2010 Annual Report

In 2010, Walter Investment Management Corp. continued to post best-in-class results, while taking dramatic steps to help ensure our future growth. We finished the year on a strong note, posting 2010 income before income taxes of $38.3 million, paying quarterly dividends of $0.50 per share and generating a total return for our shareholders of 39% for the year.

And while these financial results were certainly noteworthy in a period of record foreclosures and unprecedented challenges in our industry, just as notable were several major events that we expect to be keys to building shareholder value in years to come:

Driving growth while taking care of everyday business in a challenging environment certainly isn't easy, and it's a tribute to our 340 employees that we were able to accomplish both short- and long-term goals in 2010. Our company has a compelling story — we are a long-established business built on personal service, leveraging technology and forward thinking to focus on the goals of growing our business and increasing shareholder value.

WIMC's high-touch approach with our less-than-prime portfolio continued to pay off significantly in 2010, even as a number of companies in our industry niche encountered problems:

As WIMC grows, we know what our specialty is — servicing residential, first-mortgage, less-than-prime loans for occupied homes. Our field force, spread throughout the South, has shown the ability to handle a significant number of accounts, and the acquisition of Marix Servicing not only enhances that capability in our current footprint but allows us to expand both the size of our footprint and the scope of the services that we can provide to an ever-broadening customer base.

As we move into 2011, we cannot assume that the economic environment will improve markedly anytime soon. As long as unemployment remains an issue, we can expect foreclosures to be high and customer payment challenges to continue. In addition, government intervention into our sector threatens to impose new, more stringent regulations that may make our job tougher and more costly.

Nonetheless, we are focused on doing everything we can to continue to post strong results, while using our expanded platform and capital to look at more opportunities for growth.

Our objectives for this year can be summarized with three overarching goals:

It is extremely gratifying to work with our leadership team and employees as we continue to find ways to succeed in this environment. If anything, we believe there is good reason to be bullish about Walter Investment Management Corp.'s future, and look forward to more success in 2011.

Mark J. O'Brien

Chairman and Chief Executive Officer

March 22, 2011

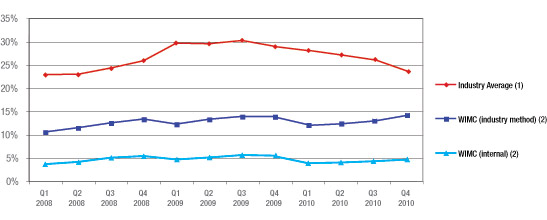

1.Delinquencies are derived from a voluntary survey by the Mortgage Bankers Association (MBA) of over 120 mortgage lenders, including mortgage banks, commercial banks, thrifts, savings and loan associations, subservicers, and life insurance companies. Delinquency rate is derived by combining the MBA delinquency rate for subprime loans plus subprime foreclosure starts. MBA delinquency rate considers all accounts in bankruptcy to be delinquent. Source: Mortgage Bankers Association.

2. WIMC (industry method) calculation consider all accounts in bankruptcy to be delinquent. WIMC (internal) calculation ages accounts in bankruptcy based upon payment status in accordance with their bankruptcy plan.