|

Since late last calendar year, the recreational vehicle industry has definitely been on an upward trend. Although calendar 2001 shipments were down Statistics point to a healthy future. A 2001 consumer preference survey conducted by the University of Michigan showed that nearly one in 12 vehicle-owning households in the United States, or almost 7 million households, owns an RV. Furthermore, 16 percent of all vehicle-owning households stated an intention to buy a recreational vehicle in the future. That figure represents nearly 13 million households. The median age of an RV owner was 49 in 2001, according to the survey. The industry has worked successfully to expand the RV market to first-time buyers, and the survey shows that since 1997, a younger, less affluent group has entered the market by purchasing folding trailers. The University of Michigan survey summary states, “With the aging baby boomers now entering the prime age ranges for RV ownership, the data indicate that future demand for Recreational Vehicles will continue to grow during the decade ahead.”

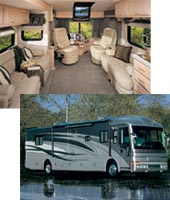

The progress in our RV Group as the year went by was noteworthy. Both sales and operating results improved steadily as we introduced new products and our Fiscal 2002 did not start off well, however. First-quarter RV sales declined 16 percent from the prior year to $266.3 million, and the Group lost $17.8 million at the operating income level. Sales in each segment were down on a year-over-year basis: motor homes by 9 percent, travel trailers by 25 percent and folding trailers by 10 percent. For the October quarter, revenues were down 15 percent from $349.3 million to $296.9 million and the Group lost $10.1 million. Again product sales declined from the prior year: motor homes by another 9 percent, travel trailers by 27 percent and folding trailers by 3 percent. But during the quarter we launched a brand-new diesel product, Revolution; began to sell our American Eagle diesel with full-body paint and a triple-slide floor plan; and introduced the redesigned Pace Arrow and Southwind—two of our most popular gasoline motor home brands We also used the Louisville trade show to present two new fifth-wheel travel trailers, Pride and Triumph. Third-quarter revenues began to show the effects of these product introductions, rising 11 percent to $278.3 million from $250.4 million in the prior year. The RV Group lost $9.2 million for the third quarter, compared with a loss of $29.7 million Fourth-quarter revenues improved a solid 28 percent from the year earlier to $371.4 million. The Group approached breakeven with a $442,000 loss from operations. Motor home revenues were up a remarkable 46 percent, and Fleetwood regained the number one market share position in Class A motor homes. Travel trailer revenues were up 5 percent from the year earlier and folding trailers gained 16 percent. In February we launched Providence, another diesel product. All three diesel products introduced during the fiscal year—Revolution, Excursion and Providence—compete at price points where we had not been participating. Later in the quarter, we also began to offer a 42-foot, 500 HP American Eagle. For the year, the RV Group brought in $1.2 billion in revenue and lost $37.5 million at the operating line. In fiscal 2001, the loss was $73.1 million on revenues of $1.2 billion. The change was primarily due to the improvement in motor homes from a loss position of $44 million to a slim profit for the year. Gross profit for the Group rose from 12.3 percent to 12.9 percent.

While Fleetwood has experienced market share erosion in the past few years, we were still the overall market share leader for calendar 2001 with 19.6 percent. Folding trailers have increased share consistently, and ended the year with Dealer relations received special attention this year, as we introduced retailer roundtables to gain valuable feedback; training materials, such as interactive CDs and an improved Website; and a book, Fleetwood RV Dealer Support, that provides easy reference to the resources we provide. We have instituted aggressive marketing programs to rebuild our inventories at the dealer level. These “pull-through” programs involve incentives and/or rebates and require the dealer to replace any of our sold products with new Fleetwood products. They have been key to our market share At the risk of oversimplifying, the RV market is driven by consumer confidence and the number of people in our target demographic profile, which primarily relates to age and discretionary income. Within that framework, individual companies market their products on the basis of innovative, functional and attractive products that have perceived value and are convenient to purchase. This means that our product development activities and dealer relationships are of paramount importance. Fleetwood differentiates itself by reminding consumers and dealers alike of our value message: SSQV, which translates into Size + Service + Quality = Value. Fleetwood has more brands and floor plans to choose from and more service points than any other RV manufacturer, and our quality assurance programs are geared toward ensuring that our RVs are built right from the start. Plus, our vastly improved product planning and product development processes are helping to assure that we build what our customers want. Consumer brand awareness is vital to our marketing efforts. For calendar 2001, Discovery was the third best-selling diesel brand; we had three of the top 10 Class A gasoline brands (Bounder, Southwind and Flair); both of our Class C brands, Tioga and Jamboree, Much of the recent work that we have done in design and innovation has been focused on our motor home brands, and that is reflected in market share statistics. Through March 2002, Discovery has moved up to number two in diesels, Southwind and Bounder’s sales are up 99 and 58 percent within the gas category over last year, respectively, and Pace Arrow, whose sales have increased 75 percent over last year, has joined the other three gasoline brands in the top 10. We have already begun to concentrate similar attention on our travel trailer brands, and we believe that they will soon show meaningful improvement. Our folding trailer division improved its product line with three new models of the Coleman Caravan, an expandable travel trailer that was introduced in 2000. Caravan’s distribution has quickly expanded throughout the United States and Canada to 160 dealerships, or half of the folding trailer network, and it continues to grow. All five Caravan models have slide-out front bedrooms, wide-access doors, oversized safety glass windows and a host of standard features that are typically reserved as options for most competitor brands.

We had a number of management changes in the RV Group, starting with Chuck Wilkinson’s promotion to executive vice president–operations in September 2001. In this position, Chuck now has responsibility for both the Housing Group, where he had been senior vice president up until his promotion, and the RV Group. Chuck has brought to the RV Group many of the successful cost-saving concepts he had utilized in the Housing Group, allowing him to focus quickly on issues with our core Chuck brought Frank Winegar in to head up operations for both the motor home and travel trailer divisions, which had been under separate leadership before. Frank was the general manager at our Decatur plant, where we build all of our diesel brands. Bob Thompson was promoted to vice president–product development after more than 30 years as a leader on our purchasing management team. In this position he, too, works with both travel trailers and motor homes. While cost cutting was less severe during fiscal 2002 than it was the prior year, we did close three travel trailer satellite plants, consolidating their production into other nearby facilities. We also continued to push for larger volume discounts for materials, combining RV and Housing purchasing power where appropriate. Inventory reduction was important at the beginning of the fiscal year, as we still had more aged products on dealer lots than is ideal. By the end of calendar 2001, the successful reduction allowed us to begin building inventories with fresh product in preparation for the summer selling season. In fact, our aged inventory ratio improved by 95 percent in motor homes and 35 percent in travel trailers from last year. We continue to make investments in our products, even beyond product planning and product development. For instance, our full-body paint facility in Decatur is up and running. It is a state-of-the-art facility that enhances our competitiveness in the important diesel market. No competitor has painting capabilities that surpass what we now have in either quality or capacity.

All in all, we’re moving forward with long strides. The industry is expected to have a bright future, and we’re regaining much of the momentum that we had lost in motor homes and travel trailers. Our new brands are gaining acceptance, and our mature core brands have seen some resurgence as we refurbish them. Our folding trailer division has provided steady sales and profit as well as an incredible share of the market, which some months reaches as high as 50 percent. We are excited about our product line, our distribution network and our service capabilities. And we know from experience that quality in these factors are key to generating market share increases and, far more importantly, to generating profits. | |||||||