2012 was an exciting and successful year for Walter Investment Management Corp. Building off 2011's strategic acquisition of Green Tree, the management team focused on executing against our strategic plan to deliver on the huge market opportunity in the specialty mortgage sector from the secular shift that we identified to our shareholders.

In addition to driving performance, we also continued to focus on building a more diverse, profitable and sustainable business model. This diversified business model has broadened our opportunity set, positioning us well to capitalize on the robust opportunities in the developing mortgage sector.

We were highly successful in our goal of capturing our share of the wave of servicing moving from the big banks to the specialty servicing sector over the last twelve months. Targeted MSR acquisitions from strategic partners supported the growth of our serviced book of business, while the acquisition of a highly regarded originations platform delivered a critical component to the long-term growth and sustainability of our business. The extension of our strong capabilities in the forward mortgage servicing space into the reverse mortgage sector diversified both our risk and earnings profiles.COMPARISON OF CUMULATIVE TOTAL RETURN

Price of Common Stock vs. Peer Group

| 2012 | 2011 | 2012 | ||||

| Walter Investment Management Corp. | 109.8% | $100.00 | $209.75 | |||

| NYSE Composite Index | 12.9% | $100.00 | $112.93 | |||

| 2012 Peer Group | 42.4% | $100.00 | $142.37 |

In 2012 we pursued opportunities to build sustainable, profitable growth into our model as we executed our strategic plan:

- The acquisition of approximately $128 billion in unpaid principal balance ("UPB") of Fannie Mae MSRs from Residential Capital, LLC ("ResCap") and Bank of America, N.A. was intentionally targeted to product backed by a strategic partner, which had a strong fit with our existing platform and servicing infrastructure, allowing us to mitigate the execution risk associated with these acquisitions.

- Taking advantage of a corporate development opportunity, we acquired the MetLife Bank servicing platform, expanding our product capabilities to Freddie Mac and Ginnie Mae, as well as to prime mortgage loans, while adding capacity to our servicing platform.

- Our acquisition of the ResCap originations platform enhances both the near-term and long-term value of our core servicing business. Capitalizing on current Home Affordable Refinance Program ("HARP") opportunities will allow us to drive strong revenues, and the platform also dovetails nicely with our ongoing commitments to serve our borrowers and help meet the goals of our strategic partner, Fannie Mae. In addition to the originations earnings provided, the retention and recapture capabilities of the platform strongly support core servicing by driving long-term revenue and extending the duration of the serviced portfolio.

- The extension of our capabilities in the forward mortgage space into the reverse mortgage sector through the acquisitions of Reverse Mortgage Solutions, Inc. ("RMS") and the entry into a contract to acquire Security One Lending ("S1L") will lead to the creation of a leading franchise in the reverse mortgage sector and further diversifies the risk and revenue profile of the Company. This sector has very attractive long-term growth prospects and is currently undergoing significant structural change, providing us with an opportunity to capitalize on those dynamics.

We expect that executing against our strategic plan and capitalizing on these business opportunities, while maintaining high standards for performance and compliance across the platform, will drive sustainable and profitable future growth for Walter Investment.

The additional business and execution against our strategic plan drove significant value for our shareholders, generating a total shareholder return since our April 2009 spin-off of over 600%. Our success in managing our growth has translated to solid earnings and cash flow, important factors in generating a total return for our shareholders of 110% in 2012.

Poised for continued growth

As we move into 2013, we are making sure that our day-to-day business has the efficiencies required to provide quality service for this larger volume of accounts and the infrastructure to support our growing portfolio of businesses.

Walter Investment is one of only a handful of players in the specialty servicing market, with the size and scale required to handle large portfolios–combined with the access to capital to facilitate continued growth. We anticipate these attributes will support our efforts to continue to drive sustainable growth for our core servicing business and allow us to win our share of transferred product which best fits our platform.

We believe the growth opportunity for not only the over-$1 trillion specialty servicing market, but also in other niches of the mortgage servicing sector, including the reverse mortgage market, will continue for some time.

Looking Ahead

In 2013, we will capitalize on and extend the successes of 2011 and 2012 as we look for sustained growth and top-notch performance from our core servicing business, a sizeable ramp-up in forward originations activity, and increased servicing and originations prospects for our reverse mortgage business, all of which we expect to combine to deliver strong financial results for our shareholders. The Company's growth beyond our core servicing platform is extremely important as we prepare for continued change in the mortgage industry. Though a significant number of assets transferred to specialty servicers in 2012, we expect that volume to remain steady for several years to come. Our skill in providing highly efficient service with a focus on compliance in each of our businesses will serve us well as we move beyond the bulk transfer opportunities in the special servicing market, driving our success for the long-term. We believe it is smart to position ourselves now for the transition to the transfer of a lower volume of distressed assets to special servicers.

Over the fast-paced period of the past 18 months, dating back to our transformational acquisition of special servicing leader Green Tree in 2011, our employees and leadership have done an outstanding job in combining operations and creating efficient processes, even as we have continued to grow.

I'd like to close by thanking all of our employees for their extraordinary efforts during 2012 and all of our business partners, clients, lenders and shareholders for their support, which made the remarkable accomplishments of 2012 possible.

In executing both our short- and long-term strategies, we remain highly focused on driving sustainable growth and maximizing shareholder return. I am energized and extremely optimistic about our prospects for continued success for 2013, as we work to achieve another year of excellent performance.

Mark J. O'Brien

Chairman and Chief Executive Officer

April 1, 2013

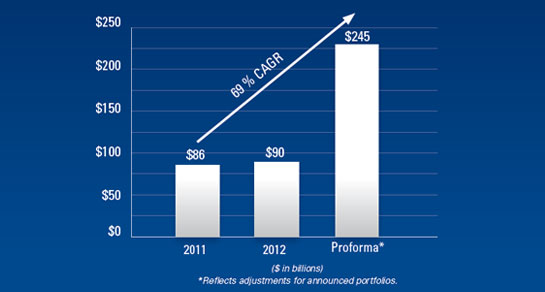

Significant Growth in UPB Serviced

Record growth in the Company's servicing portfolio significantly leverages our platform, accelerating growth in revenue and EBITDA.