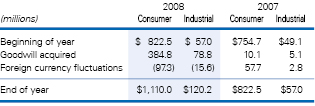

The changes in the carrying amount of goodwill by segment for the years ended November 30, 2008 and 2007 are as follows:

5. IMPAIRMENT CHARGE

In the fourth quarter of 2008, we recorded an impairment charge for a reduction in the value of our Silvo brand name in The Netherlands.

The financial results of the Silvo business, which we acquired in 2004, have been affected by a reduction in retail distribution driven by changing market conditions. We have been pursuing an aggressive plan to build sales and profit for the Silvo brand; however, execution of the plan has been below expectations.

During our annual impairment testing in the fourth quarter of 2008 under SFAS No. 142, we calculated the fair value of the Silvo brand using the relief-from-royalty method and determined that it was lower than its carrying value. Consequently, we recorded a non-cash impairment charge of $29.0 million in our consumer business segment.

6. INVESTMENTS IN AFFILIATES

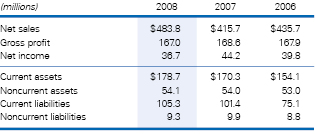

Summarized year-end information from the financial statements of unconsolidated affiliates representing 100% of the businesses follows:

Our share of undistributed earnings of unconsolidated affiliates was $51.8 million at November 30, 2008. Royalty income from unconsolidated affiliates was $13.3 million, $11.4 million and $11.1 million for 2008, 2007 and 2006, respectively.

Our principal investment in unconsolidated affiliates is a 50% interest in McCormick de Mexico, S.A. de C.V. Through March 2006, we also had a 50% interest in Signature Brands LLC.

|

|

7. FINANCING ARRANGEMENTS

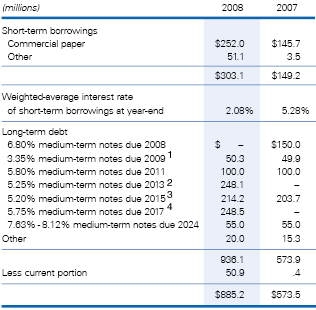

Our outstanding debt is as follows:

(1) The fixed interest rate on the 3.35% medium-term notes due in 2009 is effectively converted to a variable rate by interest rate swaps through 2009. Net interest payments are based on LIBOR minus 0.21% during this period.

(2) Interest rate swaps, settled upon the issuance of the medium-term notes, effectively fixed the interest rate on the $250 million notes at a weighted average fixed rate of 5.54%.

(3) The fixed interest rate on $100 million of the 5.20% medium-term notes due in 2015 is effectively converted to a variable rate by interest rate swaps through 2015. Net interest payments are based on LIBOR minus 0.05% during this period.

(4) Interest rate swaps, settled upon the issuance of the medium-term notes, effectively fixed the interest rate on the $250 million notes at a weighted average fixed rate of 6.25%.

Maturities of long-term debt during the years subsequent to November 30, 2009 are as follows (in millions):

2010 – $14.4

2011 – $100.0

2012 – –

2013 – $250.0

Thereafter – $510.0

In September 2008, we issued $250 million of 5.25% notes due 2013, with net cash proceeds received of

$248.0 million. Interest is payable semiannually in arrears in March and September of each year. Of these notes, $100 million were subject to an interest rate hedge as further discussed in note 8. The net proceeds from this

|