Dear Shareholder,

In 2018, we achieved robust results from our combustible tobacco portfolio and nearly doubled our heated tobacco unit (HTU) in-market sales volume, driven by growth in all IQOS markets. We fell short of our full-year net revenue growth target provided in February 2018, which was almost entirely attributable to lower-than-anticipated IQOS consumer acquisition in Japan and related distributor HTU inventory adjustments. This was a disappointment in an otherwise robust financial and strategic performance across the business.

André Calantzopoulos

Chief Executive Officer

Louis C. Camilleri

Chairman of the Board

The net revenue growth shortfall contributed to an overall decline in our share price, which was otherwise pressured by broad market concerns surrounding the industry and the consumer staples sector. While we recognize that the market is the ultimate judge, we find it difficult to understand the share price impact of certain developments in the industry last year, particularly those that were very U.S.-centered and, arguably, less relevant to our international business.

Entering 2019, we believe that PMI has laid the foundation for stronger performance, thanks to significant investments in product portfolio development and organizational capabilities, including a state-of-the-art digital infrastructure to fuel our expansion. The underlying strength of our combustible product portfolio remains intact, and our smoke-free products are catalysts for accelerating substantial overall business growth.

2018 vs. 2017 Results

Total cigarette and heated tobacco unit shipment volume of 781.7 billion units decreased by 2.1%, primarily reflecting the net impact of estimated distributor inventory movements, principally related to HTUs in Japan. Excluding these inventory movements, total shipment volume was flat, comparing favorably to the 1.6% decline for the total industry, excluding China and the U.S. This represented our best annual volume performance since 2012.

We grew total cigarette and HTU market share by 0.5 percentage points, reaching 28.4% of the international market, excluding China and the U.S., driven primarily by the strong growth of our heated tobacco brands. Underlining the strength of our combined portfolio, share grew in all six of our Regions.

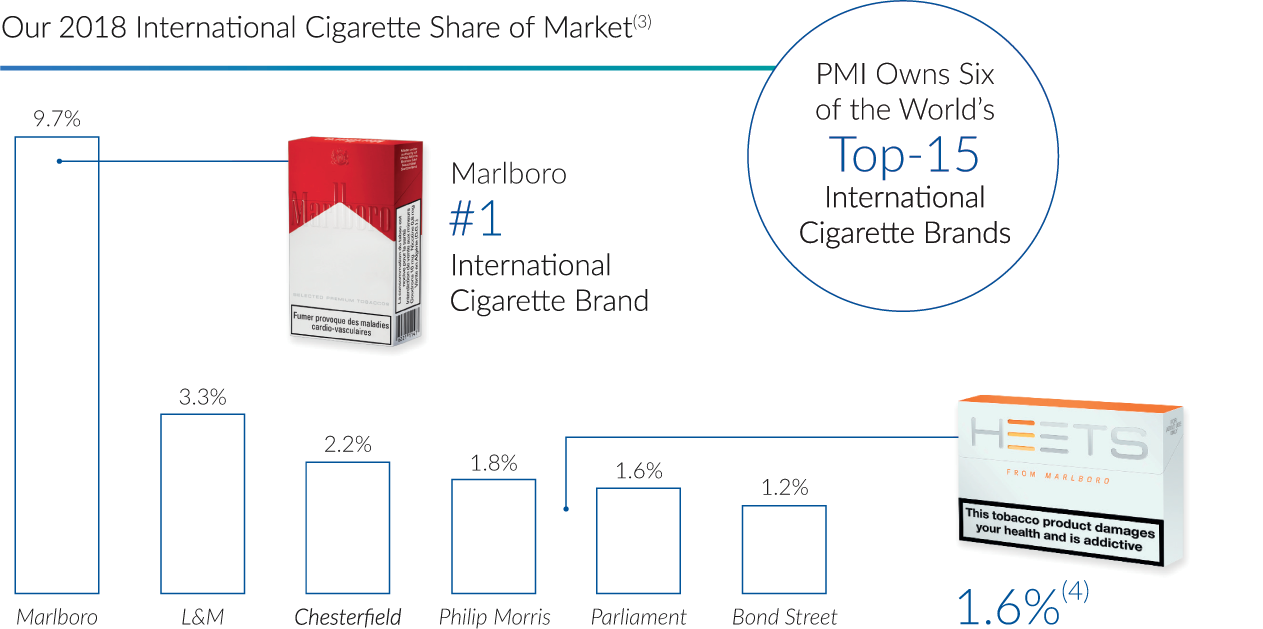

Importantly, our 27.4% share of the international cigarette category was flat, demonstrating our success in maintaining cigarette market leadership while transitioning our portfolio to a smoke-free future. Despite over-indexed out-switching to IQOS and the sizable volume contraction in Saudi Arabia during the first half of the year, Marlboro’s share of the international cigarette category was also flat at 9.7%.(1)

Net revenues of $29.6 billion increased by 3.1%, or by 3.4% excluding currency, reflecting RRP volume growth, mainly driven by IQOS in our European Union and Eastern Europe Regions, as well as our duty-free business, coupled with higher pricing for our combustible tobacco portfolio across all Regions. The inventory adjustment in Japan adversely impacted total ex-currency net revenue growth by approximately 1.2 points. The move to highly inflationary accounting in Argentina negatively impacted our currency-neutral net revenue growth by a further 0.6 points.

Operating income of $11.4 billion was down by 1.8%, or up by 0.1% excluding currency. Operating income margin decreased by 1.3 points, excluding currency, primarily reflecting net incremental investment in IQOS of approximately $600 million.

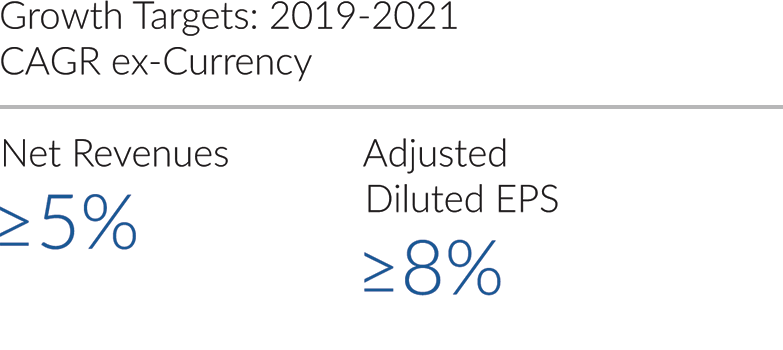

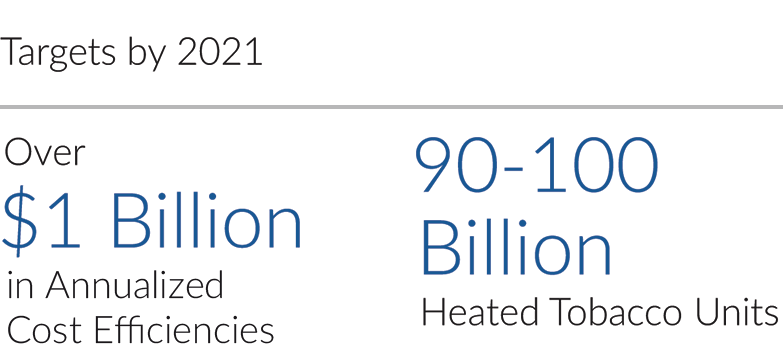

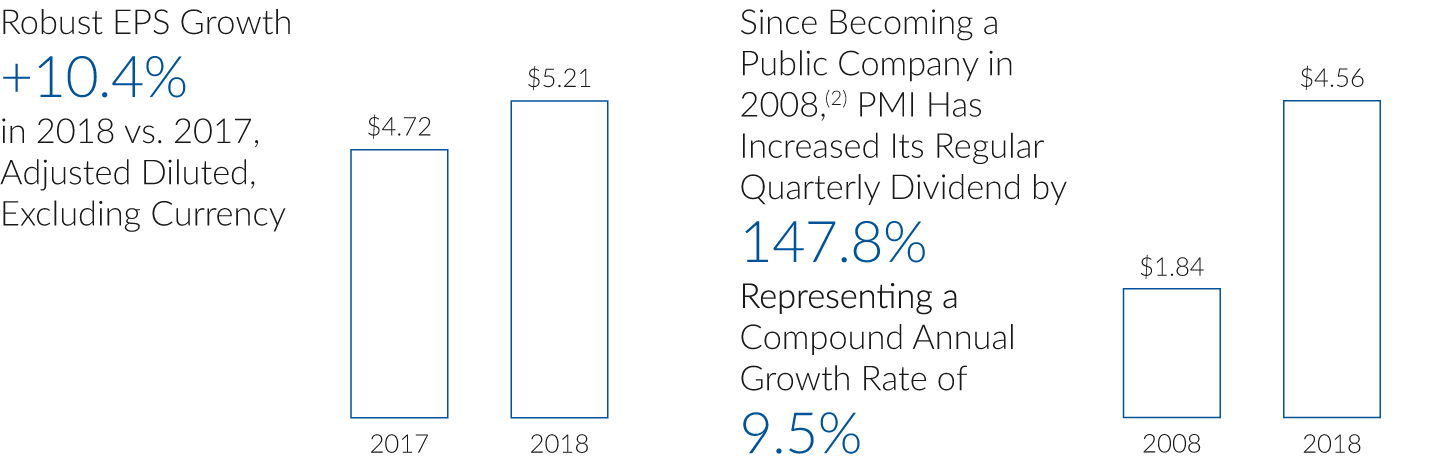

Adjusted diluted EPS of $5.10 increased by 8.1%, mainly reflecting a lower effective tax rate and net interest expense stemming from U.S. corporate tax reform, partly offset by currency. Excluding currency, adjusted diluted EPS increased by 10.4%.

Operating cash flow of $9.5 billion increased by $0.6 billion or by 6.4%, principally driven by higher net earnings, partly offset by currency. Excluding currency, operating cash flow increased by 8.9%. Capital expenditures of $1.4 billion primarily reflected further investment behind heated tobacco unit production capacity expansion.

In June, the Board of Directors approved a 6.5% increase in the quarterly dividend to an annualized rate of $4.56 per share, reflecting its confidence in the growth outlook of the business, underpinned by the potential of our smoke-free products. The increase underscored the Board’s commitment to generously reward shareholders over time.

Financing costs continued to decrease in 2018, primarily reflecting ongoing efforts to optimize our capital structure following the U.S. tax reform. Overall net interest expense was down by over 27% vs. 2017, with a 2.5% weighted-average-all-in-financing cost of total debt.

Fiscal and Regulatory Environment

Our exceptional combustible tobacco pricing variance of 7.6% in 2018 exceeded our annual average of approximately 6.4% for the period 2008 to 2017. The increase primarily reflected a largely rational cigarette excise tax environment and particularly strong pricing in Canada, Germany, Indonesia, the Philippines and Russia. Importantly, HTUs continue to be subject to excise tax classifications and structures that preserve a favorable differentiation to combustible tobacco products.

We continued to advocate for comprehensive risk-proportionate regulation for smoke-free products, believing that public health objectives regarding smoking can be met more rapidly and sustainably by fully incorporating such products into existing tobacco control policies. While widespread political endorsement has yet to emerge, a number of countries have joined the U.S. and the U.K. in recognizing better alternatives to cigarettes as important elements of policy.

Combustible Tobacco Portfolio

Our combustible tobacco portfolio has provided the resources for investing in our vision of a smoke-free future and the ultimate transformation of our business. Until we achieve our vision, we remain committed to maintaining a leading share in the international cigarette category and are managing our portfolio accordingly.

In this regard, we are focusing our combustible product innovation strategy on fewer, more impactful initiatives that can be deployed globally and swiftly. This strategy resulted in a 44% success rate for new products in 2018. Furthermore, we continued portfolio consolidation and simplification through portfolio morphing and the reduction of low-volume brands. Thanks to these efforts, our top-six international cigarette brands represented approximately 73% of total cigarette volume in 2018, up from approximately 62% in 2013.

Note: Excluding China and the U.S.

Source: PMI Financials or estimates

Reduced-Risk Product Commercialization

The year 2018 marked another meaningful step forward in our journey to replace cigarettes with smoke-free alternatives. With IQOS available in 44 markets as of year-end, our heated tobacco portfolio is now the twelfth-largest international tobacco brand, excluding China and the U.S. The number of legal age smokers worldwide who stopped smoking and switched to IQOS(5) increased by 1.9 million to reach an estimated 6.6 million, with total IQOS users(6) reaching 9.6 million. In fact, IQOS grew its user base in all launch markets, including significant growth in our EU Region and Russia. This growth in the IQOS user base drove a near-doubling of our global HTU in-market sales volume, which reached approximately 44 billion units, versus 23 billion in 2017.

The most important product milestone in 2018 was our successful global launch of the IQOS 3 and IQOS 3 MULTI devices beginning in Japan, Korea and Russia. IQOS 3 features consumer-centric enhancements, and IQOS 3 MULTI addresses the need of many consumers for consecutive use of consumables.

A key focus in 2018 was speed and effectiveness in identifying and addressing pain points along the IQOS consumer journey. This was particularly important in Japan, where the slowdown in share growth, compared to prior years, reflected lower penetration beyond the innovator and early adopter consumer segments, as well as natural experimentation by some IQOS consumers with new competitive offerings - all factors that led to a reduction in daily HTU consumption.

The global launch of IQOS 3 played an important role in addressing these issues. However, we also implemented initiatives in Japan to address the needs of more conservative adult smokers. These included a simplified registration process, deployment of more targeted communications to increase the understanding and relevance of IQOS benefits, and the introduction of HEETS consumables at a mainstream price point.

Outside Japan, we recorded sequential HTU quarterly share growth across virtually all IQOS launch markets. The standout performers included Russia, which reached a national market share in the fourth quarter of 1.8%, despite IQOS being present only in approximately 25% of the country by weighted tobacco volume, as well the EU Region, which reached a fourth quarter Regional share of 1.7%, supported by sequential share growth in all 24 launch markets. Notable examples of strong national share performance in the fourth quarter were the Czech Republic (4.2%), Greece (6.6%), Italy (3.3%), Poland (1.5%) and Portugal (4.4%). These were particularly encouraging results given that the marketing focus in these countries remained within select key cities where the shares are above the national averages. This is equally true of Japan and Russia where in Tokyo and Moscow, for example, offtake share in the fourth quarter of 2018 reached 18.8% and 7.5%, respectively.

Fourth-quarter share for HEETS in Korea increased by 1.1 points sequentially to reach 8.5%, favorably impacted by estimated trade inventory movements ahead of the change in health warnings on heated tobacco products in late December.

Notably, IQOS continues to have high conversion rates across all markets – with converted/predominant(7) rates ranging from 70% to 90%.

“We’ve built the world’s most successful cigarette company, with the world’s most popular and iconic brands. But, we will be far more than a leading cigarette company. We’re building PMI’s future on smoke-free products that are a much better choice than cigarette smoking.”

We remain confident that IQOS will be launched in the U.S. The two-day hearing before the U.S. Food & Drug Administration’s (FDA’s) Tobacco Product Scientific Advisory Committee (TPSAC) in January 2018 was a very significant milestone in the history of tobacco control. The hearing showed vividly that a tobacco company that has done its homework can and should contribute to the regulatory process. Also encouraging were comments that well-known, independent experts submitted in support of our Pre-Market Tobacco Authorization (PMTA) and Modified Risk Tobacco Product (MRTP) applications.

Following the TPSAC meeting, we responded to many FDA queries related to the applications. We also submitted to the FDA our six-month Exposure Response Study (see below) and A/J Mouse Lung Cancer Study, which completed our submission of the MRTP scientific package.

With respect to other RRP platforms, we made further product development and commercialization progress. In the U.K., we launched the next generation of our Platform 4 e-vapor IQOS MESH product, which employs a new proprietary aerosolization engine, and initial results were promising. We concluded the small-scale city test of our Platform 2 heated tobacco product, TEEPS, in the Dominican Republic and are enhancing the platform based on our learnings. Finally, we also advanced the development of our Platform 3 nicotine-containing product and will initiate a clinical product use study.

The foundation of RRP commercialization efforts is PMI’s “innovation machine,” which includes unparalleled expertise in critical areas, such as technology, engineering, product development, quality assurance, scientific substantiation, design and user experience, brand retail, human insights and behavioral research, digital solutions and experience marketing, and responsible business practices. This allows us not only to respond to consumer needs, but also anticipate them and proactively create solutions.

Scientific Assessment, Engagement and Research & Development

Our scientific assessment program, outlined at www.pmiscience.com, made substantial progress last year across all four RRP platforms.

Most notably, for IQOS, our six-plus-six-month Exposure Response Study, which included nearly 1,000 participants, was completed at the end of 2017, and the study report and results for the first six-month term were submitted to the FDA in the second quarter of 2018. The study was designed to answer important questions about the effects of IQOS in actual use by adult smokers who switch to it. Results showed that all eight clinical-risk endpoints improved in smokers who switched to IQOS by the end of the six-month study and that the majority of these endpoints (five of the eight) showed statistically significant differences between smokers who switched to IQOS compared with those who continued smoking.

The communication of our science remains paramount. In 2018, we published 41 peer-reviewed scientific articles and presented at more than 100 scientific and medical conferences.

Regarding research and development, we increased our RRP-related intellectual property portfolio. Development activities are evidenced by the approximately 4,600 patents granted worldwide as at the end of 2018, with approximately 6,300 additional patent applications pending. As competition in the RRP space intensifies, patent generation and defense have become increasingly critical. We substantially enhanced our related capabilities in 2018 and were successful in addressing numerous infringements.

Manufacturing & Supply Chain

Following IQOS-related supply limitations in 2017, first on heated tobacco units and then on devices, we were able to fully address market demand by the end of the first quarter 2018. We added a second global device supplier and additional manufacturers of components. We also increased heated tobacco unit production capacity, thanks to the installation of new production lines as well as greater efficiency and lower wastage.

In 2018, we laid the foundations for the transformation of our broader value chain, focusing on delivering financial value with the agility required by our dynamic business and developing the capabilities critical to future success. This has already led to major cost efficiencies: lower tobacco leaf costs through a better sourcing footprint, factory headcount reductions through manning and shift-pattern changes, a simplified combustible tobacco portfolio, and improved metrics for material waste, tobacco yield and labor productivity.

The Organization

The transformation of our organization to deliver on our RRP ambitions is a major undertaking. It requires unprecedented consumer focus, a vastly higher degree of project complexity, and expertise in life sciences, consumer electronics, real-time communication, own retail and customer care.

In 2018, we established Global Communications as a separate function to reinvigorate outreach regarding our vision of a smoke-free future. Our overarching objective is to be present at some of the most important milestone moments where public opinion and policy come together. Through participation in major global events, we opened a dialogue with world leaders about a shared agenda of harm reduction and global health.

A critical 2018 organizational initiative was the design of an operating model aligned with the entire IQOS consumer journey - from awareness to advocacy. This new consumer-centric organization model, piloted in a selected market, is being rolled out, implementing real-time consumer feedback measurement systems, new roles and accountabilities, new organizational structures and ways of working to drive consumer focus. We measure the quality of consumer experience across all channels at each stage of the journey. Our significant investment in digital infrastructure and related capabilities is central to this greater focus on the consumer.

As we transform the company, we continue to focus on the entire operating cost base, targeting over $1 billion in annualized cost efficiencies by 2021. Key initiatives include the shift to a project-based organization model and a new zero-based budgeting program. To support net revenue growth, some of the related cost savings will be reinvested.

We remain committed to building an inclusive culture globally and enabling a diverse mix of talented women and men to achieve their full potential. To this end, an ongoing priority has been to improve our gender balance. Last year, we increased the worldwide representation of women in management to 35% and are on target to reach our goal of 40% by 2022. We continue to aim to recruit an equal number of women and men and to make sure that all have equal opportunities to develop and advance. In 2018, women accounted for 40% at a managerial level and 47% at lower levels. In addition, 38% of those promoted were women.

We continue to benefit from the tremendous experience of our Board of Directors, whose relationship with management is governed by transparency, openness, trust and collaboration. In 2018, the Board welcomed Lisa Hook, whose expertise in technology will be a valuable resource to support PMI’s business transformation.

We were deeply saddened by the passing of Board member Sergio Marchionne last year and former Board member Harold Brown earlier this year; Mr. Brown had retired from the Board in October 2018. Both had served as Directors with distinction since our transition to a public company in March 2008. They brought invaluable business and strategic insights to PMI’s Board, and we benefited tremendously from their dedicated service. They will be sorely missed.

The Year Ahead

The underlying strength of our combustible tobacco business remains intact, and there is the unprecedented opportunity for reduced-risk products to accelerate business growth and generously reward shareholders. Our transformation to a smoke-free future allows us to play a pivotal role in improving the lives of adult smokers, while securing the long-term future of our company and the sustainability of our earnings and dividend growth for years to come.

Seizing this opportunity requires us to complete the current stage of our internal transformation and continuously improve thereafter to deliver excellence to consumers. Although the task is enormous, we are confident that the talented and dedicated people of PMI will rise to the occasion.

André Calantzopoulos

Chief Executive Officer

Louis C. Camilleri

Chairman of the Board

March 8, 2019

(1) For a definition of total international market share and total international cigarette market share see page 25 of the Form 10-K.

(2) Dividends for 2008 and 2018 are annualized rates. The 2008 annualized rate is based on a quarterly dividend of $0.46 per common share, declared June 18, 2008. The 2018 annualized rate is based on a quarterly dividend of $1.14 per common share, declared June 8, 2018.

(3) Sales volume of cigarette brand as a percentage of the total industry sales volume for cigarettes.

(4) Sales volume of PMI HTUs as a percentage of the total industry sales volume for cigarettes and HTUs.

(5) “Legal age smokers who stopped smoking and switched to IQOS” is defined as, for markets where IQOS is the only heated tobacco product, daily individual consumption of PMI HTUs representing the totality of their daily tobacco consumption in the past seven days. For markets where IQOS is one among other heated tobacco products, daily individual consumption of HTUs represents the totality of their daily tobacco consumption in the past seven days, of which at least 70% are PMI HTUs.

(6) “Total IQOS users” is defined as the estimated number of Legal Age (minimum 18 years) IQOS users who used PMI HTUs for at least 5% of their daily tobacco consumption over the past seven days.

(7) “Converted/Predominant” means the estimated number of Legal Age (minimum 18 years) IQOS users who use HeatSticks/HEETS for over 95%/between 70% and 95% of their daily tobacco consumption over the past seven days, respectively.

Transformation Through Innovation

PMI is committed to a smoke-free future, which is why we are transforming our company to be the global leader in innovative reduced-risk products (RRPs).(1) We know quitting is the best option, but we want to provide better alternatives to smoking for those who don’t quit. Through heated tobacco and precision vaping products that leverage state-of-the-art technology and scientific substantiation, we aim to deliver life-changing benefits to all adult smokers. The total estimated number of IQOS users reached 9.6 million in the fourth quarter of 2018. Importantly, nearly 70% of the total – an estimated 6.6 million users – have already stopped smoking by switching to IQOS, while the balance of three million are in conversion.

Intuitive, user-friendly design.

The start of it all. IQOS 2.4 Plus was born from the need to deliver the most satisfying heated tobacco experience free from fire, smoke and ash in a way that could be made available to all smokers.

All new, elegant and intuitive.

IQOS 3 uses the latest HeatControlTM Technology that delivers the best heated tobacco experience. Its compact and ergonomic design is perfect for all tobacco moments, whatever the occasion.

Compact, all-in-one design.

The all-in-one, lightweight, pocket-sized design of the new IQOS 3 MULTI makes it perfect for use on the go. It allows for sequential tobacco sessions with no charging time between enjoying HeatSticks/HEETS.

Next generation e-vapor.

The IQOS MESH is our e-vapor product that uses a new and satisfying approach to vapor. Unlike regular e-cigarettes, MESH cartridges are manufactured, assembled, pre-filled, and pre-sealed in our European production facilities.

(1) For a definition of "reduced-risk products" see page 1 of the Form 10-K.

(2) Cigarette and heated tobacco units, excluding China and the U.S.

(3) Relates to research, product and commercial development, production capacity, scientific substantiation, and studies on adult smoker understanding.

Our Commitment to Sustainability

Focusing on What Matters

To become truly sustainable our number one priority is to address the health impacts of our products and replace cigarettes with better alternatives, while further investing in R&D to continuously improve our smoke-free product portfolio. Our sustainability strategy, which covers our products, operations and value chain, is an integral part of PMI’s business strategy toward achieving a smoke-free future.

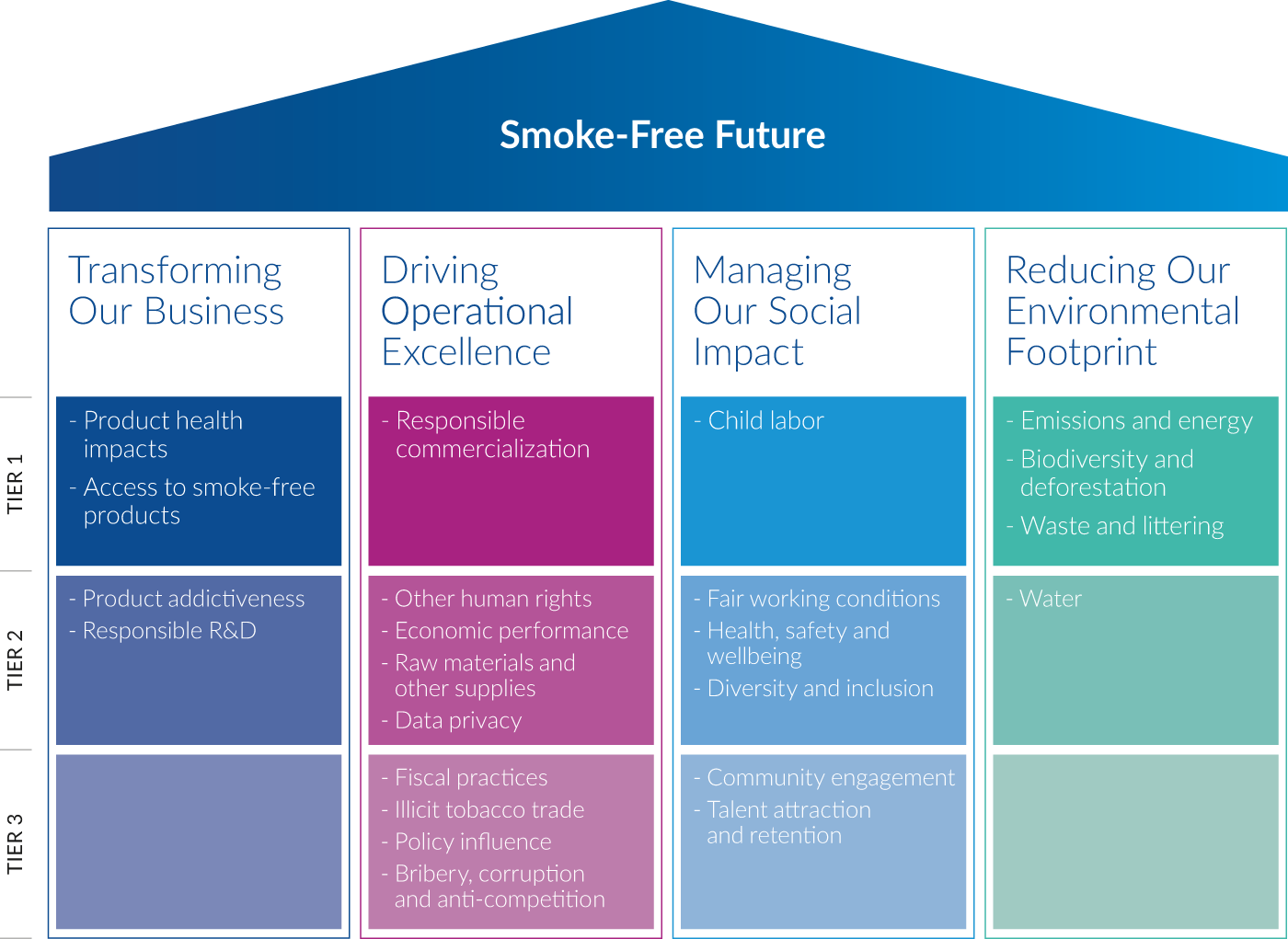

To ensure it addresses the most relevant topics and is aligned with societal expectations, we conducted a new sustainability assessment in 2018, involving a broad range of external and internal stakeholders. The assessment enabled us to refine our focus across the four pillars of our sustainability strategy, shown below.

In 2018, we further strengthened our sustainability governance. The responsibility of the Nominating and Corporate Governance Committee of the Board of Directors was extended to oversee the sustainability strategies and performance of PMI and advise the Board of Directors on sustainability matters. In addition, to further embed sustainability throughout all PMI functions and markets, we reorganized and enhanced our sustainability team and instituted dedicated committees, comprising senior leaders, which oversee cross-functional working groups.

In 2019, we will put particular emphasis on improving programs, establishing ambitious goals, carefully monitoring progress and publicly reporting performance on all tier 1 sustainability challenges.

Delivering on Our Commitment

The year 2018 saw the initiation of a number of projects, including our first pilot human rights impact assessment in Mexico and the Alliance for Water Stewardship certification of the first of our factories in Brazil. In the area of inclusion and diversity, we increased the number of women in PMI management year-over-year. Our Agriculture Labor Practices program now focuses on addressing the most recurrent and challenging issues across different geographies. We took the recycling of IQOS devices to the next level with the development of a state-of-the-art electronics recycling system, and we progressed on our green energy projects. These examples are a snapshot of our sustainability work and an indication of our ambition to become the industry’s sustainability leader.

Our Sustainability Report provides a comprehensive account of our achievements and how we seek to address the relevant topics of our Sustainability Strategy: https://www.pmi.com/sustainability.

Board of Directors

André Calantzopoulos

Chief Executive Officer

Director since 2013

Louis C. Camilleri

Chief Executive Officer,

Ferrari N.V.

Director since 2008

Massimo Ferragamo 1,3,4,5

Chairman,

Ferragamo USA Inc.

Director since 2016

Werner Geissler 1,2,3,5

Operating Partner,

Advent International

Director since 2015

Lisa A. Hook 2,3,5

Businesswoman

Director since 2018

Jennifer Li 1,3,4

Chief Executive Officer

and Managing Partner,

Changcheng Investment

Partners

Director since 2010

Jun Makihara 1,3,5

Retired Businessman

Director since 2014

Kalpana Morparia 3,4,5

Chief Executive Officer,

South and South East Asia,

J.P. Morgan Chase

Director since 2011

Lucio A. Noto 1,2,3,4

Managing Partner,

Midstream Partners, LLC

Director since 2008

Frederik Paulsen 3,5

Chairman, Ferring Group

Director since 2014

Robert B. Polet 2,3,4,5

Chairman, Rituals Cosmetics

Enterprise B.V.

Director since 2011

Stephen M. Wolf 1,2,3,4,5

Managing Partner,

Alpilles, LLC

Director since 2008

- Board and Committee Leadership

- Chairman of the Board, Louis C. Camilleri

- Presiding Director, Lucio A. Noto

- 1Member of Audit Committee, Jennifer Li, Chair

- 2Member of Compensation and Leadership Development Committee, Werner Geissler, Chair

- 3Member of Finance Committee, Jun Makihara, Chair

- 4Member of Nominating and Corporate Governance Committee, Kalpana Morparia, Chair

- 5Member of Product Innovation and Regulatory Affairs Committee, Frederik Paulsen, Chair

Company Management

André Calantzopoulos

Chief Executive Officer

Massimo Andolina

Senior Vice President, Operations

Drago Azinovic

President, Middle East & Africa Region and PMI Duty Free

Werner Barth

Senior Vice President, Commercial

Charles Bendotti

Senior Vice President, People & Culture

Frank de Rooij

Vice President, Treasury & Corporate Finance

Frederic de Wilde

President, European Union Region

Marc S. Firestone

President, External Affairs & General Counsel

Stacey Kennedy

President, South & Southeast Asia Region

Martin G. King

Chief Financial Officer

Michael Kunst

Senior Vice President, Commercial Transformation

Andreas Kurali

Vice President and Controller

Marco Mariotti

President, Eastern Europe Region

Mario Masseroli

President, Latin America & Canada Region

Deepak Mishra

Chief Strategy Officer

Jacek Olczak

Chief Operating Officer

Paul Riley

President, East Asia & Australia Region

Marian Salzman

Senior Vice President, Global Communications

Jaime Suarez

Chief Digital Officer

Michael Voegele

Chief Technology Officer

Jerry Whitson

Deputy General Counsel and Corporate Secretary

Miroslaw Zielinski

President, Science & Innovation

PDF Downloads

- Letter to Shareholders

- Transformation Through Innovation

- Our Commitment to Sustainability

- Board of Directors & Company Management

- Shareholder Information

- Comparison of Five-Year Cumulative Total Shareholder Return

- Selected Financial Data — Five Year Review

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Statements of Earnings

- Consolidated Statements of Comprehensive Earnings

- Consolidated Balance Sheets

- Consolidated Statements of Cash Flows

- Consolidated Statements of Stockholders' (Deficit) Equity

- Notes to Consolidated Financial Statements

- Report of Independent Registered Public Accounting Firm

- Report of Management on Internal Control Over Financial Reporting

- Reconciliation of Non-GAAP Measures