McCORMICK & COMPANY

2008 ANNUAL REPORT

McCORMICK & COMPANY 2008 ANNUAL REPORT |

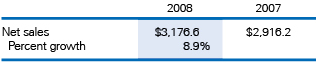

RESULTS OF OPERATIONS - 2008 COMPARED TO 2007  Pricing actions to offset higher costs, acquisitions of leading brands, innovative new products and increased marketing support led to an increase in sales for 2008. Pricing added 5.1% to sales. Favorable volume and product mix of 2.3% came primarily from the impact of the acquisitions of Lawry’s and Billy Bee (less the reduction in sales from the disposition of Season-All). Favorable foreign exchange rates added 1.5% for the year. In 2008, gross profit increased 8.1%. During 2008, we effectively offset volatile and increased material costs with pricing actions, productivity improvements and a higher-margin product mix. Wheat, herbs and dairy products were among the raw materials that had significant increases in 2008. Pricing actions were taken to pass through these higher commodity costs to both consumer and industrial customers. Productivity improvements included our restructuring program and other supply chain cost reduction initiatives. Favorable product mix was primarily the result of stronger sales growth in our consumer business versus our industrial business, as the consumer business has a higher gross margin percentage. Net sales grew at a slightly higher rate than gross profit which led to a slight decline in gross profit margin. Productivity improvements and favorable product mix had a positive effect. However, the impact of higher pricing that matched higher costs had an estimated unfavorable impact on gross profit margin of 1.7% in 2008. Cost reductions in cost of goods sold, as well as selling, general and administrative expense, totaled $31 million. |

Selling, general and administrative expenses were higher in 2008 than 2007 on a dollar basis but declined as a percentage of net sales. Our marketing support expenditures were 13% higher in 2008 than in 2007. As a percentage of net sales, selling, stock-based compensation and research and development expenses decreased, while distribution and administrative expenses were relatively unchanged. Efficiencies were obtained through our restructuring program, leveraging certain fixed expenses on our higher sales and other cost containment initiatives. In 2008 we recorded a non-cash impairment charge to lower the value of our Silvo brand intangible asset in The Netherlands. See discussion later in MD&A and in note 5 of the financial statements for more information. The following is a summary of restructuring activities: Pre-tax restructuring charges for both 2008 and 2007 related to actions under our restructuring program to consolidate our global manufacturing, rationalize our distribution facilities, improve our go-to-market strategy and eliminate administrative redundancies. More details of the restructuring charges are discussed later in MD&A and in note 3 of the financial statements. |