Travelers had a terrific 2013 despite what remains a challenging business environment. We posted net income of approximately $3.7 billion, reflecting strong underlying underwriting margins across our business segments, continued contributions from favorable prior year reserve development, more modest catastrophe losses than in recent years and solid net investment income.

We delivered record net income per diluted share of $9.74, up 55 percent from 2012, return on equity of 14.6 percent and an operating return on equity of 15.5 percent. We ended the year with a book value per share of $70.15, an increase of 4 percent over the prior year-end, and we returned more than $3 billion to our shareholders through share repurchases and dividends.

Each of our business segments contributed to the company's profitability. Our Business Insurance GAAP combined ratio in 2013 improved 5.5 points to 91.9 percent from 2012, and we posted record high net written premiums of $12.2 billion, up 3 percent from 2012. Our Financial, Professional & International Insurance GAAP combined ratio of 84.3 percent in 2013 was essentially unchanged from 2012, and our Personal Insurance GAAP combined ratio in 2013 improved 13.0 points from 2012 to 88.9 percent.

We could not be more pleased with our performance in 2013 and the value we created for our shareholders. It is a testament to our great strength as underwriters on both sides of the balance sheet.

It has been ten years since the insurance company you know today was formed by the merger of Travelers Property Casualty Corp. and The St. Paul Companies, Inc. Over the last decade, we have supported our customers and agents during a period in which the United States experienced some of the costliest natural catastrophes on record, as well as a deep recession precipitated by the global financial crisis.

During this time, our focus on delivering top-tier operating return on equity by generating appropriate returns on our products has created significant shareholder value.

From the beginning of 2005, the first full year after the merger, through the end of 2013, we have delivered an average annual operating return on equity of 13.1 percent, returned more than $27 billion in capital to our shareholders through dividends and share repurchases, and grown book value per share at a compound annual growth rate of 9 percent. Total return to shareholders over that period, including dividends reinvested, exceeded 200 percent.

...our focus on delivering top-tier operating return on equity by generating appropriate returns on our products has created significant shareholder value.

We will continue to take the steps that we believe will help us improve returns consistent with our long-held objective of producing mid-teens operating return on equity over time, the lens through which we view virtually every decision we make.

Our success in 2013 has its roots in initiatives we began to implement in 2010 when we made it our goal to increase the profitability of our products through thoughtful, appropriate rate gains and improved terms and conditions.

Our success in 2013 has its roots in initiatives we began to implement in 2010 when we made it our goal to increase the profitability of our products through thoughtful, appropriate rate gains and improved terms and conditions.

The returns on many of our products had deteriorated over time due to generally declining pricing, higher losses arising from more volatile weather patterns and the impact of historically low interest rates. We leveraged our industry-leading data and analytics to improve the price and the terms and conditions of our products on a granular account-by-account or class-by-class basis and, importantly, we did so with the express intention of not disrupting our agents, brokers or customers.

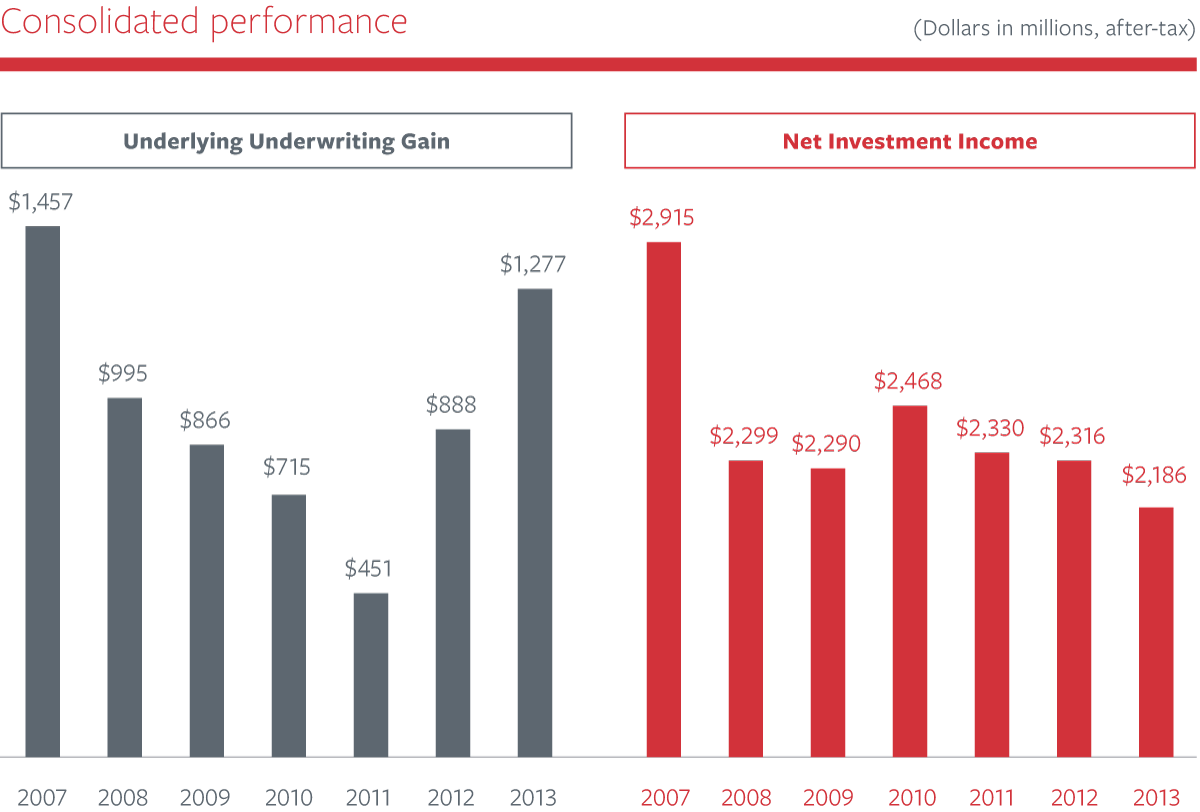

As the following charts show, underlying underwriting gain (which excludes the impact of prior year reserve development and catastrophe losses) was approximately $1.3 billion in 2013 — almost three times higher than in 2011. This dramatic rise more than offset the decline in net investment income resulting from lower yields.

In order to achieve our return objective, we will continue to execute on this strategy to seek improved returns on our products — particularly as we expect volatile weather to persist and interest rates to remain low.

We are proud of our results in 2013, but we also understand that past achievements are no guarantee of future performance. We remain committed to underwriting fundamentals as we adapt to changes in the broader economic and business environment and address emerging risks in new and innovative ways.

As a general matter, we insure the output of the economy. Consequently, our ability to grow our business is challenged in a low-growth economic environment. We are not going to respond by changing our approach to balancing risk and reward — either in our underwriting or in our investment activities. Instead, we will continue to develop better products for our agents and customers, enhance services and capabilities, and invest in technology to increase efficiency and improve our customers' experience. We will continue to be creative and inventive, bringing our data and analytics expertise and our significant resources to bear to help our agents and customers manage risk.

We also will continue to look at attractive opportunities outside the United States. Our acquisition of Dominion last year was one such opportunity, and one that has given us an exceptional platform from which to expand our commercial lines business in Canada.

We remain committed to underwriting fundamentals as we adapt to changes in the broader economic and business environment and address emerging risks in new and innovative ways.

In the evolving and dynamic insurance industry, change can be rapid and dramatic — as we have seen in the automobile insurance market and in the traditional reinsurance market, where alternative sources of capital have been introduced. Technology also has played an important role by altering the ways products are developed and distributed and by offering new methods for interacting with customers.

To remain competitive in the face of change, we are constantly recalibrating. For example, the adoption of comparative rating technology by independent agents, customers' changing expectations, and our efforts to raise rates had all meaningfully affected our new auto business volume. In response, in 2013 we introduced Quantum Auto 2.0, a more competitively priced product supported by significant expense reduction initiatives, which we developed with input from agents to meet the needs of a broader customer segment increasingly focused on value. We are very encouraged by initial market response.

Remaining true to our core as underwriters who thoughtfully balance risk and reward, we will keep taking actions such as these to remain an industry leader and to continue to deliver shareholder value.

To remain competitive in the face of change, we are constantly recalibrating.

The strong foundation we have built over 160 years is rooted in our commitment to our employees and the communities in which they, our customers and our agents live and work. Over the last five years, Travelers and Travelers Foundation have given more than $100 million to charitable and community organizations. We are pleased that for the seventh consecutive year, we were named to one of the Dow Jones Sustainability Indices in recognition of our business practices and our commitment to delivering meaningful contributions to our communities. We also are proud to have been recognized by both DiversityInc and G.I. Jobs magazines for initiatives that promote inclusion.

I want to express my gratitude to all of the individuals who helped make this a tremendous year for Travelers. I am thankful for the incredible dedication and talent of our employees, the support and partnership of our agents and brokers, and the leadership and guidance of our Board of Directors.

Jay S. Fishman, Chairman and Chief Executive Officer

On Nov. 1, 2013, we completed our acquisition of The Dominion of Canada General Insurance Company, significantly strengthening Travelers' presence in Canada. Travelers and Dominion are a strong strategic fit with complementary businesses.

— Dominion's extensive distribution network and established customer base provide an exceptional platform for expanding the commercial lines business in Canada.

— Combining Travelers Canada's existing surety, management liability and commercial middle market portfolios with Dominion's small commercial and personal products creates an organization with significant product breadth and a balanced mix of businesses.

— The integrated organization will leverage enterprise competitive advantages, including underwriting expertise, sophisticated data and analytics, and leading claim and risk control capabilities.

We focus our giving primarily on education. We also help strengthen communities by fostering small business development, and supporting community developments and the arts to sustain vibrant communities. In addition, our employees contribute many thousands of volunteer hours.

— In 2013, Travelers and the Travelers Foundation gave more than $21 million to charitable and community organizations, for a total of more than $100 million over the last five years.

— Travelers EDGE®, our signature education initiative, reached more than 3,200 underrepresented students during the year and provided 116 students with direct financial support.

— Our Small Business Risk Education program, in partnership with Valley Economic Development Center, Women's Business Development Center and Accion Chicago, provided workshops on risk management for 86 small businesses and helped more than 30 develop safety risk management plans.

— We have joined forces with Habitat for Humanity® and the Insurance Institute for Business and Home Safety to help communities build fortified homes to better withstand future storms in coastal regions of the country.

The Travelers Institute provides thought leadership on critical issues facing our industry.

— The Small Business-Big Opportunity initiative, now in its third year, brought public officials, small business owners and other thought leaders together in Chicago and Boston to elevate the dialogue around small business challenges and opportunities.

— The Institute's third annual “Kicking Off Hurricane Preparedness Season” symposium brought business owners and disaster preparedness professionals to the New York Stock Exchange to discuss lessons learned from Storm Sandy.

— We launched our Consumer Insurance Education Symposia Series in 2013. The program offers insights and information about insurance and personal safety to help people make informed decisions on how to protect their families and assets.

— The Institute screened Overdraft at more than 45 universities. This award-winning nonpartisan documentary, made possible by Travelers in collaboration with public television, highlights the national debt and its implications for individuals and U.S. competitiveness.

The way people buy personal auto insurance has changed dramatically in recent years. Consumers are making purchase decisions based primarily on price — driven largely by price-focused advertising from many auto insurers, consumers' access to pricing information online, and agents' increasing reliance on comparative rating technology for price comparisons.

Travelers launched Quantum Auto 2.0® in 2013. This new auto product offers more competitive pricing to a broader range of consumers. We believe it will help us compete more effectively in the marketplace and will strengthen our relationship with our independent agent partners. In fact, the product was developed in close collaboration with agents.

Quantum Auto 2.0 was available in 18 states at the end of 2013, and we expect to roll it out to the majority of states in 2014.

Travelers is organized into three business segments: Business Insurance; Financial, Professional & International Insurance; and Personal Insurance. For more information about Travelers and its products and services, visit travelers.com.

Business Insurance offers a broad array of property and casualty insurance products and services to its clients. They range from small “Main Street” businesses and midsized and specialty companies to Fortune 100™ corporations. Business Insurance is organized into underwriting and marketing groups focused on particular markets, industries or product lines. Select Accounts primarily sells packaged property and casualty coverage to small businesses. Commercial Accounts markets a unique set of products that deliver specialized underwriting expertise, claim, and risk control services to midsized domestic companies with global exposures in over 20 targeted industry segments. In addition, business units in the Target Risk Underwriting group provide insurance products and services to address large property, inland marine, ocean marine, equipment breakdown and excess casualty risks. Business units in the Industry-Focused Underwriting and Specialized Distribution groups tailor coverage to various industries, including oil and gas, technology, agriculture, trucking and construction, as well as to the public sector.

Financial, Professional & International Insurance includes the Bond & Financial Products business and the International business. Bond & Financial Products provides a wide range of customers with bond and insurance products and risk management services. Coverages include performance, payment and commercial surety and fidelity bonds for construction and general commercial enterprises, as well as management liability and employment practices, fiduciary and professional liability coverages, primarily for U.S.-based businesses. In addition, the business provides traditional property and casualty coverages to financial institutions. The International business offers specialized insurance and risk management products and services, property and casualty insurance products, and management liability and professional liability coverages in Canada, the United Kingdom and the Republic of Ireland, and internationally through its operations at Lloyd's. The International business also provides personal and small commercial insurance and surety bonds in Canada. Travelers' acquisition of Dominion closed Nov. 1, 2013. In addition, the company owns 49.5 percent of J. Malucelli Participações em Seguros e Resseguros S.A. (JMalucelli), its joint venture in Brazil. JMalucelli is currently the surety market leader in Brazil based on market share and also offers property and casualty insurance products.

1 Includes two months of Dominion premiums.Personal Insurance's broad array of property and casualty insurance products allows individuals to choose insurance solutions for their unique and changing needs. Travelers' primary auto and homeowners products are complemented by a suite of additional coverage offerings: umbrella, condominium, tenant, homesaver (dwelling fire), identity theft, valuable items, boat and yacht, and wedding/special events coverage. We offer our products and services through a network of approximately 11,500 independent agencies and through employee and affinity group and joint marketing arrangements. Customers can also contact us directly by phone, mobile device or at travelers.com.