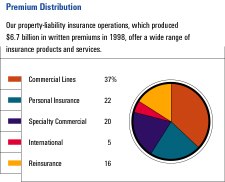

Management's discussion and analysis

U.S. Underwriting

U.S. Underwriting

Commercial Lines

The Commercial Lines segment includes our Small Commercial and Middle Market Commercial operations, which serve small and mid-sized customers in the general commercial market, our Surety business center, and several business centers which provide specialized products and services for targeted industry groups (Construction, Manufacturing, Service Industries, Special Property, National Programs and Transportation). Our Catastrophe Risk operation and the results of our limited participation in insurance Pools are also included in this segment.

Premiums - Written premiums of $2.49 billion in 1998 were nearly $300 million, or 11%, below 1997 volume of $2.79 billion. The premium decline was centered in our Middle Market and Construction operations, which together accounted for 57% of this segment's business volume in 1998. Pricing levels in these market sectors continued to erode in 1998 despite accelerating loss costs, reflecting the intense competition for market share among U.S. property-liability insurers. Our decision late in the year to selectively reduce exposures in these markets also contributed to the decline in premium volume. In addition, USF&G's exit from its unprofitable Trucking line of business in 1997 negatively impacted year-to-year premium comparisons. Small Commercial premiums of $429 million, accounting for 17% of Commercial Lines volume, were down 3% in 1998. Premiums generated by our Surety operation, now the largest in the U.S. as a result of the USF&G merger, grew to $376 million in 1998, an 18% increase over 1997. The increase primarily resulted from new business initiatives during the year.

Underwriting Result - Commercial Lines' 127.3 combined ratio for the year was over 22 points worse than the comparable 1997 ratio of 104.9. Approximately $197 million of the provision to increase USF&G's loss reserves was recorded in this segment, adding 7.5 points to the combined ratio. In addition, catastrophe losses of $138 million accounted for 5.3 points of the 1998 ratio. Catastrophe losses in 1997 totaled $62 million, adding 2.1 points to the combined ratio. Excluding the reserve strengthening provision in 1998 and catastrophes in both years, Commercial Lines' 1998 combined ratio of 114.5 was still significantly worse than 1997's comparable ratio of 102.8. Adverse development on reserves established in prior years, primarily for Middle Market and Construction business, was the chief factor in the deterioration from 1997. Deficiencies in prior risk selection, coupled with a sustained period of inadequate pricing levels, were the driving force behind our poor 1998 results in these operations. In addition, an increase in commission expenses resulting from efforts to retain certain business after the USF&G merger contributed to a 2.2 point increase in the 1998 expense ratio over 1997. Our large Surety operation, however, maintained its high level of profitability in 1998, posting a combined ratio of 79.0, virtually level with last year's ratio of 78.9.

1997 vs. 1996 - Premium volume in 1997 of $2.79 billion was slightly ahead of 1996 written premiums of $2.71 billion. The increase resulted from the incremental impact on 1997 written premiums of two acquisitions made during 1996 - Northbrook Holdings, Inc., a commercial insurance underwriting operation, and Afianzadora Insurgentes, S.A. de C.V., the largest surety bond underwriter in Mexico. Excluding these acquisitions, premiums in 1997 were down slightly from 1996, reflecting the competitive conditions prevailing throughout the commercial insurance marketplace. The 1997 combined ratio of 104.9 was virtually level with the 1996 ratio of 104.6. Improvement in Middle Market Commercial results, largely due to a decline in catastrophe losses, was offset by deteriorating loss experience in the Construction and Transportation business centers. The 1997 expense ratio was almost a point worse than 1996, reflecting the impact of ongoing integration efforts from the two 1996 acquisitions.

Outlook for 1999 - Market conditions will likely continue to deteriorate in 1999. In the second half of 1998, we began implementing comprehensive plans to address the profitability issues impacting Commercial Lines in general, and our Middle Market and Construction business centers in particular. We will focus on strict adherence to sound underwriting principles to ensure rate adequacy for individual risks, and work closely with our agents and brokers to take corrective actions on underpriced accounts and aggressive steps to retain profitable business. We expect our actions to result in a reduction of approximately $250 million in Commercial Lines' written premiums in 1999, which prompted our restructuring plan and the related charges to earnings in the fourth quarter of 1998.

Specialty Commercial

The Specialty Commercial segment includes Medical Services, Custom Markets and Professional Markets. Medical Services provides a wide range of insurance products and services to the entire health care delivery system. Custom Markets serves the following specific commercial customer groups: Ocean Marine, Surplus Lines, Technology, Oil and Gas, and Specialty Lines. Professional Markets is composed of Financial and Professional Services, which provides property and liability coverages for financial institutions and a variety of professionals, such as lawyers and real estate agents, and Public Sector Services, which markets insurance products and services to all levels of government entities.

Premiums - Specialty Commercial written premiums totaled $1.35 billion in 1998, down 4% from comparable 1997 volume of $1.40 billion. In our Medical Services business center, 1998 premiums of $490 million fell 8% short of 1997's total of $530 million. The medical malpractice market, like most other commercial markets, was characterized by intense competition and product underpricing in 1998. We elected not to aggressively participate in that environment, resulting in fewer new business opportunities and downward pressure on renewal pricing. Custom Markets' 1998 written premiums of $437 million were down 6% from 1997 volume of $467 million, predominantly reflecting a reduction in Surplus Lines business resulting from excess capacity in primary insurance markets. Premiums generated by Professional Markets of $421 million in 1998 grew 4% over the 1997 total of $404 million, primarily due to the addition of a book of Public Sector Services business resulting from our acquisition of TITAN Holdings, Inc. (Titan), a Texas-based property-liability insurer, at the end of 1997. Our Financial and Professional Services operation experienced a 4% decline in premiums from the 1997 total of $269 million.

Underwriting Result - Losses in our Medical Services operation were the primary factor in the 12.2 point deterioration in Specialty Commercial's 1998 combined ratio. We experienced a sharp increase in the severity, or average cost, per claim in Medical Services in 1998. In addition, unfavorable development on reported prior year claims, as well as a higher than expected level of newly reported claims from prior years, contributed to the $120 million deterioration in Medical Services' underwriting results compared with 1997. The magnitude of these losses overshadowed solid performances by several of our Specialty Commercial business units, including Technology, which posted a profitable 86.8 combined ratio, and Financial and Professional Services, where the combined ratio of 80.7 for the year was nearly five points better than the comparable 1997 ratio. The provision to strengthen USF&G's loss reserves had a minimal impact of $18 million on our Specialty Commercial segment in 1998. Catastrophe losses totaled $38 million in 1998, compared with losses of $21 million in 1997.

1997 vs. 1996 - Premium volume of $1.40 billion in 1997 was down slightly from the 1996 total of $1.42 billion. Medical Services' written premiums of $530 million in 1997 were 9% lower than comparable 1996 premiums of $585 million, reflecting the challenging market environment which was particularly prevalent in the health care professionals sector throughout 1996. For the remainder of Specialty Commercial, premium growth generated by new business opportunities in the Technology and Public Sector Services lines of business in 1997 was partially offset by a decline in Surplus Lines production compared with 1996. Specialty Commercial's 1997 combined ratio, while still profitable at 99.6, was 5.5 points worse than 1996 primarily due to a $56 million decline in Medical Services' profitability. Improvement in the Financial and Professional Services and Technology lines in 1997 was offset by the deterioration in Surplus Lines results.

Outlook for 1999 - We do not foresee dramatic changes in operating environments for the variety of markets served by this segment. Throughout the Specialty Commercial arena in 1999, we will intensify new product development, strengthen our agent and broker relationships and implement corrective underwriting actions in those lines where we have not achieved desired results. Aggressive expense management will also remain a priority. In Medical Services, we will continue to implement price increases for all underperforming lines of business in 1999, while at the same time taking steps to preserve our customer base and capitalize on opportunities for profitable growth in the future. In Custom Markets, we will pursue growth in our profitable Technology line, while continuing to build our new Oil and Gas and Specialty Lines operations. In Professional Markets, we will focus on maintaining and solidifying the leadership positions in the marketplace that were enhanced by the merger.

Personal Insurance

Personal Insurance provides a broad portfolio of property-liability insurance products and services for individuals. Through a variety of single line and package policies, individuals can acquire coverages for personal property - such as homes, autos and boats - and for personal liability.

Premiums - Personal Insurance written premiums of $1.42 billion in 1998 grew 13% over comparable 1997 premiums of $1.25 billion. Virtually all of the increase resulted from our December 1997 acquisition of Titan, which added a substantial book of Nonstandard Auto business to our Personal Insurance segment. Nonstandard Auto coverages are marketed to individuals who are unable to obtain standard coverage due to their inability to meet certain underwriting criteria. The addition of Titan pushed Nonstandard Auto premiums to $245 million in 1998, substantially higher than the comparable total of $76 million in 1997. Premium volume in our standard personal lines operation, at $1.17 billion, was level with 1997, reflecting the competitive marketplace conditions for homeowners and auto coverages which have reduced opportunities for appreciable rate increases or new business growth.

Underwriting Result - Catastrophe losses of $152 million dominated our Personal Insurance segment results in 1998. These losses, which accounted for 10.9 points of this segment's 1998 loss ratio, were largely the result of numerous storms throughout the United States, including several major spring storms in our home state of Minnesota that generated over 22,000 claims and $95 million in losses. Catastrophe losses in this segment totaled $45 million in 1997. In addition, $35 million of the reserve strengthening provision was recorded in this segment, accounting for 2.5 points of the loss ratio. The expense ratio of 30.3 in 1998 was 1.5 points worse than 1997's 28.8, primarily due to a change in one of our property reinsurance treaties during the year which resulted in an increase in commission expenses retained. Our Nonstandard Auto business center posted a profitable 97.7 combined ratio in 1998, a slight improvement over the comparable 1997 ratio of 99.3.

1997 vs. 1996 - Written premiums of $1.25 billion in 1997 were down $102 million, or 8%, from the 1996 total of $1.35 billion. The decline was primarily due to the ceding of $109 million of premiums under a new personal lines quota share reinsurance treaty we entered into in 1997 in connection with our efforts to realign a portion of our catastrophe reinsurance coverage. The combined ratio in our Personal Insurance segment improved by 16 points in 1997 when compared to 1996, reflecting the impact of minimal catastrophe losses and corrective pricing and underwriting measures implemented in the wake of 1996's sizable losses.

Outlook for 1999 - Capitalizing on the opportunities provided by the integration of The St. Paul's operations and systems with those of USF&G will be a key priority in 1999. We are in the process of applying the same corrective underwriting and pricing actions on USF&G's standard personal lines business that were successful in improving The St. Paul's book of this business after severe losses in 1996. The personal lines market is reaching maturity with limited potential for real growth. In that environment, our success will depend on maximizing operational efficiencies while adhering to rational underwriting standards in a marketplace characterized by an increase in price-cutting and an emphasis on brand identity.