CRITICAL ACCOUNTING ESTIMATES AND ASSUMPTIONS

In preparing the financial statements in accordance with U.S. GAAP, we are required to make estimates and assumptions that have an impact on the assets, liabilities, revenue and expense amounts reported. These estimates can also affect supplemental information disclosed by us, including information about contingencies, risk and financial condition. We believe, given current facts and circumstances, our estimates and assumptions are reasonable, adhere to GAAP and are consistently applied. Inherent in the nature of an estimate or assumption is the fact that actual results may differ from estimates, and estimates may vary as new facts and circumstances arise. In preparing the financial statements, we make routine estimates and judgments in determining the net realizable value of accounts receivable, inventory, fixed assets and prepaid allowances. We believe our most critical accounting estimates and assumptions are in the following areas:

Customer Contracts

In several of our major markets, the consumer business sells our products by entering into annual or multi-year customer contracts. These contracts include provisions for items such as sales discounts, marketing allowances and performance incentives. These items are expensed based on certain estimated criteria such as sales volume of indirect customers, customers reaching anticipated volume thresholds and marketing spending. We routinely review these criteria and make adjustments as facts and circumstances change.

Goodwill and Intangible Asset Valuation

We review the carrying value of goodwill and non-amortizable intangible assets and conduct tests of impairment on an annual basis as described below. We also test for impairment if events or circumstances indicate that it is more likely than not that the fair value of a reporting unit is below its carrying amount and test non-amortizing intangible assets for impairment if events or changes in circumstances indicate that the asset might be impaired.

Determining the fair value of a reporting unit or an indefinite-lived purchased intangible asset is judgmental in nature and involves the use of significant estimates and assumptions. These estimates and assumptions include revenue growth rates and operating margins used to calculate projected future cash flows, risk-adjusted

|

|

discount rates, assumed royalty rates, future economic and market conditions and determination of appropriate market comparables. We base our fair value estimates on assumptions we believe to be reasonable but that are unpredictable and inherently uncertain. Actual future results may differ from those estimates.

Goodwill Impairment

Utilizing the guidance under SFAS No.142, we have concluded that our reporting units are the same as our business segments. We calculate fair value of a reporting unit by using a discounted cash flow model and then compare that to the carrying amount of the reporting unit, including intangible assets and goodwill. If the carrying amount of the reporting unit exceeds the calculated fair value, then we would determine the implied fair value of the reporting unit’s goodwill. An impairment charge would be recognized to the extent the carrying amount of goodwill exceeds the implied fair value. As of November 30, 2008, we have $1,230.2 million of goodwill recorded in our balance sheet. Our testing indicates that the current fair values of our reporting units are significantly in excess of carrying values and accordingly we believe that only significant changes in the cash flow assumptions would result in an impairment of goodwill.

Non-Amortizable Intangible Asset Impairment

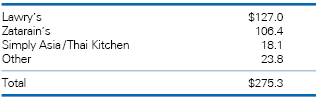

Our non-amortizable intangible assets consist of brand names and trademarks. We calculate fair value by using a discounted cash flow model or relief-from-royalty method and then compare that to the carrying amount of the non-amortizable intangible asset. As of November 30, 2008, we have $275.3 million of brand name assets and trademarks recorded in our balance sheet and none of the balances exceed their estimated fair values. We intend to continue to support our brand names. Below is a table which outlines the book value of our major brand names and trademarks as of November 30, 2008:

The majority of products marketed under our brand name intangible assets are sold in the United States.

In accordance with SFAS No. 142 we performed the required impairment tests of goodwill and non-amortizable intangible assets and recorded an impairment charge

|