McCORMICK & COMPANY

2008 ANNUAL REPORT

McCORMICK & COMPANY 2008 ANNUAL REPORT |

profit margin by 0.4%. Cost savings related to restructuring

activity lowered cost of goods sold, adding

nearly 1.0% to gross profit margin. Gross profit margin

was unfavorably impacted by higher material costs in

2007 that were only partially offset by price increases.

Production costs in certain facilities were also affected

by incremental costs early in 2007 to maintain customer

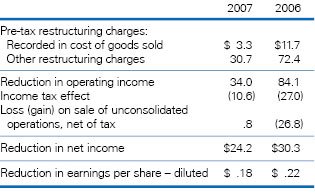

service during our facility consolidation. Selling, general and administrative expenses were higher in 2007 than 2006 on a dollar basis but declined as a percentage of net sales. As a percentage of net sales, administrative expense decreased while distribution, selling, promotion, advertising and research and development in total were relatively unchanged. The decrease in administrative expense during 2007 was driven by the benefit of expense reductions from our restructuring program. The following is a summary of restructuring activities:  Pre-tax restructuring charges for both 2007 and 2006 related to actions under our restructuring program to consolidate our global manufacturing, rationalize our distribution facilities, improve our go-to-market strategy and eliminate administrative redundancies. The gain on the sale of unconsolidated operations in 2006 was primarily for the redemption of our ownership investment |

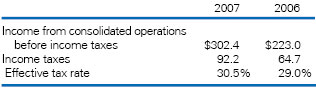

in Signature Brands LLC (Signature). More details of the restructuring charges are discussed later in MD&A and in note 3 of the financial statements.  The increase in interest expense was due to higher average short-term borrowings and higher short-term interest rates in 2007 when compared to 2006. However, these effects were partially offset by the refinancing of higher interest rate long-term debt in 2006, which has reduced the average interest rate on our total debt in 2007 when compared to 2006. The increase in other income was due to higher interest income.  The increase in the effective tax rate was due to a reduction in discrete tax benefits in 2007. The 2006 discrete items of $5.2 million included the favorable resolution of an international tax audit, a reduction of accruals recorded for state tax audits and additional tax benefit related to the closure of our operation in Finland. Income taxes in 2007 included $1.9 million for discrete tax benefits, primarily the result of new tax legislation enacted in The Netherlands, the U.K. and the U.S.  Income from unconsolidated operations increased 21% in 2007 compared to 2006. This increase was driven |