Letter to Shareholders

PMI delivered a very strong performance in 2015, despite an increasingly complex business environment, as well as the sharp appreciation of the U.S. dollar, which acted as a significant drag on our reported results.

This performance underscores the resilience of our business, our broad and balanced geographic footprint, the strength of our world-class brand portfolio and, above all, the motivation and focus of our organization.

iQOS: A New Era in Tobacco

The commercialization of iQOS continued in 2015, with the first wave of expansion in Japan, further city launches in Italy beyond Milan, and city launches in Bucharest, Lisbon and Moscow, as well as six cities in Switzerland. In many launch cities we have opened iQOS flagship stores.

Eight Consecutive Dividend

Increases Since the Company's Spin-Off

Investor Relations App

Stay up to date with access to all PMI’s previously disclosed investor relations materials.

Dear Shareholder,

PMI delivered a very strong performance in 2015, despite an increasingly complex business environment, as well as the sharp appreciation of the U.S. dollar, which acted as a significant drag on our reported results.

Chief Executive Officer

Chairman of the Board

This performance underscores the resilience of our business, our broad and balanced geographic footprint, the strength of our world-class brand portfolio and, above all, the motivation and focus of our organization.

Against a backdrop of improving industry volume trends in many key geographies, our cigarette brand portfolio performed superbly, driven by the Marlboro 2.0 Architecture, our enhanced commercial approach and the investments that we made in 2014 to address key market challenges. Last year also marked an important milestone for our Reduced-Risk Products(1) portfolio, with the geographic expansion of iQOS in Japan and Italy; city launches in Portugal, Romania, Russia and Switzerland; increased investments in preparation for further launches in 2016; and significant progress on our risk assessment and evidence package.

2015 Results

Cigarette volume of 847.3 billion units in 2015 declined by 1.0% versus the prior year. The decrease primarily reflected the impact of lower industry volume, partly offset by market share growth in the European Union (EU), Eastern Europe, Middle East & Africa (EEMA) and Latin America & Canada (LA&C) Regions. This was our best cigarette volume performance, excluding acquisitions, since 2012, driven mainly by a moderation in the cigarette industry volume decline, notably in the EU Region.

Our market share performance in 2015 was strong. Total PMI share, excluding China and the U.S., increased by 0.2 percentage points to 28.7%, with growth in the EU, EEMA and LA&C Regions of 0.1, 0.3 and 0.5 percentage points, respectively, and stable share in Asia. Importantly, we registered a growing or essentially flat share in 20 of our top-30 operating companies income (OCI)(2) markets.

Marlboro, the number one cigarette brand worldwide, enjoyed a very robust performance, driven by the continued roll-out of the 2.0 Architecture, which is now available in approximately 100 markets. The brand recorded a 0.9% increase in cigarette shipment volume, reflecting growing or stable share in all Regions. Our Be Marlboro global marketing campaign significantly enhanced the brand’s key image dimensions and appeal among adult smokers. The performance of Marlboro was further supported by a pipeline of innovative product offerings.

We were also pleased with the performance of our other key international brands. Cigarette shipment volume for L&M, our second-largest brand, increased by 3.9%. The brand’s market share grew by 0.2 percentage points to 3.3%, excluding China and the U.S., driven by particularly strong growth in the EEMA Region. Chesterfield recorded a solid performance in the EU Region, where it ranks as the third-largest cigarette industry brand by volume, behind Marlboro and L&M, and grew share by 0.2 percentage points to 5.8%.

Reported net revenues, excluding excise taxes, of $26.8 billion declined by 10.0% versus 2014. Excluding currency and acquisitions, net revenues grew by 5.8%. Favorable pricing of $2.1 billion was the key driver of this growth, led mainly by Argentina, Canada, Germany, Indonesia, Korea and Russia. Although unfavorable volume/mix weighed on net revenues, the adverse impact of $325 million was considerably lower than the $1.3 billion impact in 2014.

Robust EPS Growth Adjusted Diluted, Excluding Currency

Adjusted OCI of $11.0 billion declined by 12.4% versus 2014. Excluding currency and acquisitions, adjusted OCI grew by 6.6%. Adjusted OCI margin increased by 0.3 percentage points to 42.6%, on the same basis, driven by the EEMA and LA&C Regions.

This adjusted OCI margin expansion is noteworthy considering our decision to deploy additional investments to support the strong momentum of our cigarette brand portfolio and accelerate the geographic expansion of iQOS. The investments resulted in a constant currency cost base increase of 3.6% excluding RRPs, or 5.3% including RRPs. In 2016 we expect our total cost base, including RRPs, to increase by approximately 1%, excluding currency, reflecting certain non-recurring expenses, productivity and cost savings programs, and moderating prices for key inputs such as tobacco leaf, cloves and direct materials. Our mid-term targeted annual cost base increase is 1% to 3%, excluding RRPs and currency.

Adjusted diluted EPS of $4.42 declined by 12.0% versus 2014, with currency representing an unprecedented headwind of $1.20 per share. Excluding currency, adjusted diluted EPS increased by a strong 12.0%.

Free cash flow increased by $319 million, or 4.8%, to reach $6.9 billion in 2015. This was a remarkable achievement considering the adverse currency impact of $2.0 billion and was driven by higher net earnings and a range of important working capital initiatives implemented during the year.

Last September the Board of Directors approved an increase in our quarterly dividend to an annualized rate of $4.08 per share, reflecting its strong confidence in our business fundamentals and future prospects. This marked the eighth consecutive dividend increase since the company’s spin-off and represents a total increase of 121.7%, or a compound annual growth rate of 12.0%.

We continued to access the capital markets at very favorable rates in 2015, raising $1.25 billion over the course of the year and reducing the weighted-average all-in financing cost of our total debt by 0.2 percentage points to 3.0%. The weighted-average time to maturity of our total long-term debt stood at 10.5 years at the end of 2015, broadly in line with the prior year.

Fiscal, Regulatory and Illicit Trade Environment

Eight Consecutive Dividend Increases Since the Company's Spin-Off

Our strong pricing performance last year was supported by a largely rational international excise tax environment. Encouragingly, we continued to see improvements in fiscal structures in a range of markets, such as Germany and Italy. Unfortunately, there were some exceptions, the most notable being South Korea’s 120% excise tax increase in January 2015, which resulted in a cigarette industry volume decline for the full year of approximately 17% after adjusting for inventory movements.

Looking forward, we see a number of opportunities to further improve the fiscal structures in certain key markets and are actively working on this front. This includes seeking a further reduction in tax yield gaps between cigarettes and fine cut products.

Strict regulation of cigarettes is necessary given the health effects of the product. From a business perspective, we have proven that we can compete successfully in highly restrictive environments.

Currently, plain packaging is a focus of regulation in certain countries. There are two distinct aspects to plain packaging. One is the question of principle regarding the protection of intellectual property, including trademark rights, and the related deprivation that has been at the center of our arguments both with regulators and in various legal proceedings. The second aspect relates to the actual impact of plain packaging on market dynamics.

Regarding the question of principle, we are disappointed that in our case against Australia under the bilateral investment treaty with Hong Kong we will not have the opportunity to debate the merits due to a jurisdictional issue. However, there are still important cases pending with the World Trade Organization and the U.K. High Court. We will know their outcomes in the course of this year.

Regarding the effect of plain packaging on market dynamics, we do not anticipate any material impact on total consumption, as confirmed by the evidence from Australia. Therefore, the question is the impact on illicit trade and, over time, on brand equity, potential downtrading and pricing power, if any. There is no simple general answer, as the outcome will depend on specific market structures and dynamics. Overall, given the depth of our brand portfolio and excise tax structures that exist or can be adopted, we believe that the commercial impact of plain packaging should be manageable.

We are working to ensure that member states transpose the EU Tobacco Products Directive into national legislation by the May 2016 deadline without additional unreasonable restrictions and with the appropriate regulatory frameworks for RRPs.

While illicit trade continues to be a significant issue for the industry and governments, we witnessed important progress in 2015. The most notable improvement was in Turkey, where better enforcement led to a significant reduction in illicit prevalence. We also saw progress in the EU Region, driven by Germany and Spain. We remain determined to further combat illicit products through ongoing coordination with the relevant authorities.

Reduced-Risk Products and Research & Development

Marlboro Market Share Momentum Note: Total Marlboro share, excluding China and the U.S. Source: PMI Financials or estimates

We continue to make significant progress on the development, scientific assessment and commercialization of our Reduced-Risk Product portfolio. Our goal is to lead a full-scale effort to ensure that RRPs ultimately replace cigarettes to the benefit of adult smokers, society, our company and our shareholders. Important milestones in 2015 included the geographic expansion of iQOS in Japan and Italy, as well as the further deployment of iQOS in cities in Portugal, Romania, Russia and Switzerland. Last month, we launched iQOS in Kiev, Ukraine, as part of our plan to be present in key cities in approximately 20 markets by the end of this year.

Japan is by far our most advanced iQOS launch market in terms of geographic coverage. In the last week of January of this year, we achieved an estimated offtake share for Marlboro HeatSticks of 1.6% in the geographic expansion area and 2.4% in Tokyo, with steady weekly offtake share growth since the first wave of expansion began in September 2015.

While the commercialization of RRPs has been a complex undertaking, compounded by a landscape lacking clear, category specific fiscal and regulatory frameworks, we are very pleased with our progress to date. We have gained vital knowledge from our pilot launches relating to route-to-market, consumer engagement and required organizational know-how, which we are leveraging as we launch iQOS in new geographies. Importantly, our supply chain and after-sales service processes are working very well. We remain extremely optimistic about the potential of the product, particularly since our core selling messages for the product have so far focused on convenience benefits only, such as no ash and less smell.

Marlboro 2.0

Marlboro continues to benefit from the roll-out of the 2.0 Architecture – now available in approximately 100 markets – driving its global market share in 2015, excluding China and the U.S., to its highest level since the company’s spin-off in 2008 and further reinforcing its position as the number one cigarette brand worldwide.

We proceeded as planned in 2015 with the scientific substantiation of risk reduction for iQOS. The pre-clinical assessment has been completed, and non-clinical studies have demonstrated promising results. Furthermore, our three-month ad libitum exposure study data showed that using iQOS results in a reduction in exposure biomarkers approaching the levels measured in smokers who quit for the duration of the study. In addition, we commenced our longer-term (6 to 12 months) exposure response and cessation studies, which will finish in 2016 and 2017, respectively. Based on the totality of our evidence thus far – non-clinical, clinical, and perception and behavioral assessment studies – we expect to proceed with our modified-risk tobacco product (MRTP) application to the U.S. Food & Drug Administration (FDA) toward the end of this year. In 2015 we published over 30 RRP-related book chapters and scientific articles in peer-reviewed journals describing our methods and results in both non-clinical and clinical sciences.

We also made important advances across our broader RRP portfolio in 2015. Platform 2, our second heat-not-burn product, remains on track for both non-clinical and clinical assessment as well as an initial city test later this year. We further progressed with the development and pre-clinical testing of our Platform 3, a nicotine-containing aerosol product based on acquired technology, and aim to begin commercialization in early 2017 with a city test. We are represented in the e-vapor category via Platform 4, reflecting our acquisition of Nicocigs in the U.K. in 2014 and the 2015 launch in Spain of products based on our cross-licensing agreement with Altria Group, Inc. Our next generation of e-cigarette products is also under development and should be ready for commercialization in the last quarter of 2016. Pre-clinical and non-clinical assessments of this platform are under way.

From a fiscal perspective, we witnessed a number of significant positive developments for iQOS HeatSticks in 2015. Several countries have established dedicated excise tax categories for non-combustible heated tobacco products. Additionally, in a range of other markets, HeatSticks have been classified in existing tobacco excise tax categories other than cigarettes.

iQOS

The commercialization of iQOS continued in 2015, with the first wave of expansion in Japan, further city launches in Italy beyond Milan, and city launches in Bucharest, Lisbon and Moscow, as well as six cities in Switzerland. In many launch cities we have opened iQOS flagship stores, such as the one pictured here in the Shibuya district of Tokyo.

We continue to engage governments, as well as relevant scientific institutions and experts, on RRP regulation and are increasing our presentations of PMI’s science in both scientific and public policy forums.

Business Development and Manufacturing Footprint Optimization

We continued to focus on a number of important business development initiatives during the year, most notably in North Africa, the Middle East and sub-Saharan Africa.

In the U.K., we successfully completed the takeover of our distribution from a competitor. Having control over our own commercial resources in this profitable market will significantly enhance our brand support, portfolio expansion and RRP roll-out capabilities going forward.

Our Indonesian affiliate, Sampoerna, completed a rights issue last November to comply with a national stock exchange regulation. The transaction resulted in an implied valuation of approximately $26.4 billion for Sampoerna, slightly above 29 times analyst consensus projections for 2016 net earnings.

Our manufacturing footprint was further optimized in 2015 across a number of areas. This included the outsourcing of our leaf business in the U.S., the right-sizing of our factory in the Philippines and a hand-rolling production center in Indonesia, and the closure of facilities in Pakistan and Poland.

Environment, Health and Safety

In 2015 we continued to demonstrate our strong commitment to the environment and again were awarded CDP “Climate ‘A’ List” status. This placed PMI in the top 5% of the world’s largest 2,000 companies which are assessed on data that measure actions to reduce their carbon footprint, as published in the CDP Global Climate Leaders Report. We also received a 100% Carbon Disclosure rating – for comprehensive and transparent reporting on climate change – placing us in a very small group of leaders in this area. Furthermore, we surpassed our manufacturing targets to reduce carbon emissions and water consumption by 20% compared to 2010. Additional information on our climate change key performance indicators and results is available at www.pmi.com/carbon.

Our safety performance has been outstanding, as we further reduced injury rates in our factories and our fleet of vehicles by more than 50% over the last three years.

Russia

Guided trials are an integral part of our iQOS launch strategy and play an important role in educating adult smokers about the product’s attributes and benefits. In Russia, where Parliament is the benchmark of quality, prestige and elegance, Parliament HeatSticks have been introduced with the brand’s distinctive Recessed Filter.

We also continued the implementation of our Agricultural Labor Practices Program to eliminate child labor and other labor and human rights abuses in our tobacco-growing supply chain. Implemented in partnership with Verité, the leading not-for-profit organization in supply-chain responsibility, the program currently reaches over 450,000 farms in approximately 30 tobacco-growing countries. External stakeholders continue to recognize PMI’s leadership, with the U.S. Department of Labor recently highlighting the enforcement of our “rigorous child labor policy on all U.S. farms.”

The Organization

We continue to invest in the advancement of gender balance as well as diversity and inclusion within the company – key organizational development priorities – and made tangible progress in 2015.

Last year the Compensation and Leadership Development Committee of our Board of Directors substantially revamped our executive compensation program to strengthen the link between pay and performance, to better reflect current market practices, and to even more strongly align the longer-term interests of executives and shareholders. Details of the new program can be found in our 2016 Proxy Statement.

Finally, we believe that the relationship between management and the Board continues to be governed by total transparency, trust and a very positive atmosphere. We look forward to another fruitful year with such a formidable group.

The Year Ahead

Our business fundamentals are robust, and the strategic initiatives that we have in place will serve to enhance them further, enabling us to continue to grow our business and to generously reward our shareholders over the mid to long term. While currencies undeniably play a pivotal role in our shareholder value creation potential, we anticipate that the related headwind impacting our reported results will moderate this year compared to 2015.

iQOS and our other RRPs constitute our single-largest growth opportunity. We will maintain our uncompromising commitment to secure their success and continue leading the way forward for the industry.

Most importantly, we are blessed with a highly focused, motivated and increasingly agile organization that consistently demonstrates the ability to successfully adapt to the varied challenges that we face. Our confidence in PMI’s future growth prospects is based on the recognition that our employees are our most valuable asset. Their passion and talent deserve our sincerest gratitude.

André Calantzopoulos

Chief Executive Officer

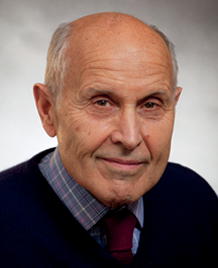

Louis C. Camilleri

Chairman of the Board

March 4, 2016

- (1)Reduced-Risk Products (RRPs) is the term the company uses to refer to products with the potential to reduce individual risk and population harm in comparison to smoking cigarettes.

- (2)Operating companies income (OCI) is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income)/loss in unconsolidated subsidiaries, net.

Board of Directors

H. Brown

H. Brown

A. Calantzopoulos

A. Calantzopoulos

L.C. Camilleri

L.C. Camilleri

W. Geissler

W. Geissler

J. Li

J. Li

J. Makihara

J. Makihara

S. Marchionne

S. Marchionne

K. Morparia

K. Morparia

L.A. Noto

L.A. Noto

F. Paulsen

F. Paulsen

R.B. Polet

R.B. Polet

S.M. Wolf

S.M. Wolf

Harold Brown 2,3,5

Counselor, Center for Strategic and International Studies

Director since 2008

André Calantzopoulos

Chief Executive Officer

Director Since 2013

Louis C. Camilleri

Chairman of the Board

Director since 2008

Werner Geissler 1,2,3,5

Operating Partner, Advent International

Director since 2015

Jennifer Li 1,3,4

Chief Financial Officer, Baidu, Inc.

Director since 2010

Jun Makihara 1,3,5

Retired Businessman

Director since 2014

Sergio Marchionne 3,5

Chief Executive Officer,

Fiat Chrysler Automobiles N.V.

Chairman, Ferrari N.V.

Chairman, CNH

Industrial N.V.

Director since 2008

Kalpana Morparia 3,4,5

Chief Executive Officer, J.P. Morgan India Private Ltd.

Director since 2011

Lucio A. Noto 1,2,3,4

Managing Partner, Midstream Partners, LLC

Director since 2008

Frederik Paulsen 3,5

Chairman, Ferring Group

Director since 2014

Robert B. Polet 2,3,4,5

Chairman, Safilo Group S.p.A.

Chairman, Rituals BV

Chairman, NSG Apparel BV

Director since 2011

Stephen M. Wolf 1,2,3,4,5

Managing Partner, Alpilles, LLC

Director since 2008

- Committees

- Presiding Director, Lucio A. Noto

- 1Member of Audit Committee, Lucio A. Noto, Chair

- 2Member of Compensation and Leadership Development Committee, Stephen M. Wolf, Chair

- 3Member of Finance Committee, Jennifer Li, Chair

- 4Member of Nominating and Corporate Governance Committee, Kalpana Morparia, Chair

- 5Member of Product Innovation and Regulatory Affairs Committee, Harold Brown, Chair

Company Management

(left to right):

Frederic de Wilde

President, European Union Region

Drago Azinovic

President, Eastern Europe, Middle East & Africa Region and PMI Duty Free

Jacek Olczak

Chief Financial Officer

André Calantzopoulos

Chief Executive Officer

Marc S. Firestone

Senior Vice President and General Counsel

Jeanne Pollès

President, Latin America & Canada Region

Martin King

President, Asia Region

(left to right):

Andreas Kurali

Vice President and Controller

Patrick Brunel

Senior Vice President and Chief Information Officer

Peter J. Luongo

Vice President, Treasury & Planning

Miroslaw Zielinski

President, Reduced-Risk Products

James R. Mortensen

Senior Vice President, Human Resources

Marco Mariotti

Senior Vice President, Corporate Affairs

Antonio Marques

Senior Vice President, Operations

Werner Barth

Senior Vice President, Marketing & Sales

Jerry Whitson

Deputy General Counsel and Corporate Secretary

PDF Downloads

- Comparison of Five-Year Cumulative Total Shareholder Return

- Selected Financial Data — Five Year Review

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Balance Sheets

- Consolidated Statements of Earnings

- Consolidated Statements of Comprehensive Earnings

- Consolidated Statements of Stockholders' (Deficit) Equity

- Consolidated Statements of Cash Flows

- Notes to Consolidated Financial Statements

- Report of Independent Registered Public Accounting Firm

- Report of Management on Internal Control Over Financial Reporting

- Reconciliation of Non-GAAP Measures