Shareholders Day

November 15, 2002

Following are transcripts of the presentations made at The Washington Post Company's Shareholders Day on November 15, 2002. The transcripts have been edited and contain clarifications.

The presentations at this Shareholders Day meeting contain certain forward-looking statements that are based largely on the Company's current expectations. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. For more information about these forward-looking statements and related risks, please link to Risk Factors under Shareholder Information on this website and refer to the section titled "Forward-looking Statements" in Part I of the Company's Annual Report on Form 10-K.

REMARKS

By

JONATHAN GRAYER

Chairman and Chief Executive Officer

Kaplan, Inc.

Thank you, Don. Good morning.

I look forward to the day when I'm not 28 years old in my introduction,

although I'm learning to appreciate it.

Kaplan's mission statement has been true sine 1938 when Stanley founded the company in the basement of a laundromat. Kaplan helps individuals achieve their education and career goals. We build futures one success story at a time.

And when you look at our divisions, when you look at our acquisition strategy, when you look at our future, I hope you'll agree that we're true to that mission statement, that we have stayed away from parts of the education industry that don't do that because implicit in that statement is happy customers with quantifiable achievements through our help, and that means fair and good prices and healthy profit margins. So it's a great combination - happy customers and larger and larger profits for doing so.

To get an understanding of Kaplan, I think you have to start with a little bit of a history lesson.

Here is the largest center, circa 1987. You can tell by the hairdos and

attire, and by the owl in the background.

As you know, we did hammer earnings and had a lot of capital expenditure in the early years of my tenure, and we put $5 million in this center on 56th Street, and you see that we got a new awning.

We actually got a lot more. The company had invented an industry. It had grown dramatically as it nationalized its distribution system, but by the mid-'90s, as Don mentioned earlier, its profits had sagged, its revenue had stopped growing, and there was not good relations among the distribution system and the people who ran it and the people running the company. So during that period, we did a lot of things.

We invested in technology, we invested in our curriculum, we invested in our management team. We tried lots of new distribution ideas, including the Sweet Pea from Apple that never happened. We updated our look and feel.

One of the things that was most apparent is our attempt to change our marketing significantly. We had trouble finding our voice during this period, but we never stopped trying.

First, we had started from this base: Who's afraid of the SAT?

This ad ran in 1989. You can imagine that our hip and happening customers were not impressed.

What I specifically like about the ad is the insistence of Stanley at the time of making sure that the full company name was in every ad. This became quite absurd in small two-by-two newspaper ads, but you'll see "Stanley Kaplan presents… Educational Center, Ltd.," found its way into every ad, a very customer-oriented benefit. Today, Stanley laughs about this.

But we didn't do much better.

Now, Stanley was extremely happy, and still today has this picture up in his office. "Stanley wants you to be one of our SAT instructors."

This was a little bit of overload. We were impressed by our intellectual

bearings here, but you can see the Rodin Thinker was a nice visual, but

who was going to read that much copy? Not many people.

So we had, of course, a reaction to that. No copy at all. This is actually

a true picture of a true human face and mouth.

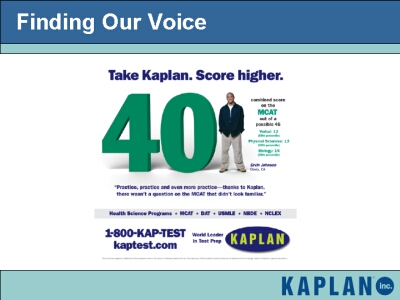

But here's where we came out. These ads run all over the country and the world today, and you'll see the evolution towards a very clear understanding of what the customer is buying in our test prep business. They're buying a score, an improvement level. There's a human feel to our ads.

And while this is one of our divisions, I think it shows a good example of what your company has been through to get where we are today and what we've learned about marketing during the period that I described in the '90s. This ad came to fruition in the late '90s. It has made its way through all of the operating divisions that we have today.

So what are our businesses? We're going to go through them each today, and we're going to actually give you some information that goes beyond our usual quarterly releases.

Our first business is that test prep business that Stanley founded in 1938, helping people get higher scores or passing licensure exams on all kinds of tests.

Then, we have our division that provides education to a variety of professional markets, helping people achieve licensure or achieve entry into a profession.

We have our after-school learning for kids division called SCORE!, and

we have our fast-growing and soon-to-be-largest division, Kaplan Higher

Ed, that provides degree credit and degree programs for all different

types of college learners at the associates degree level and at the baccalaureate

level, a very exciting business that just was entering our portfolio when

we had our first shareholders meeting.

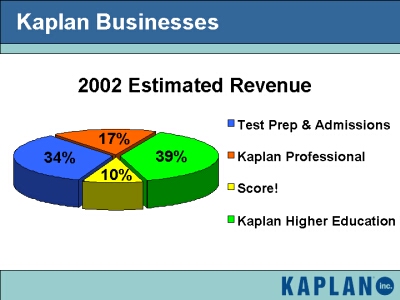

Well, this is a pie chart of each of those businesses: 34 percent of our revenue from test prep; 17 percent of our revenue from Kaplan Professional; 10 percent from our after-school business SCORE!; and 39 percent from our higher ed division.

Now we started putting up pie charts in 1997, and that blue portion of the pie chart dominated for many, many years. In fact, the attempt to put color in the space that the others existed was a little bit of an overreach, and the titles of those little slivers dominated their portions.

But today very few people would guess, because we don't go out and market and sell this, that only 34 percent of our revenue comes from the business that we're identified with - our Mickey Mouse to Disney is our test prep business. Thirty-four percent of it is test prep, and it has grown very quickly, but the rest of your company has grown much faster.

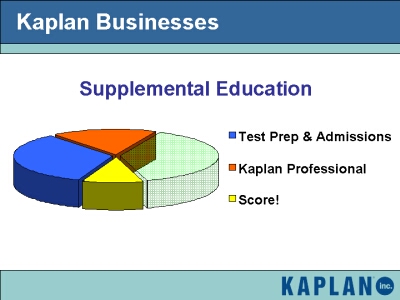

We release our public information based on supplemental education, which is these three divisions, and

Kaplan Higher Ed, but today we're going to take you through the four units individually.

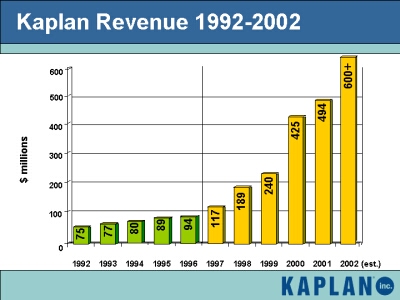

Don spoke about long-term investing, and this is a bar chart that we show regularly to new recruits to the company and at company meetings because it speaks to exactly what your investment and your patience has led to.

I joined in November '91. We had $75 million of revenue, and we set out on our task to grow our business from there. That was actually our only down year in revenue. We had been $78 million - I think in '91. So we added all of those computers, and we updated our curriculum, and we brought in new managers, and we grew from 75 to 77. So we added more marketing methods, more curriculum. Remember that Thinker. We grew to $80 million.

At this point, the only person who had this bar chart on their refrigerator was me, my mother, and Don, who kept saying, "We invest for the long term."

So we had a break-out year in 1995, big growth, 10 percent. We thought we were on to something. The growth slowed. My tenure as CEO was no different than the predecessors'. But the reality was, during the green period, as we call it, we were doing a lot of good things that were going to affect the opportunities the company had. They were going to affect the financial performance of the business, and most importantly our ability to grow in the future, and that's what has happened since.

The yellow period is a much happier time. I will say that we do not make forward-looking statements, but the 2003 numbers should do nothing but increase the velocity of that chart.

During the green period, we build the company; during the yellow period,

we had been harvesting those talents, those people, those technologies,

the understanding of how to market educational products, which educational

product sells well and which does not, and the profitability has followed

behind these revenue numbers.

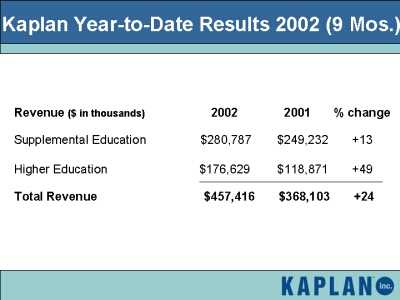

So here's what we reported, once again, on the two segment levels. In 2002, these are 9-month numbers. You see that our revenue has grown 24 percent, about 20 percent of that, 20-percent total, is organic growth this year. It's been an enormous year for us for a variety of reasons.

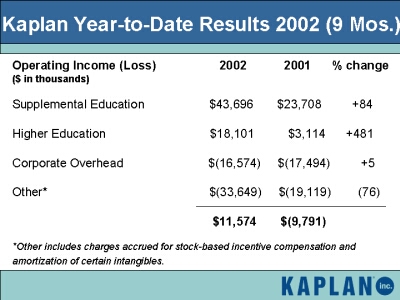

And on its operating income level, you see that we grew from a loss of 10 to a profit of 11, but that includes the other line, which is the incentive comp plan.

So if you look at the two pieces that we follow, supplemental education,

$23- to $43 million in operating income; higher ed, $3 million to $18

million with a pretty flat overhead. That's what has happened behind the

revenue growth that you see.

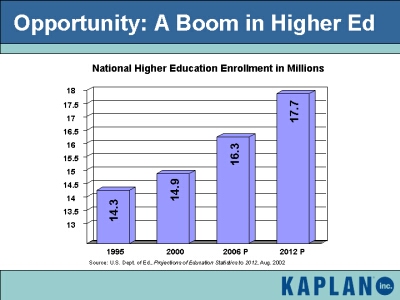

What's driving these trends? As Don said, we're not geniuses, but we've been persistent in the business that has some very good characteristics driving it. 1995, 14.3 million enrolled in higher ed. In 2000, that number has grown to 14.9 million, but look what's coming.

Now, these numbers are excellent for us for two reasons: One, we're in the higher ed business. More people going into higher ed means more enrollments at our higher ed campuses in our on-line programs, good things.

But in addition, it's harder to get into good schools. One in twelve people got into Harvard in 1982. One in 17 got into Harvard this year. One in 25 will get into Harvard in 2012.

The double dynamic for us is that, as these populations grow, the best

opportunities become harder and harder to get on an exponential basis.

That's good for test preparation for obvious reasons.

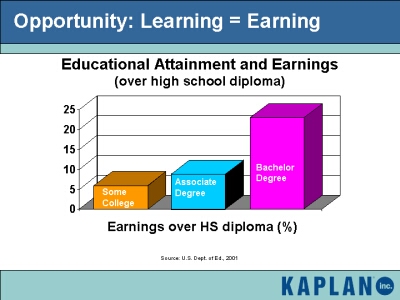

Why are these numbers growing? Two reasons: first, there's a baby boom; and, second, it's become clear that earnings increase with education. There's some noise in these results. There are many people who think they're prejudice because they confuse correlation and causation, but the fact is that people believe if they get more education, they'll earn more, and the empirical data shows that. That means matriculation rates are higher than ever before. Population is up; matriculation levels are up. That means more people. More people is good.

No Child Left Behind. Money is flowing into our school systems. I would point out with the caveat that federal money takes two or three years to find its way into your school buildings. The No Child Left Behind Initiative is in play, it is happening, but that money is going to take time to flow through. A lot of that money is being driven towards assessment, testing, the kinds of things that Kaplan can help teachers and principals do better.

One of the major components of the education bill is that by 2005 all

schools are going to have to publish their testing data publicly - their

performance by sex, by income, by race. There's going to be no place to

hide at the local level, and that's going to lead to very big things for

companies like us that can help schools and their teachers improve performance.

Good things for our business.

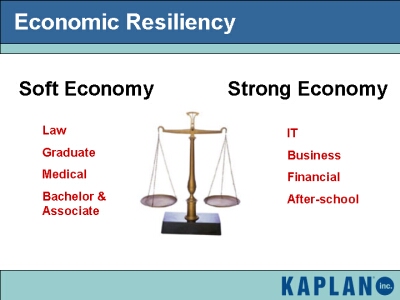

Your company has a very broad mix of education product. In a soft economy, our graduate test prep business booms because people leave the workforce to go back to school. And college and graduate programs increase as well. In strong economies, our professional businesses, our after-school centers boom as well, although we're seeing some resiliency in this economy for the after-school business, which I'll talk about in a bit.

So you have a business that's doing well, with a growth perspective that

we think is fantastic, but most importantly there is a reason for it.

There are macroeconomic and demographic underpinnings to our performance

that are here to stay for quite a while, and that's exciting for investors,

in the long run, in our company.

Let's look at the pieces. Once again, this is something that is new, for those of you who have asked me for years, will you show this, here is our moment--not that this you haven't seen. This is actually not clip art. This is a classroom of ours.

Once again, our expensive awning.

The test prep business has a number of units within it. It delivers a number of K through 12 services both at the center level, the SAT and the ACT that you know well, and school programs that are growing quickly will do a sizable business helping principals and superintendents improve test scores.

We have graduate programs: the LSAT, the MCAT, those tests for law school and medical school, the GMAT for business school, and the GRE for graduate school.

We dominate the medical licensure business, helping people who have graduated from medical school get their license to practice, and we have a very well-regarded and highly performing international business, mostly helping students acquire English as a second language.

We do that through our centers. As you saw, that's our biggest center

in New York.

We do it through books and software. We have a publishing imprint that we own with Simon & Schuster that's doing very well.

And we do it through a very aggressive use of the Internet for both our in-course students who take programs with us, we call them in-line students, and then through online-only students, where we have a business that's doing quite well.

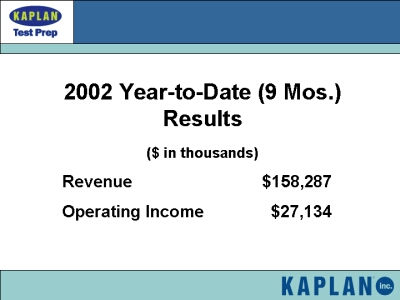

The results for this business are through nine months. Now this was a business in that green period that did $75 million. Through nine months, we've done $158 million, operating income of $27 million. You probably can apportion $3- or $4 million of the overhead of the company to that. So through nine months, that business has performed extremely well, all organic growth run by a management team of people who have been with your company for 10 years.

The great success of Kaplan's test prep unit is really true of our whole

company, and that is the people running the place have been there a long

time. In an industry that has very few people who know what they're doing,

keeping your people is the key driver of success.

John Polstein, who runs this business, came in September of 1992 from

Viacom and has been running parts of it ever since.

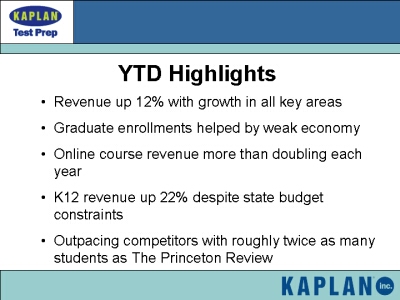

Our highlights. Our revenue is up 12 percent, with growth in all areas. We have a very good look into the future, and I can tell you we're unfortunately doomed to have more lawyers than ever before. Our LSAT business is very strong.

People go into medicine when times get bad, and MCAT enrollments always boom when there are layoffs. So our MCAT business is up dramatically as well. Overall, we're up 12 percent for the year. We're helped by a weak economy, obviously.

Our online revenue-only programs have doubled this year, and we're encroaching on eight figures of revenue there. Our K-12 revenue is up 22 percent, despite the state budget constraints, and that's because the federal money has not yet funneled through. It will, and it's an exciting future for us.

You all know that we have one big competitor in test prep, The Princeton

Review, and we have roughly twice as many students as they do today. They

have never reported a profit. They're public today. Our business will

make, you can extrapolate from the $25 million or so through nine months.

So watch that competitive dynamic as it plays out over the years.

Our professional business is our offerings to the adult workplace market.

We are leaders in the financial service segment, where we provide securities licensure and CFA help for students and professionals who want to obtain securities licensing rights and CFA designation.

For real estate, we dominate the real estate preparation market. Over 75 percent of individuals who take a real estate brokers or agents test use your product, over 75 percent, in some form or another. It may be under our brand or Better Homes & Gardens or Century 21. That business has done very well.

We also own schools that provide preparation. In IT, we have two businesses that have been hurt this year by the obvious slowdown in the IT segment of our economy, but we provide a lot of help to IT professionals looking to upgrade their skills.

In our trade publishing business, we have a small, but well-performing,

book imprint that provides business publications to professionals.

We have classrooms,

have books, and

in this business thriving websites that both provide students with a place to go on the Web, but as importantly, and in the future more importantly, websites that live within the company's own set of websites called "Behind the Fire Wall," where we can customize our offerings for a specific employer.

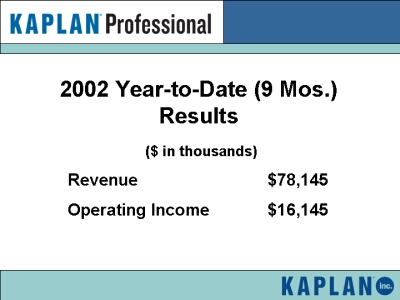

The results here have been dramatic. We are up significantly in a very tough economy. Revenue of $78 million - these are nine-month numbers - operating income of $16 million for nine months, and we did about $16 million of operating income for all of 2001.

So the performance here has been very gratifying. We will hit our budget, and that's in an economy with a number of large companies really crushing the number of workers in key segments for us, like brokers, traders, and other types of financial professionals.

Eric Cantor runs this business for us. He's actually a newcomer for us.

He's been with us about four years. He came from McGraw-Hill, but provided

us with a set of skills that the group that was running Kaplan did not

have in institutional selling. So we have big hopes for this division

and are looking actively to grow it through acquisition.

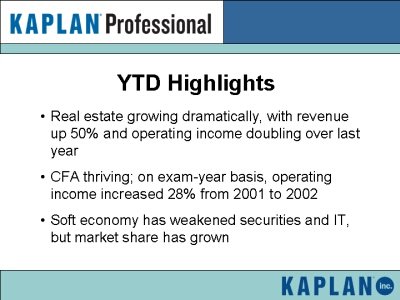

The highlights, our real estate segment has grown dramatically, with our revenue up 50 percent. A lot of that is because people are going back to work - second wage-earners within a household going into real estate, and operating income that followed suit.

Our CFA business is a fantastic business in Wisconsin run by 12 people.

Very profitable. Kaplan Professional has increased 28 percent on the bottom

line. But we've had trouble in our securities and IT segments, but our

market share has grown, as we used our relative size over our competitors

to support marketing expenditures against them.

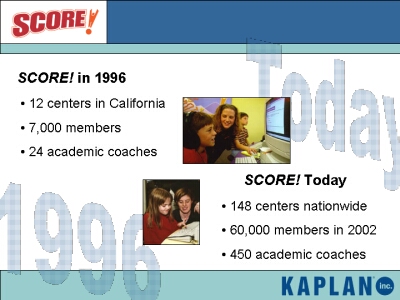

SCORE! is our after-school business for kids. It's a great business to own because we're helping kids, we're helping families increase their self-esteem and their love of learning. This is not a remediation business. Seventy percent of the kids that are coming to SCORE! centers are coming because they want to learn more, but they're already testing at or above their grade level. This is a picture of a SCORE! center, with coaches helping kids at their work stations.

We bought SCORE! in 1996 from a man named Alan Tripp, who had started it, but was going to have trouble expanding it because it was capital intensive. The business had 12 centers in California, 7,000 members and 24 coaches working for it when we bought it.

Today, SCORE! has 148 centers that we own and operate. We do not franchise

any of our centers. We have 60,000 members this year and 450 academic

coaches. So we've grown the business substantially in the time we've owned

it.

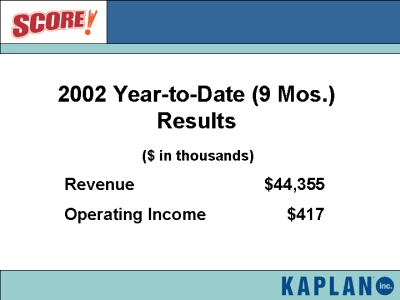

We've lost money to grow this business because we have opened up centers on our own dime, on our own P&L and expensed the operating losses of doing so, but through nine months, under Jeff Conlon's leadership, the CEO of SCORE!, we actually have an operating income of $417,000; $44 million revenue. When we bought the company, the revenue was under $2 million in 1996.

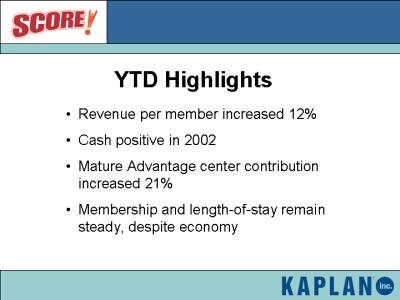

Revenue per member has increased 12 percent, and that's a big part of our story. We get and command a more and more attractive price from our customer, and in doing so have much higher profitability per member and obviously at the center level as well.

We generated cash this year. SCORE! used less cash than it generated. That's a first, and a year ahead of our original schedule.

Our mature centers that are opened more than three years have seen center contribution grow 21 percent this year, mostly on the back of a small up-tick in membership, but a higher price per student, and in spite the economy, we've been able to maintain our length of stay. SCORE! has every expectation of being profitable in 2003..

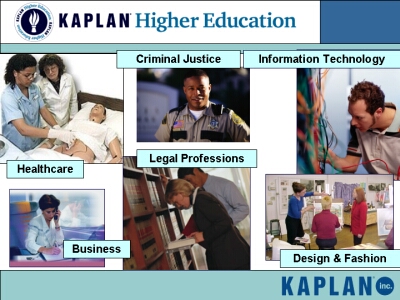

That brings us to our largest division, and our newest, Kaplan Higher Ed. We provide programs to students in health care - Allied Health is another name for that segment - in criminal justice, helping individuals become police officers and other types of law-enforcement professionals; legal professionals, paralegals mostly. We have both a graduate program and an associates' degree program; design and fashion, not something most of us know a lot about, but Gary does; and business, undergraduate business degrees for people who want to get into some area of commerce; and, finally, information technology, which had been our fastest-growing program until the recent slowdown.

Gary Kerber is with us today. Gary was the founder of Quest Education, which we bought out of the public market in 2000, and ran a public company, a founder, who had the same long-term view of this business as we did, and has been an excellent addition to the top of management of Kaplan and The Washington Post Company. He's been mentioned a couple of times, but I don't think anyone has seen him. So, Gary, if you'll stand up so people can get a good look. This is a very important man to all of you right there.

This business has boomed since we bought it, and Gary and his management

team are the reason why.

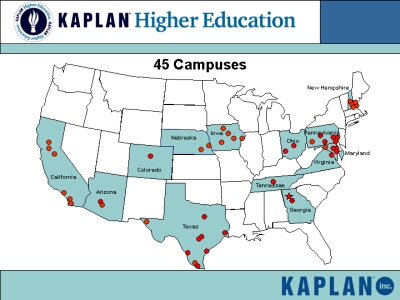

We have 45 campuses around the country. I showed a similar slide with 31, I believe, at the last shareholder meeting right after we bought it, and you'll see there's still a lot of opportunity for red circles in those blue states, and more importantly there's still a lot of blue states, and we're going to be opening up more campuses as we go. It takes a lot of management bandwidth to get one open, not easy, but we're excited about the prospect of doing so.

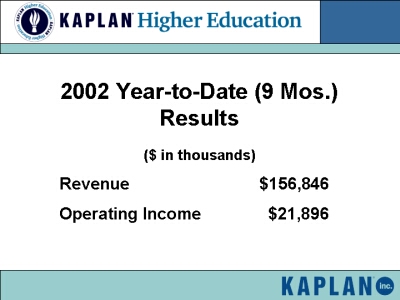

Year-to-date through nine months, those are our numbers. Very profitable business. You should know that on the total, the fourth quarter is, far and away, the largest quarter of the year for us. So we will finish substantially higher than $22 million in operating income. It has been an enormous year for your Higher Ed Division.

The public markets have recognized this segment, and the reason is you

have high margins, and very, very large moats around the business because

there's a lot of regulation and a lot of expertise needed to run these

schools. We're lucky to have Gary and his management team who can do it.

Your management team at Kaplan could not have gotten into this business

on our own. We would not have had the expertise to do so.

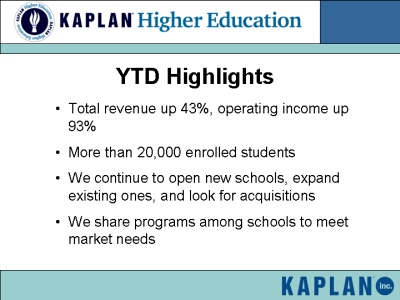

What are the highlights? Well, look at that. This is a problem for next year.

Total revenue up 43 percent and operating income up 93 percent on a base of in the low 20s, not bought, but organically grown. This is the kind of year, when you look back on companies' histories, when great businesses are built, and I'm sure The Washington Post had a similar kind of time. This is our time, and Gary is doing it.

We have 20,000 enrolled students getting their associate or bachelor's degree, fully accredited from the same accreditors that accredit any great school in this country. We're going to open up new schools, and we are always looking for acquisitions. We have bought six or seven campuses this year. It's hard to buy schools, for a number of reasons; one, there's pricing pressure as private equity has come into the market, but, two, there's an enormous amount of regulation and small operators have not always followed the letter of the law. That poses risks for us when we acquire, so it's hard to get a deal done.

We're actively looking, but more importantly, we know we will open up more campuses ourselves to grow our distribution. We're sharing programs among schools, and we're getting the benefits as we grow of a larger distribution system. We can afford better talent, and we're keeping the best people that we have.

This business is all about the top management. Revenue is not the largest

challenge here. The largest challenge is making sure that your students

who are borrowing money from the federal government are able to repay

their loans. If they can't repay their loans, you get that funding opportunity

from the federal government taken away, you have no business, and the

risks here are not insubstantial.

The sister company to our Campus Division that Gary runs is Kaplan Higher Education Online. This is actually a student going to Concord Law School. The student lives in Alaska. There is no law school in Alaska. We've joked about petitioning to become the official law school of the State of Alaska because we're the only law school that can offer a program there.

Alaska, we did talk to them, and they said, "What will you pay us?"

and that was the end of that discussion.

But you'll see, he looks like he's going to law school, doesn't he? Well,

he is, and next week we're graduating our first class-about eight students,

which is a remarkable achievement for them. They bet on the Internet in

ways that go beyond even how we're betting on the Internet. They have

spent an enormous amount of time, much of which occurred between the hours

of 10 p.m. and 4 a.m. They worked, they're all working adults, these graduates,

and they're graduating with a full law degree, and we're having a big

party for them in L.A. next week.

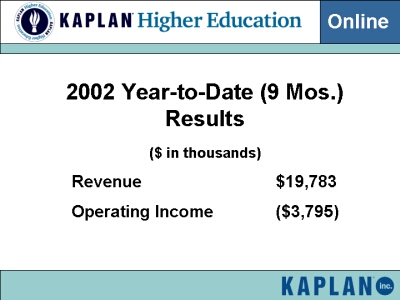

Higher Ed Online is an enormous opportunity for us. We have undergraduate programs, graduate programs and professional certification. This is our nine-month numbers.

You'll see this is online-only revenue. We did about $12 million last year. This business is growing well. It has very good operating leverage characteristics because students stay for a long time and pay you a lot of money.

So the industry metric is driven around how much it costs to get them

and then how long you keep them. If you can get them for something reasonable,

and you can keep them, you will make a lot of money. And the opportunity

for this to be an enormous driver of income growth for us in the next

five to seven years is very exciting.

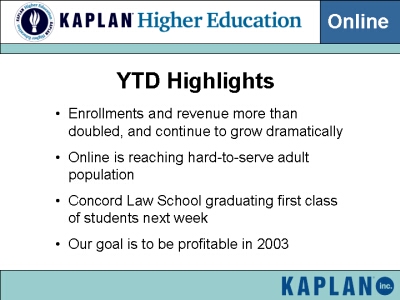

Our highlights, we've more than doubled our enrollment and revenue, and because they were installed base of students, we know that that will basically happen again next year.

We are all about access to reach adults who have bills to pay and must

keep their current job. We're graduating our first class next week. Our

goal is to be profitable in 2003, and we have every intention of doing

that, but the negotiation on forward-looking language on this statement

took about a week for Jay, so that's as much as I can tell you.

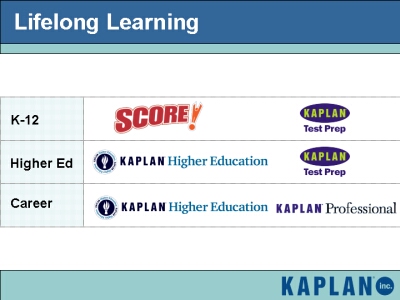

Your company presents a set of offerings for lifelong learning to students. In the K through 12 space, we have SCORE! for families, we have test prep for SAT/ACT and other types of entrance exams pre-college. We have higher ed, through our Kaplan Higher Ed Divisions, both campus and online, and our test prep business, serving graduate programs for adults, and we have career education, both again at Kaplan Higher Ed, campus and online, and also our professional businesses.

We have worked hard to find companies and assets that have sustainable

margins that have moats around them that will offer growth in the future,

and in each of our acquisitions, we think we have done that.

They are unified by, again, this simple statement. We are not, for instance, in the business of helping people appreciate art, learn about cooking, even learn about accounting. We are helping people acquire skills so that they can have better jobs, feel better about themselves, increase their proficiency or pass the hurdles. That's how you make money in the education business, and that is what our focus is. We haven't always understood that, but we certainly understand it today.

Our business has been laid out today in numbers, figures, pictures, but we are a business of students, and I thought it would be worthwhile to show you our students and what they think about their experience with your various divisions.

So, with that, let's take a look at your students.

[Flash

Video Link - Real Player]

[Flash

Video Link - Windows Media]

One interesting note. The neuroscientist was talking historically. He's

actually a resident in neurosurgery. I understand he was part of the team

that operated on the Guatemalan twins joined at the head. And he was a

Kaplan student who paid us for his MCAT. So, you know, it's a very important

part of our story.

The reason people come to work at our company is because of what you just saw--helping people and being paid well for doing it. So thank you for your time. Hopefully, I've made some sense of our world for you.

# # #