Club House in Canada, Schwartz in the U.K. and Ducros in France are all number one brands added through acquisition. Across all of our brands we supply products to nearly 100 countries around the world.

The acquisition of leading brands continues to be an integral part of our growth strategy. For the past five years, we have had average annual sales growth of 5%, and acquisitions have accounted for one-third of this increase. In our developed markets we are seeking iconic brands like Lawry’s seasonings and marinades or Billy Bee® honey products. Products with a distinct flavor profile such as Simply Asia and Zatarain’s offer compelling growth opportunities. We have a particular interest in emerging markets such as China and India as we identify acquisition candidates.

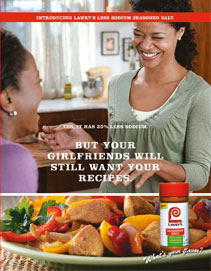

A fresh marketing campaign featured Lawry’s new reduced sodium product.

A fresh marketing campaign featured Lawry’s new reduced sodium product.

Our integration effectiveness increases with each successive acquisition. After completing the transaction in July 2008, our teams worked to fold in the Lawry’s business with few incremental costs, exceeding our projected earnings accretion for the first 12 months. We have reignited sales growth for the Lawry’s brand. Early in 2009, we introduced a new reduced-sodium version of the iconic Lawry’s seasoned salt and two new marinades. This was followed by a fresh marketing campaign, the launch of additional marinade varieties and an appealing new bottle design. Lawry’s has been our largest acquisition to date and one of our most successful.

For our U.S. foodservice customers, we recently launched our “McCormick for Chefs” campaign. This initiative moves us from a spice and herb expert to a flavor partner. As a key part of this master brand campaign, we are introducing the exciting flavors of Lawry’s, Zatarain’s and Thai Kitchen® products to restaurant chefs.

The introduction of acquired brands such as Lawry’s is part of our “McCormick for Chefs” campaign.

The introduction of acquired brands such as Lawry’s is part of our “McCormick for Chefs” campaign.

Beyond acquisitions, we have gained new distribution of our leading brands in North America and Europe with value-priced retailers in 2008 and 2009. In China, we have developed a strong foothold for the McCormick brand since its introduction in 1990. The opportunity for further expansion is significant. In just the past two years we doubled the number of major cities where consumers can purchase our products. Through our selling network we are gaining placement in both modern grocery stores and traditional street markets.

Over the past five years, sales growth for our industrial business in Asia has been strong, as we support the expansion of multinational restaurants and food manufacturers.

Over the past five years, sales growth for our industrial business in Asia has been strong, as we support the expansion of multinational restaurants and food manufacturers.

Over the past five years, sales growth for our industrial business in Asia has also been strong, as we support the expansion of multinational restaurants and food manufacturers. Production capacity of our plant in Thailand was recently doubled to accommodate this growth. We also added a condiment plant in South Africa due to increased demand.

Acquisitions will continue to be an important avenue for growth at McCormick. Along with new distribution, acquisitions will continue to expand our business into new regions and new product categories that bring flavor to consumers.

Previous Page A Connection with Consumers

Previous Page A Connection with Consumers

Next Page A Commitment to Sustainability

Next Page A Commitment to Sustainability