Letter to Shareholders

We are on a rewarding and exciting journey. It’s rewarding in that we’re surpassing our goals, earning superior shareholder returns and achieving excellent growth. It’s exciting because we have initiatives underway that position us well to continue that success.

Our 2006 results were record-setting. Earnings per share were $1.50 – up substantially from 2005 on a comparable basis. In addition, we met or exceeded all our financial goals – clearly showing that our disappointing 2005 was just a bump in the road.

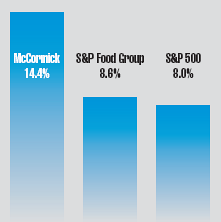

Over the past 10 years, our total shareholder return on an annual basis has been 14%. This has exceeded the total shareholder returns of our food industry group as well as the S&P 500 Index.

Over the past 10 years, our total shareholder return on an annual basis has been 14%. This has exceeded the total shareholder returns of our food industry group as well as the S&P 500 Index.

“There are four initiatives we have in place to continue our growth – advance, revitalize, transform and innovate.”

Surpassing Our Goals

Our three key financial goals for 2006 were to:

![]() Increase sales by 3% to 5%.

Increase sales by 3% to 5%.

![]() Increase our gross profit margin by 1.0 percentage point.

Increase our gross profit margin by 1.0 percentage point.

![]() Increase our earnings per share by 8% to 10% on a comparable basis.

Increase our earnings per share by 8% to 10% on a comparable basis.

We increased sales by 5%. Consumer sales increased by 5%, and industrial sales increased by 4%. Sales grew with successful new products, effective marketing programs, the acquisition of Simply Asia Foods, and higher pricing.

We increased our gross profit margin by 1.0 percentage point through a combination of cost savings programs, pricing and a favorable business mix. Our gross profit margin reached 41.0%. That’s an increase of 5.8 percentage points since 2000 and the result of our aggressive pursuit of gross profit margin improvement.

We increased earnings per share by 14% on a comparable basis. That comparison excludes the impact of stock-based compensation expense, which we began to record in 2006, and restructuring charges. Including 22¢ of restructuring charges and 11¢ of stock-based compensation expense, our earnings per share for 2006 were $1.50. In 2005, our earnings per share – including 5¢ of restructuring expense – were $1.56.

Earning Superior Shareholder Returns

Over the past 10 years, our average annual total return to shareholders has been 14%. That compares with the 9% average annual return of our food industry group and the 8% average annual return of the S&P 500. Total return to shareholders is the combination of stock price appreciation and dividends.

In November 2006, we increased our quarterly dividend 11% to 20¢ per share. We have been paying dividends since 1925, and we have increased the dividend annually for the last 20 consecutive years.

In 2006, our common stock price rose 24%. That reflects both our strong performance and our strong outlook.

Our business continues to generate a high level of cash. Our 2006 cash from operations was $311 million. We returned more than 80% of this amount to shareholders through dividends and repurchased shares. The remainder we’ve invested in growing our business.

Achieving Excellent Growth

Our growth strategy is straightforward: improve margins, invest in the business and increase sales and profits. There are four initiatives we have in place to continue our growth – advance, revitalize, transform and innovate.