Management's Discussion and Analysis

In total, changes in operating assets and liabilities were comparable between 2006 and 2005. However, increases in inventories attributable to a build-up in anticipation of production transfer from facilities that will be closed, as well as increased purchases of certain raw materials, were offset by an increase in other accrued liabilities in 2006 as compared to the same period last year. The increase in other accrued liabilities is due to increased incentive compensation and restructuring charges. When 2005 is compared to 2004, the change in operating cash flow was primarily the result of a reduction in receivables in 2005 as compared to an increase in 2004 and higher dividends received from unconsolidated operations. These favorable cash flows were offset by an increase in inventory in 2005 as compared to 2004 when inventory decreased and a decrease in other liabilities in 2005 compared to an increase in 2004.

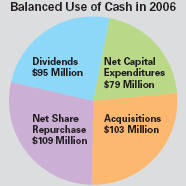

Investing Cash Flow - Included in 2006 was $9.2 million in net proceeds from the redemption of a joint venture (see note 4 of the financial statements). Net capital expenditures (capital expenditures less proceeds from the sale of fixed assets) were $78.7 million in 2006, $64.5 million in 2005 and $59.9 million in 2004. The increase in net capital expenditures in 2006 is mainly due to increased spending under our restructuring program. This higher level is expected to be maintained for 2007 as we continue with the program. Cash outflow for the acquisition of businesses was primarily the Simply Asia Foods asset purchase in 2006, a small business purchase in France in 2005 and the Silvo business in 2004.

Financing Cash Flow -We increased our total borrowings $77.2 million in 2006, compared to a decrease of $67.6 million in 2005 and an increase of $19.3 million in 2004. The main cause of the increase in 2006 was to fund the Simply Asia Foods asset purchase for $97.6 million. In 2006, we issued $100 million of 5.80% senior notes due 2011. Net interest payments are payable semi-annually in arrears in January and July of each year. Also, in 2006, we issued $200 million of 5.20% senior notes due 2015. Net interest payments are payable semi-annually in arrears in June and December of each year. The net proceeds from the $200 million offering were used to pay down $195 million of long-term debt which matured in 2006. In 2005, we paid off $30 million of medium-term notes at maturity. In 2004, we issued a total of $50 million in medium-term notes which mature on April 15, 2009 and pay interest semi-annually at a rate of 3.35%. The net proceeds of this 2004 issuance were used to pay down short-term debt.

The following table outlines the activity in our share repurchase programs:

| 2006 | 2005 | 2004 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Number of shares of common stock |

4.4 | 5.4 | 5.1 | ||||||

| Dollar amount | $ | 155.9 | $ | 185.6 | $ | 173.8 | |||

In the fourth quarter of 2005, we completed our $300 million share repurchase authorization and began to buy against our $400 million authorization approved by the Board of Directors in June 2005. As of November 30, 2006, $206 million remained under the $400 million share repurchase program. We expect to continue to repurchase shares under this authorization during 2007. The common stock issued in 2006, 2005 and 2004 relates to our stock compensation plans.

Net share

repurchase is net

of proceeds from

exercised stock

options. Net

capital expenditures

are net of

proceeds from

sale of fixed

assets.

Our dividend history over the last three years is as follows:

| 2006 | 2005 | 2004 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Total dividends paid | $ | 95.0 | $ | 86.2 | $ | 76.9 | |||

| Percentage increase | 10.2 | % | 12.1 | % | 20.0 | % | |||

| Dividends paid per share | $ | .72 | $ | .64 | $ | .56 | |||

In November 2006, the Board of Directors approved an 11.1% increase in the quarterly dividend from $0.18 to $0.20 per share. During the last five years, dividends per share have risen at a compound annual rate of 12.5%.