Dear Shareholder,

Our robust performance in 2017, a landmark year in our transformation to a smoke-free future, underscored the enormous promise of reduced-risk products (RRPs), the strength of our combustible product portfolio and the commitment of our employees to lead the transformation of our industry.

André Calantzopoulos

Chief Executive Officer

Louis C. Camilleri

Chairman of the Board

Our strong currency-neutral financial results were underpinned by the excellent performance of our flagship smoke-free product, IQOS, which exceeded our expectations and helped offset the adverse impact of essentially no net pricing in Russia and a severe cigarette volume contraction in Saudi Arabia.

2017 vs. 2016 Results

Our total cigarette and heated tobacco unit shipment volume of 798.2 billion units declined by 2.7%, primarily reflecting lower cigarette industry volume in the Asia and Eastern Europe, Middle East & Africa (EEMA) Regions, partly offset by higher heated tobacco unit volume, driven principally by Japan.

Our total international market share, excluding China and the U.S., declined by 0.1 percentage point to 28.0%, mainly due to mid- and low price segments cigarette brands in the Asia and EEMA Regions. Market share of our premium brands increased, driven by the strong performance of our heated tobacco portfolio. We recorded growing or stable total market share in 16 of our top 30 operating companies income (OCI)(1) markets.

Marlboro’s international cigarette share increased slightly to 9.7%,(2) a notable achievement given the impact of out-switching to our heated tobacco products in IQOS launch markets and the volume contraction in Saudi Arabia. The brand’s cigarette share increased in the Asia and EEMA Regions, reflecting robust growth in the Philippines and across markets in North Africa.

Our other key international cigarette brands also performed well. Chesterfield and Philip Morris grew their cigarette share. While share of L&M, the third largest international cigarette brand, declined slightly, Parliament, our above-premium brand, recorded stable share – noteworthy given the challenging economic conditions and related consumer down-trading in some of its key Eastern European markets.

Net revenues, excluding excise taxes, of $28.7 billion increased by 7.7%, driven by strong RRP growth (principally heated tobacco units and IQOS devices) coupled with favorable pricing for our cigarette portfolio. This reflected a favorable volume/mix variance of $1.1 billion, our best-ever full-year performance on this measure. On a currency-neutral basis, net revenues, excluding excise taxes, grew by 9.4%.

Adjusted OCI of $11.8 billion increased by 6.0%, or by 7.4% excluding currency, driven by the strong growth in net revenues, partly offset by investment behind the commercialization of IQOS, as well as the unfavorable profitability impact of higher IQOS device sales, which yielded a negative margin due to introductory discounts offered in the initial commercialization phase to accelerate adult smoker switching. Adjusted OCI margin declined by 0.7 points to 41.1%, or by 0.8 points, excluding currency.

Our reported diluted EPS were unfavorably impacted by tax items totaling $0.84 primarily related to the enactment of the Tax Cuts and Jobs Act in the United States, reflecting the requirement to pay a one-time transition tax on accumulated foreign earnings. Excluding these tax items, our adjusted diluted EPS of $4.72 increased by 5.4%, despite a currency headwind of $0.21 per share. Excluding currency and the aforementioned tax items, adjusted diluted EPS increased by 10.0%.

Robust EPS Growth +10.0% in 2017 vs. 2016, Adjusted Diluted, Excluding Currency

Operating cash flow(3) of $8.9 billion increased by $0.8 billion or 10.3%. Excluding currency, operating cash flow increased by $0.4 billion, or 5.5%. Capital expenditures of $1.5 billion increased by $0.4 billion, primarily reflecting investment behind heated tobacco production capacity expansion.

In September, the Board of Directors approved an increase in our quarterly dividend to an annualized rate of $4.28 per share. This was the tenth consecutive year in which we increased our dividend, representing a total increase of 132.6%, or a compound annual growth rate of 9.8%, since we became a public company.

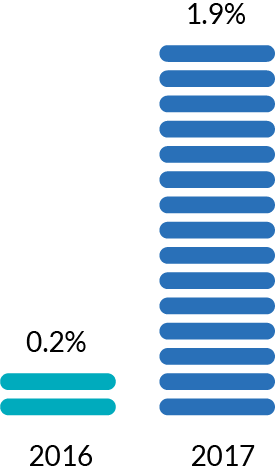

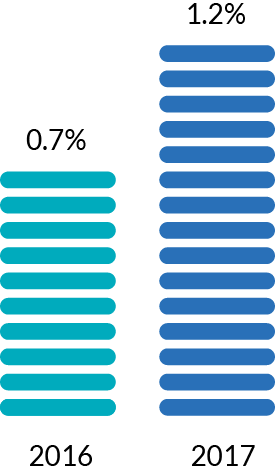

We continued to access the capital markets at favorable rates in 2017, raising $6.9 billion and reducing the weighted-average all-in financing cost of our total debt by 20 basis points to 2.6%. The weighted-average time to maturity of our total long-term debt stood at 9.4 years at the end of 2017 compared to 10.6 years at the end of 2016.

U.S. Tax Reform

As a U.S. company that operates exclusively in markets outside of the U.S., the impact of the Tax Cuts and Jobs Act on our business is unique. Based on our current interpretation of the law, we expect an effective tax rate of approximately 28% for 2018. The difference between this rate and the 21% statutory tax rate under the new law reflects three main factors: foreign tax rate differences, the non-deductibility of interest expense, and the partial disallowance of foreign tax credits related to the application of the rules for global intangible low-taxed income. A more detailed discussion on the impact of U.S. tax reform on our business is included in our Form 10-K.

Fiscal, Regulatory and Illicit Trade Environment

Our favorable pricing in 2017 was supported by a fiscal environment for combustible tobacco products that remained largely rational with either no, or moderate, excise tax increases in most of our major markets. The clear exception was Saudi Arabia, where the introduction of the country’s first-ever excise tax system resulted in a doubling of cigarette retail prices.

Since its Spin-Off in March 2008,(6) PMI has Increased its Regular Quarterly Dividend by 132.6%

Representing a Compound Annual Growth Rate of 9.8%

Depending on national legislation, heated tobacco units generally continue to be taxed under a dedicated excise category or as OTP (Other Tobacco Products). Last year, the governments of Japan and Korea reviewed their fiscal structures for heated tobacco and maintained the excise tax differentiation to cigarettes, albeit at reduced levels.

In implementing traditional restrictive regulatory measures, including plain packaging, governments aim to foster smoking prevention and cessation. We believe these objectives can be met more rapidly and sustainably by fully incorporating the opportunities represented by reduced-risk products into existing tobacco control policies. The establishment of regulatory frameworks that differentiate between cigarettes and smoke-free products is a critical component in the switching of smokers to better alternatives compared to continued smoking.

The regulatory environment for RRPs continued to evolve in 2017, though the underlying process remains undeniably complex, as RRPs are uncharted territory for the vast majority of regulators. This complexity is exacerbated by the divide in the public health community on the topic of tobacco harm reduction. We hope that the interests of the men and women who smoke will ultimately prevail over ideology in this debate.

We were encouraged by a number of policy announcements and findings related to RRPs by governmental agencies and advisory committees, such as the U.S. Food & Drug Administration (FDA), the U.K. Committee on Toxicity, Public Health England and others. We hope that they will soon act as a catalyst for other governments to adopt similar sensible policies.

Despite continued progress on combatting illicit trade, notably in the EU Region, it remains a sizable challenge, particularly in markets such as Brazil and Pakistan. To help confront tobacco smuggling and related crimes, we launched PMI IMPACT in 2016, and last year the program’s council of independent experts, in the fields of law, anti-corruption and law enforcement, allocated approximately $28 million in grants across 32 projects as part of its first funding round. The projects come from public, private and academic organizations in 18 countries.

Reduced-Risk Product Commercialization

In 2017, PMI’s journey to replace cigarettes with RRPs took a meaningful step forward, led by significant momentum in the product development, commercialization and scientific substantiation of our product platforms.

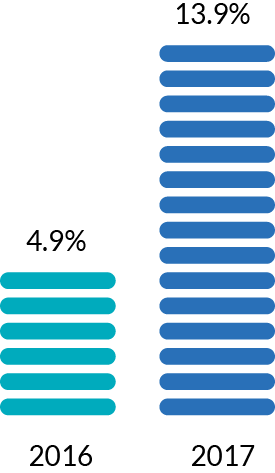

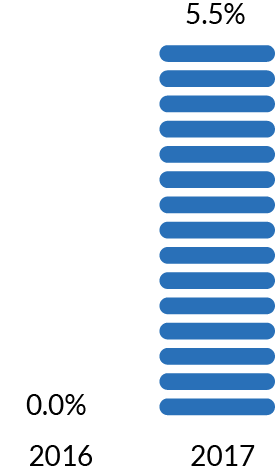

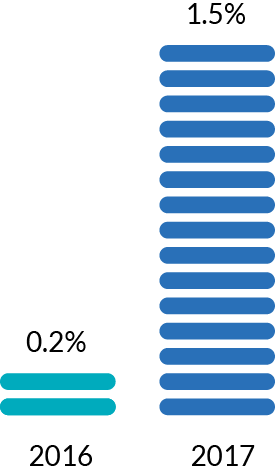

The most notable achievement was our ongoing progress in commercializing IQOS. As of year-end, IQOS was available in key cities in 38 markets. We estimate that nearly 5 million adult consumers around the world have already stopped smoking and made the change to IQOS. The impressive performance of IQOS was led by Japan and Korea, where national market shares in the fourth quarter reached 13.9% and 5.5%, respectively, despite capacity-driven constraints, first on the heated tobacco consumables and then on device sales.

Outside Asia, we recorded sequential quarterly volume growth for our heated tobacco products in essentially all launch markets. Favorable performances in the Czech Republic, Greece, Portugal and Romania stood out in particular.

For the time being, the momentum of IQOS outside Asia remains below the very high bar set by Japan and Korea. We are actively enhancing sustainable adult consumer adoption against a backdrop of lower initial awareness and greater limitations on consumer engagement. To address this, we are working to build adult consumer understanding of the heated tobacco category, raise adult consumers’ commitment to the exclusive use of IQOS and enhance consumer conversion support. This approach entails a greater deployment of specialized field forces to conduct IQOS guided trials.

We remain focused on our aspiration to see IQOS launched in the United States. Following the submission of our Modified Risk Tobacco Product (MRTP) application to the FDA in December 2016, we submitted our Premarket Tobacco Application in March 2017. Both applications have been accepted by the FDA for substantive review. As part of this process, the FDA concluded a series of pre-approval inspections of our manufacturing facilities and quality control systems, as well as research and select suppliers’ facilities. In addition, in January 2018 the FDA’s Tobacco Product Scientific Advisory Committee (TPSAC) held a two-day meeting on our MRTP application for IQOS. We appreciate the open, positive dialogue and the serious consideration that TPSAC showed in discussing the complex science presented in our MRTP application and are encouraged by the recognition of the risk-reduction potential of IQOS compared to continued smoking – including a significant decrease in exposure to harmful chemicals – that clearly emerged from the statements of the Committee members.

With respect to our other RRP platforms, we made further progress in terms of product development and commercialization. We began a small-scale city test of our Platform 2 product, marketed under the brand name TEEPS, in the Dominican Republic in December 2017, and while still early, we are very excited by the potential for this platform. The city test in the U.K. of our Platform 4 product with MESH technology has been well received by adult consumers and has provided important insights and uncovered opportunities for product improvement. We plan to commercialize a next-generation version of the product this year. Finally, we also advanced the development of our Platform 3 product, for which we plan a consumer test in 2018.

Scientific Assessment, Engagement and Research & Development

Our scientific assessment program, outlined in our dedicated website at www.pmiscience.com, continued to make substantial progress last year. The program is built on best practices and guidelines. We adhere to the internationally recognized Good Clinical Practices and Good Laboratory Practices. We actively share our methods and data, making them available to the public for verification of our approaches and results. We post our clinical study protocols and subsequent results on www.ClinicalTrials.gov. We invite scientists from around the world to verify our systems biology methods through a crowd-sourcing platform called www.sbvIMPROVER.com. We are going a step further by gradually making the data and results from our nonclinical and clinical programs around IQOS available to the public this year, in part through a database and associated web portal called INTERVALS (see http://intervals.science).

In 2017, we published 46 peer-reviewed papers in leading scientific journals and shared our science and smoke-free vision in over 150 presentations at 76 scientific conferences.

With regard to our research and development program, we continued to build our RRP-related intellectual property portfolio in 2017, with over 170 new patent applications filed, and we expect, once again, to have been among the top 100 filers at the European Patent Office. We currently have more than 2,900 RRP-related patents granted worldwide and over 4,600 such patent applications pending.

Manufacturing & Supply Chain

The accelerated expansion of our heated tobacco unit and IQOS device capacity was the major undertaking of 2017. The increase of our annualized production capacity of heated tobacco units was mainly driven by the installation of additional machines at our Greenfield facility in Bologna, Italy, and also greater production efficiency.

To support the growth of our heated tobacco unit production capacity over the near to mid-term, we began the second phase of our facility expansion in Bologna and the partial or full conversion of our cigarette factories in Greece, Korea, Romania and Russia. Additionally, we announced plans for a new Greenfield facility in Dresden, Germany.

Last year, we qualified additional manufacturers for the IQOS device and its critical components such as the heating blade, allowing us to diversify our supply base and increase capacity. Indeed, since February of this year, we have been able to fully supply devices to our markets. Importantly, we also reduced the unit cost of devices, a key – and ongoing – component of improving their economics.

The Organization

To deliver on the substantial promise of RRPs, we initiated fundamental changes to our operating model, organizational structure and culture in 2017 to accelerate our evolution into a consumer-centric, technology and science-driven company.

We grouped the smoke-free products and related ecosystem development, as well as scientific substantiation, under a new Science & Innovation function. We focused the commercial deployment of both our smoke-free and combustible products, as well as global strategy execution, under a newly created Chief Operating Officer position. And we realigned our operating segments from four to six geographic Regions to provide greater speed and efficiency and recognize their differing levels of maturity with respect to our smoke-free vision.

Further to enhancing organizational effectiveness, employee engagement remains a top priority – even more so as we transform into an RRP-focused company. In 2017, the Top Employer Institute recognized PMI for its excellence in professional development programs, workplace environment and opportunities for career advancement in a total of 34 countries, compared to 24 and 15 in 2016 and 2015, respectively.

We are committed to leveraging the full potential of women in the workplace, and we recognize we have more work to do. Nevertheless, by year-end 2017, women made up over 34% of our employees at managerial levels, reflecting continued steady progress towards our goal of reaching 40% by 2022. To support this goal, we aim for a 50:50 gender ratio in our recruitment pipeline. In 2017, 43% of new hires at managerial levels and 47% of new hires at more junior levels were women. Women’s career support and advancement are also critical for achieving this goal. In 2017, women accounted for 38% of promotions at managerial levels.

Overall, our organization is fully energized by our smoke-free vision that will benefit the hundreds of millions of men and women who smoke, our company and ultimately society at large. Finally, we continue to benefit from the tremendous experience of our Board of Directors, whose relationship with management continues to be based on transparency and candor.

The Year Ahead

Against the backdrop of a broadly rational regulatory and excise tax environment, the fundamentals of our business remain robust, supported by our leading brand portfolio in the combustible product category. For the first time since 2011, we entered the year with annual EPS guidance that, at exchange rates prevailing at the time it was announced, reflects favorable currency.

Our RRP portfolio continues to provide us with the single-largest opportunity to accelerate our business growth and generously reward our shareholders, and we will make further significant investments in 2018 to drive this growth potential over the coming years.

Momentum behind the harm-reduction principle is accelerating, helped by our vision for a smoke-free future. While the task is enormous, our resolve is steadfast, and we are confident that the outstanding people of PMI will rise to the challenge.

André Calantzopoulos

Chief Executive Officer

Louis C. Camilleri

Chairman of the Board

March 2, 2018

Note: Reduced-risk products (RRPs) is the term we use to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continued smoking. We have a range of RRPs in various stages of development, scientific assessment and commercialization. Because our RRPs do not burn tobacco, they produce an aerosol that contains far lower quantities of harmful and potentially harmful constituents than found in cigarette smoke.

(1) Operating companies income, or OCI, is defined as operating income, excluding general corporate expenses and the amortization of intangibles, plus equity (income)/loss in unconsolidated subsidiaries, net.

(2) Marlboro international cigarette share is defined as PMI total sales volume for Marlboro cigarettes as a percentage of the total industry estimated sales volume for cigarettes, excluding China and the U.S.

(3) Net cash provided by operating activities.

(4) Reported diluted EPS.

(5) Reported diluted EPS of $3.88, excluding the unfavorable impact of tax items and currency of $0.84 and $0.21 per share, respectively.

(6) Dividends for 2008 and 2017 are annualized rates. The 2008 annualized rate is based on a quarterly dividend of $0.46 per common share, declared June 18, 2008. The 2017 annualized rate is based on a quarterly dividend of $1.07 per common share, declared September 13, 2017.

Designing a Smoke-Free Future

The greatest contribution PMI can make to society is to replace cigarettes with less-harmful alternatives, which is why we are transforming from a cigarette maker to a smoke-free technology leader. Thanks to groundbreaking research, we have developed and are commercializing smoke-free products that are enjoyable for adult smokers and are a much better choice than cigarette smoking. The first of these is our flagship heat-not-burn product, IQOS.

Click to read about: Reduced-Risk Products – Our Four Product Platforms

IQOS, using the consumables HeatSticks or HEETS, features an electronic holder that heats tobacco rather than burning it, thereby creating a nicotine-containing vapor with significantly fewer harmful toxicants compared to cigarette smoke.

TEEPS uses a pressed carbon heat source that, once ignited, heats the tobacco without burning it, to generate a nicotine-containing vapor with a reduction in harmful toxicants similar to IQOS. A small-scale city test of the product was initiated in 2017.

Platform 3 is based on acquired technology that uses a chemical process to create a nicotine-containing vapor. We are exploring two routes for this platform: one with electronics and one without.

Products under this platform are e-vapor products: battery-powered devices that produce an aerosol by vaporizing a nicotine solution. One of these – MESH – uses new proprietary vaporization technology.

IQOS Highlights in 2017

PMI National Heated Tobacco Unit Market Shares - Fourth Quarter 2017 vs. Fourth Quarter 2016

High Conversion Rates (b)

Converted/Predominant Situational Abandoned

(a) Status at the end of January 2018. For markets where IQOS is the only heated tobacco product, daily individual consumption of PMI heated tobacco units represents the totality of their daily tobacco consumption. For markets where IQOS is one among other heated tobacco products, daily individual consumption of heated tobacco units represents the totality of their daily tobacco consumption, of which at least 70% are PMI heated tobacco units.

(b) Estimated number of legal age IQOS users that used our heated tobacco units for the following percentages of their daily tobacco consumption over the past seven days: Converted/Predominant: 70% or more. Situational: Between 5% and less than 70%. Abandoned: Less than 5%.

Note: Product visuals in this report are for illustrative purposes only.

![]()

The greatest contribution PMI can make to society is to replace cigarettes with less-harmful alternatives. In 2017, smoke-free products represented approximately 5% of our combined cigarette and heated tobacco unit shipment volume. But they already accounted for approximately 13% of our net revenues, excluding excise taxes, 39% of our global commercial expenditure and 74% of our global R&D expenditure. We estimate that more than 4.7 million adult smokers around the world have already stopped smoking and made the change to IQOS, and approximately 10,000 are switching every day. Our aspiration is that, by 2025, at least 40 million people who would have otherwise continued smoking will have switched to our smoke-free products. Last September we announced our support for the establishment of the Foundation for a Smoke-Free World by contributing $80 million per year over the next 12 years. The Foundation is an independent body that will fund research and encourage innovative measures to reduce the harm caused by smoking and help accelerate the pace at which a smoke-free world is achieved.

![]()

Through our Good Agricultural Practices program, we support over 350,000 contracted tobacco farmers by increasing productivity, implementing safe and fair labor practices, and minimizing environmental impacts. The program includes efforts to promote crop diversification to generate additional sources of income and improve food security.

![]()

We provide a professional, safe and inclusive workplace for our approximately 81,000 employees and continue to implement programs to uphold respect for labor and human rights internally and across our supply chain, including electronics manufacturing. Our Responsible Sourcing Principles set processes and performance requirements for all suppliers so as to identify, manage, and address risks in the areas of human rights, labor rights, the environment and business integrity.

![]()

Our main contribution to SDG 12 relates to the improvements in the life cycle impacts of our products. We have adopted science-based targets for greenhouse gas emissions, which we aim to reduce by 60% by 2040 (using 2010 as the base) across both our own operations and value chain. In 2017, PMI made the CDP Climate A list for the fourth year in a row and achieved CDP A list status for both Water and Supplier Engagement for the first time.

![]()

Illicit trade fuels criminal activity and corruption, making our efforts to tackle illicit tobacco trade of particular relevance for SDG 16. We continue to invest time, effort and resources in maintaining the integrity of our supply chain. Through PMI IMPACT, a global initiative supporting organizations in developing and implementing projects to fight illegal trade and related crimes, 32 projects were selected in 2017 for the first funding round of approximately $28 million. A further 157 expressions of interest were received for the second funding round.

We continue to align our practices with all SDGs. Our Sustainability Report (available at https://www.pmi.com/sustainability) provides a comprehensive overview of our performance.

Note: Unless otherwise stated, all data as at end December 2017.

Board of Directors

Harold Brown 2,3,5

Counselor, Center

for Strategic and

International Studies

Director since 2008

André Calantzopoulos

Chief Executive Officer

Director since 2013

Louis C. Camilleri

Chairman of the Board

Director since 2008

Massimo Ferragamo 3,5

Chairman,

Ferragamo USA Inc.

Director since 2016

Werner Geissler 1,2,3,5

Operating Partner,

Advent International

Director since 2015

Jennifer Li 1,3,4

Chief Executive Officer and

General Managing Director,

Baidu Capital

Director since 2010

Jun Makihara 1,3,5

Retired Businessman

Director since 2014

Sergio Marchionne 3,5

Chief Executive Officer,

Fiat Chrysler

Automobiles N.V.

Chairman, Ferrari N.V.

Chairman, CNH

Industrial N.V.

Director since 2008

Kalpana Morparia 3,4,5

Chief Executive Officer,

South and South East Asia,

J.P. Morgan Chase

Director since 2011

Lucio A. Noto 1,2,3,4

Managing Partner,

Midstream Partners, LLC

Director since 2008

Frederik Paulsen 3,5

Chairman, Ferring Group

Director since 2014

Robert B. Polet 2,3,4,5

Chairman, Rituals Cosmetics

Enterprise B.V.

Director since 2011

Stephen M. Wolf 1,2,3,4,5

Managing Partner,

Alpilles, LLC

Director since 2008

- Committees

- Presiding Director, Lucio A. Noto

- 1Member of Audit Committee, Jennifer Li, Chair

- 2Member of Compensation and Leadership Development Committee, Werner Geissler, Chair

- 3Member of Finance Committee, Jun Makihara, Chair

- 4Member of Nominating and Corporate Governance Committee, Kalpana Morparia, Chair

- 5Member of Product Innovation and Regulatory Affairs Committee, Harold Brown, Chair

Company Management

André Calantzopoulos Chief Executive Officer

Massimo Andolina

Senior Vice President,

Operations

Drago Azinovic President, Middle East & Africa Region and PMI Duty Free

Werner Barth

Senior Vice President,

Commercial

Charles Bendotti

Senior Vice President,

People & Culture

Patrick Brunel Chief Information Officer

Frank de Rooij

Vice President,

Treasury &

Corporate Finance

Frederic de Wilde

President, European

Union Region

Marc S. Firestone

President, External Affairs

& General Counsel

Paul Janelle

Vice President,

Corporate Planning &

Business Development

Stacey Kennedy

President, South &

Southeast Asia Region

Martin G. King Chief Financial Officer

Andreas Kurali Vice President and Controller

Marco Mariotti

President, Eastern

Europe Region

Jacek Olczak Chief Operating Officer

Jeanne Pollès

President, Latin America

& Canada Region

Paul Riley

President, East Asia

& Australia Region

Jaime Suarez Chief Digital Officer

Jerry Whitson

Deputy General Counsel

and Corporate Secretary

Miroslaw Zielinski

President, Science

& Innovation

PDF Downloads

- Letter to Shareholders

- CHANGE - Designing a Smoke-Free Future

- Our Approach to Sustainability

- Board of Directors & Company Management

- Shareholder Information

- Comparison of Five-Year Cumulative Total Shareholder Return

- Selected Financial Data — Five Year Review

- Management's Discussion and Analysis of Financial Condition and Results of Operations

- Consolidated Balance Sheets

- Consolidated Statements of Earnings

- Consolidated Statements of Comprehensive Earnings

- Consolidated Statements of Stockholders' (Deficit) Equity

- Consolidated Statements of Cash Flows

- Notes to Consolidated Financial Statements

- Report of Independent Registered Public Accounting Firm

- Report of Management on Internal Control Over Financial Reporting

- Reconciliation of Non-GAAP Measures