Media Week

New York

December 12, 2002

Remarks by

Donald E. Graham

Chairman of the Board and Chief Executive Officer

Good morning, everyone. It's always a great pleasure to be in New York

during the holiday season.

For those of you with shopping still left to do, may I recommend the

new book, "Katharine Graham's Washington." I always knew my

mother was a powerful woman. But this is the first indication we've had

that she actually owned the city. My mother was working on this book at

the time of her death two summers ago. It was completed by the same exceptional

team that produced "Personal History": Bob Gottlieb at Knopf

and my mother's remarkable researcher Ev Small.

Let me now say a few sentences aimed only at those who are new to this meeting or new to thinking about investing in this company. The rest of you have heard these few words many times before.

Many excellent companies will present to you this week; The Washington Post Company is somewhat different in our aims and in certain corporate policies.

We don't care in the least what we will make next quarter (or any quarter) and will expend no effort at influencing quarterly results. We do not think short-term financial results are important. We pay no attention to analysts' expectations.

And if you try to estimate our quarterly results, you will only be frustrated. We give no guidance, nor any information not publicly available. Investors who focus on such things should not own our stock.

We aim at increasing the real value of The Washington Post Company, measured by free cash flow over the long term. Management is responsible for our few successes and our many failures in pursuing that aim, but we are aided by a Board which completely understands and is supportive of these aims and is full of notoriously tough graders: Warren Buffett, Barry Diller, Dan Burke, and Alice Rivlin, to name some of the better-known ones.

One policy in a small way underscores this aim: every time we make an

acquisition or capital expenditure of any size, the executive recommending

it knows that he or she will be back in front of the Board in three years

reporting on how the investment performed against the original expectations

described to the Board.

Our presentation this year will be somewhat different than what we've done before. As most of you know, we held our second Shareholders Day a month ago, on November 15. Like our first Shareholders Day two years ago, our purpose was to give people who own Washington Post Company stock an opportunity to look in depth at what makes the company what it is.

We weren't trying to sell anyone anything. As Warren Buffett says, we wanted to tell our shareholders things we would like to know if roles were reversed, and we were shareholders and they were management.

At the time of our first Shareholders Day, the company had had a pretty familiar shape for many years. But we had the sense that Kaplan and Cable ONE, which had started as small operations, were changing the face of the business. And everyone was interested in the Internet and how we planned to use this new medium.

Since then, changes in the company have been fairly consistent with what we hoped would occur. Cable ONE has branched into important, profitable, new product offerings. Washingtonpost.Newsweek Interactive has developed. And Kaplan has expanded rapidly and is performing much better financially. Indeed, Kaplan is growing so fast that it could become the company's number one property in revenues as early as next year.

A month ago, we wanted to bring shareholders up to date on these changes, as well as talk about the progress of Post-Newsweek Stations, which is our largest profit center.

The CEOs of these businesses gave extensive presentations on each of them and answered all the questions our shareholders could think of. All of this information is now available on the company's web site, washpostco.com, for the handful of you who didn't spend an entire morning listening to the webcast of our Shareholders Day presentations.

At this point, there isn't very much to add to what we said then. So today I'll give you a brief overview of the highlights of Shareholders Day. Then we'll open the floor to a longer-than-usual question and answer session.

Two points on corporate matters.

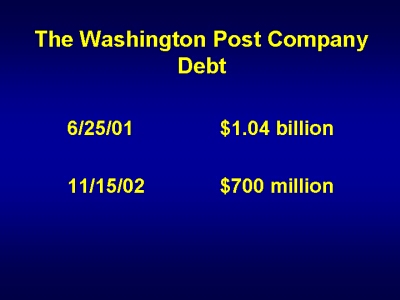

Our debt, which peaked at $1.04 billion in June 2001, had fallen to $700 million by Shareholders Day. This is an indication of our company's cash-generating potential; we actually made four small acquisitions early in the year and sold no assets except for $20 million in Ticketmaster stock (and our half-interest in the International Herald Tribune, but that has not yet closed).

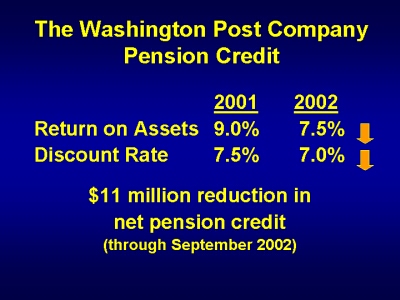

Second: students of our company's results have to understand pension credit, a non-cash item that makes up a large amount of our earnings and is of lesser value than the rest of our earnings.

For the first three quarters, the net pension credit was $48.3 million, down by almost $11 million, primarily because we lowered our return assumption from 9 percent to 7.5 percent; we also lowered the discount rate by one-half percent. Every indication suggests that the credit will be lower next year.

Now, let me bring you up to date on The Washington Post and Newsweek, which did not present on Shareholders Day. As you know, The Post has the highest daily and Sunday market penetration of any metropolitan newspaper in the nation's ten largest markets. It has survived the slowdown in advertising very well - so far without laying off any full-time employees. And its journalism simply has never been better.

I'm sure you're all daily users of washingtonpost.com and have followed

The Post's day-in, day-out reporting on Iraq, terrorism, the snipers who

paralyzed our region, the elections, and many other subjects. The Post's

reporting has made a difference in the debate in Washington.

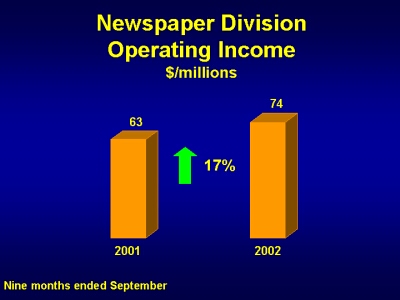

Operating income for the newspaper division through the first three quarters

increased 17 percent, owing almost entirely to good cost controls and

lower newsprint prices.

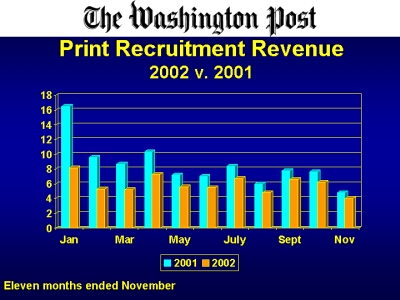

You can see that print ad revenues are down at The Washington Post through

November. Much of that decline is attributable to help-wanted advertising,

still lagging behind last year through November. Excluding the recruitment

categories, revenues actually are up 1.3 percent.

Here is a breakout showing month-to-month comparisons of recruitment

advertising versus last year. How much help-wanted recovers and when is

a key question.

The Post is certainly closer to the bottom than to the top of the advertising cycle. And in the medium term, its economic performance will improve if the advertising climate does. The holiday season is always important, and this year it's a very short one.

On a positive note, small and medium-size retailers have been buying

more ads in The Post in the second half of the year. We consider this

encouraging, since these customers tend to be very conservative in down

times. Many discount retailers continue to do very well.

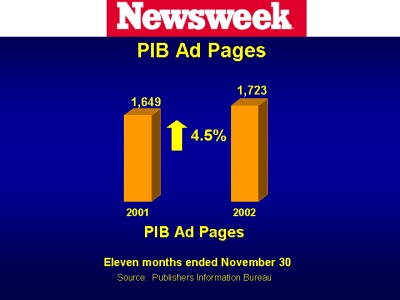

Newsweek has been run astutely, generating unusually loyal readers and

an outstanding circulation performance. The ad climate has been tough

for years - especially for Newsweek's international editions.

However, we're very pleased that the domestic edition has its nose above water and has run more ad pages this year than in 2001.

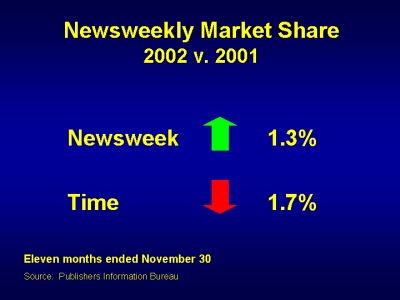

Newsweek picked up 1.3 percent of market share through November, largely at the expense of Time, which lost 1.7 percent of market share.

Newsweek's total revenue may be off because of the millions of issues

sold on newsstands last year after September 11. But Newsweek's vital

signs are very healthy, even though it has never been one of the company's

larger divisions in operating income.

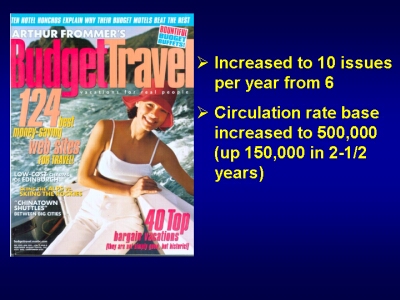

We also have a tiny but gratifying success story in Arthur Frommer's Budget Travel, showing that we can run other magazines as well, if we get affordable acquisition opportunities.

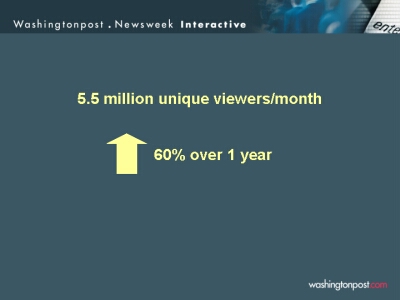

Washingtonpost.Newsweek Interactive (or WPNI) is doing well. It's now clear to us that advertising on the Internet works. It's the only medium whose prime time is daytime. It reaches people "on task," when they are online at their desktops.

washingtonpost.com is now running, on average, more than 5.5 million unique monthly viewers, up almost 60 percent from a year ago. Twenty percent of this audience is local. And with about 40 percent penetration of the Washington market, the site is by far the most heavily penetrated local site in the country.

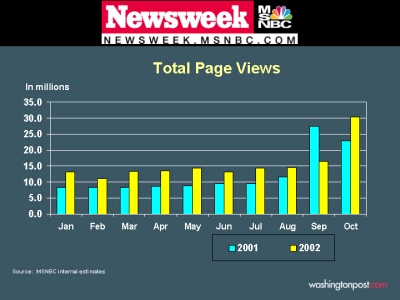

The numbers for Newsweek also look good. Here are the average monthly page views for Newsweek.MSNBC.com. Except in September, page views are up sharply over last year.

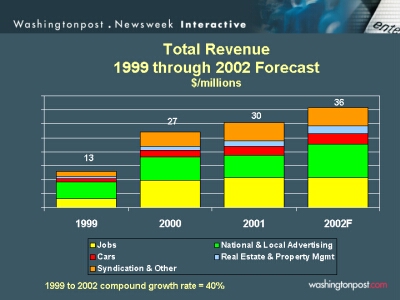

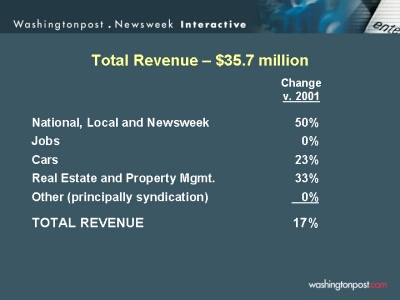

The advertising picture is encouraging. WPNI will be about a $36 million company at the end of this year, up from $13 million in 1999. Here's another way of looking at the 2002 revenues.

National and local advertising - including Newsweek - is up more than 50 percent. Cars and real estate also have enjoyed double-digit growth.

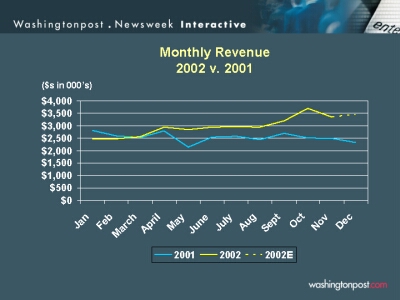

The blue line is last year's revenue on a month-to-month basis. The yellow line is the month-to-month figure this year.

Although we got off to a sluggish start, revenue since April has significantly

outpaced 2001. As you can see, we expect to end the year on a pretty high

note.

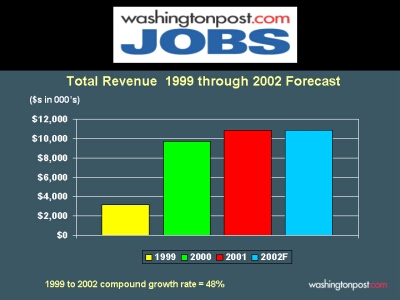

On the recruitment side, jobs is a very important part of the business. It's flat this year in a tough economy. However, the fact that we're flat - while some national recruitment sites are down in excess of 20 percent -shows that we're holding our own.

WPNI is losing money; everyone knows those losses have to come down as

fast as possible, consistent with building a strong base in our market

for the future.

Now let me turn to Post-Newsweek Stations. Consistently over the last 30 years, we've been willing to spend what was needed to be number one or highly competitive in our markets in news, audience, and revenue share. And that continues to be our goal.

Our stations have achieved higher margins than any other publicly reporting

group broadcaster. PNS has surprised us and its own management as well

with its performance this year.

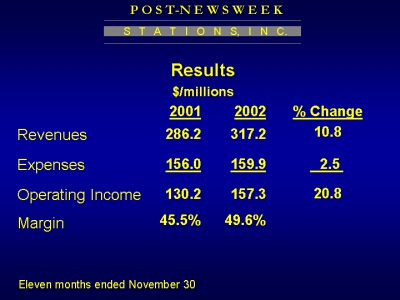

Overall financial results through November are encouraging. Year to date, revenues are up almost 11 percent, and operating income has increased more than 20 percent.

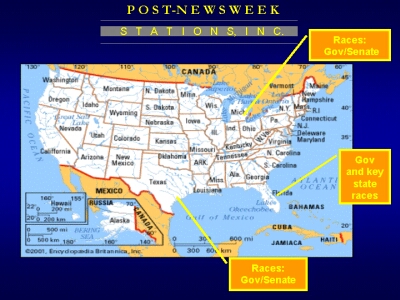

But much of this was political advertising. Every state where we have a station - Michigan, Texas, and Florida - had major elections.

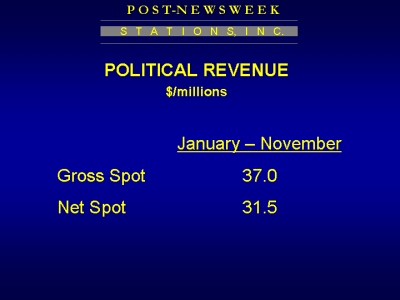

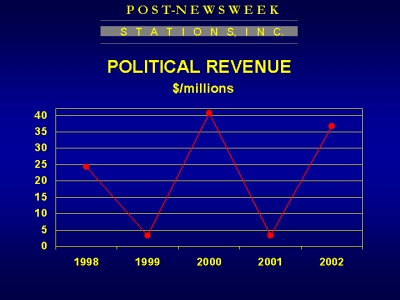

By the time the polls closed on November 5, PNS had recorded a total of $37 million gross, or $31.5 million net, in political advertising.

As you know, political revenues are cyclical, making broadcasting a business that booms in the even years, while we struggle to hold our own in the odd years.

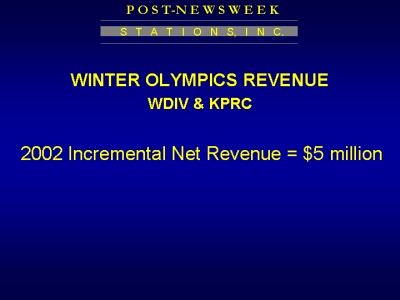

This situation is reinforced by the Olympics. Our two largest stations - WDIV in Detroit and KPRC in Houston - carried the Winter Olympics from Salt Lake City in February, generating approximately $5 million this year.

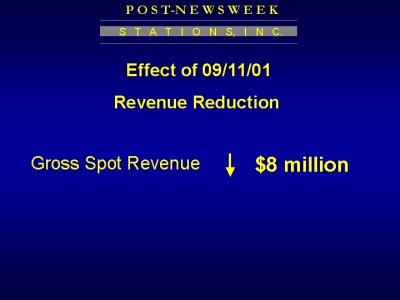

Lastly, the negative impact of September 11 on the 2001 revenue numbers makes the 2002 numbers look stronger. We estimate the loss in September 2001 to be approximately $8 million..

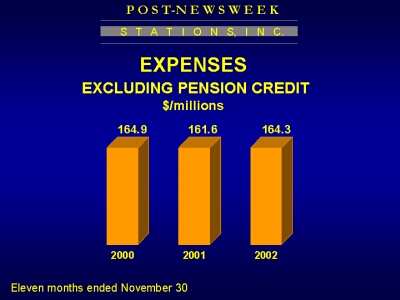

One of the hallmarks of our stations is the ability of our station managers to maintain quality while keeping costs down. Excluding the pension credit, PNS expenses are running a modest $2.7 million, or 2 percent ahead of last year, and actually are down slightly from 2000.

One word about WJXT in Jacksonville. After 53 years as a CBS affiliate, WJXT severed that relationship last summer when we were unable to arrive at a new affiliation agreement with CBS, which wanted to eliminate all network compensation payments.

WJXT had traditionally been so strong - ranking as the number one or

two CBS affiliate nationwide - that we decided to chart our own course.

PNS is creating a different type of station in Jacksonville. It has almost

doubled the amount of news it produces. Plus it has great syndicated programming.

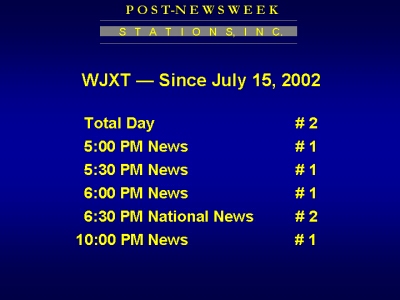

It's too soon to absolutely declare how the station is doing, but here is the grade so far. For total day, WJXT is second in the market, less than one-half point from the top-rated station. Its newscasts are still the top-rated in the market. And the stations' bottom-line performance is right on plan.

Cable ONE is a highly unusual cable company. So much negative news about cable companies has been in business-press headlines this year, I'd like to point out some key differences between other companies and our own cable operation.

First, in an industry massively burdened by debt, Cable ONE has no debt

of its own, nor does it show any debt on our books. Its profits have paid

off its investment costs.

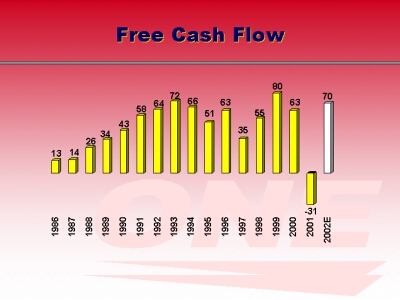

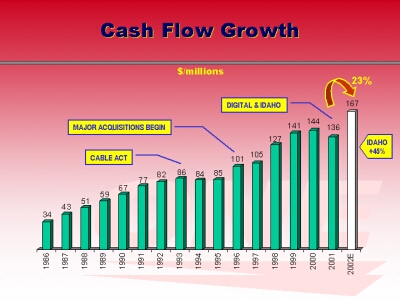

Remarkably, Cable ONE has been a net generator of cash - after capital expenditures - every year except last since we purchased the division in 1986.

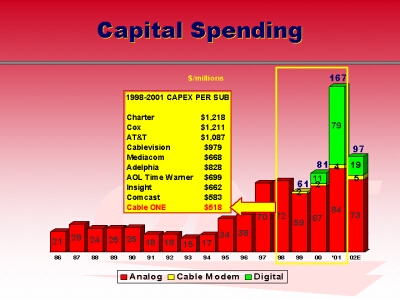

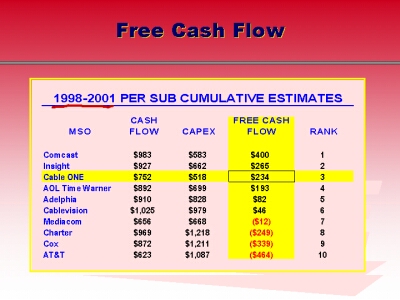

Our small-town/small-city operations have given us the opportunity to provide better-than-average customer service with lower-than-average spending on plant, since cable systems are, by definition, less elaborate in the markets we serve. In fact, over the past four years, our capital spending of $518 per subscriber is the lowest in the industry.

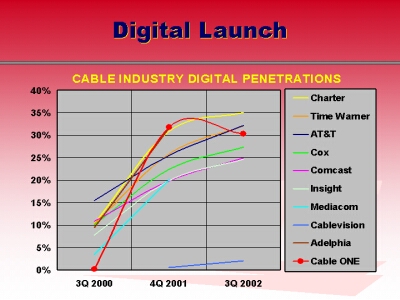

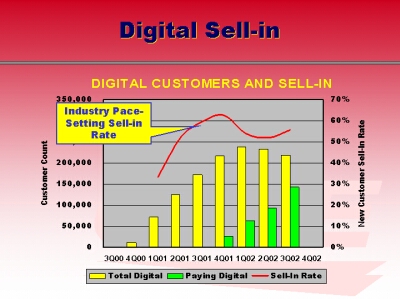

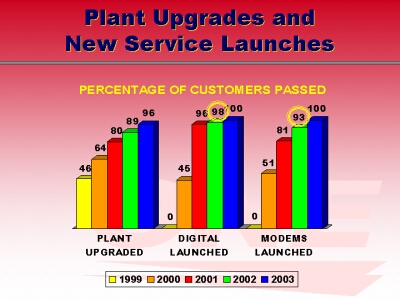

We were the next-to-last top ten MSO to launch digital cable, but then launched explosively to the entire customer base in about nine months. We gave digital away free to any willing customer for 12 months, with the result today of 30 percent penetration.

When we sell a new Cable ONE customer, there's a 55 percent chance they'll sign up for digital.

We were the very last of the top ten MSOs to launch cable modems, but again launched so rapidly that we attained the highest or second-highest modem availability in the industry by this time last year.

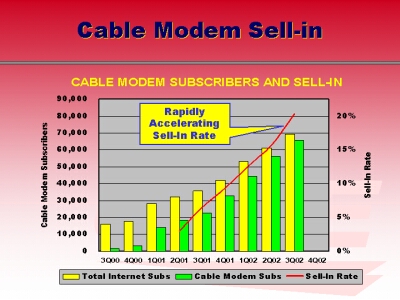

Cable modems should create a second franchise almost as valuable as the original video franchise. These bars show our quarterly numbers since the third quarter of 2000. Notice the accelerating rate of growth. The green bars are cable modem customers.

Last quarter, 21 out of every 100 new basic cable subscribers signed

up for a cable modem.

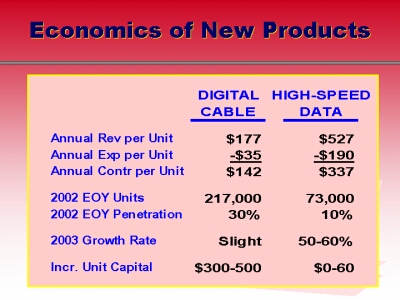

Needless to say, the impact on cash flow is significant. The annual contribution of digital cable is more than $142 per customer.

However, we expect modest digital growth going forward, and the incremental

capital cost runs anywhere between $300 and $500 per customer.

On the other hand, a cable modem customer generates more than $300 of cash flow contribution per year on average and requires no more than $60 of capital once you rebuild the system. Our penetration right now is about 10 percent of basic customers. In the competition with DSL to convert that massive base of dial-up customers to high-speed, we are winning 4 to 1.

In 2002, cash flow is expected to be up 23 percent - before capital spending - as our 200,000 digital customers start paying. The cash flow from the subscribers we acquired in Idaho jumps 45 percent in this one year.

Here is an industry snapshot of four-year free cash flow. As you can see, Comcast leads the group, followed by three of us in a similar $200-$300 range, with Cable ONE third overall. But this is not bad for a small MSO that is supposed to lack economies of scale.

There are three clouds on this overall bright horizon that Tom Might

and his team pay a lot of attention to.

First, Cable ONE focused so successfully on launching new services that it lost focus on satisfaction with its core analog customer base. As a result, their satisfaction has declined. So Cable ONE will go back to fundamental satisfaction issues in the year ahead.

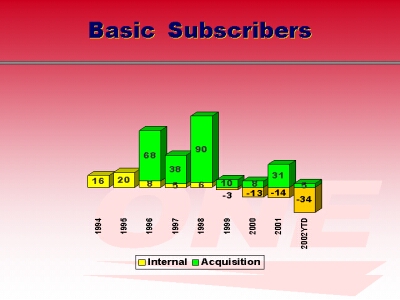

Second, Cable ONE reported a substantial drop in basic customers in the third quarter, taking the company down 34,000 total for the year. This has us very concerned. Since 1999, we've been fighting the effects of a severely weakening economy in most of the smaller markets where we have customers.

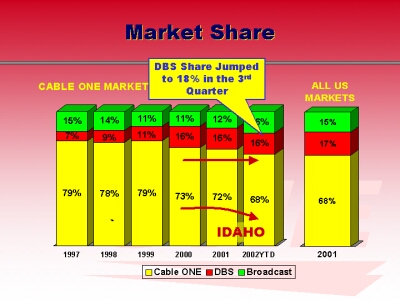

While Cable ONE attributes most of the subscriber loss to the economy as opposed to DBS, whose market share has been flat in our markets for two years, last quarter DBS's market share jumped. We have several major actions underway to address this.

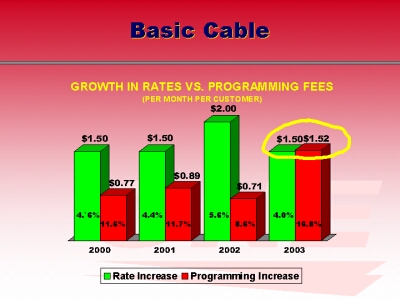

Finally, we're carefully watching the profitability squeeze on basic cable as programmers seek to raise their fees. As always, Cable ONE will be an aggressive negotiator as programming contracts come up for renewal.

Kaplan has turned out to be a phenomenal success story, a real tribute to the foresight of Kay Graham and Dick Simmons, who bought the business in 1984, and to the skill and dedication of Kaplan's current management team, headed by Jonathan Grayer.

Kaplan has grown from the original test prep business to a valuable collection of education franchises.

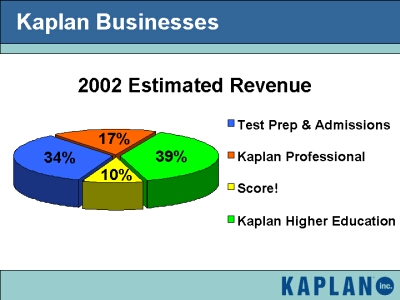

As you can see, Test Prep now accounts for 34 percent of revenue. Seventeen percent comes from Kaplan Professional, which helps people achieve licensure or entry into a profession. Score, our after-school centers for kids, contributes 10 percent of revenue.

The biggest revenue contributor, at 39 percent, is Kaplan's higher education division, which provides degree and certification programs for all different types of college learners at the associate and baccalaureate levels.

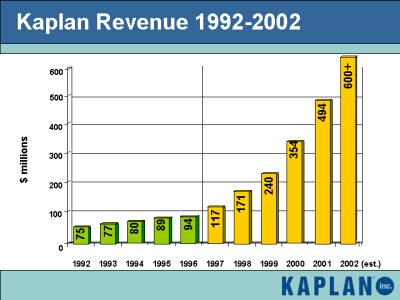

Altogether, these operations will produce more than $600 million in revenue this year, compared to $75 million a decade ago.

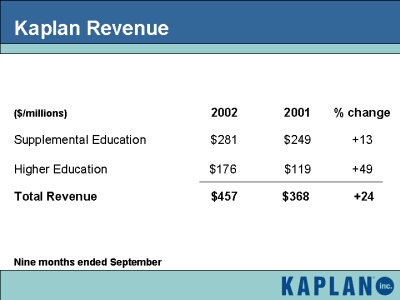

This chart reflects how we report Kaplan's numbers to shareholders. Through the third quarter, Supplemental Education (which includes Test Prep, Professional, and Score) is up 13 percent, while Higher Education is up 49 percent.

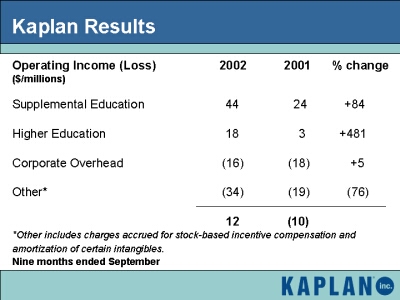

The big news is that Kaplan will move from a net loss to profitability this year. Going forward, Kaplan will benefit from growing higher education enrollments and is positioned to profit from either a strong or a weak economy. When times are tough, many young professionals go back to graduate school. When times are good, workers seek to better their professional skills.

No discussion of Kaplan would be complete without reference to its management

compensation plan. In 1997, The Post Company created a stock option-like

plan for Kaplan managers. It's not truly a stock option plan, because

Kaplan doesn't have publicly traded stock, and we don't want to take Kaplan

public.

Under the plan, 10.4 percent of Kaplan's stock is currently under option

to its management team. The plan calls for an annual valuation of Kaplan

by the Compensation Committee of The Post Company's Board of Directors,

as if Kaplan were a public company.

The components of the valuation have been Kaplan's earnings, its immediate earnings forecast, and the multiples of comparable, publicly traded education companies.

We expect Kaplan's compensation plan to trigger a substantial payout from The Post Company to Kaplan management sometime between now and 2007, when most of the options expire.

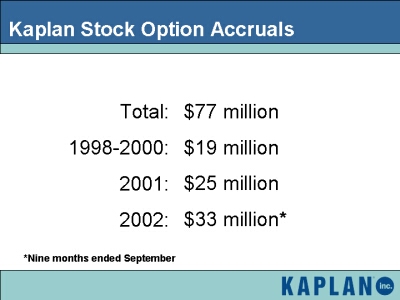

Therefore, we have been accruing each quarter, in our usual conservative GAAP-approved manner, to prepare to pay out the sums involved. To date we've accrued $77 million. In the first three quarters of this year, we've already accrued $33 million, compared with $25 million for full year 2001.

This reflects how rapidly Kaplan's businesses have been growing. If we

are accurate in determining the value of Kaplan, Post shareholders should

root for these accruals to go as high as possible. There is no question

that Kaplan is a much, much more valuable business now than it was in

1997.

To go back to where I started: it wouldn't have been possible to build Kaplan without the long-term orientation (and the absence of short-term orientation) in our company. We incurred operating losses and reported non-cash (but real) expenses of millions in amortization and comp-plan accruals. But we now possess a very valuable business whose profits have grown rapidly.

Kaplan is a great success story. We also pounded reported operating results

to invest in some absolutely dreadful businesses - I named several in

this year's annual report and will be pleased to call the roll again if

you wish.

# # #