Financial Services

At-a-Glance

Investors; corporations, governments, and municipalities; commercial and investment banks; insurance companies; asset managers; and other debt issuers.

Asset managers; investment banks; investors; brokers; financial advisors; investment sponsors; and companies’ back-office functions, including compliance, operations, risk, clearance, and settlement.

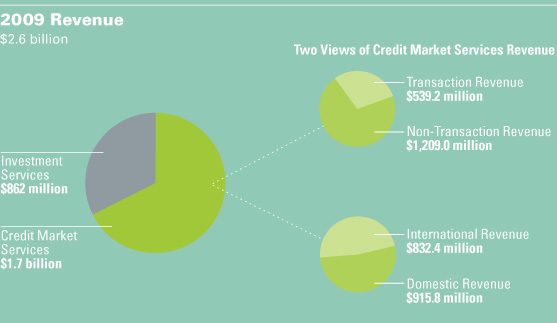

Standard & Poor’s serves the global capital markets through S&P Credit Market Services and S&P Investment Services. S&P’s resilient and diverse portfolio positions the Financial Services segment to expand in recovering and growing markets.

Standard & Poor’s

Credit Market Services

A global leader in credit ratings and credit risk analysis, Standard & Poor’s Credit Market Services provides objective and independent opinions on credit risk. Standard & Poor’s public ratings opinions are disseminated broadly and free of charge to recipients all over the world on www.standardandpoors.com. S&P’s worldwide ratings organization builds upon its extensive knowledge and deep insight through its focus on sectors, type of debt, and geographic location. Analytical teams assess issuers and debt obligations of corporations, financial institutions, insurance companies, states and municipalities, and sovereign governments, and provide insight into the credit risk associated with securitized instruments.

Standard & Poor’s

Investment Services

Standard & Poor’s Celebrates 150 Years of Leadership in Serving Capital Markets Worldwide

2010 marks the 150th anniversary of the founding of Standard & Poor’s. Standard & Poor’s traces its origins to the 1860 publication of The History of Railroads and Canals in the United States by Henry Varnum Poor, an early champion of investor rights and pioneer in the then-emerging industry of financial research and reporting, and the 1906 founding of Luther Blake’s Standard Statistics Bureau, which provided previously-unavailable financial information on approximately 100 U.S. companies.

For 15 decades and through even more business cycles, Standard & Poor’s has been an important source of financial information, insight, and analysis for millions of investors. S&P has empowered investors and markets through its lasting commitment to integrity, transparency, independence and analytical rigor, and its continual search for better and new ways to aid market participants in understanding and gaining access to markets and investment opportunities around the world.

After 150 years, S&P is still a learning institution determined to find new ways to serve capital markets more effectively, to maintain a leadership position, and to grow the business. In ratings, for example, strengthening analytics, increasing transparency, and reinforcing the integrity and value of the rating process are important steps that are enabling S&P to enhance the value of its global benchmarks for credit risk to investors.

Standard & Poor’s anniversary Web site: