Financial Highlights

| 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net sales | $ | 2,716.4 | $ | 2,592.0 | $ | 2,526.2 | $ | 2,269.6 | $ | 2,044.9 | |||||

| Percent increase | 4.8 | % | 2.6 | % | 11.3 | % | 11.0 | % | 5.5 | % | |||||

| Gross profit margin | 41.0 | % | 40.0 | % | 39.9 | % | 39.6 | % | 39.1 | % | |||||

| Operating income | 269.6 | 343.5 | 332.7 | 295.5 | 262.4 | ||||||||||

| Net income from continuing operations | 202.2 | 214.9 | 214.5 | 199.2 | 173.8 | ||||||||||

| Diluted earnings per share from continuing operations |

1.50 | 1.56 | 1.52 | 1.40 | 1.22 | ||||||||||

| Average diluted shares outstanding | 135.0 | 138.1 | 141.3 | 142.6 | 142.3 | ||||||||||

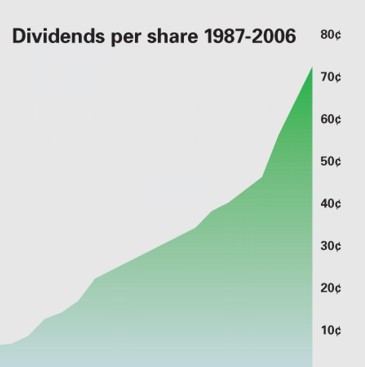

| Dividends paid per share | $ | .72 | $ | .64 | $ | .56 | $ | .46 | $ | .42 | |||||

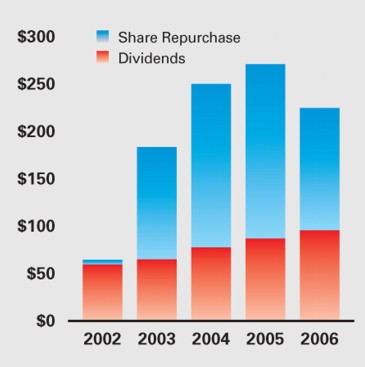

| Dividends paid | 95.0 | 86.2 | 76.9 | 64.1 | 58.6 | ||||||||||

| Share repurchases | 155.9 | 185.6 | 173.8 | 120.6 | 6.8 | ||||||||||

The financial highlights include the following impact of restructuring charges, and in 2004 the net gain from a special credit:

| 2006 | 2005 | 2004 | 2003 | 2002 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating income | $ | (84.1 | ) | $ | (11.2 | ) | $ | 2.5 | ($5.5 | ) | ($7.5 | ) | |||

| Net income | (30.3 | ) | (7.5 | ) | 1.2 | (3.6 | ) | (5.5 | ) | ||||||

| Earnings per share | (.22 | ) | (.05 | ) | .01 | (.03 | ) | (.04 | ) | ||||||

In 2006, McCormick began to record stock-based compensation expense. Stock-based compensation reduced operating income by $22.0 million, net income from continuing operations by $15.1 million and diluted earnings per share from continuing operations by $0.11. Prior year results have not been adjusted.

Our Financial Objectives

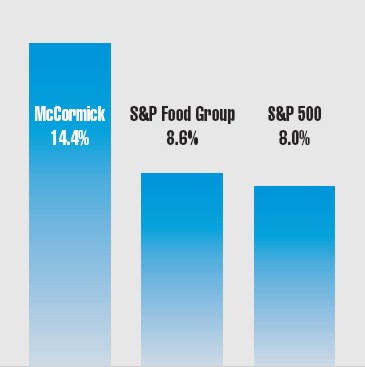

With good visibility into our business prospects and operating environment, growth objectives are used as internal goals and to provide a financial outlook for our shareholders. In 2006, annual objectives were set to grow sales 3-5% and earnings per share on a comparable basis 8-10% through 2008.

Our business generates strong cash flow which has increased in the past 10 years. Actions to grow net income and improve working capital should lead to further gains. We have consistently paid dividends and expect to increase dividends at a rate similar to the increase in earnings per share. Additional cash is being used to fund strategic acquisitions and capital projects. An active share repurchase program is lowering shares outstanding and improving value for McCormick shareholders.

We have been paying

dividends since1925, and

we have increased the

dividend annually for the

last 20 consecutive years.