Dear Shareholder,

On March 28, 2008, five years ago this month, Philip Morris International Inc. spun off from its former parent to become the most profitable publicly traded tobacco company in the world. Since then, our company has gone from strength to strength. My letter to you highlights our very solid growth in 2012 across key operational metrics, but I take this opportunity to draw your attention to one particular hallmark of our success, both this year and since the spin-off, namely our employees. Our company is blessed with a diverse pool of superb talent that, with unwavering passion and commitment to excellence, is the driving force behind our performance. This year’s Annual Report is dedicated to them and showcases the considerable breadth of talent that we enjoy around the world today.

2012 Results

Our robust performance in 2012 was all the more impressive given the spectacular results achieved in 2011 and the continuing economic woes affecting all southern European nations. Our growth is testament to the resilience of our business, which in turn is attributable to our broad geographic footprint, our relatively unique pricing power driven by the strength and vibrancy of our industry-leading brands, the disciplined management of the challenges and opportunities that we confront and the considerable efforts of our dedicated workforce. This was the fifth consecutive year that saw us meet or exceed our mid- to long-term annual currency-neutral adjusted diluted earnings per share (EPS) growth target of 10-12%. This consistent level of double-digit EPS growth puts us at the forefront of all major global consumer products companies.

Organic cigarette shipment volume reached 927.0 billion units, an increase of 1.3% versus 2011. Of particular note is that, excluding the Japan “hurdle” related to additional volume shipped in the second quarter of 2011 following the disruption of our principal competitor’s supply chain, our volume would have increased by 2.0% on an organic basis – and this despite a 13.5 billion unit or 6.4% erosion in volume in the EU Region. Our strong volume performance, which on an apples-to-apples basis surpassed that of all our direct competitors, was driven by our Asia and EEMA Regions with particularly strong results in Indonesia, Russia and Turkey. In addition, our Other Tobacco Products volume performance was exceedingly strong – rising, in cigarette equivalent units, by 9.8% versus 2011. The EU Region was the principal contributor to this positive result where we drove our share up by 1.1 percentage points to 12.2%.

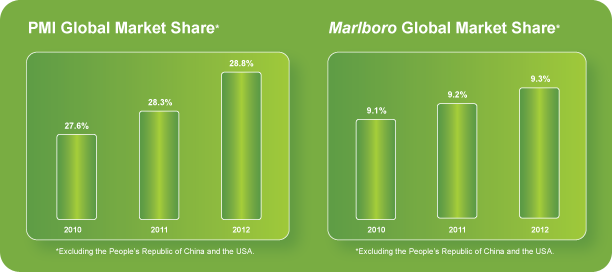

Our cigarette market share performance was solid and improved as the year unfolded. We gained share at the international level, closing the year up by 0.5 percentage points to an estimated 28.8%, outside of the U.S. and the People’s Republic of China, and gained 0.6 percentage points to reach a share of 37.4% across our combined top 30 income markets.

Reported net revenues, excluding excise taxes, of $31.4 billion exceeded those in 2011 by $280 million, or by 5.6%, excluding currency and acquisitions.

Adjusted operating companies income reached a level of $14.2 billion, up by 3.7% versus 2011 and up by a strong 8.1%, excluding currency and acquisitions. As usual, pricing was the key contributor to our profit growth versus the prior year, but most importantly our volume/mix variance was positive, excluding the Japan hurdle – a major achievement given the pressures we faced in southern Europe.

Adjusted diluted EPS of $5.22 were 7.0% ahead of 2011. On a constant currency basis, adjusted diluted EPS were a strong 11.7% above the prior year level.

Our free cash flow of $8.4 billion in 2012 was down by $1.1 billion, or by 11.6%, excluding currency. The decline was attributable to higher working capital requirements and an increase in capital expenditures. The working capital increase was driven by Indonesia, where our business growth led to higher tobacco leaf and finished goods inventories and increased purchases of cloves at higher market prices. In addition, we replenished our global tobacco leaf stocks following our unexpectedly large cigarette sales in Japan in 2011. The increase in capital expenditures was primarily attributable to production capacity increases in our Asia and EEMA Regions. We anticipate a strong increase in our currency-neutral free cash flow in 2013, although we do plan further increases in capital expenditures related notably to additional capacity in Indonesia and to the establishment of Next Generation Products (NGP) manufacturing capacity.

We had a cost and productivity savings target of $300 million for 2012 and exceeded it handsomely. We also took further steps to consolidate our manufacturing footprint and continued to benefit from restructuring initiatives, in Curaçao, Guatemala, Malaysia, Mexico, Uruguay and Venezuela. All factory closures were executed flawlessly and with no disruptions. In February of this year, we announced a new cost and productivity savings target for 2013 of a further $300 million.

We successfully conducted a number of capital market transactions in 2012. We issued an aggregate of $5.6 billion in bonds and, in so doing, extended the weighted-average time to maturity of our long-term debt from 8.2 to 10.1 years and reduced the weighted-average coupon of our bond portfolio from 4.8% in 2011 to 4.2% in 2012.

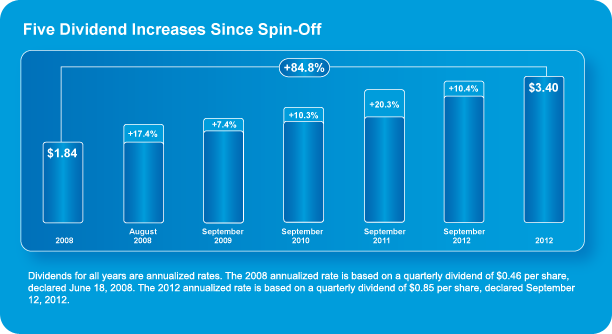

On August 1, 2012, we began repurchasing shares under a new three-year $18.0 billion share repurchase program that was authorized by our Board of Directors in June last year. In September, we increased our annual dividend by 10.4%. Since the spin-off, we have increased the dividend payout by 84.8% and have spent $27.9 billion through the end of 2012 to repurchase 489.0 million shares, representing 23.2% of shares outstanding at that time, at an average price of $56.96 per share.

Our total shareholder return (TSR) in 2012 was 10.6%. Since the spin-off, our TSR of 103.5% in U.S. dollar terms surged ahead of that of our Compensation Survey Group (37.3%), our Tobacco Peers (57.2%), the S&P 500 Index (20.6%) and the FTSE 100 (1.1%). Our three-year rolling TSR performance of 96.7% was such that the only company we trailed in the top 25 S&P 500 Index companies was Apple Inc.

Arguably our greatest achievement in 2012 was the growth of Marlboro. With its architecture firmly in place, complemented by the advent of the new campaign, which you will see featured later in this Annual Report, and the continued roll-out of an array of line extensions across all three pillars of Red, Gold and Fresh, Marlboro continued to expand its share on a global basis. In fact share grew across all four Regions, underscoring its enhanced brand equity, relevance and renewed vitality. Share growth in our EU Region, of 0.3 points to 18.3%, was particularly gratifying and marked a watershed turnaround after several years of share erosion in this geography.

Other brands fared strongly too. Of particular note was the excellent performance of above-premium Parliament, which grew shipment volume by 10.1%, and L&M with a growth rate of 4.0%. Both brands benefited from the roll-out of new packaging initiatives and the launch of several new line extensions including, in the case of Parliament, the industry’s first-ever recessed filter capsule product.

The Fiscal, Regulatory and Illicit Trade Environment

Our solid volume and, indeed, strong underlying product mix performance was due, in part, to the reasonable excise tax environment that prevails internationally. Our consistent efforts to seek longer-term predictability on excise tax rates and structure continue to be rewarded with several key countries adopting, and in certain instances prolonging, multi-year plans. From time to time there are disruptive exceptions, but these have tended to become less numerous and less frequent. This year we have the Philippines. While the increases there are without precedent, one should note that the structure adopted is in line with the trend observed elsewhere and, accordingly, is favorable if one takes the longer-term view.

On the regulatory front, 2012 was marked by a number of actions and achievements that not only contributed to our annual results but also enhanced our longer-term competitiveness and growth prospects. Regretfully, there were also a number of setbacks or lack of progress on some key regulatory initiatives, the most obvious of which was the implementation of plain packaging legislation in Australia in December of last year. However, legal and commercial considerations in other jurisdictions, combined with ongoing efforts to challenge Australia through the claim we have lodged pursuant to the Hong Kong-Australia Bilateral Investment Treaty, and the World Trade Organization proceedings, which have been commenced by several nations, lead us to hope that this extreme regulatory measure will not spread beyond Australia’s borders.

In December last year, the European Commission issued its long-awaited proposed revision to the European Union Tobacco Products Directive. This proposal is now under consideration by the European Parliament and the European Council, where it may undergo further changes. The Commission has said it expects its final proposal to be adopted in 2014 and come into effect from 2015 to 2016. In its current form, the Commission’s proposal includes extreme provisions, such as excessively large health warnings, standardization of pack formats, as well as a ban on slimmer-diameter cigarettes and menthol, without any sound evidence that implementation of these measures would achieve the Commission’s public health objectives. In addition, the proposal would significantly limit consumer access to, and information about, products that have the very real potential to reduce the risk of smoking-related diseases in comparison to conventional cigarettes. We remain hopeful that these numerous flaws will be addressed over the coming months to ensure that the EU implements a regulatory framework for tobacco products in Europe that is fair, science-based and effective in reducing the harm caused by smoking and avoiding a surge in illicit trade.

Elsewhere, Brazil’s National Health Surveillance Agency (ANVISA) issued a resolution effective September 2013 that would essentially ban almost all ingredients and additives, including menthol. This resolution, unless reversed, will force modifications to products that constitute more than 95% of the cigarette market and fuel the already significant penetration of illicit products in Latin America’s largest cigarette market. Several legislative and legal actions are under way to overturn this resolution permanently, the final outcomes of which remain to be seen.

While we have witnessed some improvement in various countries, the global prevalence of illicit trade in cigarettes continues to be a growing and insidious issue. Our determination to address illicit trade was given fresh impetus last year through the creation of a well-staffed and centralized organizational structure, an agreement with INTERPOL and sustained progress on the Codentify tracking and tracing technology. We continue to engage with governments in an effort to ensure they are made fully aware of the undesired consequences of implementing flawed fiscal or regulatory policies, specifically their impact on the levels of illicit trade.

Business Development, Research & Development and Environmental Health & Safety

During 2012, we announced plans to build one or two NGP manufacturing facilities in Europe with an initial capacity of 30 billion units, investing €500–€600 million over three years in the process, with a goal of commercialization in 2016/2017. We expect to break ground on the first site this year.

We have finalized all elements required to conduct a series of human clinical trials in different venues with both global and regional clinical research organizations and have concluded a plan and methodology to conduct consumer perception and behavior studies in line with draft guidelines published by the U.S. Food and Drug Administration.

On the environmental front we continued to make great strides and remain on track to achieve our targets for 2015 and beyond. Our 2012 Carbon Disclosure Project submission qualified us for the Carbon Performance Leadership Index. We are the only consumer staples company in the S&P 500 Index to have achieved such recognition and one of only five from the FTSE Global 500 Index. All the more impressive is that only 16 companies in the S&P 500, and 34 in the FTSE Global 500, are listed in this 2012 Leadership Index.

We continue to vigorously address labor issues in the tobacco supply chain, and our efforts are beginning to generate profound changes in numerous countries. These efforts have not gone unnoticed and have been the subject of public recognition from the U.S. Department of Labor and State Department, among others.

Continued progress was observed on virtually all Operations’ key performance indicators. Particularly noteworthy was the significant improvement in our lost-time injury rate resulting from the unrelenting focus on safety in the workplace. While our fleet safety record improved modestly, this remains an area that requires further significant improvement in 2013 and beyond.

The Organization

I believe morale within the organization is strong, in part due to our solid results and shareholder returns, but also as a result of a deeper and growing understanding that our challenges are manageable and that these pale in comparison to the opportunities that lie ahead. There is a better understanding of our strategies at all levels, less risk aversion, visible signs of sustained investment in the future and recognition that the numerous initiatives that have been put in place over the last few years are bearing fruit.

We continue to benefit from the tremendous experience of our Board of Directors. The complete transparency between the Board and management leads to a rather exceptional atmosphere.

This month our Board of Directors announced that André Calantzopoulos will become our Chief Executive Officer immediately following the Annual Meeting of Shareholders on May 8, 2013. I have known André for more than 27 years, and I cannot think of a better qualified and prepared individual to take on this significant task. André has been the architect of numerous initiatives and the principal contributor to our strong performance since we became an independent company. I am convinced that with him at the helm our future success will be assured. I am genuinely pleased that, at the request of the Board and of André, I will continue to serve this great company as Chairman of the Board and remain an employee.

After some 35 years of service at this company and its prior parent, 11 of which were in the role of Chairman and Chief Executive Officer, I believe the time has come for me to relinquish my executive role and pass the baton to a most-deserving successor. I have had a great run, and it has been a real privilege to serve you, our shareholders, our Board and the fabulous management team and employees of this wonderful company. Our future is brighter than ever, and I sincerely believe that our best days lie ahead.

I could never have imagined back in 1978 that I would be lucky enough to have had such a wonderful career. While history will be the ultimate judge of my accomplishments, my greatest source of pride and satisfaction has been to be associated with countless talented, committed and inspiring individuals who have worked and will continue to work for our company. My most heartfelt gratitude goes out to each and every one of them.

The Year Ahead

We enter 2013 with considerable momentum, solid plans and cautious optimism. Challenges will inevitably arise, or become more acute, but we are more than equipped to deal with them. We remain steadfast in our commitment to generously reward our long-term investors by building on the tremendous success of our first five years as a public company. This success is a direct reflection of the vision of our formidable Board of Directors, the considerable expertise of our superior management leadership team and the quality and unerring dedication and professionalism of our talented workforce.

Louis C. Camilleri

Chairman of the Board and Chief Executive Officer

March 13, 2013

Chairman of the Board and Chief Executive Officer

“Our company is blessed with a diverse pool of superb talent that, with unwavering passion and commitment to excellence, is the driving force behind our performance. Our Annual Report this year celebrates our first five years as a public company and showcases our talented people, our unparalleled brand portfolio and our exceptional business performance around the world.”