Salomon Smith Barney 12th Annual Global Entertainment, Media, and Telecommunications Conference Remarks by

Scottsdale, Arizona

January 7,

2002

Thomas O. Might

President and Chief Executive Officer, Cable ONE

At Cable ONE we have continued our strategy of significant short-term capital and cash flow investment for extraordinary long-term potential. Our game plan has been unique; no other cable company has approached the business the same way. But our unique success in 2001 suggests that our independent thinking is going to pay off big.

There are five key factors that characterize last year’s cable results.

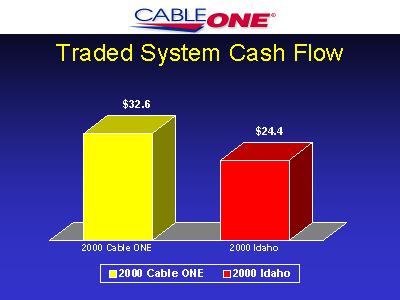

First, we traded 20 percent of Cable ONE’s subscribers with AT&T – giving up our highest performing subs, who were in California and Indiana, for significantly under-performing subs in Idaho. But, we gained almost 30 percent more subscribers than we gave up, 70 percent more homes passed, rebuilt plant, and some cash. But we gave up 25 percent in cash flow for 2001.

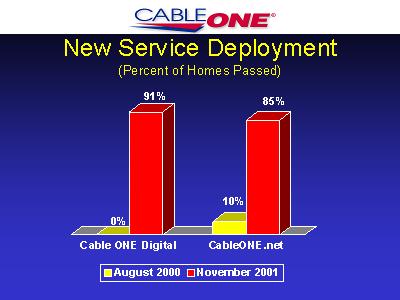

Second, we launched digital video and cable modem services to virtually all homes passed in 2001 – all in one short year. Waiting to launch for a few years has paid large dividends in lower costs and higher product quality. However, the full cost of ramp-ups hit in 2001.

Third, by giving digital access to our customers free for 12 months, we went from no digital penetration to the industry’s highest penetration just 12 months. This stunted cash flow growth last year, but should be highly rewarding thereafter.

Fourth, by waiting three years to launch cable modems, we got it right. We do it entirely on our own. We don’t share the revenues. And unlike all the high-speed bankruptcies, we’re generating $25 per month in cash flow per incremental sub, fully loaded.

Fifth, based on our daily research over five years, we are reaching new all-time highs in customer satisfaction.

Here are the details, and I will start with the last item first.

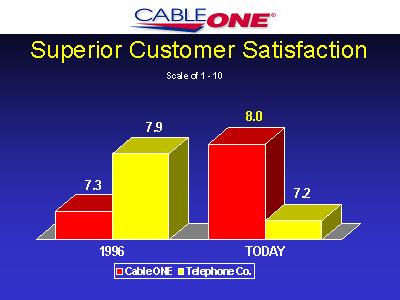

On a scale of 1 to 10 you can see our significant progress since becoming committed to customer satisfaction in 1996. It is particularly impressive when viewed next to our wire-based competitor, the local phone companies, who have destroyed their former legendary standards of service. The even better news is that our growing numbers of digital and high-speed data customers are even more satisfied at 8.4 and 8.3, respectively. Think about these high numbers. We operate in an industry that has repeatedly gotten the lowest marks of any consumer product by consumer research companies. We buck the trend.

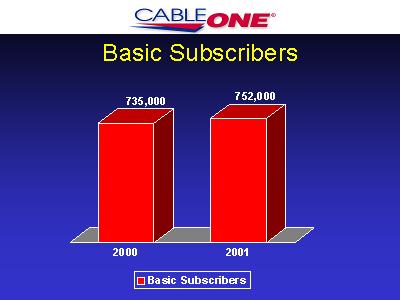

Cable ONE was up 17,000 basic customers last year. However, all of that was due to the gain in subs in the Idaho trade.

Speaking of Idaho, here you can see the short-term cash flow penalty we paid for the trade. 2000 was the last full year before the trade, and Idaho had 25 percent less cash flow even with 30 percent more subscribers. However, Idaho is on track for substantial cash flow growth in 2002. And with all the extra subs and 70 percent more homes passed, there is more cash flow growth potential yet to come.

Here is the first graphic detail of our rapid new service rollout in 2001. This is the universal rollout I mentioned earlier to almost the whole MSO in just ONE year.

We achieved these results despite asking our customers to self-install both products. This has kept Cable ONE’s costs remarkably low in this manic year. Thanks to self-installations, Cable ONE’s new service take-up rates have never been constrained by installation capacity for new products.

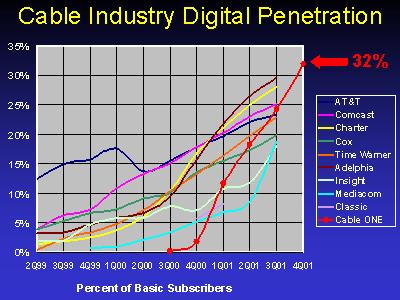

Here is the second graphic detail of our rapid launches. Cable ONE was the last MSO to launch digital, except for Cablevision, in September 2000, but may become the highest penetrated MSO in just 16 months. We attained over 32 percent penetration by the end of 2001 last week. As you can see, no other MSO had attained this level even after four years of deployment as of their third quarter results. Let your eyes draw the lines for other MSO’s fourth quarter gains. It suggests we clearly passed Charter, number 2, the yellow line. And we probably passed Adelphia, number one, the brown line. If so, Cable ONE is number one in digital penetration in one short year. Sometimes bold strategies pay off. In this case gambling on attaining huge digital penetration very quickly by giving digital away free for one worked. Now let the cash flow begin.

Early reports on the retention of free digital subs when they start paying are encouraging. The digital cash flow swing from 2001 to 2002 and 2003 should be highly satisfactory.

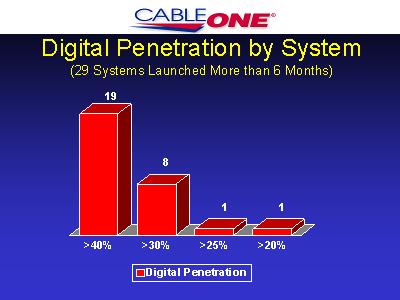

Cable ONE’s digital penetration story is actually even better than the last slide made it look. That 32 percent MSO penetration includes a few unlaunched systems, some recently launched systems, and our new Idaho systems (which were stuck at 16 percent penetration after three years of AT&T’s traditional digital packaging and marketing).

Here you can see what’s really happening by looking at all 29 Cable ONE systems that have been launched for at least six months:

- 19 are over 40 percent penetrated

- 8 are over 30 percent penetrated

Collectively, this group of 29 systems is 41 percent penetrated as of last week.

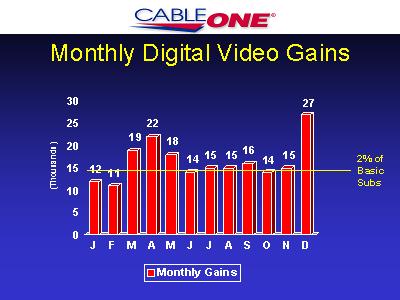

Here are the monthly net gains for last year. As you can see, we’re averaging about 2 percent of the MSO per month. Other MSOs have averaged 1 percent per quarter for the past two years. That’s 2 percent per month, versus 1 percent per quarter, or 6 times the industry rate. Thus we were able to pass the industry from a standstill in one year. You can see the nice Last Chance push in December with 27,000 new digital subs as the free offer expired.

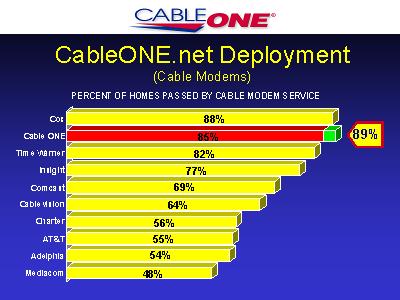

Now let’s swing to the launch of CableONE.net, which is our brand name for cable modems, and look at another industry lead. This is a chart of homes passed deployment, or availability, by large MSOs. Our high-speed CableONE.net is available to 85 percent of our customer base. And a dial-up version of the service is available to another 4 percent in systems still lacking a two-way plant. Depending on how you want to count it, that makes us number one or number 2 in Internet deployment. In either case, that is a great accomplishment for a smaller MSO in non-urban markets. I am sure that it surprises you considering all the talk about the digital divide.

How did we do this?

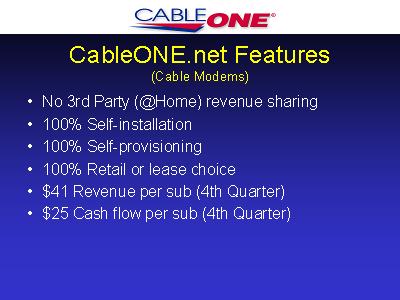

The first bullet makes the point that our service is not CableONE@Home. I believe Cable ONE is the only top 10 MSO without any affiliation with @Home, Roadrunner or HSA.

Rather than going for launch speed four years ago, which would have mandated partnering, Cable ONE took the time to teach itself the Internet business and stay independent. We buy our own backbone, provide our own call center, handle our own email, and keep all our own revenue. This is where the bigger MSOs are now trying to get.

From day one, our service has been 100 percent self-installed. We also had the first and only MSO-wide self-provisioning system. All customers do their own ordering and account setup online, after the self-installation.

We started out where the other MSOs want to be, with 100 percent retail distribution. However, after the wholesale price of cable modems dropped precipitously from $250 to less than $100, we began leasing modems for $5 and our monthly net gains have tripled. No problem. Since we’re 100 percent self-installed and self-provisioned, tripling the take-up rate caused no installation backlog.

We average a very consistent $41 of revenue per customer. And on a fully loaded incremental cost basis, we’re generating $25 per month in cash flow per cable modem subscriber. Since we have no installation costs and no revenue sharing obligations, the money quickly flows to the bottom line.

In contrast, I’m pleased to see that some telephone companies are complaining that they can’t make money on DSL services in rural areas priced at $50 today. I like our financial odds of winning most of the market share growth over the next ten years, since our monthly cost is only $16 per cable modem subscriber.

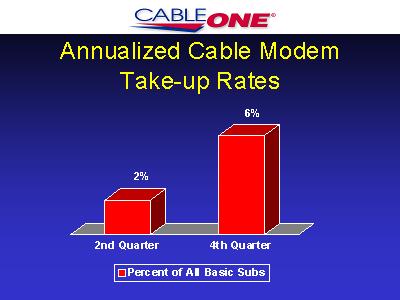

This shows what leasing modems for $5 did for our penetration growth rates. We started leasing in the middle of the third quarter. The annualized take-up rate has tripled from 2 percent to 6 percent. So, while retail is nice, leasing modems at $5 clearly drives the business.

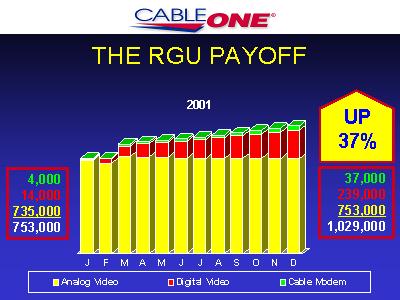

Here is a graphical summary of the RGU payoff from our unique strategies last year. The basic analog core is mature and relatively flat, with a bump up for the extra subs we gained in March from the Idaho trade.

But the rapid digital deployment has added substantial new life to the business in 2001 and substantial new cash flow in 2002.

And cable modems are just beginning to be heard from in quantity, but like the early days of cable, they should grow steadily for more than a decade. And the large incremental cash flow per unit really multiplies the small unit base into sizeable annual cash flow gains.

In summary, we have grown from about 750,000 units to over 1 million units in just one year, with more to come and cash flow to follow. That is a 37 percent RGU growth factor.

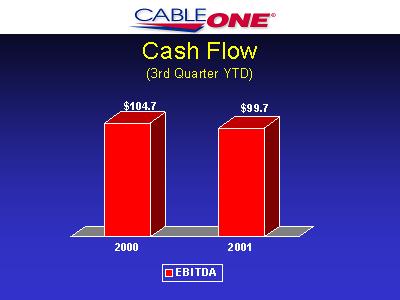

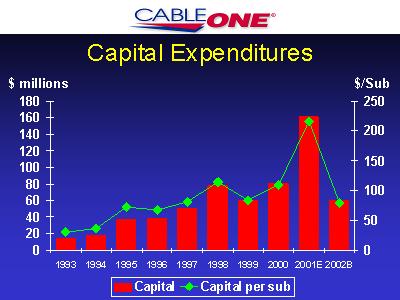

As I said a few minutes ago, 2001 was a year of short-term pain for long-term gain at Cable ONE. Here’s the short-term pain. Cash flow was down due to the Idaho trade, the costs of universal new service rollouts, and giving digital away free for 12 months last year.

We chose to sacrifice current gains to bet on even greater growth rates in the years ahead with Cable ONE’s unique strategies.

However, so that you don’t think the rewards for investing in our unique cable strategies lie only in the future, let me show you some past rewards.

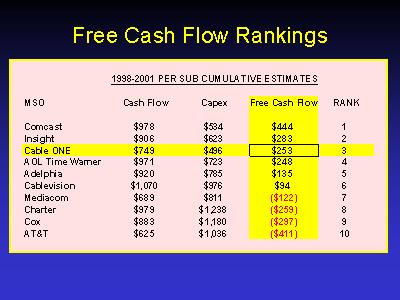

A year ago, Rich Bilotti of Morgan Stanley wrote an article for Broadcasting & Cable magazine that compared the largest MSOs by many financial measures.

With his numbers you could calculate the free cash flow per sub, after capital spending, for each MSO from 1998 to 2000. We added Cable ONE’s numbers to his list and were pleasantly surprised by the results. We’ve updated Rich’s work with numbers from other MSOs’ second-quarter guidance to get this four-year picture.

Cable ONE ranked third from last in EBITDA cash flow at $749 per sub (because, of course, we’re a small-town, small-city cable operator). However, we ranked third from highest in free cash flow at $253 per sub. That is because we have the best and lowest capital spending record in the industry at $496 per sub. Yet we are still 91 percent deployed in digital and 85 percent in cable modems.

We picked our smaller market strategy eight years ago because we thought that niche offered dependable, if not superior, free cash flow – it looks like we were right!

- We think our massive digital penetration and our efficient self-installations of digital and cable modems bode well for these measures and comparisons in the next few years as well.

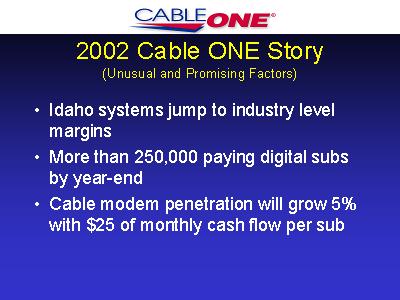

Here’s a preview of what Cable ONE hopes to achieve in 2002.

- The Idaho systems should attain industry level margins by the end of 2002.

- More than 250,000 digital subs will be paying an incremental $107 per year by the end of 2002.

- Cable modem penetration should grow 5 percent or more with an incremental $25 in monthly cash flow per subscriber.

- Capital spending will drop by two-thirds as rebuilds end and the purchase of expensive digital receivers slows, from around $160 million last year to around $55 million this year.

In short, 2002 should be a year of substantial free cash flow growth at Cable ONE – significantly higher than other MSOs.

# # #