| |

|

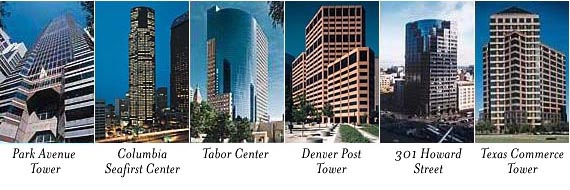

| Acquisitions continued at a high level for Equity Office in 1998 as the company established a significant presence in Denver, expanded in New York City and added to its leading market positions in other markets. Leasing activity was brisk, producing higher occupancy rates and rents. Operations improved as margins rose and the company began initiatives to improve its administrative processes that will further enhance productivity.

Working primarily through alliances with premier regional developers, Equity Office expanded its pipeline of development investments during 1998. Announced during the year were 10 office properties and two parking structures representing a combined investment of approximately $550 million, totaling 2.6 million square feet of office space and 1,100 parking spaces. During 1998 Equity Office solidified its development strategy and formed several development relationships across the country to pursue projects in key markets. In pursuing new development with premier regional developers, the company is able to invest in well-conceived, well-timed projects that meet our customers' demands in select submarkets. Our development strategy complements our overall acquisition strategy to invest in well-located, high-quality office buildings while, in this case, reducing the high overhead costs, entitlement and other pre-development risks unique to the development process. Three new transactions were signed with Wright Runstad & Company in 1998. The new developments include the 100% pre-leased World Trade Center I in Seattle, and Sunset North and Three Bellevue Center in east suburban Bellevue. Total projected investment in the three projects is $192.0 million. Other major projects with development partners include:

Equity Office leasing activity for 1998 totaled 8.8 million square feet, compared with 4.5 million square feet in 1997. The weighted average lease rate on expiring leases was $20.96, while the average rate on new leases signed rose 22.8%, to $25.75 on a GAAP basis ($24.73 on a cash basis). Total occupancy rose to 95%, while occupancy in the "same store" of buildings owned for a year or more rose to 96.1% from 91.9% over the two-year period ended December 31, 1998.

Equity Office has identified 150 National Accounts customers who lease space in more than one location and have the potential to grow or expand with Equity Office regionally or nationally. Its National Accounts program seeks to serve these customers through one-stop-shopping and other services – including customized leases that can be adapted from building to building across the country, and portfolio flexibility, including the ability to reconfigure space requirements to address needs from city to city. The National Accounts program coordinates local, regional and corporate Equity Office leasing staff with the customers' local and national real estate decision-making teams. For example, Marsh & McLennan, an insurance and professional services firm, leases 30,279 square feet in two locations, and one of its subsidiaries, William M. Mercer Companies, Inc., leases 231,768 square feet in five Equity Office locations including, in 1998, renewal and expansion of their office space in Chicago. Marsh & McLennan, already in discussions with Equity Office about space requirements in three additional markets, worked through the National Accounts structure to plan further reconfiguration of Marsh & McLennan-related offices. This allowed Mercer and Marsh & McLennan to coordinate a wide range of requirements through a single point of contact, and provided an extra measure of service and certainty. In much the same way, Equity Office has worked closely with Chicago Title & Trust, which leases 357,966 square feet of space, including its national headquarters, in eight Equity Office locations. Equity Office is Chicago Title's largest landlord, and frequently has solutions to its space and working environment needs. "We believe we can be of particular assistance in helping a customer quickly enter a new market, and plan ahead for corporate real estate space decisions," says Kevin Burke, vice president of National Accounts for Equity Office. "Because of our national presence and our customers' national needs, we work closely with them to solve problems and meet multi-city space requirements." National Accounts occupied more than 21 million square feet at year-end 1998 across the Equity Office portfolio.

Equity Office identified $8.1 million in total operating savings at the regional level during 1998, including $1.7 million in staffing savings, and $6.4 million in cost reductions on contracts that were jointly rebid among multiple buildings or regions. For example, joint bidding in five markets has saved nearly $677,000 in annualized costs for landscaping. Insurance costs fell nearly 40%, to 11.0 cents per square foot, because of the company's improved buying power following the Beacon merger and other acquisitions, as well as other factors. An agreement to buy energy for Equity Office facilities throughout California is expected to save $1.5 million over the next several years. Additional national and regional savings are expected as Equity Office identifies and exploits further opportunities. "Project Zen," the company's most significant effort to improve many administrative processes, policies and procedures as it plans for growth, reached an important milestone in 1998 when a review of all internal accounting practices was completed. The next step – implementing the operational improvements to increase efficiency – is under way in 1999

The key to customer satisfaction is providing services that make Equity Office buildings too good for a tenant to consider leaving. This might include a tastefully appointed, large conference room with full electronic infrastructure for elaborate presentations, or offering expert assistance with planning and implementing the most sophisticated telecommunications systems. All are services that Equity Office now offers, or facilitates for customers in many of its buildings. One of the most important facets of building distinction is the ability to deliver, as an intrinsic element of the superior office environment, a range of services that make Equity Office buildings a more important and welcome part of successful working life. "For many of our clients, the quality of the building and its amenities is an essential part of recruiting and retaining the best employees," says Mike Steele, chief operating officer. "The more we can offer our customers and exceed their needs, the better our chance of retaining them for the long term. We want our levels of service to be a significant barrier to exit. We want to be known as the preferred landlord." The company's telecommunications plans are an example of the direction in which it is proceeding. After 16 months of deliberation and discussion, the Internal Revenue Service, in January 1999, ruled that Equity Office may participate in the delivery of a broad range of advanced telecommunications services to its customers. The ruling was the first of its kind in the REIT industry, and opens the door to a wide variety of options that might be offered to Equity Office tenants. "Our customers have told us that up to 25% of office build-out costs are related to telecommunications systems for voice, e-mail, video communications, electronic research, Internet access, networking, safety and security systems and environmental control systems," says Steele. "We are listening."

Equity Office, through its Equity Capital Holdings L.P. affiliate, owns 19 stand-alone parking facilities, comprising 18,059 parking spaces, in eight markets. Same-store parking sales rose 6.6% on a cash basis in 1998. The facilities were linked in 1998 through a national parking program that assigns parking management to designated national operators – Central Parking System and Standard Parking Corporation – to lower operating costs and increase revenue opportunities. A key component of the program is development of a national car care program to incorporate and, where possible, standardize best practices and amenities available for all Equity Office parking facilities. A significant event in late 1998 was the agreement by Equity Capital to lease two City of Pittsburgh parking facilities under a 50-year lease with an initial cost of $28 million, reflecting a move to privatize parking facilities in that city as well as the growing privatization trend nationwide. They include the Forbes Garage, with 817 spaces, and Allies Garage, a 493-space facility. |

|

| |