding excise taxes, increased by 9.0% to $7.4 billion.

Excluding the favorable impact of currency of $76 million and acquisitions, net revenues, excluding excise taxes, increased by 6.7%, primarily reflecting higher pricing of $605 million, partially offset by unfavorable volume/mix of $147 million.

Excluding the favorable impact of currency of $76 million and acquisitions, net revenues, excluding excise taxes, increased by 6.7%, primarily reflecting higher pricing of $605 million, partially offset by unfavorable volume/mix of $147 million.

Reported operating companies income grew by 18.4% to $3.2 billion.

Reported operating companies income grew by 18.4% to $3.2 billion.

Excluding the favorable impact of currency of $107 million and acquisitions, reported operating companies income increased by 13.3%, primarily reflecting higher pricing, partially offset by unfavorable volume/mix.

Excluding the favorable impact of currency of $107 million and acquisitions, reported operating companies income increased by 13.3%, primarily reflecting higher pricing, partially offset by unfavorable volume/mix.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 2.4 percentage points to 41.6%.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 2.4 percentage points to 41.6%.

PMI’s market share was stable or improved in a number of markets, notably Algeria, Bulgaria, Croatia, Egypt, Georgia, Moldova, Morocco, Russia, South Africa and Tunisia.

PMI’s market share was stable or improved in a number of markets, notably Algeria, Bulgaria, Croatia, Egypt, Georgia, Moldova, Morocco, Russia, South Africa and Tunisia.

PMI’s cigarette shipment volume in the Asia Region increased by 24.8% to 282.3 billion units, principally due to 57.4 billion units from the new business combination in the Philippines, and growth in Indonesia and Korea. Excluding the favorable impact of the Philippines transaction, cigarette shipment volume decreased by 0.6%, mainly reflecting tax-driven price increases in Japan.

PMI’s cigarette shipment volume in the Asia Region increased by 24.8% to 282.3 billion units, principally due to 57.4 billion units from the new business combination in the Philippines, and growth in Indonesia and Korea. Excluding the favorable impact of the Philippines transaction, cigarette shipment volume decreased by 0.6%, mainly reflecting tax-driven price increases in Japan.

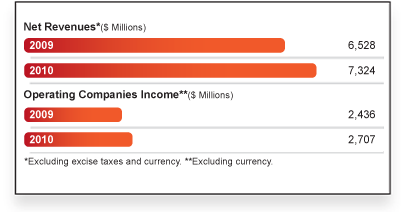

Net revenues, excluding excise taxes, increased by 21.6% to $7.9 billion.

Net revenues, excluding excise taxes, increased by 21.6% to $7.9 billion.

Excluding the favorable impact of currency of $611 million and the business combination in the Philippines, net revenues, excluding excise taxes, increased by 3.8%, primarily reflecting higher pricing of $491 million, partially offset by unfavorable volume/mix of $243 million.

Excluding the favorable impact of currency of $611 million and the business combination in the Philippines, net revenues, excluding excise taxes, increased by 3.8%, primarily reflecting higher pricing of $491 million, partially offset by unfavorable volume/mix of $243 million.

Reported operating companies income grew by 25.2% to $3.0 billion.

Reported operating companies income grew by 25.2% to $3.0 billion.

Excluding the favorable impact of currency of $342 million and acquisitions, reported operating companies income increased by 7.7%, primarily reflecting higher pricing, partially offset by unfavorable volume/mix.

Excluding the favorable impact of currency of $342 million and acquisitions, reported operating companies income increased by 7.7%, primarily reflecting higher pricing, partially offset by unfavorable volume/mix.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 1.4 percentage points to 38.7%.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 1.4 percentage points to 38.7%.

PMI’s market share was stable or improved in a number of markets, notably Hong Kong, Indonesia, Japan, Korea, Malaysia, Pakistan, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

PMI’s market share was stable or improved in a number of markets, notably Hong Kong, Indonesia, Japan, Korea, Malaysia, Pakistan, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

PMI’s cigarette shipment volume in the Latin America & Canada Region increased by 1.5% to 105.3 billion units, driven mainly by Canada and Mexico.

PMI’s cigarette shipment volume in the Latin America & Canada Region increased by 1.5% to 105.3 billion units, driven mainly by Canada and Mexico.

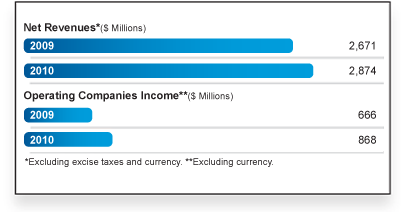

Net revenues, excluding excise taxes, increased by 14.3% to $3.1 billion.

Net revenues, excluding excise taxes, increased by 14.3% to $3.1 billion.

Excluding the favorable impact of currency of $179 million, net revenues, excluding excise taxes, increased by 7.6%, primarily reflecting higher pricing of $175 million and favorable volume/mix of $28 million.

Excluding the favorable impact of currency of $179 million, net revenues, excluding excise taxes, increased by 7.6%, primarily reflecting higher pricing of $175 million and favorable volume/mix of $28 million.

Reported operating companies income grew by 43.1% to $953 million.

Reported operating companies income grew by 43.1% to $953 million.

Excluding the favorable impact of currency of $85 million and acquisitions, reported operating companies income increased by 30.8%, primarily reflecting higher pricing.

Excluding the favorable impact of currency of $85 million and acquisitions, reported operating companies income increased by 30.8%, primarily reflecting higher pricing.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 0.3 percentage points to 30.3%.

Excluding the impact of currency and acquisitions, adjusted operating companies income margin was up 0.3 percentage points to 30.3%.

PMI’s market share was stable or improved in a number of markets, notably Argentina, Bolivia, Brazil, Chile, Ecuador, Mexico and Uruguay.

PMI’s market share was stable or improved in a number of markets, notably Argentina, Bolivia, Brazil, Chile, Ecuador, Mexico and Uruguay.