|

The value

of relationships runs deep at Southwest Bank of Texas. Relationships

with our customers. With our community at large. And within

our own Southwest Bank of Texas family.

We build

these relationships with open ears and open minds. Listening

carefully to our customers and to the community. And to our

colleagues. Taking a little extra time to consider what we’ve

heard.

And responding.

With ideas. With solutions.

Solutions

that, in many cases, might be considered “outside of

the box” for a financial institution.

And that’s

how we build trust. The cornerstone of any relationship.

Inspiring

customers to turn to us—to rely on us—more and

more.

This is

particularly evident in the ongoing growth of Southwest Bank

of Texas Investment Services which includes:

Personal

investment advisors located in our network of retail branches Personal

investment advisors located in our network of retail branches

Institutional

services for fixed-income and cash management Institutional

services for fixed-income and cash management

Retirement

services helping commercial customers introduce 401k and retirement-related Retirement

services helping commercial customers introduce 401k and retirement-related

benefits into their businesses

In a related

area, we have continued to expand and invest in Private Client

Financial Services. This is a direct result of an increasing

number of individuals who in their personal financial management

partner, seek the service, attention to detail and trustworthy

advice they receive every day in business from our Private

Bankers and Investment Advisors. That’s true relationship

extension. True relationship banking.

Also this

year, we’ve increased our retail presence with the addition

of seven full-service branches—continuing our ambitious

retail development strategy that we began last year.

Our customers

enjoy the convenience of the branch experience. And we enjoy

the benefits of an additional broad base of deposits, loans

and fee-based service income.

This is

how we grow. Through value. Through trust.

Through

relationships. Built one at a time.

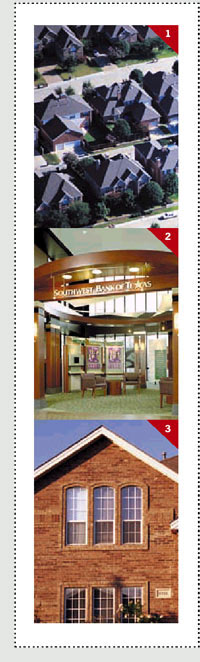

1

CONSOLIDATED EFFORT The Dubose Model Home Company is a

lessor and re-seller of model homes—and a customer of

Southwest Bank of Texas. The Dubose Company buys model homes

built by developers and then leases the home back to the builder

until the time that the subdivision has sold out and the builder

no longer needs a model home. Dubose, in turn, sells them

to consumers. It’s good business all around. Except that

Dubose may carry an inventory of 300 homes at any one time

through various partnerships. And that has meant 300 individual

mortgages in the company system. We suggested—and helped

implement—a simple solution. We recommended that Dubose

self-finance its inventory purchases by setting up an in-house

finance company. We helped with the financial structuring

and consolidation of outstanding mortgages. Dubose not only

saves money, the company can also track and manage its finances

more efficiently. And they couldn’t be more pleased.

Not a typical bank solution. But then, we’re not a typical

bank. 1

CONSOLIDATED EFFORT The Dubose Model Home Company is a

lessor and re-seller of model homes—and a customer of

Southwest Bank of Texas. The Dubose Company buys model homes

built by developers and then leases the home back to the builder

until the time that the subdivision has sold out and the builder

no longer needs a model home. Dubose, in turn, sells them

to consumers. It’s good business all around. Except that

Dubose may carry an inventory of 300 homes at any one time

through various partnerships. And that has meant 300 individual

mortgages in the company system. We suggested—and helped

implement—a simple solution. We recommended that Dubose

self-finance its inventory purchases by setting up an in-house

finance company. We helped with the financial structuring

and consolidation of outstanding mortgages. Dubose not only

saves money, the company can also track and manage its finances

more efficiently. And they couldn’t be more pleased.

Not a typical bank solution. But then, we’re not a typical

bank.

2

BRICKS AND MORTAR While so many global banks seem to be

driving customers out of their branch facilities, Southwest

Bank of Texas, this year, quietly initiated a unique plan

to invite more customers into ours. It’s a key component

in “our way” of building real relationships with

our customers. And a key component of our way of extending

and solidifying our brand. By

extending the “portal” concept of our Internet-enabled

e-banking products, the new Southwest Bank of Texas branch

facilities are a carefully designed and arranged mix of electronic

and people-assisted banking services. (Even special computer

kiosks for kids in our Woodlands branch, where families comprise

the majority of branch traffic.) Everything in place to allow

customers to access what they’ve told us they want. Everything

created to encourage customer participation in developing

the relationship. Call in. Click in. Or come by. At

Southwest Bank of Texas, we’re here for our customers.

3

BUILDING RELATIONSHIPS The Houston-based Sueba Company

is the U. S. subsidiary of one of the largest residential

developers in Western Europe. Southwest Bank of Texas, aware

of the Company’ss ongoing activity in the Houston market,

kept local Sueba representatives informed of our desire to

work with them. In spite of Sueba’s traditional and almost

exclusive reliance upon German-based institutions. However,

this year, recognizing a need to move faster and smarter in

the dynamic U. S. market, Sueba began the process of choosing

a U. S. banking institution to serve its business. In Houston,

Southwest Bank of Texas competed with the largest names in

national banking. And won. Based on our demonstrated interest

in their business over time. Based on our ability to move

faster than the rest. And based on our ability to bring creative

solutions to the relationship. We’re proud of our new

relationship with such a fine company. And we anticipate a

long and mutually rewarding future together. This is just

the beginning.

S O U T H W E S T B A N C O R P O R A T I O N

O F T E X A S , I N C

. A N N U A L R E P O R T 2

0 0 0

S O U T H W E S T B A N C O R P O R A T I O N

O F T E X A S , I N C

. A N N U A L R E P O R T 2

0 0 0

|