Shareholders Day

November 15, 2002

Following are transcripts of the presentations made at The Washington Post Company's Shareholders Day on November 15, 2002. The transcripts have been edited and contain clarifications.

The presentations at this Shareholders Day meeting contain certain forward-looking statements that are based largely on the Company's current expectations. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. For more information about these forward-looking statements and related risks, please link to Risk Factors under Shareholder Information on this website and refer to the section titled "Forward-looking Statements" in Part I of the Company's Annual Report on Form 10-K.

OPENING REMARKS and COMPANY OVERVIEW

by

DONALD E. GRAHAM

Chairman of the Board and Chief Executive Officer

The Washington Post Company

Good morning and welcome to our second Shareholders Day. The format will be a bit different from what we did at our previous Shareholders Day. We want you to hear from the newest and fastest-changing divisions

We continue to meet with success at Kaplan; cable is having more ups than downs; the ad-based businesses are still in the doldrums, with the important exception of Post-Newsweek Stations and, interestingly, Washingtonpost.Newsweek Interactive.

This morning I'm going to ask Alan Frank to talk briefly about the broadcast division, our most profitable division and one where a couple of important changes have taken place this year.

Because everyone is interested in the Internet and online journalism, I'll then introduce Chris Schroeder to talk about the current state of things at WPNI.

Tom Might will talk about Cable ONE, where there's a great story to tell about our expanding digital and cable-modem products, and a less-than-great story to tell about basic subscribers.

Finally, Jonathan Grayer will summarize the state of affairs at Kaplan, which has changed so much in the two years since our last Shareholders Day.

At the end of each presentation, we'll take written questions for the presenter. You can also send questions to me; Bo Jones, who runs The Post; Rick Smith, chairman and editor-in-chief of Newsweek; Ann McDaniel and Chuck Lyons, who are responsible for The Gazette, The Herald, and PostNewsweek Tech Media Group; and Jay Morse, our CFO.

Let me begin with a few housekeeping details. As we indicated in our letter of invitation, we will not accept questions on editorial matters; this is a meeting on business affairs; there is opportunity to discuss editorial issues at the company's annual meeting.

Again, as at our previous Shareholders Day, we ask that you submit your questions in writing. We'll get to as many as possible, focusing particularly on those topics of most concern to most shareholders, and on the tough questions.

We held our first Shareholders Day two years ago, and I haven't enjoyed many days in business more. Our purpose was to give people who own Washington Post stock an opportunity to look in depth at what makes the company. We aren't trying to sell you anything; as Warren Buffett says, we want to tell you some things we'd like to know if roles were reversed and we were shareholders and you were management.

At the time of our first Shareholders Day, the company had had a pretty familiar shape for many years. But we had the sense that Kaplan and Cable ONE, which had started as small operations, were transforming the face of the business.

The changes in the company over the past two years have been fairly consistent with what we told you we hoped would occur. Cable ONE has branched into important, profitable, new product offerings. And Kaplan has expanded rapidly and is performing much better financially. Indeed, Kaplan is growing so fast that it could become the company's number one property in revenues as early as next year.

These developments reflect something about the unusual nature of this company, which I'd like to say a few words about now. It's pretty plain even to distant observers - and I guess it's very plain to you - that our goals are different from those of most American public companies.

Every company says it's investing for the long term. We really mean it. The Board of this company includes people who own very meaningful amounts of Post stock. They have a direct stake in our results, and they are tough graders. What we want to do - and what the Board is urging us to do - is grow the company's value in the long term without regard to the impact on short-term results.

To take the example closest to hand, we pounded operating results for several years, while rapidly growing Kaplan to a much bigger scale. Jonathan Grayer will tell you where Kaplan is in its progress. We're delighted, and we think you will be, too.

(I will tell you that our operating results also were pounded for investments in much less successful businesses. I spelled some of that out in the annual report and will happily return to the subject of our investment failures if anyone wants.)

We still have the same interest in long-term results and the same lack of interest in short-term results. Our company pays almost no attention to how each quarter's earnings per share stack up against a year ago.

We're also totally uninterested in whether our earnings match up with Wall Street analysts' idea of how much we should make. We don't know; we don't care; and we won't bend the company out of shape trying to beat someone's estimate.

This is fortunate. Your management is not composed of geniuses. Ignoring

quarterly results saves us lots of time that we can devote to the two

things we do care about: first, running the businesses we currently own

as well as we can; and second, carefully investing the company's money

- your money - in what we believe will be sensible ways.

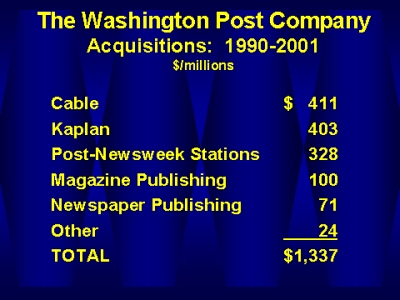

Here's a breakdown of the money we've spent on our acquisitions since 1990. I will be the first to tell you a few of our investments didn't work at all, and others are struggling.

But thanks in great part to the management at Post-Newsweek Stations, at Cable ONE, and at Kaplan, and to Chuck Lyons at The Gazette Newspapers, the company's overall investment record is pretty good. The collective sum of these investments has built the value of the company, and that will become even clearer in the future.

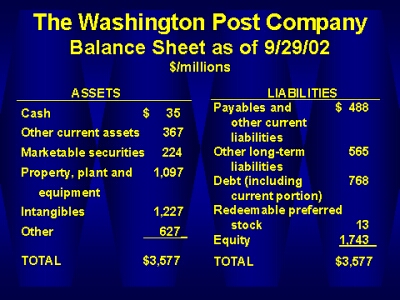

These investments drove debt higher. So did a steady diet of share repurchases.

We ended the decade of the 1990s with 3.1 million fewer shares than we began.

In 2002, our debt has come down. It peaked at $1.04 billion in 2001; at the end of the third quarter, it was $768 million. It's now close to $700 million.

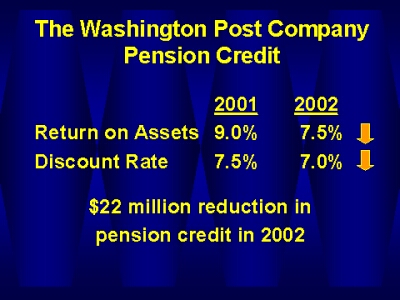

Now may be a good time for one of my disquisitions on pension credit, without which no Washington Post Company meeting would be complete.

A meaningful amount of our reported earnings each year consists of "pension credit"; this is true because our pension plan is overfunded and, in accordance with accounting standards, we report a substantial operating credit.

Pension credit is not wholly meaningless; our company should not have to contribute money to our pension plans in the future because they are well funded (and our employees, too, can feel unusual certainty that pension promises will be kept). But, pension credit is noncash, and is definitely of lower quality than the rest for our earnings.

Funds set aside for pensions were successfully invested by two managers chosen a quarter century ago. To know how much money companies will need to fund pension plans in the future, companies have to make - and publish - assumptions about the future return on their pension assets.

After consulting with our largest investment adviser and our Finance Committee last year, we lowered our return assumption from 9 percent to 7.5 percent, and lowered another assumption, called the discount rate, too.

These changes in assumptions will reduce our pension credit by $22 million in 2002. This reduction in a noncash credit is of no consequence to the real value of the company. But it does affect reported earnings, and that's why I mention it.

If you're a student of our company, you should understand this issue: pretax pension credit amounted to $48 million through the first three quarters of 2002, out of $249 million in operating income.

Since neither The Post nor Newsweek will be presenting today - though

their senior managers are here to answer your questions - I'd like to

briefly pay tribute to Bo Jones, Len Downie, and Steve Hills at The Post,

and to Rick Smith, Mark Whitaker, and Harold Shain at Newsweek. I feel

these leaders are as good as you'll find at any newspaper or magazine

anywhere in the country.

The Post has the highest daily and Sunday market penetration of any metropolitan newspaper in the nation's ten largest markets. It has survived the slowdown in advertising very well - so far without laying off any full-time employees. And its journalism simply has never been better.

Many of you live in the Washington area and have followed The Post's

day-in, day-out reporting on Iraq, terrorism, the sniper, and many other

subjects. I can't begin to tell you how proud I am of the quality of The

Post's journalists and the difference I feel they are making in the debate

in Washington.

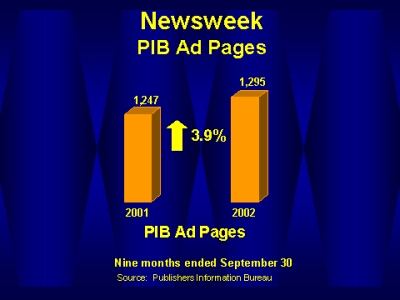

I'm more pleased than I can tell you that Newsweek has its nose above water and has run more advertising pages this year than in 2001.

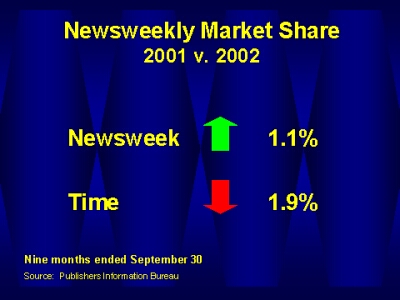

Newsweek picked up more than 1 percent of market share through September, largely at the expense of Time, which lost almost 2 percent of market share.

Total revenue may be off because of the millions of issues Newsweek sold

on newsstands last year after September 11. But Newsweek's vital signs

are very healthy.

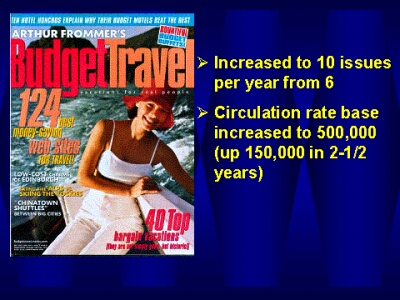

We also have a tiny but gratifying success story in Arthur Frommer's Budget Travel, showing that we can run other magazines as well, if we get affordable acquisition opportunities.

We want to point out our weaknesses as well as our strengths so you can

make judgments about your investment. I'd like to give you my own assessment

of some of the strengths and weaknesses of each of our operating divisions

going

forward.

I just talked a little about The Post.

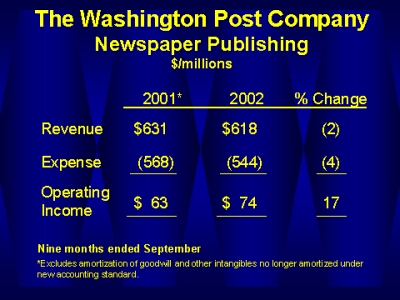

The newspaper division's operating income is up for the first three quarters, owing almost entirely to good cost controls and lower newsprint prices. You can see that revenues are actually down; much of that is attributable to help-wanted advertising, still lagging behind last year. How much help-wanted recovers and when is a key question. The future of newspaper circulation is, also, still a question mark.

The Washington Post is certainly closer to the bottom than to the top

of the advertising cycle. And in the medium term, its economic performance

will improve if the advertising climate does.

Newsweek has been run astutely, generating unusually loyal readers and an outstanding circulation performance.

The ad climate has been tough for years and is toughest for Newsweek's

international editions. Again, Newsweek will benefit from a lift in the

general U.S. economy, but it has never been one of our larger divisions

in operating income.

Broadcasting companies and analysts have pointed out for years that the performance of major-market television stations is challenged by a marketplace where viewers have hundreds of entertainment choices. In the face of that, the performance of Post-Newsweek Stations has held up remarkably well.

Consistently over the last 30 years, we've been willing to spend what was needed to be number one or highly competitive in our markets in news, audience, and revenue share. And that continues to be our goal.

Our stations have consistently achieved higher margins than any other

publicly reporting group broadcaster. PNS has surprised us and its own

management, as well, with its performance this year.

Cable ONE is a highly unusual cable company. So much negative news about cable companies has been in business-press headlines this year, all of us at The Post Company would like to point out some key differences between other companies and our own cable operation.

First, in an industry massively burdened by debt, Cable ONE has no debt of its own, nor does it show any debt on our own books. Its profits have paid off its investment costs.

Remarkably, Cable ONE has been a net generator of cash - after capital expenditures - in nine of the last ten years. We don't know of another cable company that can make that statement.

As Tom Might will describe later, our small-town/small-city operations have given us the opportunity to provide better-than-average customer service with lower-than-average spending on plant since cable systems are, by definition, less elaborate in the markets we serve.

All of these virtues are challenged by a recent decline in Cable ONE's

basic subscriber numbers, as Tom will outline in his presentation. Tom

will spell out the reasons for the decline, which in cable customers is

a much more serious immediate matter than a decline in newspaper circulation,

because cable customers themselves provide almost 100 percent of the income

stream. We are taking a series of steps to halt the decline and hope to

regain some of this business.

Finally, I'd like to say a word about the future of Kaplan. The education business has many characteristics we like: it provides a valued service where quality is a big plus. This is certainly not a capital intensive business. It is a challenging business that requires excellent management, and we believe we have it.

In picking apart Kaplan's operating income, it's necessary for me to return to the subject of Kaplan's management compensation plan, as I have in the last couple of annual reports and most other public utterances.

In 1997, The Post Company created a stock option-like plan for Kaplan managers. It's not truly a stock option plan, because Kaplan doesn't have publicly traded stock, and we don't want to take Kaplan public.

Under the plan, 10.4 percent of Kaplan's stock is currently under option to its management team. When Kaplan was first valued in 1997, the value was ascertained by the Compensation Committee of our Board of Directors with the assistance of an outside adviser. In the course of making acquisitions, Kaplan has also incurred debt to The Washington Post Company.

The plan calls for an annual valuation of Kaplan by The Post Company's

Comp Committee as if it were a public company. The components of the valuation

have been Kaplan's earnings, its immediate earnings forecast, and the

multiples of comparable, publicly traded education companies.

We expect Kaplan's compensation plan to trigger a substantial payout from The Post Company to Kaplan management sometime between now and 2007, when most of the options expire. Therefore, we have been accruing each quarter, in our usual conservative GAAP-approved manner, to prepare to pay out the sums involved.

To date, we've accrued $77 million. In the first three quarters of this year, we've already accrued $33 million, compared with $25 million for full year 2001. This reflects how rapidly Kaplan's earnings have been growing. If we are accurate in determining the value of Kaplan, Post shareholders should root for these accruals to go as high as possible. There is no question that Kaplan is a much, much more valuable business now than it was in 1997.

In recent years, acquisitions in the education sector have been more attractive than those of media companies; of course, this could change. Kaplan's revenue growth has been fueled by sustained internal progress, as well as a steady stream of acquisitions.

Although its financial results have been very small indeed relative to the scale of The Washington Post Company, I have to say a word about the end of our interest in the International Herald Tribune.

It's a painful subject. Even this year in a difficult advertising climate, losses at the Tribune were small, and we had hopes that in any kind of improved advertising market, the IHT could break even or make a little money.

Unfortunately, our partnership with The New York Times was a 50-50 one, and the approval of both partners was required for even routine business proceedings. Specifically, it was required for the approval of executive appointments, the funding of losses, the approval of budgets, and the approval of capital expenditures.

As I have said before, executives of The Times announced to us this fall that they planned to publish an international edition of The New York Times and preferred to purchase our interest in the IHT before doing so. But they intended to publish such an international edition in any case.

We were surprised. I had always felt - and feel now - that the IHT is one of the world's great newspapers. All our instincts were to defend it. On reviewing our options, this seemed totally impractical. The IHT has had its challenges meeting competition from the Financial Times and the international editions of The Wall Street Journal - even with the willing cooperation of its two partners. A 50-50 partnership with a less than cooperative partner appeared to be a recipe for certain disaster.

Therefore, reluctantly, we will sell our stake in the IHT. The money

involved is certainly not material to either company, and had little to

do with our reasons for selling.

The Tribune has played a valuable role for Post journalism by making it

available around the world. Now we're pursuing other alternatives for

distributing Post journalism globally in print and on washingtonpost.com.

We've had a strong year this year - partly a tribute to a healthy year

at television broadcasting, Kaplan, and cable, and partly a tribute to

the big percentage gains you record if you drive earnings low enough.

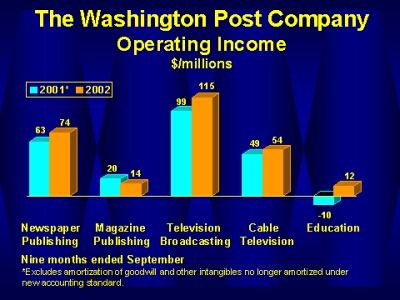

Here are our first three quarters of operating results. Newsweek's numbers are fuzzed up by $16 million in retirement incentives.

I'll now introduce the heads of our four fastest-changing business units,

who will share with you their progress and plans - warts and all.