INVESTMENT MANAGEMENT

| WHOLESALE | FUNDS UNDER MANAGEMENT $1.3 BILLION |

|---|---|

| FUNDS | |

| MIRVAC WHOLESALE HOTEL FUND | |

| TRAVELODGE GROUP | |

| MIRVAC WHOLESALE RESIDENTIAL DEVELOPMENT PARTNERSHIP |

| RETAIL | FUNDS UNDER MANAGEMENT $0.5 BILLION |

|---|---|

| LISTED | UNLISTED |

| MIRVAC INDUSTRIAL TRUST | MIRVAC DEVELOPMENT FUND – SEASCAPES |

| MIRVAC DEVELOPMENT FUND – MEADOW SPRINGS |

| JOINT VENTURES 1,2 | FUNDS UNDER MANAGEMENT $3.1 BILLION |

|---|---|

| AUSTRALIAN – FUNDS | INTERNATIONAL – FUNDS |

| JF INFRASTRUCTURE YIELD FUND | QUADRANT FUND 3 |

| AUSTRALIAN SUSTAINABLE FORESTRY INVESTORS | CALIFORNIA COMMUNITY MORTGAGE 3 |

| NEW ZEALAND SUSTAINABLE FORESTRY INVESTORS | INSTITUTIONAL COMMERCIAL MORTGAGE FUND NO 5 3 |

| JF INFRASTRUCTURE SUSTAINABLE EQUITY FUND |

| INTERNATIONAL – MANDATES | |

| QUADRANT REAL ESTATE ADVISORS | |

| HEALTH SUPER PTY LTD |

INVESTMENT MANAGEMENT / WHOLESALE

| MIRVAC WHOLESALE HOTEL FUND | |||

|---|---|---|---|

| FOCUS | FUM ($M) 4 | NO OF INVESTORS | |

| Wholesale | 549.3 | 5 | |

Mirvac Wholesale Hotel Fund was launched in 2007 and is an open-ended wholesale fund with total investor equity of $341 million and a portfolio of seven hotels located in Sydney, Melbourne, Brisbane and Cairns. Total value of the portfolio is $534.3 million.

The Fund's portfolio consists of four hotels acquired from Carlton Hotel Group in 2007, together with the Marriott Hotel Sydney and a 50 per cent interest in The Sebel Cairns, both of which were acquired from Mirvac in June 2007. The Fund acquired the Courtyard by Marriott Hotel at North Ryde in August 2009.

All seven hotels are of a 4 to 5 star standard and provide a total of 2,024 rooms.

Details of the Fund's investment portfolio are available from www.mirvac.com/mwhf.

On 16 December 2011, Mirvac announced that it had entered into contracts for the sale of its hotel management business, Mirvac Hotels & Resorts, and various associated investments to a consortium comprising Accor Asia Pacific ("Accor") and Ascendas. The sale process at 31 December 2011 was still being finalised and is expected to occur prior to 30 June 2012.

| TRAVELODGE GROUP | ||

|---|---|---|

| FOCUS | FUM ($M) 4 | NO OF INVESTORS |

| Wholesale | 420.3 | 2 |

The Travelodge Group is a sector specific wholesale fund established in March 2005 and focuses on the 3 to 3.5 star hotel market in Australia and New Zealand. The portfolio comprises 13 hotels and 2,048 rooms with a value of $394.3 million all of which are leased to Value Lodging Pty Limited, a subsidiary of Toga Hospitality.

Details of the Travelodge Group's investment portfolio are available from www.mirvac.com/travelodge-group.

| MIRVAC WHOLESALE RESIDENTIAL DEVELOPMENT PARTNERSHIP | ||||

|---|---|---|---|---|

| FOCUS | FUM ($M) 5,6 | END VALUE ($M) 5 | NO OF INVESTORS | |

| Wholesale | 287.5 | 2,017.1 | 4 | |

The Mirvac Wholesale Residential Development Partnership is a closed-end vehicle that has acquired well-located residential development/management projects around Australia, that are diversified by geography, product type, timing and stage of the development cycle. The portfolio comprised 2,186 lots and 1,150 medium density units.

The Partnership has raised equity commitments of $300 million, including Mirvac's 20 per cent co-investment, of which $287.5 million has been applied to the establishment of the current portfolio.

Details of the Partnership's investment portfolio are available from www.mirvac.com/mwrdp.

INVESTMENT MANAGEMENT / LISTED – RETAIL

| MIRVAC INDUSTRIAL TRUST | ||

|---|---|---|

| FOCUS | FUM ($M) 7,8 | NO OF INVESTORS |

| Retail | 432.9 | 1,891 |

Mirvac Industrial Trust ("MIX") is an ASX listed property Trust. The portfolio consists entirely of industrial assets leased to a diverse range of quality tenants in and around the Greater Chicago region. Details of MIX's investment portfolio are available from the Trust's website www.mirvac.com/mix.

UNLISTED – RETAIL

| MIRVAC DEVELOPMENT FUNDS – SEASCAPES & MEADOW SPRINGS | ||||

|---|---|---|---|---|

| FOCUS | FUM ($M) 4 | NO OF INVESTORS | ||

| Retail | 53.3 | 440 | ||

At 31 December 2011, Mirvac Investment Management had two active unlisted funds with approximately $53.3 million under management.

Details of the unlisted fund portfolio are available from www.mirvac.com/investmentmanagement.

INVESTMENT MANAGEMENT / JV AUSTRALIA

| JF INFRASTRUCTURE | ||

|---|---|---|

| FOCUS | FUM ($M) 4,9 | NO OF INVESTORS |

| Wholesale | 136.2 | 40 |

JF Infrastructure ("JFI") is a 50/50 joint venture between Mirvac and Leighton Holdings Limited.

| WHOLESALE FUNDS | ||

|---|---|---|

| FUND | ASSETS | GROSS ASSETS ($M) 4,9 |

| JF Infrastructure Yield Fund | The Fund completed the sale of its 20.8% equity interest in International Parking Group on 15 August 2011. 33.3% equity interest in BAC Airports Group, which beneficially owns Bankstown and Camden Airports in Sydney. 22.4% equity interest in Melbourne Stadium Trusts which are the owners of Etihad Stadium, Melbourne. | 59.1 10 |

| New Zealand Sustainable Forestry Investors Australian Sustainable Forestry Investors | 20,522 hectares of freehold forestry land in Victoria, South Australia and Western Australia. | 68.9 11 |

| JF Infrastructure Sustainable Equity Fund | MPT owns 100% JFISEF. JFISEF holds a 25% equity investment in Australian Sustainable Forestry Investors (assets as above). | 8.2 |

| TOTAL WHOLESALE FUNDS | 136.2 |

INVESTMENT MANAGEMENT / JV INTERNATIONAL

| QUADRANT REAL ESTATE ADVISORS | |||

|---|---|---|---|

| FOCUS | FUM ($M) 9,12 | ||

| Wholesale funds | 58.7 | ||

| Mandates | 5,935.7 | ||

Quadrant Real Estate Advisors, LLC has offices in the United States (Atlanta, Georgia) and in Sydney. Quadrant provides institutional investors a full range of commercial real estate advisory services across the public and private, debt and equity sectors.

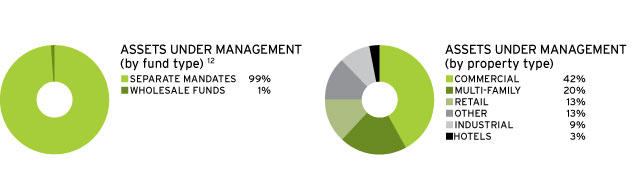

As at 31 December 2011, Quadrant has approximately A$6.0 billion9 of commercial and multi-family real estate assets under management.

Quadrant's management team has been advising institutional investors since the early 1990s and develops and manages tailored investment strategies on behalf of a wide range of US and Australian institutional (wholesale) investors across the public and private debt and equity real estate markets.

Clients include:

— Health Super Pty Limited

— California Public Employees' Retirement System ("CalPERS")

— AXA – Equitable Life

— Colorado Public Employees Retirement Association

— Minnesota State Board of Investment

Quadrant's strategy is to continue to develop leading public and private real estate investment products which provide access to targeted sectors of the US and Australian income producing commercial and multi-family real estate markets.

1) FIGURES QUOTED ARE AFTER ADJUSTMENTS FOR JOINT VENTURE INTERESTS.

2) MIRVAC IS A 50 PER CENT OWNER OF THE MANAGEMENT ENTITY.

3) FUNDS MANAGED BY QUADRANT REAL ESTATE ADVISORS.

4) SUBJECT TO FINAL AUDIT AND BOARD APPROVAL.

5) THE FUM NUMBER REPRESENTS CONTRIBUTED EQUITY.

6) FUM AND END VALUE ARE FORECAST TO 31 DECEMBER 2011.

7) AS AT 30 JUNE 2011.

8) SUBSEQUENT TO 30 JUNE 2011, A NUMBER OF SIGNIFICANT EVENTS OCCURRED IN RELATION TO MIX'S DEBT FACILITIES AND PROPERTY ASSETS.

FOR FURTHER INFORMATION REFER TO THE ASX ANNOUNCEMENTS MADE BY MIX SINCE 30 JUNE 2011.

9) BEFORE ADJUSTING FOR JOINT VENTURE INTERESTS.

10) LATEST INDEPENDENT VALUATION 31 DECEMBER 2011.

11) LATEST INDEPENDENT VALUATION 30 JUNE 2011.

12) AUD/USD EXCHANGE RATE OF 1.0156 AS AT 31 DECEMBER 2011.