2009 Annual Report Letter to Shareholders

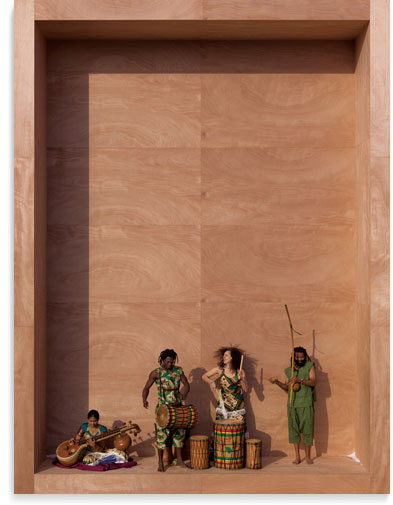

everywhere

The widespread retrenchments and uncertainty that characterized 2008 faded as ’09 developed and gave way to a largely “Go North” year for Progressive. What a difference — a disappointing net loss in ’08 was solidly put in our rearview mirror with a return on shareholders’ equity of 21.4% and net income over a billion dollars. Concerns for capital adequacy moved to more comfortable considerations of effective use of underleveraged capital and the frequency of discussion about book value impairment to invested assets faded like old news stories.

Passenger side rearview mirrors caution us that “objects may be closer than they appear.” Similarly, percentage gains and single-year comparisons over a year like 2008 will undoubtedly need added clarification to appropriately communicate a meaningful perspective on the year — separating good actions from good fortune. That said, it was a good year for Progressive on almost all measures and, in more ways than not, what we had hoped to achieve.

Starting the year, we had two clear and critical imperatives: Meet or exceed underwriting targets and continue with our efforts to “de-risk” the investment portfolio. Each of these imperatives evolved as the year progressed, but both set the tone for our actions.

Underwriting Results

Commenting on the 94.6% combined ratio for 2008 I wrote that “Duplicating this profit margin next year will be very pleasing, but will take incredible vigilance” and expressed confidence by stating my view that these situations are Progressive at its best.

Our full year combined ratio for 2009 was 91.6%. Imperative one was met well.

A significant concern was pricing to reflect the level of claim frequency likely to emerge post the dramatic gas-price induced decline of 2008. Our models and estimates, while interesting, will never substitute for our ability to observe and respond quickly. With the benefit of hindsight, frequency escalation was, generally speaking, more benign than some of our estimates and contributed to our outperformance on margin relative to our goal of a 96 combined ratio. A notable exception was considerably more aggressive trends in personal injury protection coverage in a handful of important states.

Perhaps more impressive than the aggregate result is our performance at the product and state level. 48 of our 51 jurisdictions were profitable for Personal Lines for the year and only an additional five states did not meet or exceed their target profitability. To highlight the point of incredible vigilance, the single best common denominator among those states not meeting targets was personal injury protection coverage.

Our Commercial Auto business, struggling with the derivative effect of a damaged economy for volume, certainly contributed on margin with an aggregate 85.8 combined ratio with just five states on the wrong side of breakeven.

I suggest readers add a point to the total combined ratio above to get a more accurate read on the 2009 accident year results and, more importantly, the price adequacy for the year. The difference is a contribution from prior accident year claims settling at amounts lower than originally estimated, thus resulting in favorable development.

The business production story was equally hard to predict. As the year started, we were happy to see a measurable surge in quoting activity, most notably in our Direct business and even more specifically through the Internet. Theories to explain the growth remain mostly that, but our surveying seems to suggest that consumers, reacting to the economic news that surrounded them every day, were evaluating economic choices they perhaps may not have without such stimulus. Actions within my own household suggest some veracity to the theory and, while not meeting Progressive’s standards of proof, I’m prepared to conclude QED. Regardless, the surge was welcome and we were well prepared and positioned.

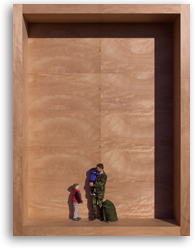

Every interaction provides us with the opportunity to demonstrate our respect for the people who rely on us. Our licensed professionals are available 24/7, online and off, to answer questions and provide peace of mind. Our comparison rates deliver information that helps customers feel confident they’ve made an informed decision. And, our Name Your Price® option gives customers control by telling us what they would like to pay for car insurance.

Prepared and Positioned

In past letters I’ve outlined key elements of our strategic agenda and progress on each. While far from complete, our progress has been substantial and helped position us to take advantage of the market conditions.

Our intense focus on leading in the online space has resulted in a Web site that has consistently been recognized as the industry leader. Additional recognition was expressed by Forrester Research in the third quarter as they named our Web site the best Brand Building Web site across all financial services sectors.

We feel the real power of the online experience is changing it to involve the customer in respectful and engaging ways. This year, we substantially completed the countrywide roll-out of our “Name Your Price®” offering, which invites the customer to participate in the quoting process by telling us how much they would like to pay. The timing was perfect and the symbolism of a low-tech price gun provided an interesting juxtaposition that consumers had no trouble understanding. We see this as a perfect example of the changing customer experiences that are possible and, by our measures, welcomed and business generating. We clearly need to do more and have plans to do so, but 2009 was an encouraging year online.

Increasing our focus on target consumer segments over the past several years has resulted in notable improvements in customer retention and care. The largest segment of consumers, as we use that term, is one that purchases multiple personal lines products for the household. We have low penetration in this sizable segment and see greater penetration as the best way to achieve our internal organic growth ambition of doubling the premium of the company. We are now far better positioned to serve the needs of those consumers wishing to combine a renters or homeowners policy with their auto selection and have consistently expanded this capability, ending the year with three meaningful relationships for companion products.

This effective expansion of our target market is an exciting prospect for further growth and consistent with the notion of positioning Progressive as a “destination” insurer. While noting my rearview mirror analogy, our growth in policies in this target segment in both our Agency and Direct businesses was over 100% in 2009. “Small with potential” is an exciting positioning for us but will not distract us from our commitment to segments we currently serve well.

A stronger brand communicated well is an action call that has been part of this letter for some time and represents an earnest aspiration. The last two years have been confirming of the effort and more importantly have provided a glimpse of what’s possible with a strong brand to unify the other skills we value. Consumers have responded well to our messages and market innovations, but the buzz seems to stem from “Flo” — our self-constructed employee of the Superstore. Consumer recognition and appeal is high, and we have exciting plans to keep the campaign fresh and relevant. At the same time, we acknowledge that we have a significant gap yet to close relative to the best-in-class recognition.

Clearly, the consumer demand generation objective of a brand is essential and, in 2009, we were served well, but for me there is an even bigger contribution to our customer care culture that has been served by our brand-building efforts. Employees at every level identify with Flo, and with the positive brand characteristics she demonstrates to customers and shoppers — even her quirkiness. When we challenge ourselves with the question — “Who does the customer expect to answer the phone or settle a claim?,” the immediate answer is clear and, while common sense suggests it will not be Flo, the expectations are unchanged.

Our customer-focused agenda has been a source of some pride for us over the past several years but the model of brand ambassadorship exhibited by Flo, and accepted by all employees with similar enthusiasm, ensures the critical congruence of brand messaging and brand execution.

Late in the second quarter, and continuing through the second half of the year, we saw the emergence of stronger new application growth in our Agency business. This was a very positive sign we had not seen for some time. While net growth in Agency auto policies in force for the year was slight, it reversed a multi-year declining trend. We always have theories on the pricing adequacy of our competitors and were not surprised when some increased rates in amounts that outstripped our estimates of loss-cost trends. Relative positioning on price is an important consideration in the Agency business and being comfortable with our rate level when others need additional rate is a position we like to be in. We have also taken additional measures to present our rates to agents such that they can ensure the consumer is offered the best options we can make available.

We consider our access to consumers via independent agents and directly, now primarily via the Internet, to be a significant strategic advantage over many in our space. The strategies are largely the same in each channel and, although our advertising is designed to incent consumers to shop with us directly, our recognition and support of consumer choice is unwavering. Agents have consistently expressed support for, and excitement about, our brand-building efforts and the positive reflection it has on their business.

Our Agency business remains the larger portion of our Personal Lines business and the dominant part of our Commercial Auto production. The Direct business, which perhaps reflects consumers’ changing buying habits, is now substantial. Against the relatively flat growth in customers in Agency, Direct grew 13% for the year and is now about 43% of our personal auto policies in force. Both businesses produced combined ratios between 93 and 94 for personal auto for the year. Of some note is that the annual trend in average written premium is relatively flat for the Agency business, and still quite negative for Direct, at -4%, tempering Direct’s top line growth to 11%.

Aggregate measures of combined ratio ultimately are most important, and our goal of an aggregate companywide 96 in any calendar year is unchanged. With room for some debate, the Agency auto business, along with the special lines and Commercial Auto businesses, are best thought of as variable cost acquisition businesses for which calendar-year combined ratio is an accurate assessment.

The key to controlling the Direct business is having a very clear understanding of target margins during the life of a policy, based on an accepted recognition period for acquisition costs, and an ability to predict policy life expectancy by consumer segment with some reliability. With a substantial base of renewal business in the Direct book, our calendar combined ratios have been consistently below 96. However, under certain high growth new business scenarios, we would be happy to see the reported monthly and calendar-year combined ratios go above 96 for our Direct business, as long as our new and renewal business consistently meets predefined targets that ensure a lifetime result at or below 96.

Surpassing aggregate written premium of $14 billion in 2009 was welcomed, but it’s not the first time we have crossed that threshold. Aggregate premiums in 2005 and 2006 were at comparable levels. There are, however, notable differences which speak to both successes and challenges of the past several years. We now serve over a million more Personal Lines policies than in 2006 when we achieved our highest ever premium of $14.1 billion. 639,000 of these additional policies are auto customers with the rest consumers of our special lines products. Our state and customer mix has changed, and the composition of our book of active policies between Direct and Agency is very different with Direct having increased some 773,000 policies offset by a loss of 134,000 Agency policies.

We respect the environment and are mindful of the impact of our actions, as evidenced by our offer to fund the planting of a tree in a U.S. National Forest on behalf of each of the first one million customers who chose to go paperless by receiving their policy documents online.

I offer this multi-year view to provide some perspective of the past several years. We have healthy growth in Personal Lines customers, which for me is the best form of growth, but battled a headwind of declining average premium per customer. Our growth has clearly come from our Direct business during that time. Our policy counts in Commercial Auto are up slightly from 2006 levels, but premiums are down in total more than $360 million. The macro industry conditions of the last few years become a little starker cast in this light.

While there are no guarantees, the forward-looking picture may be somewhat different. I expect continued growth in our Direct offerings, with added fuel from our multi-product consumer segment. Similarly, I expect our Agency business to continue to benefit from our competitive positioning and expanded multi-product offering. A return to greater employment levels, which is harder to predict, will almost certainly have an across-the-board effect and most importantly in our Commercial Auto products. I believe 2010 will be a year to build on the momentum from 2009 and all the initiatives that unquestionably have made Progressive an even better consumer and agent proposition.

Although a relatively minor premium contributor, we were very proud of our Professional Liability Group and its highly consistent track record of performance. However, we increasingly saw a mismatch with our long-term strategic interests and decided during the year to initiate a sale of our interest in the program to an affiliate of our partner, the American Bankers Association.

Building options for the future that are in line with our strategic interests, we launched our Internet-only personal auto insurance business in Australia just before year end. While there is little market activity to report yet, if it matches the effort expended by the new market entry team, we should have more to report next year.

Acknowledging our emerging strengths and their potential is appropriate, but it should be in balance with some commentary about other skills we hold central to our business model such as Claims and Information Technology.

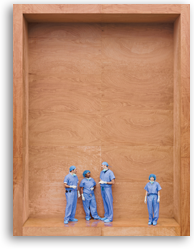

In Claims, 2009 was a milestone year, but not without some pain. Our Claims strategy has been evolving over the past decade. Starting with a simple premise, “It’s Cars not Cash,” which reflects our customer’s preference for a repaired vehicle over just the financial compensation, we built and expanded our patented Concierge Service Centers approach, and a proxy in areas of lower policy concentration.

This type of change starts the first domino and invites rethinking of what’s possible in all aspects of our claims process. A simple set of Guiding Principles designed to maximize the accuracy and quality of settlement, the efficiency and cost effectiveness of resolution, along with the highest satisfaction of customers and our people has and will be a constant.

Continuous process improvement for us led to greater recognition that, to achieve all the benefits available, more structural change would be needed. In the second quarter, we made a significant change to our Claims management infrastructure, reducing the size and increasing the scope of management to better fit with the cumulative process improvements. I have seen more than a few cost benefit analyses that in retrospect seem to be clearer on the costs than the attainment of benefits. For our Claims organization, 2009 was a year in which many of the intended benefits from nearly a decade of continuous improvement in claims response and accuracy were fully realized.

We ended the year with our run rate Loss Adjustment Expense ratio approximately one point lower than the prior year, improved on what was already our highest attained quality of settlement measure, and added considerable emphasis to our focus on employee and customer satisfaction expecting future measures to reflect the efforts. Key to success is attaining the delicate balance between all four guiding principles; however, a point of LAE reduction, with a very realistic goal of more, helps in no small way to keep our prices lower longer and below external trends wherever possible. It is certainly not out of place to extend a special recognition to the 11,500 claims employees who, through their patience, flexibility, openness, and nimbleness in the midst of some substantial changes, made these results possible.

Focus on non-claims costs is every bit as important to increasing market competitiveness. While, on a relative basis, we may be very good, we see opportunity and we’re going after it in ways that count. Last year, commenting on our Information Technology Group’s process agenda to re-think just about every aspect of what we do and how we do it, I expressed an expectation that their efforts would result in increased leverage and greater accountability to market priorities. Suffice it to say that through terrific commitment by the whole organization, expectations are being met. Our expected IT spending level for 2010 is lower than the comparable number for 2006. Of special note, our multi-year effort to develop a replacement for our policy processing system went live in its first state during the year, with excellent quality.

Changing things that work because there is a better way is difficult and requires a special mindset and leadership. Relentlessly improving our products and services and providing reasons for customers to stay, in addition to eliminating reasons they leave, is never ending. Innovating in ways that matter to customers, and better defining target segments and our appeal to each, is exciting. This is what we do. I like the changes we’ve made and am genuinely excited about the prospects for 2010. We remain continuously motivated by our aspiration of becoming Consumers’ #1 Choice for Auto Insurance.

Navigating the car repair process can be confusing and time-consuming. That’s why customers tell us they don’t want just payment — they want their car fixed. Our claims process is designed to respect the customer’s time and offer to reduce their burdens to an absolute minimum. And, we deliver information customers need to make smart decisions and provide helpful alternatives including “we’ll take it from here.”

Investments

Last year in this letter I editorialized that I had trouble typing the $1.4 billion we had recognized in net realized losses, including other-than-temporary impairments. This year I have no such trouble. We attained a 12.5% fully taxable equivalent return for 2009, but as the mirror analogy suggests, this too needs greater context.

Was last year as poor as the numbers suggested? Possibly not. Accounting guidance that exists now from the Financial Accounting Standards Board would have changed the accounting for last year had it been in place. While important, it’s not the context that matters.

We think a better context is to use what I have referred to as the more consistent “all-in” economic data point of comprehensive income, a measure combining income statement results with balance sheet recognition of changes in unrealized gains or losses. We believe strongly that this measure takes out any timing issues of asset impairment or asset disposition and values assets at market, best reflecting the health of the company.

Based on that belief, we added a table of comprehensive income to our monthly disclosures and hope that it is insightful for readers. Comprehensive income for 2009 was $1.75 billion (I had no trouble typing that) or $2.61/share versus a comprehensive loss of $615 million in 2008. We ended 2009 with a net unrealized gain of nearly $700 million, a significant swing from last year’s position of more than $100 million in unrealized losses.

With all appropriate adjustments to the fair value of assets, we started the year with a little less than $6.4 billion in capital. During the first quarter, we hit a low point closer to $6.3 billion, still, as we reported, several hundred million above the sum of our statutory capital requirement and our self-constructed extreme contingency reserve.

While our capital had been greatly diminished in 2008 and early 2009, our capital management practices allowed us the luxury of managing through the effects of reduced asset valuations and we were not forced to sell securities at low values or turn to external sources to restore capital balances. We had continued belief that the assets we held, and specifically our financial preferred stocks, would be far more likely to appreciate from our now re-established book values than they were to fall further. Our preferred stock portfolio ended 2009 with net unrealized gains of $533 million and received nearly $150 million of dividends during the year.

Our confidence in holding these positions stemmed from three reasons: we were very forthright in recognizing their changed fair value and expected no surprises to our capital position even without recovery; we were effective in “de-risking” the portfolio to protect the company’s ongoing operations; and performance from insurance operations was strong.

With few exceptions, we held our preferred stock positions throughout the year, and benefited as financial institutions improved and, in some cases, added equity to their capital structure providing greater support for our positions. The dramatic recovery from low levels distorts single-year reporting, but the decision to hold was well considered, with more upside than down, and proved to be a good one. Notwithstanding, we expect to hold fewer preferred stocks in the future and have changed our guidelines to require that outcome but with no requirement to take actions counter to our best judgment to attain that position in an artificial time frame.

While our preferred stock position was the focus of most of our attention, it was not the only asset sector that warranted significant attention. Our active management of the fixed-income portfolio allows us to have a thoughtful thesis on our selections, even within sectors that are subject to additional macro market risk — municipal bonds and commercial real-estate bond structures are two easy examples for the year. We were pleased with our performance in each sector for 2009 and, although the portfolio still has a higher proportion of lower-risk treasuries than we may hold through 2010, we plan to be very prudent but purposeful in assuming additional risk.

With comprehensive income in positive territory, the mechanics of our variable dividend policy were very much back in play. Applying the 20% target established by the Board to our after-tax underwriting income of $764 million and further adjusting by the companywide Gainshare factor of .71, a shareholder dividend of 16.13 cents per share was declared. We’re pleased with our variable dividend approach and, while not satisfying to have declared no dividend for 2008, it was exactly the right approach to capital management at the time.

The 2009 dividend, while only one way to facilitate a return of capital to shareholders, represents the largest regular dividend we have paid to date. For 2010, the Board of Directors has proposed an increased target of 25% of after-tax underwriting income. Consistent with our long-standing and continuing position on capital management — to repurchase shares when our capital balances, view of the future, and the company’s stock price make it attractive to do so — we repurchased 11.1 million shares in the open market mostly during the latter part of the year. Repurchase activity was moderate compared to historic levels, reflecting in part our view of required capital adequacy for 2009 and volatility in the equity markets.

Book value at year end increased by 37% to $8.55 per share (post dividend accrual) and our debt-to-total capital ratio was back in line with our guideline at 27.5%.

Social responsibility – a fancy label for doing the right thing by or simply respecting customers, agents, shareholders, employees, vendors, and the environment. We’re doing this by building a sustainable business that provides a stable market for our agents and that will be here to provide the products and services our customers expect. Our actions are highlighted at progressive.com/socialresponsibility.

Our Culture and Credits

Nothing we have achieved has been without the efforts of so many and our single most important initiative, especially in current times, is ensuring Progressive is a great place to work. Creating an environment where all of us enjoy working hard, are motivated to do our best, can grow constantly, and one that others want to join is a never-ending challenge. Our people and culture are what makes us special.

Consistent with our culture and values is the simplest of notions to just do the right thing, and in a world that is fast recognizing that we must all up our game on social responsibility, Progressive is actively reviewing our business practices to further increase our social and environmental responsibility. A report on our actions is available online.

To the people who make all this possible — our employees, the customers we are privileged to serve, the agents and brokers who choose to represent us, and shareholders who support what we are doing — Thank you.

Glenn M. Renwick

President and Chief Executive Officer