Management's discussion and analysis

Capital Resources

Our capital resources consist of shareholders' equity, debt and capital securities, representing funds deployed or available to be deployed to support our business operations. The following table summarizes our capital resources at the end of the last three years:

(In millions)

December 31

1998

1997

1996

Shareholders equity:

Common equity:

Common stock and retained earnings

$5,608

$5,777

$4,993

Unrealized appreciation of investments and other

1,013

814

638

Total common shareholders' equity

6,621

6,591

5,631

Preferred shareholders' equity

15

17

216

Total shareholders' equity

6,636

6,608

5,847

Debt

1,260

1,304

1,171

Capital securities

503

503

307

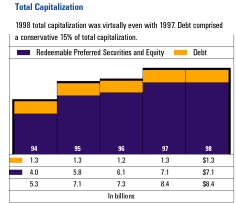

Total capitalization

$8,399

$8,415

$7,325

Ratio of debt to total capitalization

15%

15%

16%

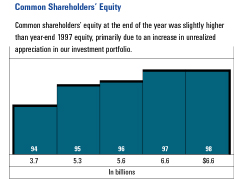

Equity - Common shareholders' equity at the end of 1998 was slightly higher than year-end 1997, as a decline in our retained earnings resulting from common share repurchases and dividends was offset by an increase in the net unrealized appreciation of our investment portfolio. Common equity at the end of 1997 grew $960 million over a year earlier, primarily due to our record net income of $929 million in 1997.

Our preferred shareholders' equity consists of the par value of Series B preferred shares we issued to our Preferred Stock Ownership Plan (PSOP) Trust, less the remaining principal balance of the PSOP Trust debt. Preferred equity at the end of 1996 also included $200 million of the former USF&G's Series A Preferred Stock, which were redeemed in 1997 through the issuance of capital securities.

Debt - Consolidated debt outstanding at the end of 1998 was down $44 million from year-end 1997, largely the result of a $75 million decline in Nuveen's debt. We issued $150 million of medium-term notes in the fourth quarter of 1998 under a shelf registration statement filed with the Securities and Exchange Commission in 1996. Proceeds were primarily used to fund our common share repurchases. The maturity of our $145 million, 7% senior notes in May 1998, as well as several medium-term note maturities throughout the year totaling $25 million, were funded through a combination of commercial paper issuances and internally generated funds. Commercial paper outstanding at the end of 1998 increased $89 million over year-end 1997. At Dec. 31, 1998, medium-term notes outstanding totaled $637 million, comprising just over one-half of our total debt. These notes bear a weighted average interest rate of 6.9%.

The $133 million increase in debt outstanding at Dec. 31, 1997, compared to a year earlier was due in part to $85 million in new debt issued by Nuveen for general corporate purposes and to purchase securities for its investment products. We also issued $82 million of medium-term notes in 1997 under our shelf registration to partially fund the maturity of our 9 3/8% notes in June 1997. In addition, we borrowed $35 million under a standby credit facility to refinance receivables outstanding related to an insurance premium finance company we acquired at the end of 1997. .

Capital Securities - Our $503 million of capital securities consist of company-obligated mandatorily redeemable preferred capital securities issued by four entities wholly-owned by The St. Paul. Each entity was formed for the purpose of issuing capital securities and the sole assets of each entity consist of securities issued by The St. Paul. We issued $196 million of capital securities in 1997 and $100 million in 1996, the proceeds of which were used to redeem an issue of $4.10 Series A Cumulative Convertible Preferred Stock, repay intercompany loans and retire borrowings outstanding against standby credit facilities. The remaining $207 million of capital securities were issued in 1995 for general corporate purposes and to repay commercial paper debt, and are convertible into shares of our common stock.

Capital Transactions - Our merger with USF&G in 1998 was a tax-free exchange accounted for as a pooling-of-interests. The St. Paul issued 66.5 million of its common shares for all of the outstanding shares of USF&G. The transaction was valued at $3.7 billion, which included the assumption of USF&G's debt and capital securities.

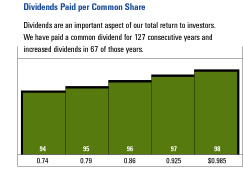

We repurchased 3.8 million common shares for a total cost of $135 million in late 1998, largely funded through the issuance of medium-term notes. We also repurchased 3.4 million shares in 1997 and 7.5 million shares in 1996 for a total cost of $128 million and $225 million, respectively. Our common and preferred dividend payments totaled $226 million in 1998, $198 million in 1997 and $200 million in 1996.

In 1997, we purchased Titan Holdings, Inc., a property-liability company in San Antonio, Texas, for a total cost of $259 million, funded through the issuance of common stock and borrowings against standby credit facilities. In 1996, we purchased Northbrook Holdings, Inc. from Allstate Insurance Company for approximately $190 million in cash from internally generated sources. Also in 1996, 1.2 million common shares were issued to redeem all of the Series B Cumulative Convertible Preferred Stock.

In February 1999, The St. Paul's board of directors increased our dividend rate to $1.04 per share, a 4% increase over the 1998 rate of $1.00 per share. Our dividend rate has grown at a compound annual rate of 7% over the last five years.

We made no major capital improvements during 1998, 1997 or 1996. Through March 1, 1999, we had repurchased a total of 8.9 million common shares at a cost of $295 million under the $500 million repurchase program authorized by our board of directors in November 1998. We may make additional repurchases during the remainder of 1999 if we deem it a prudent use of capital