Chief Executive’s review

BackContinued strategic progress

Financial review of the year

Our overall financial performance this year has been steady. Our major emerging markets operations have had a very strong year. In addition, Verizon Wireless (‘VZW’), our 45% owned associate in the United States, combined continued good revenue growth with substantial cash flow. On the other hand, the tough macroeconomic and regulatory environment in much of Europe has made revenue growth in that region increasingly challenging.

However, on a relative basis, we have held or gained share in most of our major markets, continuing last year’s trend. The quality of our network continues to improve, with high speed data now available across a growing proportion of our voice network in our European markets, and low frequency spectrum for 4G/LTE services now secured in Italy and Spain. Cash flow generation and shareholder remuneration, even after sustained network investment, continue to be significant.

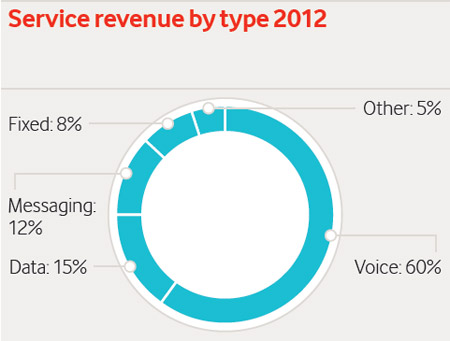

Group revenue for the year was up 1.2% to £46.4 billion, with Group organic service revenue up 1.5%* and data revenue up 22.2%*. Group EBITDA margin fell 0.8 percentage points, as a result of continuing high levels of commercial costs associated with the migration to smartphones, and the difficult trading environment in Spain in particular. Group EBITDA was £14.5 billion, down 1.3% year-on-year, but flat organically before restructuring costs.

Group adjusted operating profit was £11.5 billion, down 2.4% year-on-year but at the top of our guidance range of £11.0 billion – £11.8 billion based on guidance exchange rates. The decline in adjusted operating profit was due to the sale of our interest in SFR at the start of the year; on an organic basis, adjusted operating profit was up 2.5%*, as a result of the good performance at VZW.

We recognised £3.5 billion of net gains on the disposals of our interests in SFR and Polkomtel, and we recorded impairment charges of £4.0 billion relating to our businesses in Italy, Spain, Portugal and Greece primarily driven by lower projected cash flows within business plans and an increase in discount rates, resulting from adverse changes in the economic environment.

Free cash flow was £6.1 billion and within our guidance range of £6.0 billion – £6.5 billion for the year. The year-on-year decline reflected the loss of dividends from China Mobile Limited, the reduction in dividends from SFR, and the conclusion of our prior year working capital programme. Capex was up 2.3% at £6.4 billion, as we continued to maintain our significant level of investment to support our network strategy. In addition to our reported free cash flow we received an income dividend of US$4.5 billion (£2.9 billion) from VZW.

Adjusted earnings per share was 14.91 pence, down 11.0% on last year. The decline was driven by the loss of our share of SFR and Polkomtel profits, the loss of income from our interests in China Mobile Limited and SoftBank, and higher finance charges as the result of our decision to take advantage of low prevailing interest rates to fix a higher proportion of our debt.

The Board is recommending a final dividend per share of 6.47 pence, to give total ordinary dividends per share of 9.52 pence, up 7.0% year-on-year. During the year we also paid a special dividend of 4.0 pence per share, paid out of the income dividend we received from VZW. Total dividends per share were therefore up 51.9%.

Europe

Organic service revenue in Europe was down 1.1%* year-on-year. Excluding the impact of regulated cuts to mobile termination rates (‘MTRs’), service revenue grew by 1.4%*. As in the prior year, we saw a broad divide between the more stable major markets of northern Europe, with Germany, the UK and the Netherlands all growing; and the much weaker markets of southern Europe, with Italy and Spain suffering from strong competition and a very poor macroeconomic environment.

Data revenue growth was strong at 20.2%*, with smartphone penetration on contract customers of 44.9%, up 11.5 percentage points during the year. We have continued our major commercial push towards integrated voice, SMS and data tariffs, so that in the final quarter, 43.2% of consumer contract service revenue in our major European markets came from customers on integrated tariffs.

Organic EBITDA was down 4.5%*, and the EBITDA margin fell 1.5* percentage points. The decline in EBITDA margin was almost entirely driven by margin erosion in Spain, where we put through significant price cuts during the year. Elsewhere, we benefited from increased cost efficiency.

AMAP

Organic service revenue growth in AMAP was 8.0%*. Our two major businesses, India and Vodacom, reported growth of 19.5%* and 7.1%* respectively. In India, pricing showed clear signs of stabilisation after a prolonged price war. In South Africa, growth continued to be strong, despite significant price cuts on data tariffs. In Australia, revenue declined sharply as our network perception continued to suffer after service issues experienced more than a year ago.

Organic EBITDA was up 7.8%* with EBITDA margin down 0.1* percentage points. EBITDA margins in our two biggest AMAP businesses, Vodacom and India, increased, but this positive impact was offset by a significant decline in the EBITDA margin in Australia.

Verizon Wireless

Our share of the net income of VZW represented 42.2% of our Group adjusted operating profit. VZW enjoyed another very strong year, with organic service revenue up 7.3%* and EBITDA up 7.9%*. Our share of profits from VZW amounted to £4.9 billion, up 9.3%* year-on-year. In December 2011 VZW announced the proposed acquisition of 122 Advanced Wireless Services spectrum licenses, covering a population of 259 million, from SpectrumCo for US$3.6 billion (£2.3 billion).

For a detailed analysis of our financial performance for the year, please download our Operating results.

Priorities

All the elements of our Group strategy are covered in detail elsewhere in the annual report. In this section, therefore, I think it is more useful to give you some deeper insight into what I see as the key priorities for the business over the year ahead, and where Vodafone’s leadership team will be focusing their energies. Some of these priorities are, indeed, specific constituents of our strategy; others reflect our ability to influence the markets in which we operate or the resources we have at our disposal to execute our strategy.

Data

After many years of investment and technological development, the customer experience of mobile data services in developed markets has now generally reached very good levels, with for example, high quality streamed video now widely available. However, operators in Europe have three significant challenges when it comes to data services: pricing, commercial costs and customer usage.

Our progress on pricing is inconsistent. In the best markets we are successfully generating incremental ARPU of €10 a month as we migrate customers to smartphones and data packages. However, in others the uplift is more marginal, often driven by the level of competition in the market. Our goal over the next 12 months is to achieve a more consistent revenue return from data – through faster, more reliable networks, significantly enhanced customer service, and a range of new and differentiated services accessible through the handset.

Unfortunately, almost all of the incremental ARPU we are generating ends up being invested in commercial costs. The smartphone market is still skewed to the high end, which has driven significant increases in average customers acquisition and retention costs over recent years. Looking ahead, we see scope for more competition in the handset market as new vendors seek to enter the market and more established players look to grow in the mid-tier. This should drive down our customer investment costs.

The pressure on our top line, particularly in Europe, is intense and we need to protect profitability through better cost discipline. Commercial costs are the biggest single cost in our business and we will not successfully stabilise margins unless we manage these acquisition and retention costs more rigorously.

Finally, we need to find a way to stimulate customer consumption of data. Average data usage on a smartphone in Europe is around a third of that in the US and less than a fifth of that in some parts of Asia. We have to work more effectively at showing customers they can use data more freely while still controlling their spend, and also helping them understand what they can actually use data services for. The ongoing upgrade to our European network, creating a platform which offers high speed data services everywhere we provide a voice connection, will in itself breed additional demand.

Regulation

The telecoms industry continues to experience intense regulation on mobile termination rates (‘MTRs’), and voice and data roaming. In addition, auctions of new spectrum are often structured to favour new entrants at low prices. The consequence of these actions is to suppress investment in next generation mobile and fixed networks, and thus to limit our ability to provide high speed data across a broad footprint. This universal access to high speed connectivity is a key goal of regulators across Europe, and will not be achieved if the current onerous level of regulation continues. I see it as a major priority to continue to work with my industry peers and local and EU regulators to find a fairer balance which protects customers while encouraging investment and competition.

I have been very vocal in my objection to this ongoing regulation, much of which has not produced the results intended by regulators. For example, reductions in mobile termination rates since 2009 have not meant that prices fall faster for mobile consumers and have not encouraged fixed line customers to make more calls to mobiles. If anything, the opposite has happened. I believe regulators should avoid auto pilot regulation that does not check whether regulation has achieved its purpose.’

Talent and diversity

We continue to have high standards for talent and to strengthen our senior leadership population. Last year we promoted 20 internal talents to the senior team, of which 30% were female, and we hired 15 external candidates of which 20% were female. We continue to rotate top talents during their Vodafone careers. This not only stimulates the cross-pollination of ideas and best practices between markets, it also develops the cultural sensitivities that will be key in our future senior management.

As with many large companies, we have a disproportionate representation of men in our middle and senior management. I strongly believe that women have a range of skills and insights that are often different from, but complementary to, those of men, and management teams that do not reflect a better balance are the worse for it. Currently 19% of our senior leadership team is female, up from 17% in the prior year. We have set a target of increasing the percentage year-on-year.

Organisational change

Big organisations inevitably have a tendency towards bureaucracy, complexity and caution. Often the right option does not get pursued because of fear of failure or a desire not to “rock the boat”, or the time between decision and execution is too long and the opportunity has passed.

Over the last three years, we have embarked on a cultural change programme called The Vodafone Way which is designed to engender a cultural shift in how we do business, both internally and externally. The key building blocks of The Vodafone Way are speed, simplicity and trust. I believe we are already beginning to see the benefits of this in more personal accountability and better decision making, but we need to drive this throughout the Group and our leaders must be responsible for exhibiting the right behaviours. Download Our people to read more .

Prospects for the 2013 financial year

Vodafone is well positioned for the coming year. We have continued to gain revenue share in many of our markets, as we lead the migration to smartphones and the adoption of data services by the mass market. Our exposure to the enterprise segment and our emerging market assets will continue to be strategic drivers of our performance and, with VZW set for another strong year, our overall geographical exposure is a positive differentiator. We have a strong balance sheet and will continue our major focus on shareholder remuneration, while reinvesting substantially in our network to enhance the customer experience.

Nevertheless, the environment in Europe is set to remain very difficult. Weak consumer demand from poor macroeconomic conditions, a harsh regulatory backdrop and ongoing competition create material barriers to growth. MTRs alone will have a negative impact, similar in percentage terms to the 2012 financial year, on service revenue growth in the 2013 financial year.

On an underlying basis, excluding foreign exchange rate movements, we expect growth in adjusted operating profit, and stability in free cash flow, compared with the 2012 financial year.

Adjusted operating profit is expected to be in the range of £11.1 billion to £11.9 billion.

We anticipate free cash flow for the coming year of £5.3 billion to £5.8 billion. The loss of dividends from SFR following the sale of our 44% stake, as well as a weaker euro year-on-year, are the main differences from the 2012 financial year. We expect capital expenditure to remain broadly steady on a constant currency basis.

We expect the Group EBITDA margin decline to continue its improving trend, supported by continued strong growth and operating leverage in our AMAP region, and improving control of commercial costs in Europe.

We remain committed to continuing to deliver a good return to our shareholders through the achievement of our targets for free cash flow and dividend growth; our focused investment in profitable growth areas; and our ongoing capital discipline.

Vittorio Colao

Chief Executive

Year in review 2012

Year in review 2012