The world of Parliament is one of luxury and intrigue, privilege and pleasure. With its unique recessed filter, Parliament offers adult smokers the promise of a refined smoking experience of superior quality.

Parliament is particularly popular across our EEMA Region, where it accounted for almost 70% of the brand’s global shipment volume in 2010.

In Russia alone, the world’s largest cigarette market, excluding China, it is our leading above-premium offering, including the elegant, superslims variant Parliament Reserve. Despite the economic downturn, shipment

volume of Parliament  in Russia grew in 2010, demonstrating both its remarkable resilience and tremendous potential.

in Russia grew in 2010, demonstrating both its remarkable resilience and tremendous potential.

Today’s adult consumers demand, at an increasing pace, variety and novelty, in terms of both functional and emotional product benefits. We are capitalizing on these consumer preferences by maintaining a strong pipeline of innovative products and communication platforms. Leading the way, through the roll-out of its new brand architecture, is Marlboro. In Asia, our flagship brand continued to grow through innovation as best exemplified by the launch of different variants within the Marlboro Fresh family.

This is particularly true in Japan, where the introduction of brands such as Marlboro Ice Blast, which uses innovative menthol capsule technology, and which rapidly achieved a more than 1% share after only six months in the market, helped Marlboro to become the fastest-growing brand in terms of market share performance in 2010.

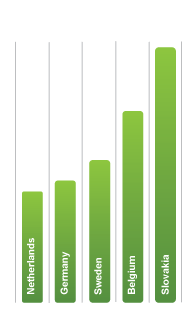

In 2010 as in 2009, in addition to being the second-largest brand in our global portfolio, L&M was also the second-largest brand in the European Union Region. In all the markets shown in this chart, L&M grew share by at least 0.8 percentage points in 2010.  Positioned in the mid-price segment in emerging markets and mostly in the low-price segment in developed markets, the cornerstone of the brand’s success is based on its value proposition and progressive, urban image.

Positioned in the mid-price segment in emerging markets and mostly in the low-price segment in developed markets, the cornerstone of the brand’s success is based on its value proposition and progressive, urban image.

L&M is notably popular in Germany, where shipment volumes in 2010 grew by double digits, and market share increased by 1.0 point to 9.3%. Sold in over 80 countries worldwide, L&M also enjoys success across many emerging markets, often serving as the international brand of reference for adult consumers looking to trade up from local alternatives.

Making its global debut in Italy in June 2010, Marlboro Core Flavor was carefully designed to respond to adult consumer preferences for a different type of Marlboro Red experience. A slightly smaller diameter product with a matte black packaging varnish and tactile red rooftop logo, Marlboro Core’s image is modern and contemporary, its personality non-conformist and its taste full bodied, yet smooth. Its presence on the market is another reflection of how the new Marlboro architecture has unlocked the brand’s full potential and its ability to compete in all growth segments.  Marlboro Core reached a relatively modest 0.2% market share in Italy in 2010, but the positive “halo” effect it had on the franchise contributed to Marlboro’s overall market share growth for the full year of 0.2 points to 22.8%.

Marlboro Core reached a relatively modest 0.2% market share in Italy in 2010, but the positive “halo” effect it had on the franchise contributed to Marlboro’s overall market share growth for the full year of 0.2 points to 22.8%.

The roll-out of the new Marlboro Gold packaging, present in almost 100 markets at the end of 2010, has been one of the main drivers of the variant’s success. Indeed, Marlboro Gold’s share was stable or increased in almost 70% of the top 30 volume markets in which it was present in 2010.

Marlboro Gold’s promise is always to be the most modern and progressive brand, delivering pleasurably smooth taste and refined smoking sensations.

A market with one of Gold’s largest share gains in 2010 was Poland. Share of Marlboro  Gold grew by 0.5 share points to 6.4%, helping our total share in the market to increase by 1.2 points to 37.3%.

Gold grew by 0.5 share points to 6.4%, helping our total share in the market to increase by 1.2 points to 37.3%.

One of PMI’s most impressive growth stories in recent years has been our performance in South Korea, the ninth-largest cigarette market in the world, outside of China and the United States, and one where adult consumers have  shown an increasing preference for premium and above-premium international brands.

shown an increasing preference for premium and above-premium international brands.

Our strong brand portfolio, led by Marlboro, the number one brand among young adult consumers, and Parliament, the fastest-growing brand in the market, has spurred our tremendous performance. Since 2006, we have increased shipment volume by over 100%, driving our share from 8.6% to almost double, at 16.9% in 2010, making PMI the fastest-growing tobacco company in Korea.

We are building on our commitment to this important market through the construction of a new factory in Yangsan. A groundbreaking ceremony was held in October 2010 and the factory will be fully operational in 2012.

In February 2010, PMI announced that its affiliate, Philip Morris Philippines Manufacturing Inc. (PMPMI), and Fortune Tobacco Corporation (FTC), one of the five largest privately owned cigarette companies in the world, had signed an agreement to unite their respective business activities by transferring selected assets and liabilities of PMPMI and FTC to a new company called PMFTC, with each party holding an equal economic interest. The Philippines is one of the largest global cigarette markets, with an estimated 2010 volume of 101 billion cigarettes. The new company held a pro forma market share of 92.8% in 2010, with FTC brands, such as Fortune,

which are strong in the low-price segment,

complemented by PMI’s brands, including

Marlboro, in the premium segment.

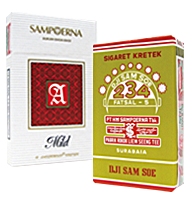

Our terrific stable of international brands is complemented in many markets around the world by local heritage brands that enable us to compete effectively across all segments. Indeed, three of PMI’s ten largest brands in volume terms are local trademarks, illustrating the depth of our portfolio. Some of our most important local heritage brands are premium priced. For example, Sampoerna A in Indonesia is the leading light-tasting premium brand, with record shipment volume of some 32 billion cigarettes in 2010,  making it the eighth-largest brand in our global portfolio. Dji Sam Soe, the eleventh-largest brand in our portfolio, is the leading premium kretek cigarette in Indonesia, with shipment volume of more than 20 billion cigarettes in 2010.

making it the eighth-largest brand in our global portfolio. Dji Sam Soe, the eleventh-largest brand in our portfolio, is the leading premium kretek cigarette in Indonesia, with shipment volume of more than 20 billion cigarettes in 2010.

Our progress in North Africa, including Algeria, Egypt, Morocco and Tunisia, has been nothing short of exceptional.

In 2010, our combined shipment volume in this area increased by more than 20%, with growth coming from all four markets. Our performance was driven by our flagship brand, Marlboro. In Egypt, where PMI has an estimated 93% share of the premium segment, Marlboro’s share grew in 2010 by 0.3 points to 5.1%.

In Algeria, shipment volume of Marlboro surged over 60% in 2010, contributing to an extremely robust 6.2 point increase in the brand’s market share to a record 18.2% and to PMI’s more than 98% share of the premium-price segment.

Whilst events in North Africa at the start of 2011 will affect our performance, we hope the impact will be temporary.

Delicados, our largest local heritage brand in Mexico, is the second-largest brand in the market and one of PMI’s top 25 brands worldwide. The brand elicits strong affection for its genuine national heritage — perhaps not surprisingly given that it is one of the country’s oldest cigarette brands, having been launched originally in 1919. Delicados, positioned in the low-price segment, reached a record 11.9% share of the total market in 2010 and complements our portfolio, which includes Marlboro, the market leader, which increased share by 0.9 points to reach 49.1%.