|

In 2000 EBITDA amounted

to US$169 million, a 15% drop in constant pesos, and an 8% decrease in

dollars. The unitís cost and expense reduction initiatives were countered

by large price increases for natural gas and packaging materials. Despite

these price increases, the unit delivered recurring cost savings in excess

of US$20 million for the year and is exploring further opportunities to

reduce cost.

Exports grew 8% to US$203 million versus 1999. Niche food and beverage,

as well as cosmetics sales, largely fueled export growth.

Review

In

2000 the Glass Containers unit successfully completed its planned reorganization

into four segments: food and beverage (including soft drinks, juice and

beer), wine and liquor, cosmetics and pharmaceutical, and exports. This

more focused structure will enable the unit to better understand and meet

customer needs; it will also allow the unit to better support the businesses

that offer long-term strategic value, diversify business risk and maximize

profitability.

As they have done around the world, substitute materials have taken market

share away from commodity glass containers. Accordingly, Glass Containers

has redirected its strategy to concentrate on value-added domestic and

international niche product markets. The unit will capitalize on: the

knowledge and technology it acquired and developed through years of serving

the Mexican market, which demands lower volume runs and higher flexibility,

and new decorating technologies that are already in place.

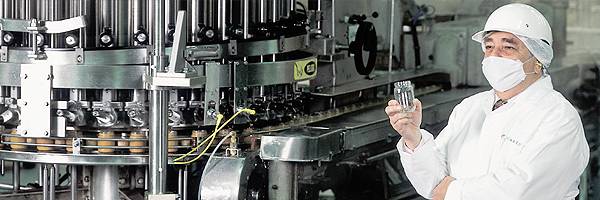

The

unit is focusing its efforts on better understanding, anticipating and

serving customersí changing needs by leveraging its ability to innovate

and develop new value-added niche products, enhancing

its information technology

and improving overall supply chain management. Glass Containers is able

to produce distinctive lightweight bottles, niche bottles and containers

with customized images, special colors, sophisticated decorations and

designs, as well as plastishield, and adhered ceramic and heat transfer

labels. The unit has dramatically reduced its product development cycle

from 12 to five weeks to ensure rapid and accurate new product development.

Central Americaís economic

slowdown negatively affected its regional joint ventureís results (Comegua).

Although cost reductions did not fully compensate for the loss, the unit

will take advantage of the ventureís improved productivity during this

marketís anticipated recovery.

|

|

|

Business

Outlook

Food & Beverage

For the year, food,

cosmetics and pharmaceutical product sales will compensate for expected

declines in beer and soft drink volumes. Looking forward, the unit plans

to leverage its growing export position, technological agility, and innovative

product mix to tap demand in United States, Central and South American,

and European markets.

Wine & Liquor

Wine is a growing market in

both North and South America. In 2000 U.S. exports represented US$39 million

of this businessí sales. By capitalizing on its distinct design and technological

capability, the unit expects to build on its presence in profitable niche

wine and liquor markets.

Cosmetics

& Pharmaceutical

Cosmetics

are a particularly promising business segment because customers use distinctive

glass designs to create a compelling brand that resonates with consumers.

The value-added content and labor required to manufacture this type of

containers puts this business in an excellent worldwide competitive position.

The unitís glass containers also comply with the stringent requirements

of the pharmaceutical market, and the unit will continue to service this

market with quality highly hygienic products as Mexicoís pharmaceutical

industry continues to grow.

Exports

Exports have

become a very important part of the unitís total sales. Exports are primarily

concentrated in the Americas. The unitís special capabilities enable it

to penetrate and carve out interesting niche market positions that, because

of their size, are not as attractive to commodity glass manufacturers.

|