Over our first 25 years, we have worked hard to stay ahead of changing markets and the ever-evolving needs of our clients, while always embracing the highest ethical standards. Our fundamental principles have guided this approach.

As we focus on the next quarter century, BlackRock's Global Executive Committee has incorporated these principles into a pledge to all of our stakeholders — and to ourselves — that reaffirms our commitment to helping our clients build better financial futures. Working together, we pledge to:

Perform to the highest ethical, investment and operational standards

Understand our clients' real-world needs and build solutions to meet them

Lead by harnessing our collective intelligence and global reach

Advocate as a responsible voice and valued source of information for investors

Evolve to stay ahead of change and deliver for clients, shareholders and employees

In this annual report, we highlight how BlackRock fulfilled this pledge in 2013 — and how we will redouble our efforts to do so in the years to come.

Despite global political volatility, uneven economic recovery and uncertainty over monetary policy, the S&P 500 Index rose 30% in 2013, its largest annual advance since 1997. Equities in developed regions outpaced those in emerging markets as well as commodities at a historic rate, while the end of a three-decade bull market in bonds produced losses in long-duration fixed income. This market behavior highlighted the importance not only of being invested, but also of taking a balanced approach.

A core belief at BlackRock is that patient, long-term investing is the best path to financial success, and 2013 again confirmed the risk to investors of remaining on the sidelines. Those who steadfastly invested in a diversified portfolio were rewarded. Those who were indecisive or tried to time the market missed another opportunity to improve their financial position.

We remain believers in global equity markets. Developed markets continue their recovery and, while emerging market performance has lagged materially, those economies retain their role as substantial long-term drivers of growth.

Yet market performance remains stubbornly tied to political outcomes. In recent years, central bank policy in the United States, Europe and Japan has been a dominant factor in generating asset appreciation and aiding global economic recovery. Today, the impact of monetary policy tools on economic growth is diminishing, portending greater volatility, given the unpredictability of political activity in many parts of the world. As the first months of 2014 highlighted, geopolitical instability remains elevated and investor confidence is likely to be tested further.

The next stage in expanding economic and market growth will depend on the willingness and ability of governments and the private sector to provide leadership. To broaden recovery, strengthen markets and, in particular, tackle persistent unemployment, political leaders must look beyond monetary policy and enact fiscal and economic reforms that address the structural challenges to the global economy and the investment landscape. Leadership must also involve changing the culture of savers worldwide to encourage long-term investing and smart, measured risk-taking in the markets, which creates the potential to generate growth and meaningful income over time.

BlackRock will continue to respond forcefully as well — both within our business and as a responsible advocate for the investors we serve. Our firm today reflects our vision of how the investment environment was likely to change over time. Now, as we build the BlackRock of tomorrow, we are keenly focused on understanding the mega-trends shaping the future and offering our best thinking on solutions to policymakers, opinion leaders and investors.

Foremost among these global trends, and perhaps the defining investment challenge of our age, is increasing longevity — and the lack of preparedness for it. In the United States, for example, only 40% of Americans take part in any retirement plan. Savings for pre-retirees average just $12,000. Fewer workers around the world participate in defined benefit plans, and too many of those are underfunded. The fiscal costs of supporting an aging population continue to increase.

Two-thirds of the assets that BlackRock manages support people in their retirement, and we have an obligation to be a strong voice in public debate on how governments, corporations and individuals can confront the challenges of longer lives. I believe that bold policy ideas must be considered, such as the compulsory retirement savings model used in Australia's superannuation system. Pension funds also should consider a broader range of investments, including alternatives and nontraditional fixed income, to achieve the returns they need to meet their liabilities.

BlackRock is investing in the tools and technology to inform and equip the current generation of savers — and the next. We continue to evolve our offerings in the growing category of target date funds, where we now serve more than eight million clients through our LifePath franchise. In 2013, we also introduced our new CoRI index tool, which gives pre-retirees a measure of how much retirement income their savings can provide and, in early 2014, launched five new funds linked to the CoRI index.

Recognizing the social, political and financial significance of longevity, we recently created a dedicated U.S. Retirement group to harness BlackRock's best ideas and drive innovative solutions in this area.

Exacerbating the longevity crisis is the slow pace of job creation in many economies. Addressing persistent unemployment requires a multifaceted response by governments and businesses, and one of the most promising opportunities is investment to meet the massive global need for infrastructure. Around the world, the energy revolution; the aging of roads, rail links, airports and other transportation resources; and social and economic development all call for trillions of dollars of infrastructure spending in the coming decades.

Yet action on this front remains elusive, if not ambiguous. Governments simply cannot afford to self-fund infrastructure projects, demonstrating the need to harness the capacity of the private sector.

Private institutional investors with low risk tolerances and long-term liability structures, such as pension funds and insurance companies, are ideally suited to put money to work in yield-oriented, multidecade projects that provide current income and can act as a natural inflation hedge. Attracting that investment requires matching institutional demand and capital with attractive projects in jurisdictions where regulatory, legal and political conditions are conducive to successful public-private partnerships.

Countries that get it right will position themselves for job creation and economic growth and create significant competitive advantages for their economies. This is an important area for BlackRock to work with both policymakers and institutional investors to facilitate bringing the infrastructure opportunity to scale.

BlackRock's business is centered on managing risk and delivering investment solutions, but I believe that today all companies are in the technology business. The pace of innovation is accelerating, with dramatic implications for markets and society. The sheer mass of information available and the speed of access to it are staggering.

Innovation highlights the importance of managing legacy systems. Companies that do not take advantage of innovation can become caught up in an increasingly complex and risky tangle of technology. Winners will be those firms that are diligent about breaking down and integrating systems and establishing a common technology language.

The question now is which firms — and which societies — will seize the opportunity and build transformational business models based on technology innovation. BlackRock is committed to winning in a world reshaped by technology. As our company has grown, so has our technological leadership. We have leveraged that leadership to foster a culture of collective intelligence that allows us to share our best thinking not only with each other but also with our clients around the world.

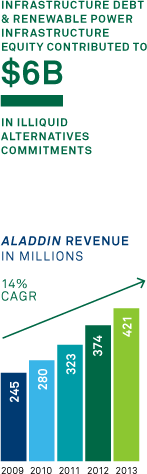

BlackRock Solutions (BRS

), including

our Aladdin, Financial Markets Advisory

and Client Solutions groups, brings to

bear a unique set of analytical tools and

sophisticated advisory services that

elevates the level of our interaction and

deepens the relationships and trust we

build with clients.

BRS is pervasive in our conversations with clients, helping them understand risk across their entire portfolios and develop customized, long-term investment strategies. It has also allowed us to be a valued advisor to institutions, governments and central banks confronting critical economic and financial challenges.

BlackRock's analytical and risk management capabilities are more important than ever in today's investing environment. For decades, investors took comfort in a simple paradigm: when stocks go up, bonds go down. The financial crisis of 2008–2009 provided ample evidence that correlation is the enemy of portfolio construction, and the post-crisis period has been marked by a significant rise in investor preference for uncorrelated, risk-adjusted returns. This is driving an increased appetite for alternative strategies and for unconstrained products that offer fund managers greater flexibility in delivering returns to shareholders.

Outcome-oriented investing is about looking beyond relative performance and solving for future goals — how do clients earn enough income for retirement in the current interest rate environment or how can clients protect themselves against inflation concerns? BlackRock's broad investment platform positions us to construct and deliver the investment outcomes our clients are searching for by combining active and passive offerings across asset classes and leveraging the analytical and risk management capabilities of BlackRock Solutions.

Solving problems and delivering solutions is at the core of what we do — and has been since our founding. From helping governments and troubled institutions work through some of the most challenging issues of the financial crisis, to helping clients move beyond benchmark-driven investing to generate outcomes, BlackRock is and will continue to be a partner in building solutions.

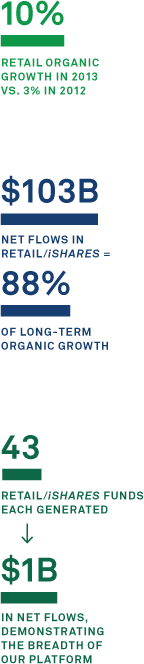

The shift to outcome-oriented strategies is driving the Global Retail growth opportunity, as client demand for packaged solutions, including liquid alternatives, increases. We continue to evolve our product set, enhance our distribution capabilities and build our global brand to better deliver BlackRock to our clients.

We are also expanding the profile and capabilities of our leading iShares franchise to take advantage of the increasing use of ETFs to construct investment solutions and the secular shift to passive investing. Clients are turning to iShares to generate alpha through asset allocation models, as a liquidity tool to manage exposures, as a buy-and-hold investment in their core portfolios and to access a wide variety of global markets efficiently and transparently.

Over the years, BlackRock has not just responded to changing times and markets but anticipated them by building breadth and diversity into our platform. As we built our technology and analytics capabilities, we expanded our scope to meet client needs in a way we believe is unique in the industry. In 2006, we acquired Merrill Lynch Investment Managers, which expanded our equity business overnight, forged our global footprint and took us into the retail business. Our acquisition of Barclays Global Investors in 2009 introduced us to the passive market through iShares ETFs and a wide range of institutional index offerings.

Our success in building and positioning our platform to take advantage of a changing investment ecosystem drove strong financial results in 2013. We attracted $117.1 billion in long-term net new flows in 2013, representing a 3.4% organic growth rate. We achieved a 9% increase in revenues to $10.2 billion, a 13% rise in adjusted operating earnings and a 21% increase in adjusted earnings per share versus 2012. We increased our adjusted operating margin to 41.4%, demonstrating our commitment to reinvesting in our business for growth while maintaining expense discipline. Finally, we returned $2.2 billion to shareholders through dividends and share repurchases and, in January 2014, announced a 15% increase in our annual dividend to $7.72 per share.

BlackRock's growth and consistent financial performance result from our commitment to put clients at the center of all we do, and understand and anticipate their needs. We will continue to invest in our business to solve for our clients' investment goals, build our brand, enhance our product set and distribution capabilities and drive organic growth.

Investment performance remains the bottom line for investors. The shift to index and ETF investing reflects an appreciation that active managers seeking higher fees must offer value beyond replicating a benchmark. However, those who proclaim the end of active management are mistaken. The creation and delivery of excess returns plays a vital role and only those managers who consistently outperform will see strong flows in the current winner-take-all environment, in which assets flow to only a handful of top-performing funds.

Superior investment performance has been a significant area of attention for BlackRock. Following the financial crisis, we reassessed and restructured much of our active fixed income business. This effort and our focus on helping our clients assess risk in their fixed income portfolios paid off amid the turmoil affecting those markets in 2013, when 82% of our taxable fixed income assets outperformed their benchmarks or peer medians over the three-year period. Our ability to outperform across our fixed income platform at a time when others have struggled earned BlackRock the #1 industry ranking in U.S. Retail Active Fixed Income flows. We believe our track record will provide a meaningful competitive advantage in 2014.

To enhance performance in our fundamental equities offerings, we streamlined our investment process and recruited top-quality managers to augment BlackRock's existing talent base. Multiple-year track records will be the true measure of success, but early results show material performance improvement.

We are also taking advantage of our scale and global reach to generate outperformance in other ways, including through the BlackRock Investment Institute. The institute brings together our 1,600 portfolio managers, analysts and researchers to leverage our best thinking for clients, through robust dialogue on investment drivers, trends and opportunities.

Core to our mission is that we are a fiduciary to our clients. This is a responsibility to help build better financial futures not just for corporations, pension funds, endowments and foundations, but for those whose investments we ultimately manage — working people, retirees, families saving for college and entrepreneurs starting businesses. It is imperative that we not only provide the best investment advice and performance possible, but also that we take a leadership role to advocate on behalf of the constituencies we and our clients serve.

In the face of significant changes in the regulatory environment, BlackRock is working to promote financial reform that increases transparency, protects investors and facilitates responsible growth of capital markets, while preserving consumer choice and maintaining a level playing field across industries and products. We have been active participants in the public debate on issues ranging from money market reform and ETF regulation to housing finance, market structure and liquidity.

Many post-crisis regulatory changes have had a profoundly positive impact on the safety and soundness of the global financial industry. However, we must protect against poor policy decisions and unintended consequences that can take decades to rectify and potentially harm the economy, businesses and investors. For example, we strongly believe that, in the case of asset managers, regulation should be focused where the risk occurs — at the product and practice level. Asset managers are agents, not principals. We act as fiduciaries on behalf of our clients.

We agree that additional regulation of products and practices may be necessary to promote transparency and stability and improve the financial ecosystem, but we believe the most effective regulatory action will focus on those activities that pose actual risk. Across the firm we will continue to take a leadership role in driving constructive change to increase the safety and soundness of the financial system.

BlackRock's ownership position in companies across geographies and industries positions us to advocate for corporate change on behalf of our clients. We believe that a sound corporate governance framework promotes strong leadership by boards of directors and prudent management practices, contributes to the long-term success of companies and leads to better risk-adjusted returns for investors. To that end, in 2013 we engaged with approximately 1,400 companies on corporate governance, including on social, environmental and ethical issues, and voted at more than 14,000 shareholder meetings in 85 markets to protect and enhance the value of our investments. We believe that direct engagement with management, rather than headline-grabbing public pronouncements, are the most effective way to drive change. We will continue to challenge the management of the companies in which we invest to engage with us directly on governance issues.

Much has changed over the first 25 years of BlackRock's existence. Our clients changed, our competitors changed, the landscape changed. All we can predict for certain is that change will accelerate in the years to come. So as we embark on the next 25 years, we will continue to evolve and align our offerings with investment trends and market opportunities to meet the needs and expectations of our clients.

Evolving our platform in this manner will preserve our ability to deliver for our clients, which will translate into continued value creation for our shareholders. We are committed to investing to drive organic growth and prudently managing the trade-offs between growth and margin, while maintaining a balanced approach to capital management. Our pledge to you is that we will succeed in the pursuit of these goals with the same clear mission, leadership and ethical standards on which our reputation has been built.

Just as importantly, we will continue to invest in our people. Our more than 11,400 employees are the core of BlackRock — and I want to thank them for their abiding determination to do the right thing in every situation, every day. We are committed to developing our talent and fostering an environment in which all of our people can thrive both personally and professionally. We will continue to challenge employees to question the status quo, shape the world of tomorrow and never be afraid to fail in pursuit of our objectives.

I also want to recognize the role that BlackRock's Board of Directors has played in the continued growth and success of the company. Just as the company has evolved, so too has our Board in pursuit of strong corporate governance and excellence. We were pleased to welcome our two newest directors to the Board in 2013: Pamela Daley, former senior executive at the General Electric Company, and Cheryl D. Mills, a lawyer with diverse experience in public policy, international diplomacy and economic development. Sadly, 2013 also saw the passing of our long-time director, Dennis Dammerman, who is dearly missed by his many friends at BlackRock. We also deeply appreciate the service of James Rohr and Thomas Montag, who, after many years of service to the Board, will complete their service at the 2014 Annual Meeting of Shareholders. I am indebted to all the members of our Board for their firm engagement, collective wisdom, expert guidance and diligent oversight.

If the last 25 years are any indication, the future comes quickly in our business. I am confident that we have the capabilities, culture and people in place to stay ahead of our evolving industry and the markets, and to create value for our clients, our shareholders and our employees.

Sincerely,

Laurence D. Fink

Chairman and Chief Executive Officer