|

|

Letter

to Notice

of 2004 2003

Annual

|

|

|

|

|

|

||

| • | Management’s Discussion and Analysis |

|||||||

| • | Consolidated Financial Statements |

|||||||

Other Stockholder Information |

||||||||

Hershey Foods Corporation

Proxy Statement and

2003 Annual Report

to Stockholders

March 12, 2004

To Our Fellow Stockholders:

I’m pleased to report on a healthier Hershey Foods, a company which now is on track and on trend.

Last year, 2003, reflected continued progress behind our value-enhancing strategy. In 2001, we began to capitalize on the significant strengths within Hershey Foods while addressing the barriers to growth. During this time, we restructured our cost base to enable increased investment in our brand-building and selling capabilities.

This combination has resulted in solid market-share growth, as well as the achievement of top-tier financial performance. Equally important, we have an organization that’s energized and committed to delivering superior value to our stockholders. Clearly, we are on track. Moving forward, we are on trend. We compete within the very attractive $60-billion snack market and have a competitively-advantaged business system well-positioned to capture significant future growth opportunities.

On Track

2003 Results

Hershey Foods delivered balanced, sustainable performance in 2003. Through a combination of improving top-line performance, market-share expansion and continued productivity gains, income for the year, excluding items affecting comparability, was $474.7 million or $3.59 per share-diluted, an increase of 13% vs. 2002*. This financial performance marked the third consecutive year of double-digit gains in earnings per share and is significantly improved compared with the prior period:

| 1996- 2000 CAGR |

2001 | 2002 | 2003 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

||||||||||||||

|

EPS

Growth (excluding items affecting comparability)* |

5% |

14% |

12% |

13% |

||||||||||||

| * | Please see the chart following this letter for a reconciliation of income and earnings per share-diluted before cumulative effect of accounting change as reported under GAAP to income and per share amounts excluding items affecting comparability. |

2003 Highlights

Profitable Organic Growth

Consolidated net sales increased by 1%. We made significant progress in the key areas that represent both a source of competitive advantage and long-term marketplace potential. The first of these areas is our scale brands.

These brands, which contribute close to two-thirds of our retail sales, achieved a 6% increase in retail growth, gaining market share. A combination of value-added new items (Sugar Free and several Limited Edition varieties), superior advertising, and solid retail execution are positioning these brands for accelerating momentum.

The second such area of emphasis is “instant consumables,” or single-serve items. This packaging format delivers superior taste and the convenience demanded by today’s consumer. In 2003, instant consumables delivered 8% growth in retail takeaway.

We also continue to do well in the higher-margin Convenience Store channel, our third area of emphasis. This retail segment accounts for 17% of our wholesale sales and is growing. In 2003, our retail takeaway increased by 9%, resulting in a 0.9 point market-share gain in this channel. This follows a 10% increase in 2002, clear evidence that we’re building growth on top of growth in this segment.

One of our major challenges in 2003 was to successfully implement the price increase that took effect in January. New product innovation and targeted retail programs, supported by strong in-store execution, combined to increase our leadership position in the largest, most-profitable chocolate segment (+6% growth and +0.2 share point gain). We achieved these results despite aggressive competitive activity that followed the price increase.

As with most businesses, we didn’t achieve all of our goals for the year. Certain areas of our U.S. portfolio must improve. While we are the leader in the non-chocolate segment and have terrific brands (Jolly Rancher candy, Twizzlers candy, PayDay candy bar), we’ve yet to fully unlock their growth potential. This is a very different segment from chocolate confectionery, both from a consumer and customer standpoint. Our marketing initiatives must therefore reflect a different approach. Fortunately, good work is underway in the non-chocolate segment, particularly in the area of new products. We fully expect 2004 to be a much-improved year for these important brands.

Our business results were mixed outside the United States. Both Hershey Canada and Hershey Mexico (70% of our International sales) had a very strong year, with solid increases in sales, market share and income. The major area of weakness was in the Far East where several external factors such as the weak economy and the SARS epidemic contributed to the shortfall. Hershey International, while small overall, can and must be a source of predictable, profitable growth for the Company.

The rationalization of non-strategic, low-profitability items, while affecting the growth rate in reported sales, has been a key initiative in improving the long-term vitality of our portfolio. While this program is scheduled to be completed in 2004, we will remain disciplined about eliminating items that limit our potential for profitable growth.

Gross Margin Improvement

This past year marked the third consecutive year of very strong margin expansion. Improved price realization and sales mix, combined with supply chain productivity, contributed 110 basis points to gross margin expansion in 2003, building upon solid gains from the same factors in 2002 (+130 basis points) and 2001 (+140 basis points).

ii

Our supply chain deserves special mention both in its contribution to improved gross margins and in its role as a major source of competitive advantage for Hershey Foods. From Research and Development on through Logistics, we have superb people and capabilities that yield a cost-effective and flexible supply chain. All areas—from raw materials and packaging savings to in-plant productivity initiatives to continued improvements within our logistics area—contributed in 2003 while delivering higher levels of customer service.

Organizational Effectiveness

Of equal, if not greater, importance to the success of 2003 was the progress we made with our organization. It’s thanks to the over 13,000 people who are Hershey Foods that we were able to deliver upon our commitment to win both with our consumers and our customers. Not a day goes by that I don’t witness this commitment first-hand.

Two major organizational initiatives took place during the year. The first was the restructuring of our U.S. sales force. Building upon Hershey Foods’ long-standing reputation as a superior selling organization, we moved quickly and decisively to create a field sales structure that now reflects the ongoing consolidation of our customer base. This new structure created numerous opportunities for advancement for our sales personnel. By removing two layers of field sales management, we were able to reinvest the savings in store-level coverage (up 29% since 2002), a key advantage for our Company. Equally important was the investment in new information and selling capabilities. Winning at retail now requires both superior selling and superior store-level execution capabilities. I’m very encouraged by our progress to date.

The second major organizational change was the creation of the U.S. Snack Group in the second half of 2003. This group will enable us to aggressively enter the appropriate snack market adjacencies. We’re off to a great start, with several new initiatives already announced for introduction in 2004.

Building our strategic and leadership capabilities continues throughout the organization. One exciting new effort is the KISS program (Knowledge and Insights for Strategic Success), launched in 2003 and currently being rolled out to all management levels. KISS utilizes a common framework for assessing business issues and developing sound business plans, and is designed to strengthen Hershey Foods’ strategic thinking capabilities.

A strong indication of organization effectiveness is overall expense control. Despite significant increases in medical costs, pension expenses, etc., all areas of the Company delivered disciplined cost management during 2003. Our employees clearly were up to the challenge, understanding that general and administrative expenses must increase at a lower rate than sales if we are to continue to invest in our business over the long term.

Management and Board Changes

Two key management additions were made in 2003. Thomas K. Hernquist joined the Company in April 2003 as Senior Vice President and Chief Marketing Officer. Tom brings to Hershey Foods a broad base of marketing and general management experience across a large number of snack categories. His impact already can be seen in his commitment to building superior marketing capabilities within the Company and in major new product launches both in our core confectionery business and snack market adjacencies.

John P. Bilbrey joined the Company as Senior Vice President, President Hershey International in late 2003. JP has extensive international experience with major consumer products companies and brings a wealth of practical “marketplace knowledge” to this challenging area.

iii

John C. Jamison, a director since 1974, has decided to retire from Hershey Foods’ Board of Directors. John, one of the longest-serving Board members in the Company’s history, has served our stockholders exceptionally well over the past 30 years. No one understands the Hershey culture and its relationship both with Wall Street and the Hershey community better than does John. To say that he will be missed is woefully inadequate. His dedication to our Company and its stockholders has set an exceptionally high standard for us all. John has served as Chair of the Audit Committee and has been a member of the Executive Committee since January 2002.

We were fortunate to add three new directors in 2003. Robert F. Cavanaugh joined the Board on October 7, 2003, and serves on the Audit Committee and the Compensation and Executive Organization Committee. Harriet Edelman joined the Board on April 22, 2003, and serves on the Audit Committee and the Compensation and Executive Organization Committee. Marie J. Toulantis also joined on April 22, 2003, and serves on the Audit Committee and the Committee on Directors and Corporate Governance. All three of our new directors bring significant experience and capabilities to the Hershey Foods Board.

Corporate Governance

Your Company, at both the Board and management levels, made significant progress in the area of corporate governance during 2003. In addition to the three new directors highlighted in the previous section, we established and filled the position of Deputy General Counsel and Chief Governance Officer. Susan M. Angele joined Hershey Foods in September 2003, bringing extensive food company legal experience. Susan will ensure on-going excellence in all governance matters.

The Board has complied with and in many instances exceeded the applicable requirements of the Sarbanes-Oxley Act, the rules of the Securities and Exchange Commission and the listing standards of the New York Stock Exchange. Our Board committees focusing on audit, directors (including nomination)/corporate governance and executive compensation/organization are composed exclusively of independent directors. Both our independent auditors and our internal audit group report directly to the Audit Committee. We’ve revised the charters for all Board-level committees as well as established the Hershey Foods corporate governance principles. These and related governance materials can be viewed on Hershey Foods’ Internet website at www.hersheys.com.

To underscore that good corporate governance must extend beyond the Board level, we’re implementing a new process to promote compliance with our Code of Ethical Business Conduct. The Code has been updated, now is available on the Hershey Foods Intranet and Internet website and will be communicated to all employees worldwide. All active salaried employees will be required to sign a statement acknowledging that they have read the Code, will comply with it and will report any Code violation. This new process will be implemented in the first half of 2004. The Company has long encouraged frank communication to foster compliance and, with Board approval, has established new Procedures for Submission and Handling of Complaints Regarding Compliance Matters. This also is available on the Hershey Foods Intranet and Internet website.

The capital structure of the Company was enhanced through the $500-million share repurchase program, of which 66% was completed in 2003. Taking advantage of both our strong cash flow from operations and the more favorable tax treatment for dividends, the Board increased the dividend rate by 21% in August 2003. This marks the 29th consecutive year that the dividend has been increased.

The Board also implemented share ownership guidelines for directors and reaffirmed guidelines for key managers during the year, a move which further aligns the objectives of the Board and management with those of our stockholders.

iv

On Trend

The past three years have built a sound foundation on which to grow. As we look to the future, there are three areas that will keep Hershey Foods on trend.

First is the attractive category in which we compete. Confectionery is the largest segment within the $60-billion snack market, representing 38% of total retail sales. In addition to its size, the confectionery category is #1 in household penetration, #1 in impulse purchases, #1 in terms of responsiveness to in-store merchandising and #1 in terms of conversion from awareness to purchase at the checkout aisle. Together, these make the category a very profitable one for our Company and for our retail customers.

The second area that will keep us on trend is our competitively-advantaged business. We have category-defining iconic brands with thirteen $100-million brands and great recognition within the snack market. Importantly, we’ve restored investment and vitality to these great brands over the past few years. The combination of both brand and portfolio scale provides strong leadership within the U.S. confectionery market. Our 29% market share is well above the competition and our broad retail distribution across multiple customer channels provides significant marketplace leverage. Further optimization of our manufacturing and logistics networks will facilitate better speed-to-market and an improving cost structure. Key to our success will be the selling capabilities that we’re now putting in place. With the new sales structure less than a year old, we anticipate a significant step-up during 2004 in our ability to meet the ever-changing needs of our retail customers.

What will really keep Hershey Foods on trend is capturing transformational growth opportunities with consumers. We’ll do this first, by building Hershey’s leadership within our core confectionery business and second, by expanding our presence in the broader snack market. Within core confectionery, we’re reshaping our portfolio to ensure that we’re delivering the key consumer benefits of taste, convenience and better-for-you. Whether it be Hershey’s S’mores, Swoops or our new Kisses filled with Caramel, we’re adding value to our brand franchises and leveraging our asset base. In addition to new products, we’ll continue to shift our brand/product mix to more profitable packaging types such as instant consumables and to the more profitable trade channels such as Convenience Stores. We’re intent on building upon the success we’ve achieved over the past few years.

Moving beyond core confectionery growth, we’ll aggressively expand our presence within the broader snack market. While we have a 29% market share in the core confectionery market, we only have an 8% share in the broader snack market. There’s clearly room to grow.

Our initial efforts are in the better-for-you snack and nutrition-bar segment. This segment measures $3.3 billion and has demonstrated consistent double-digit growth over the past five years. We see numerous opportunities to leverage our existing capabilities, with several new products planned for introduction in 2004. We’ve announced our Hershey’s 1 gram Sugar Carb line and Hershey’s Smart Zone bar line. Both are on-trend with consumers and represent a profitable growth business for our retail customers and for Hershey Foods. Our new product strategy, in total, provides incremental growth while also allowing us to de-emphasize the slower-growth segments within our existing portfolio.

We know that we must increase our productivity initiatives if we are to continue winning in the marketplace. In 2004, we face a significant increase in raw material costs, primarily cocoa, that will add to this challenge. However, we have hundreds of projects underway to ensure that we generate the necessary funds to invest in our brands and achieve balanced performance. Our employees know what’s expected of them and will deliver.

v

In closing, we’ve made solid progress over the past three years, with 2003, in particular, coming in very strong. We’ve lowered our cost base, gained market share, and delivered superior financial performance. Hershey Foods clearly is on track. Now, our sights are firmly set on the future in terms of capturing the immense transformational growth opportunities I described above and delivering superior stockholder value over the long-term.

As I conclude my third year as CEO, I continue to be gratified and energized by the support across the Company for the path we’ve chosen. Certainly, there’s a growing appreciation of the challenges that will confront us in this ever-changing marketplace. However, there’s also an ever-greater resolve to ensure the long-term success of Hershey Foods. All in all, it makes for a winning combination.

Richard H. Lenny

Chairman of the Board, President

and Chief Executive Officer

_________________

Safe Harbor Statement

Please refer to the Safe Harbor Statement on page A-24 for information about factors which could cause future results to differ materially from forward-looking statements, expectations and assumptions expressed or implied in this letter to stockholders or elsewhere in this publication.

vi

Hershey Foods Corporation

Reconciliation of Items Affecting

Comparability

| For

the years ended December 31,

|

1996

|

2000

|

2001

|

2002

|

2003

|

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| In thousands

of dollars except per share amounts |

Per

Share- Diluted |

Per

Share- Diluted |

Per

Share- Diluted |

Per

Share- Diluted |

Per

Share- Diluted |

||||||||||||||||||||||||||||||||||||

|

Income

before cumulative effect of accounting change |

$ | 273,186 | $ | 1.75 | $ | 334,543 | $ | 2.42 | $ | 207,156 | $ | 1.50 | $ | 403,578 | $ | 2.93 | $ | 464,952 | $ | 3.52 | |||||||||||||||||||||

|

Items

affecting comparability after tax: |

|||||||||||||||||||||||||||||||||||||||||

|

Business

realignment and asset impairments included in cost of sales |

— | — | — | — | 31,765 | 0.23 | 4,068 | 0.03 | 1,287 | — | |||||||||||||||||||||||||||||||

|

Costs

to explore the sale of the Company included in selling, marketing and

administrative expense |

— | — | — | — | — | — | 10,907 | 0.08 | — | — | |||||||||||||||||||||||||||||||

|

Gain

on sale of airplane included in selling, marketing and administrative

expense |

— | — | (4,475 | ) | (0.03 | ) | — | — | — | — | — | — | |||||||||||||||||||||||||||||

|

Business

realignment and asset impairments, net |

— | — | — | — | 140,085 | 1.02 | 17,441 | 0.13 | 14,201 | 0.11 | |||||||||||||||||||||||||||||||

|

(Gain)

loss on sale of business |

35,352 | 0.23 | — | — | (1,103 | ) | (0.01 | ) | — | — | (5,706 | ) | (0.04 | ) | |||||||||||||||||||||||||||

|

Elimination

of amortization of goodwill and other intangible assets |

12,443 | 0.08 | 13,477 | 0.10 | 13,579 | 0.10 | — | — | — | — | |||||||||||||||||||||||||||||||

|

Income

excluding items affecting comparability |

$ | 320,981 | $ | 2.06 | $ | 343,545 | $ | 2.49 | $ | 391,482 | $ | 2.84 | $ | 435,994 | $ | 3.17 | $ | 474,734 | $ | 3.59 | |||||||||||||||||||||

|

|

1996-2000 CAGR |

5% |

Increase vs. prior yr. |

14% |

Increase vs. prior yr. |

12% |

Increase vs. prior yr. |

13% |

|||||||||||||||||||||||||||||||||

vii

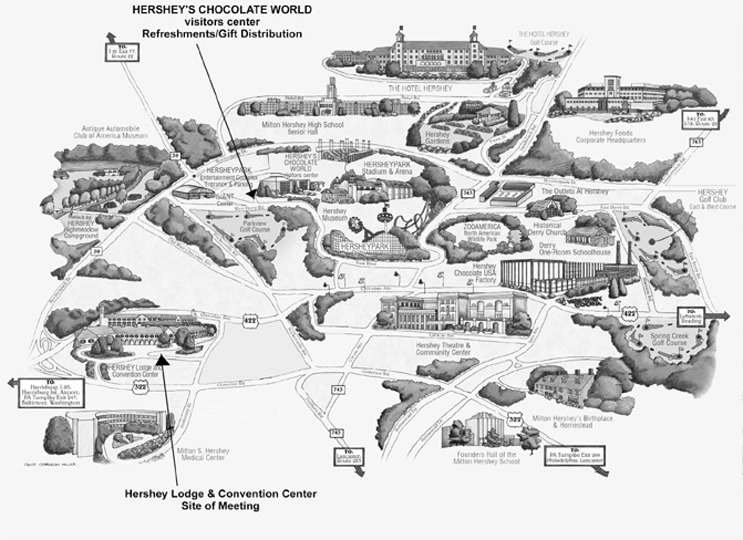

2004 Annual Meeting of Stockholders

| • | When: 2:00 p.m., April 28, 2004 (doors open at 12:30 p.m.) |

| • | Where: The Hershey Lodge & Convention Center, West Chocolate Avenue and University Drive, Hershey, Pennsylvania 17033 |

| • | Map on back cover |

| • | Registered stockholders should bring Admission Ticket from top half of proxy card for admission to the Annual Meeting |

| • | If voting by Internet, Admission Ticket will be forwarded to you |

| • | If your shares are held by a broker, bank or other nominee, obtain a letter from the broker, bank or nominee, or bring your most recent account statement showing ownership of Hershey stock as of March 1, 2004, to gain admission to the Annual Meeting |

| • | HERSHEY’S CHOCOLATE WORLD visitors center will provide refreshments, a product sample and 25% discount on selected items from 9:00 a.m. to 6:00 p.m. |

| • | To receive product sample and 25% discount, present Admission Ticket, letter from broker, bank or nominee, or account statement described above |

Annual Meeting Security

Security measures will be in place at the Annual Meeting for the safety of attendees. Metal detectors similar to those used in airports will be located at the entrance to the meeting room. Stockholders are strongly encouraged not to carry items such as handbags and packages to the meeting as all such items will be inspected. Photo identification will be required to gain admittance. Sharp objects (such as pocketknives and scissors), cell phones, pagers, cameras and recording devices will not be permitted inside the meeting room.

viii

TABLE OF CONTENTS

| Page

|

|||

|---|---|---|---|

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS |

1 | ||

PROXY

STATEMENT |

2 | ||

Corporate

Governance Principles |

2 | ||

Director

Independence, Code of Ethical Business Conduct and Communications with Directors |

8 | ||

Proposal

No. 1 — Election of Directors |

8 | ||

Board

Committees |

12 | ||

Directors’ Attendance |

14 | ||

Directors’ Compensation |

15 | ||

Audit

Committee Report |

16 | ||

Independent

Auditor Fees |

17 | ||

Proposal

No. 2 — Appointment of Auditors |

17 | ||

Voting

Securities |

18 | ||

Description

of the Milton Hershey School Trust and Hershey Trust Company |

20 | ||

2003

Executive Compensation |

21 | ||

Voting

of Proxies |

32 | ||

Solicitation

of Proxies |

33 | ||

Section

16(a) Beneficial Ownership Reporting Compliance |

33 | ||

Certain

Transactions and Relationships |

33 | ||

Other

Business |

34 | ||

Stockholder

Proposals and Nominations |

34 | ||

Annual

Report on Form 10-K |

35 | ||

Other

Documents Not a Part of This Proxy Statement |

35 | ||

APPENDIX

A |

|||

ANNUAL

REPORT TO STOCKHOLDERS |

A-1 | ||

Management’s Discussion and Analysis |

A-1 | ||

Consolidated

Financial Statements |

A-25 | ||

Notes

to Consolidated Financial Statements |

A-29 | ||

Responsibility for Financial Statements |

A-59 | ||

Independent

Auditors’ Report |

A-60 | ||

Report

of Predecessor Auditor (Arthur Andersen LLP) |

A-61 | ||

Six-Year

Consolidated Financial Summary |

A-62 | ||

APPENDIX

B |

|||

OTHER

STOCKHOLDER INFORMATION |

B-1 | ||

Directors

and Hershey Executive Team |

B-4 | ||

APPENDIX

C |

|||

POLICIES

AND PROCEDURES |

|||

Code

of Ethical Business Conduct |

C-1 | ||

Procedures

for Submission and Handling of Complaints Regarding Compliance Matters |

C-11 | ||

APPENDIX

D |

|||

BOARD

COMMITTEE CHARTERS |

|||

Audit

Committee of the Board of Directors |

D-1 | ||

Committee

on Directors and Corporate Governance of the Board of Directors |

D-6 | ||

Compensation

and Executive Organization Committee of the Board of Directors |

D-8 | ||

Notice of Annual Meeting

and

Proxy Statement

Hershey Foods Corporation

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

on

April 28,

2004

The Annual Meeting of Stockholders of HERSHEY FOODS CORPORATION will be

held at 2:00 p.m. on April 28, 2004 at The Hershey Lodge & Convention Center, West Chocolate Avenue and University Drive, Hershey, Pennsylvania

17033 for the following purposes:

(1) |

To elect nine directors; |

(2) |

To approve the appointment of KPMG LLP as the Company’s independent auditors for 2004; and |

(3) |

To transact such other business as may be brought properly before the meeting and any and all adjournments thereof. |

In accordance with the By-Laws and action of the Board of Directors, stockholders of record at the close of business on March 1, 2004 will be entitled to notice of, and to vote at, the meeting and any and all adjournments thereof.

March 12, 2004

Please follow the instructions on the enclosed proxy card for voting by Internet or by telephone whether or not you plan to attend the meeting in person; or if you prefer, kindly mark, sign and date the enclosed proxy card and return it promptly in the enclosed, postage-paid envelope.

P R O X Y S T A T E M E N T

This Proxy Statement is furnished in connection with the

solicitation of proxies by the Board of Directors (“Board”) of HERSHEY FOODS CORPORATION, a Delaware corporation (the “Company” or

“Hershey Foods”), for use at the Annual Meeting of Stockholders (“Annual Meeting”) which will be held at 2:00 p.m., Wednesday,

April 28, 2004 at The Hershey Lodge & Convention Center, West Chocolate Avenue and University Drive, Hershey, Pennsylvania 17033, and at any and

all adjournments of that meeting. This Proxy Statement and the enclosed proxy card are being sent to stockholders on or about March 12, 2004. The

Company’s principal executive offices are located at 100 Crystal A Drive, Hershey, Pennsylvania 17033-0810.

Shares represented by properly voted proxies received by the Company at or prior to the Annual Meeting will be voted according to the instructions indicated by such proxies. Unless contrary instructions are given, the persons named on the proxy card intend to vote the shares so represented FOR the election of the nominees for director named in this Proxy Statement and FOR the approval of the appointment of KPMG LLP as the Company’s independent auditors for 2004. As to any other business which may properly come before the Annual Meeting, the persons named on the proxy card will vote according to their best judgment.

CORPORATE GOVERNANCE PRINCIPLES

Role of the Board of Directors

The business of the Company is carried out by its employees under the direction and supervision of its Chief Executive Officer (“CEO”). The business shall be managed under the direction of the Board. In accordance with Delaware law, the role of the directors is to exercise their business judgment in the best interests of the Company. This role includes:

| • | review of the Company’s performance, strategies and major decisions; |

| • | oversight of the Company’s compliance with legal and regulatory requirements and the integrity of its financial statements; |

| • | oversight of management, including review of the CEO’s performance and succession planning for key management roles; and |

| • | oversight of compensation for the CEO, key executives and the Board, as well as oversight of compensation policies and programs for all employees. |

Selection and Composition of the Board

Board Size — As set forth in the By-Laws of the Company (“By-Laws”), the Board has the power to fix the number of directors by resolution. The Company’s Restated Certificate of Incorporation requires at least three directors. In fixing the number, the Board will be guided by the principle that a properly functioning Board is small enough to promote substantive discussions in which each member can actively participate, and large enough to offer diversity of background and expertise. The Board will consider whether it is of the appropriate size as part of its annual performance evaluation.

Board Membership Criteria — In selecting directors, the Board generally seeks individuals with skills and backgrounds that will complement those of other directors and maximize the diversity and effectiveness of the Board as a whole. Directors should be of the highest integrity and well-respected in their fields, with superb judgment and the ability to learn the Company’s business and express informed, useful and constructive views. In reviewing the qualifications of prospective directors, the Board will consider such factors as it deems appropriate in light of these principles, which may

2

include judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of the other Board members, and the extent to which any candidate would be a desirable addition to the Board and any committees of the Board. In general, the Board seeks individuals who are knowledgeable in fields including finance, international business, marketing, information technology and consumer products. All members of the Audit Committee must be financially literate and at least one member must have accounting or related financial management expertise and be an audit committee financial expert as defined in Item 401(h) of Regulation S-K of the Securities and Exchange Commission (“SEC”), or any successor provision.

Independence — The Company is not required to have a majority of independent directors, because it is a “controlled company” within the meaning of the New York Stock Exchange (“NYSE”) listing standards. However, the Company recently has operated with a Board composed of directors who are independent, with the exception of the Chairman and CEO. As this practice has served the Company well, a requirement that a majority of the Board consist of independent directors is included in these principles. In addition, the Company’s Audit Committee, Compensation and Executive Organization Committee, and Committee on Directors and Corporate Governance shall consist solely of independent directors. At least annually, the directors shall determine which directors are independent. Rather than have one set of criteria for Board members as a whole and additional criteria for Audit Committee members, the Board will judge the independence of all directors based on the stringent standards applicable to Audit Committee members. Accordingly, the independence of directors shall be determined based on the following criteria:

| • | A director who receives (or, in the last three years, received), or whose immediate family member receives (or, in the last three years, received), direct compensation as an employee or any consulting, advisory or other compensatory fees from the Company, other than director or committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service), is not independent, provided, however, that in making such determination, compensation received by an adult child or stepchild of a director who does not share a home with such director, for service as an employee of the Company, shall not be considered, except in the case of service as an elected or appointed officer of the Company, which service shall be considered. |

| • | A director who is (or, within the last three years, was) affiliated with or employed by, or whose immediate family member is (or, within the last three years, was) affiliated with or employed in a professional capacity by, the present auditor of the Company or a firm which served (within the last three years) as the auditor of the Company is not independent. |

| • | A director who is (or, within the last three years, was) employed, or whose immediate family member is (or, within the last three years, was) employed, as an executive officer of another company where any of the Company’s present executives serves (or, within the last three years, served) on that company’s compensation committee is not independent. |

| • | A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of a company that makes (or, within the last three years, made) payments to or receives (or, within the last three years, received) payments from the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues, is not independent. |

| • | A director who is (or, within the last three years, was) an employee or a non-employee executive officer of the Company is not independent. |

| • | A director who is an immediate family member of an individual who is (or, within the last three years, was) an executive officer of the Company, whether as an employee or non-employee, is not independent. |

| • | A director who is an affiliated person of the Company, as defined under the rules of the SEC, is not independent; provided, however, if the director is an affiliated person solely because he or she |

3

| sits on the board of directors of an affiliate of the Company, as defined under the rules of the SEC, then the director is independent if he or she, except for being a director on each such board of directors, does not accept directly or indirectly any consulting, advisory, or other compensatory fee from either such entity, other than the receipt of only ordinary-course compensation for serving as a member of the board of directors, or any board committee of each such entity, and the director satisfies all other standards. |

| • | A director who is, or whose immediate family member is, a director, trustee, officer or employee of a non-profit organization to which the Company has donated more than $100,000 in any year within the last three years is not independent. |

| • | A director’s participation in the Company’s Charitable Awards Program does not render him or her non-independent. |

A director who is not deemed non-independent under the foregoing shall be presumed to have no material relationship with the Company, however the Board shall make its determination based on all facts and circumstances. For purposes of application of these criteria, (i) “immediate family” shall be defined as including all individuals who are considered immediate family of a director under the regulations implementing the Sarbanes-Oxley Act, as well as all individuals who are considered immediate family of a director under the NYSE listing standards, (ii) compensation received by a director for former service as an interim Chairman or CEO shall not be considered in determining independence, and (iii) references to “company” for purposes of determining independence, include any parent or subsidiary in a consolidated group with the company. Directors shall notify the Chair of the Committee on Directors and Corporate Governance and the Chairman and CEO prior to accepting a board position on any other organization, so that the effect, if any, of such position on the director’s independence may be evaluated.

Selection of Board Members — Nomination of directors is the responsibility of the Committee on Directors and Corporate Governance, all of whose members shall be independent directors. Recommendations may come from directors, stockholders or other sources. Recommendations may come from management, with the understanding that the Board is not required to consider candidates recommended by management. An offer to join the Board will be extended by the Chair of the Committee on Directors and Corporate Governance or the Chairman of the Board if the Chairman is not also an officer or employee of the Company.

Tenure

| • | The Board has not established term limits, and, given the value added by experienced directors who can provide a historical perspective, term limits are not considered appropriate. New ideas and diversity of views are maintained by careful selection of directors when vacancies occur. In addition, the performance of individual directors and the Board as a whole are reviewed annually, prior to the nomination of directors for vote by stockholders at each Annual Meeting. |

| • | When a director’s principal occupation or business or institutional affiliation changes materially from that at the time of his or her first election to the Board, the director will tender his or her resignation by directing a letter of resignation to the Chair of the Committee on Directors and Corporate Governance, except that if the director is the Chair of such committee, he or she shall direct the resignation to the Chairman of the Board. The Board will determine whether to accept such resignation. |

| • | Directors will not be nominated for reelection after their 70th birthday. |

Operation of the Board

Chairman — The CEO serves as Chairman of the Board. This serves the Company well, and the independent directors have many opportunities to have a significant influence on the structure and functioning of the Board. However, the Board might determine that during periods of transition following the election of a new CEO or during other unusual circumstances, the CEO should not also serve as Chairman of the Board.

4

Board Meetings

| • | The Board will hold approximately six regular meetings per year, scheduled by resolution of the Board sufficiently far in advance to accommodate the schedules of the directors. Special meetings may be called at any time by the Chairman or a Vice Chairman of the Board (if any), or by the CEO, or by one-sixth (calculated to the nearest whole number) of the total number of directors constituting the Board, to address specific issues. |

| • | Agendas are established by the Chairman and sent in advance to the Board. Any director may submit agenda items for any meeting. A rolling agenda has been established, which includes a full annual review of the Company’s strategic plan, quarterly reviews of the Company’s financial performance, and committee reports and updates at each meeting on the business and other items of significance to the Company. Information relevant to agenda items shall be submitted to the Board in advance, and the agenda will be structured to allow appropriate time for discussion of important items. |

Executive Sessions — Executive sessions are sessions of non-management directors. The directors may choose to invite any member of management, including the Chairman and CEO. Typically, closed sessions are held at the beginning of each regular Board meeting, and at such other times as the Board may determine, with all directors, including the Chairman and CEO, in attendance without any third parties or Company officers or employees (other than the Chairman and CEO). Executive sessions are held at the conclusion of each regular Board meeting, and at such other times as the non-management directors may determine, without the Chairman and CEO or any other member of Company management present, to review such matters as may be appropriate, including the report of the outside auditors, the criteria upon which the performance of the CEO and other senior managers is based, the performance of the CEO measured against such criteria and the compensation of the CEO. If at any time the Board includes any non-management directors who are not independent, such directors shall be excluded from one executive session each year. Executive sessions are chaired by an independent director assigned on a rotating basis. This has served the Company well historically and has allowed each independent director an opportunity to serve as lead director. In addition, any director may call a special executive session to discuss a matter of significance to the Company and/or the Board.

Committees — All major decisions are made by the Board; however, the Board has established committees to enable it to handle certain matters in more depth. The committees are (1) Audit, (2) Directors and Corporate Governance, (3) Compensation and Executive Organization, and (4) Executive. Although not mandatory, independent directors, other than Committee chairs, are generally expected to serve on two committees. Members of the committees are recommended by the Committee on Directors and Corporate Governance and approved by the Board. Committee members serve at the pleasure of the Board, for such period of time as the Board may determine, consistent with these governance principles. All directors serving on the Audit, Directors and Corporate Governance, and Compensation and Executive Organization committees must be independent, as determined by the Board in accordance with these governance principles and as required by applicable law and regulation. The Executive Committee is made up of the chair of each of the other committees along with the Chairman of the Board. Any transaction not in the ordinary course of business by and among the Company and Hershey Trust Company, Hershey Entertainment & Resorts Company and/or the Milton Hershey School, or any subsidiary, division or affiliate of any of the foregoing, shall be reviewed and approved in advance by a subcommittee composed of the independent members of the Executive Committee. The charter of each committee is published on the Company’s website and will be made available to any stockholder on request. Each committee chair shall report the highlights of the committee meeting to the full Board at the Board meeting following the committee meeting. The Chairman of the Board serves as chair of the Executive Committee. The chairs of the Audit Committee, the Committee on Directors and Corporate Governance and the Compensation and Executive Organization Committee (the “Independent Committees”) are recommended by the Committee on Directors and Corporate Governance and approved by the Board. Under normal circumstances, following four consecutive years as the Chair

5

of an Independent Committee, a director shall not serve again on such committee for at least one year after standing down as the Chair thereof. A Chair of an Independent Committee may be permitted to continue to serve on such committee with Board approval if the Board determines that the former Chair uniquely fills a specific need of such Committee. The structure and functioning of the committees shall be part of the annual Board evaluation.

Director Participation in Board and Committee Meetings — Each director is expected to participate actively in his or her respective committee meetings and in Board meetings. Directors are expected to attend all meetings and are expected to come prepared for a thorough discussion of agenda items. Directors are expected to attend the Company’s Annual Meeting of Stockholders. Participation by directors will be reviewed as part of the annual assessment of the Board and its committees.

Access to Company Personnel

Directors have full and free access to the Company’s officers and employees. Division and function heads regularly make presentations to the Board and committees on subjects within their areas of responsibility. The CEO will invite other members of management to attend meetings or other Board functions as appropriate. Directors may initiate communication with any employee and/or invite any employee to any Board or committee meeting; however, they are expected to exercise judgment to protect the confidentiality of sensitive matters and to avoid disruption to the business, and they are expected to copy the CEO on written communications to company personnel under normal circumstances.

Access to Outside Advisors

The Board and each committee have the power to hire independent legal, financial or other advisors as they may deem necessary, without consulting or obtaining approval of Company management in advance.

Training

Orientation — Each new Board member shall undergo an orientation designed to educate the director about the Company and his/her obligations as a director. At a minimum, the orientation shall include meetings with several members of the Hershey Executive Team and the Chief Governance Officer, a tour of key facilities and review of reference materials regarding the Company and corporate governance, the Company’s strategic plan and the last annual report.

Ongoing Education — The Company will pay reasonable expenses for each director to attend at least one relevant continuing education program each year. Directors are encouraged but not required to attend. In addition, the Company will keep directors informed of significant developments as appropriate. Each Board meeting shall include a report to directors on (1) significant business developments affecting the Company, (2) significant legal developments affecting the Company, and (3) significant legal developments affecting the Board members’ obligations as directors.

Oversight of Management

Review of CEO Performance and Compensation — The independent directors, together with the Compensation and Executive Organization Committee, monitor the performance of the CEO. Annually they shall review the performance appraisal of the CEO performed by the Compensation and Executive Organization Committee and shall review and approve the CEO’s compensation recommended by such committee.

Review of Strategic Plan — The Board shall review the Company’s strategic plan annually. All Board members are expected to participate in an active review. The CEO will invite to the review members of management with responsibility for key divisions and functions and any other personnel the CEO deems helpful, for purposes of providing information sufficient to facilitate a full and frank discussion.

6

Management Succession

| • | The Board shall review management succession plans annually. This shall include review by the Board of organization strength and management development and succession plans for each member of the Company’s executive team. The Board shall also maintain and review annually, or more often if appropriate, a succession plan for the CEO. |

| • | If the President, CEO and/or Chairman of the Board is unable to perform for any reason, including death, incapacity, termination, or resignation before a replacement is elected, then: (1) if the Company is without a Chairman of the Board, the Chair of the Committee on Directors and Corporate Governance shall serve as Chairman until a replacement is elected or, in the case of temporary incapacity, until the Board determines that the incapacity has ended; (2) if the Company is without a President and CEO, the interim President and CEO shall be the officer of the Company approved by the Board, taking into consideration the annual recommendation of the CEO; (3) in the case of incapacity of the President, CEO and/or Chairman, the Board shall determine whether to search for a replacement; and (4) the Chair of the Compensation and Executive Organization Committee shall lead any search for a replacement. |

Evaluation and Compensation of the Board

Annual Evaluations — The directors shall evaluate the performance of the Board and its committees annually. Each director shall complete an evaluation form for the Board as a whole and each of the committees on which he or she has served during the year. Evaluation results shall be reviewed by the Committee on Directors and Corporate Governance, which shall present to the Board the results along with any recommendations for change that the Committee deems appropriate. These governance principles and the committee charters shall be reviewed annually in conjunction with the annual evaluation. The Committee on Directors and Corporate Governance shall also review the performance of Board members when they are considered for reelection and at any time upon request of a Board member.

Director Compensation and Benefits

| • | General — The Compensation and Executive Organization Committee shall review and make recommendations to the Board annually with respect to the form and amount of compensation and benefits. These will be established after due consideration of the responsibilities assumed and the compensation of directors at similarly situated companies. |

| • | Stock Ownership |

— |

The Board will not nominate any person to be elected a director at an Annual Meeting of Stockholders unless such person owns, as defined below, or agrees to purchase and own at least 200 shares of the Company’s Common Stock on or before the record date for the proxy statement for such meeting. |

— |

The Board desires that each director own, as defined herein, shares of the Company’s Common Stock in an amount at least equal to the Stockholding Guidelines as of January 1 of each year following the fifth anniversary of the date the Board approves this policy in the case of current directors and as of January 1 of each year following the fifth anniversary of becoming a director in the case of a director first becoming a director subsequent to the date of such Board approval. For purposes of the requirements herein and in the preceding paragraph, ownership of the Company’s Common Stock includes Common Stock equivalent shares such as common stock units deferred under the Company’s Directors’ Compensation Plan and restricted stock units granted quarterly under that plan. |

— |

Stockholding Guidelines as of January 1 of any year means the number of shares of the Company’s Common Stock, as described in the preceding paragraph, with a value, valued at the average closing price on the NYSE of the Common Stock on the first three trading days of the month of December of the preceding year, equal to three times the sum of (a) the annual |

7

| retainer under the Company’s Directors’ Compensation Plan for such year and (b) the target value of the restricted stock unit grant under that plan. |

Code of Conduct

Directors are held to the highest standards of integrity. The Company’s Code of Ethical Business Conduct applies to directors as well as officers and employees and covers areas including conflicts of interest, insider trading and compliance with laws and regulations. The Audit Committee has responsibility for oversight of the Company’s communication of, and compliance with, the Code of Ethical Business Conduct.

DIRECTOR INDEPENDENCE, CODE OF ETHICAL BUSINESS CONDUCT AND

COMMUNICATIONS

WITH DIRECTORS

Director Independence

The Board has reviewed the qualifications, relationships, employment history, board affiliations and other criteria of each of the directors recommended by the Board for election at the Annual Meeting to determine his or her independence under the Company’s Corporate Governance Principles and under applicable rules of the Securities and Exchange Commission and listing standards of the New York Stock Exchange. Based upon its evaluation, the Board has unanimously determined that, except for R. H. Lenny, Chairman of the Board, President and Chief Executive Officer of the Company, no director recommended by the Board for election at the Annual Meeting has a material relationship with the Company and all such directors are independent in accordance with the Company’s Corporate Governance Principles and applicable rules of the Securities and Exchange Commission and listing standards of the New York Stock Exchange.

Code of Ethical Business Conduct

The Board has adopted a Code of Ethical Business Conduct applicable to the Company’s directors, officers and employees, a copy of which is furnished in Appendix C to the materials provided to stockholders with this Proxy Statement and may also be viewed on the Company’s website at www.hersheys.com in the Investor Relations section.

Communications with the Audit Committee and Other Non-Management Directors

The Audit Committee of the Board of Directors (“Audit Committee”) has established procedures for confidential, anonymous submission of complaints by employees and for receipt, retention and treatment of complaints, from whatever source, received by the Company, regarding accounting, internal accounting controls or auditing matters. These procedures are outlined in a document entitled Procedures for Submission and Handling of Complaints Regarding Compliance Matters, a copy of which is furnished in Appendix C to the materials provided to stockholders with this Proxy Statement and may also be viewed on the Company’s website at www.hersheys.com in the Investor Relations section. Interested persons (including stockholders and employees of the Company) may also communicate directly with the non-management directors of the Board as a group by following the procedures posted in the Investor Relations section of the Company’s website.

Proposal No. 1 — ELECTION OF DIRECTORS

Nine directors are to be elected at the Annual Meeting, each to serve until the next Annual Meeting and until his or her successor shall have been elected and qualified. Each of the nominees named in the following pages is currently a member of the Board. John C. Jamison, currently a director of the Company, will retire from the Board as of the Annual Meeting on April 28, 2004. The Milton Hershey School Trust, a stockholder of the Company whose holdings are more fully described in this Proxy Statement beginning on page 20 in the section entitled “Description of the Milton Hershey School Trust and Hershey Trust Company,” recommended to R. H. Lenny by letter dated June 2, 2003

8

that Robert F. Cavanaugh, an independent member of the Board of Directors of Hershey Trust Company and the Board of Managers of Milton Hershey School, be nominated as a new director of the Company. Mr. Lenny referred the recommendation to the Committee on Directors and Corporate Governance which, in turn, reviewed and approved Mr. Cavanaugh’s qualifications for Board membership. Mr. Cavanaugh was elected a new director by the Board on October 7, 2003 upon the recommendation of the Committee on Directors and Corporate Governance. He will stand for election by the stockholders for the first time at the Annual Meeting.

Pursuant to the Company’s Restated Certificate of Incorporation, as amended (“Certificate”), and By-Laws, one-sixth of the directors, which equates presently to two directors, are to be elected by the holders of the Company’s Common Stock, one dollar par value (“Common Stock”), voting separately as a class. The nominees receiving the greatest number of votes of the holders of the Common Stock voting separately as a class will be elected.

Mmes. Harriet Edelman and Marie J. Toulantis have been nominated by the Board for the positions to be elected by the holders of the Common Stock voting separately as a class. The remaining seven individuals listed have been nominated by the Board for the seven positions to be elected by the holders of the Common Stock and the Company’s Class B Common Stock, one dollar par value (“Class B Stock”), voting together without regard to class. Holders of Common Stock will be entitled to cast one vote for each share held, and holders of Class B Stock will be entitled to cast ten votes for each share held. The seven nominees receiving the greatest number of votes of the holders of the Common Stock and Class B Stock voting together will be elected. In case any of the nominees should become unavailable for election for any reason not presently known or contemplated, the persons named on the proxy card will have discretionary authority to vote pursuant to the proxy for a substitute.

|

JON A. BOSCIA, age 51, is Chairman and Chief Executive Officer

of Lincoln National Corporation, Philadelphia, Pennsylvania, a leading

financial services company. He was elected Chairman of the Board of Lincoln

National Corporation in March 2001 and has been Chief Executive Officer

since July 1998. From January 1998 to March 2001, he held the office of

President. A Hershey Foods director since 2001, he chairs the Committee

on Directors and Corporate Governance and is a member of the Executive

Committee. |

|||

|

ROBERT H. CAMPBELL, age 66, retired in 2000 as Chairman of the

Board and Chief Executive Officer of Sunoco, Inc., Philadelphia, Pennsylvania,

a petroleum refiner and marketer. He had been Chief Executive Officer

since 1991, Chairman of the Board since 1992 and a director of Sunoco,

Inc. since 1988. He is a director of CIGNA Corporation and Vical Incorporated.

A Hershey Foods director since 1995, he is a member of the Committee on

Directors and Corporate Governance and the Compensation and Executive

Organization Committee. |

|||

9

|

ROBERT F. CAVANAUGH, age 45, is Managing Director of DLJ Real

Estate Capital Partners, Los Angeles, California, a subsidiary of Credit

Suisse First Boston and a leading global investment banking firm. He has

held that position since October 1999. From 1995 to 1999, he was Managing

Director — Real Estate Investment Banking for Bankers Trust Company.

A Hershey Foods director since 2003, he is a member of the Audit Committee

and the Compensation and Executive Organization Committee. |

|||

|

GARY P. COUGHLAN, age 60, retired in 2001 as Senior Vice President, Finance and Chief Financial Officer of Abbott Laboratories, Inc., Abbott Park, Illinois, a diversified international healthcare company. He had held that position since May 1990. He is a director of Arthur J. Gallagher & Co. A Hershey Foods director since 2001, he is a member of the Audit Committee and the Committee on Directors and Corporate Governance. |

|||

|

HARRIET EDELMAN, age 48, is Senior Vice President and Chief Information Officer of Avon Products, Inc., New York, New York, the world’s leading seller of beauty and related products. She was elected to that position in January 2000. She was formerly Senior Vice President, Global Operations from June 1998 to January 2000. She is a director of Blair Corporation. A Hershey Foods director since 2003, she is a member of the Audit Committee and the Compensation and Executive Organization Committee. She has been nominated for election by the holders of the Common Stock voting separately as a class. |

|||

|

BONNIE G. HILL, age 62, is President of B. Hill Enterprises, LLC, Los Angeles, California, a consulting company, and Chief Operating Officer of Icon Blue, Inc., Los Angeles, California, a brand marketing company. Previously she was President and Chief Executive Officer of The Times Mirror Foundation; and Senior Vice President, Communications and Public Affairs, Los Angeles Times, a subsidiary of Tribune Company. She is a director of AK Steel Holding Corporation, Albertson’s, Inc., California Water Service Group, The Home Depot, Inc., and YUM! Brands, Inc. Although also currently a director of ChoicePoint, Inc., she has elected not to stand for reelection as a director of that corporation at its annual meeting on April 29, 2004. A Hershey Foods director since 1993, she is a member of the Committee on Directors and Corporate Governance and the Compensation and Executive Organization Committee. |

|||

10

|

RICHARD H. LENNY, age 52, was elected Chairman of the Board, President

and Chief Executive Officer of Hershey Foods Corporation effective January

1, 2002. From March 2001 to December 2001, he was President and Chief

Executive Officer of the Company. From January 2001 until March 2001,

he was Group Vice President of Kraft Foods, Inc. and President of its

Nabisco Biscuit and Snack business. From February 1998 to December 2000,

he was President, Nabisco Biscuit Company. He is a director of Sunoco,

Inc. A Hershey Foods director since 2001, he chairs the Executive Committee. |

|||

|

MACKEY J. McDONALD, age 57, is Chairman of the Board, Chief Executive

Officer and President of VF Corporation, Greensboro, North Carolina, an

international apparel company. He was elected Chairman of the Board of

VF Corporation in 1998. He has been Chief Executive Officer since 1996

and President since 1993. He is a director of Wachovia Corporation and

Tyco International Ltd. A Hershey Foods director since 1996, he chairs

the Compensation and Executive Organization Committee and is a member

of the Executive Committee. |

|||

|

MARIE J. TOULANTIS, age 49, is Chief Executive Officer of Barnes

& Noble.com, New York, New York, an online retailer of books, music

and DVDs. She was elected to that position in February 2002. From May

2001 to February 2002, she held the office of President and Chief Operating

Officer and from May 1999 to May 2001 was Chief Financial Officer. From

March 1999 to May 1999, she was Chief Financial Officer of Barnes &

Noble, Inc., the world’s largest bookseller, and from July 1997 until

March 1999, was that company’s Executive Vice President, Finance.

A Hershey Foods director since 2003, she is a member of the Audit Committee

and the Committee on Directors and Corporate Governance. She has been

nominated for election by the holders of the Common Stock voting separately

as a class. |

|||

The Board of Directors recommends a vote FOR the director

nominees listed above, and proxies that are returned will be so voted unless otherwise instructed.

11

BOARD COMMITTEES

The Board has four separately designated standing committees: the Audit Committee (established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”)), the Committee on Directors and Corporate Governance, the Compensation and Executive Organization Committee, and the Executive Committee. In addition to the four standing committees, the Board from time to time establishes committees of limited duration for special purposes.

| Audit

Committee |

10 meetings in 2003 | |

| Members: |

John C. Jamison (Chair) Robert F. Cavanaugh Gary P. Coughlan Harriet Edelman Marie J. Toulantis |

|

| Independence: |

The

Board has determined that all directors on this Committee are independent

under applicable listing standards of the New York Stock Exchange, Rule

10A-3 under the Exchange Act and the Company’s Corporate Governance

Principles. |

|

| Responsibilities: |

Assists the Board in its oversight of the integrity of the Company’s

financial statements, the Company’s compliance with legal and regulatory

requirements, the qualifications and independence of the Company’s

independent auditors and the performance of the independent auditors and

the Company’s internal audit function; |

|

| |

Directly oversees and has direct responsibility for the appointment,

compensation, retention and oversight of the work of the independent auditors; |

|

| |

Approves all audit and non-audit engagement fees and terms with the independent

auditors; and |

|

| |

Establishes and maintains procedures for the receipt, retention and treatment

of complaints received by the Company, from any source, regarding accounting,

internal accounting controls or auditing matters and from employees for

the confidential anonymous submission of concerns regarding questionable

accounting or auditing matters. |

|

| Charter: |

A

current copy of the amended Charter of the Audit Committee accompanies

this Proxy Statement and is furnished in Appendix D to the materials provided

to stockholders with this Proxy Statement. The Charter may also be viewed

on the Company’s website at www.hersheys.com in the Investor Relations

section. |

12

| Committee

on Directors and Corporate Governance |

6 meetings in 2003 | |||

| Members: |

Jon

A. Boscia (Chair) Robert H. Campbell Gary P. Coughlan Bonnie G. Hill Marie J. Toulantis |

|||

| Independence: |

The

Board has determined that all directors on this Committee are independent

under the listing standards of the New York Stock Exchange and the Company’s

Corporate Governance Principles. |

|||

| Responsibilities: |

Reviews and makes recommendations on the composition of the Board and

its committees; |

|||

| |

Identifies, evaluates and recommends candidates for election to the Board

consistent with the Board’s membership qualifications; |

|||

| |

Reviews and makes recommendations to the full Board on corporate governance

matters and the Board’s corporate governance principles and policies;

and |

|||

| |

Oversees the evaluation of the Board and management. |

|||

| Charter: |

A

current copy of the Charter of the Committee on Directors and Corporate

Governance is furnished in Appendix D to the materials provided to stockholders

with this Proxy Statement and may also be viewed on the Company’s

website at www.hersheys.com in the Investor Relations section. |

|||

The Committee on Directors and Corporate Governance follows the process for identifying and evaluating candidates to be nominated as directors and the criteria for Board membership contained in the Company’s Corporate Governance Principles, set forth in this Proxy Statement beginning on page 2. Recommendations for director candidates may come from directors, stockholders or other sources. Occasionally, the Committee on Directors and Corporate Governance utilizes a paid third-party consultant to assist it in identifying and evaluating director candidates. Stockholders desiring to nominate a director candidate at any meeting of stockholders, including any annual meeting of stockholders, must comply with the procedures for nomination set forth in the section entitled “Stockholder Proposals and Nominations,” beginning on page 34.

__________

| Compensation

and Executive Organization Committee |

9 meetings in 2003 | |||

| Members: |

Mackey J. McDonald (Chair) Robert H. Campbell Robert F. Cavanaugh Harriet Edelman Bonnie G. Hill |

|||

| Independence: |

The

Board has determined that all directors on this Committee are independent

under the listing standards of the New York Stock Exchange and the Company’s

Corporate Governance Principles. |

|||

| Responsibilities: |

Establishes the compensation of the Company’s directors and elected

officers; |

|||

13

|

|

Grants performance stock units, stock options, restricted stock units

and other rights under the Long-Term Incentive Program of the Company’s

Key Employee Incentive Plan, as amended (“Incentive Plan”); |

|||

|

|

Establishes target-award levels and makes awards under the Annual Incentive

Program and the Long-Term Incentive Program of the Incentive Plan; |

|||

|

|

Administers the Incentive Plan, the Employee Benefits Protection Plans

and the Supplemental Executive Retirement Plan; |

|||

|

|

Monitors compensation arrangements for management employees for consistency

with corporate objectives and stockholders’ interests; |

|||

|

|

Reviews the executive organization of the Company; and |

|||

|

|

Monitors the development of personnel available to fill key management

positions as part of the succession planning process. |

|||

|

Charter: |

A

current copy of the Charter of the Compensation and Executive Organization

Committee is furnished in Appendix D to the materials provided to stockholders

with this Proxy Statement and may also be viewed on the Company’s

website at www.hersheys.com in the Investor Relations section. |

|||

__________

| Executive

Committee |

1 meeting in 2003 | |

| Members: |

Richard H. Lenny (Chair) Jon A. Boscia John C. Jamison Mackey J. McDonald |

|

| Responsibilities: |

Manages the business and affairs of the Company, to the extent permitted

by the Delaware General Corporation Law, when the Board is not in session.

A subcommittee consisting of the independent directors on this Committee

reviews and approves in advance any transaction not in the ordinary course

of business between the Company and Hershey Trust Company, Hershey Entertainment

& Resorts Company and/or the Milton Hershey School, or any subsidiary,

division or affiliate of any of the foregoing. |

|

| Charter: |

A

current copy of the Charter of the Executive Committee may be viewed on

the Company’s website at www.hersheys.com in the Investor Relations

section. |

DIRECTORS’ ATTENDANCE

There were six regular meetings and two special meetings of the Board of Directors during 2003. No director attended less than 75% of the sum of the total number of meetings of the Board held during the period for which he or she was a director and the total number of meetings held by all committees of the Board on which he or she served during the period that he or she served in 2003. Average attendance for all of these meetings equaled 94%.

14

Directors are also expected to attend the Company’s annual meetings of stockholders. All but one of the directors standing for election at the Company’s annual meeting held April 22, 2003 were in attendance at that meeting, including six directors standing for reelection and two director nominees.

DIRECTORS’ COMPENSATION

Annual Retainer |

$ | 55,000 | |

Annual Restricted Stock Unit Grant |

$ | 40,000 | * |

Annual

Retainer for Committee Chairs |

$ | 5,000 |

* $60,000 beginning January 1, 2004

The Directors’ Compensation Plan is designed to attract and retain qualified non-employee directors and to align the interests of non-employee directors with those of the stockholders by paying a portion of their compensation in units representing shares of Common Stock. Directors who are employees of the Company receive no remuneration for their services as directors.

In 2003, restricted stock units (“RSUs”) were granted quarterly on the first day of January, April, July and October on the basis of the number of shares of Common Stock, valued at the average closing price on the New York Stock Exchange of the Common Stock on the last three trading days preceding the grant, equal to $10,000. Following a review of competitive data, which disclosed the need to adjust director compensation upward to be in line with that paid at comparable companies, the Board elected in December 2003 to increase the quarterly RSU grant to a value equivalent to the number of shares of Common Stock equal to $15,000, beginning January 1, 2004. While the value of the annual RSU grant is targeted at $60,000, the actual value of the grant may be higher or lower depending upon the performance of the Common Stock following the grant dates. A director’s RSUs will vest and be distributed upon his or her retirement from the Board.

Directors may elect to receive all or a portion of their retainer in cash or Common Stock, although committee chair fees are paid only in cash. A director may defer receipt of the retainer and committee chair fees until his or her retirement from the Board.

All directors are reimbursed for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at Board and committee meetings and for minor incidental expenses incurred in connection with performance of directors’ services. In addition, directors are reimbursed for at least one director continuing education program each year, provided with travel accident insurance while traveling on the Company’s business, receive the same discounts as employees on the purchase of the Company’s products and are eligible to participate in the Company’s Gift Matching Program.

The Company maintains a Directors’ Charitable Award Program for individuals who became directors prior to December 31, 1996. This program is a self-funded life insurance program on eligible directors and funds charitable donations by the Company to educational institutions designated by those directors. The amount of the donation varies according to the director’s length of service as a director, up to a maximum donation of $1 million after five years of service. Four current directors (Ms. Hill and Messrs. Campbell, Jamison and McDonald) and fifteen retired directors participate in the program. The amount of the charitable donation per current participating director is $1 million.

15

AUDIT COMMITTEE REPORT

The role of the Audit Committee of the Board of Directors is to prepare this report and to assist the Board in its oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditors’ qualifications and independence, and (iv) the performance of the independent auditors and the Company’s internal audit function. The Board, in its business judgment, has determined that all members of the Audit Committee are “independent” as required by applicable listing standards of the New York Stock Exchange, Rule 10A-3 under the Exchange Act and the Company’s Corporate Governance Principles; that all members are financially literate; that at least one member of the Committee, Gary P. Coughlan, qualifies as an “audit committee financial expert” as defined in the applicable regulations of the Securities and Exchange Commission; and that Mr. Coughlan has accounting or related financial management expertise. The Audit Committee operates pursuant to a Charter that was last amended and restated by the Board on December 2, 2003. A copy of that Charter accompanies this Proxy Statement and is furnished in Appendix D to the materials provided to stockholders with this Proxy Statement. The Charter may also be viewed on the Company’s website at www.hersheys.com in the Investor Relations section. As set forth in the Charter, management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, and the effectiveness of internal control over financial reporting. Management and the internal auditing department are responsible for maintaining the Company’s accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

In the performance of its oversight function, the Audit Committee has considered and discussed the audited financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as currently in effect. Finally, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect, and has discussed with the independent auditors the auditors’ independence.

The members of the Audit Committee are not full-time employees of the Company and are not performing the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Audit Committee necessarily rely on the information provided to them by management and the independent auditors. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with auditing standards generally accepted in the United States, that the financial statements are presented in accordance with accounting principles generally accepted in the United States or that the Company’s auditors are in fact “independent.”