Evolving our strategy to address industry headwinds

During the past year we have experienced a significant fall in our share price. Despite good performance in most markets, we faced increasing competition in Spain and Italy, as well as pressures in South Africa during the second half of the year. Although we met our financial guidance, our revenue growth slowed during the year and 5G spectrum auction costs were high, reducing our financial headroom and contributing to downward pressure on our share price. A decline in the value of our listed stake in Vodafone Idea was a further headwind.

Rebasing the dividend to support Vodafone’s transformation and rebuild headroom

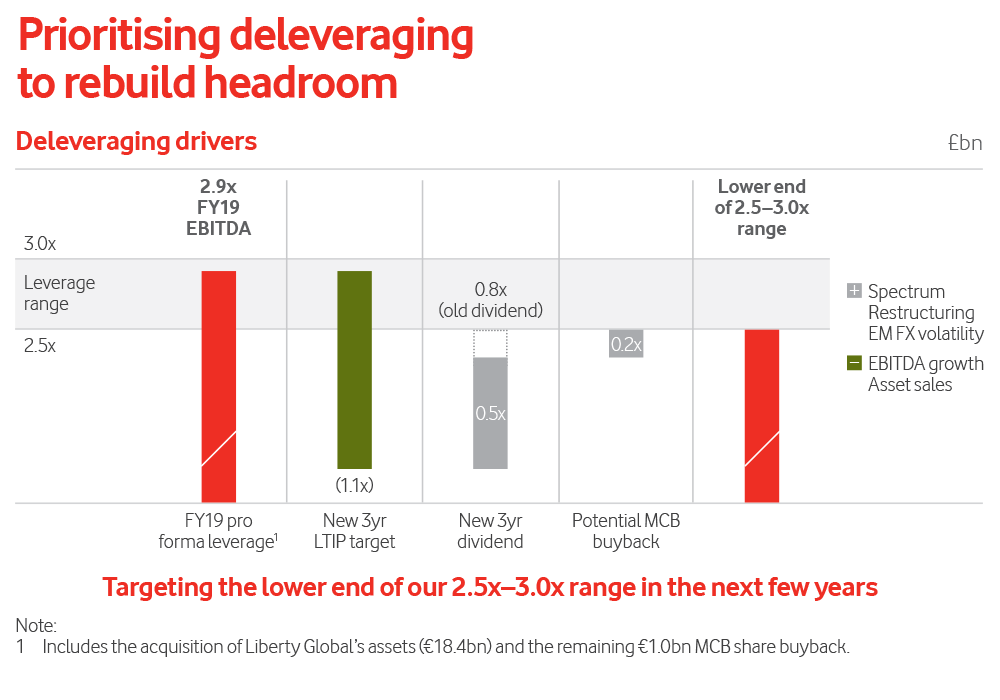

Vodafone is at a key point of transformation – deepening customer engagement, accelerating digital transformation, radically simplifying our operations, generating better returns from our infrastructure assets and continuing to optimise our portfolio. In order to support these goals and to rebuild headroom, the Board has made the decision to rebase the dividend to 9 eurocents per share. This will help us to reduce debt and move to the lower end of our targeted 2.5x-3.0x leverage range in the next few years. In her review, Margherita describes the comprehensive programme of further deleveraging actions that we are taking, including the sale of our business in New Zealand for €2.1 billion which we announced in May 2019.

The Board’s decision to rebase the dividend was not taken lightly, but we believe it is a necessary step to ensure that we deliver on our ambition to improve returns on capital, grow free cash flow and drive shareholder value. Going forward we intend to maintain a progressive dividend policy.

Executing at pace on our new strategic priorities

Under the leadership of our new Chief Executive, Nick Read, the Board has evolved the Group’s strategy to respond to ongoing industry headwinds. Nick and his team have executed at pace and made encouraging progress on improving the consistency of our commercial performance, particularly in Spain and Italy. Mobile contract churn fell to a record low level in the year, and we have already put in place actions which will deliver over half of our FY21 cost reduction targets. We are also making rapid progress in our efforts to improve capital efficiency through our ‘smart capex’ approach in combination with a number of important industry partnerships, particularly for 5G network sharing. These sharing agreements also unlock potential tower monetisation options.

On track to complete the Liberty Global deal in July

In May 2018, we announced the acquisition of Liberty Global’s assets in Germany, the Czech Republic, Hungary and Romania. This acquisition positions Vodafone as Europe’s largest next generation network (‘NGN’) infrastructure owner, the leading converged challenger to the incumbents in these markets and unlocks synergies with an NPV of over €7.5 billion. We have offered a package of remedies to the European Commission, including a broadband wholesale access agreement with Telefonica Deutschland, and we expect the acquisition to complete in July 2019.

Recapitalising Vodafone Idea in India

We completed the merger of Vodafone India and Idea Cellular in August 2018, creating a new leading player, Vodafone Idea. However, the competitive environment remained challenging during the year as industry prices remain below cash costs. In response, we have accelerated our integration efforts, targeting full realisation of cost synergies by FY21, two years earlier than originally planned. In addition, we decided to strengthen Vodafone Idea’s balance sheet by raising €3.2 billion of new equity through a rights issue, which completed in May 2019. Vodafone contributed €1.4 billion (funded by a loan secured against our Indian assets), and our partner Aditya Birla Group committed €0.9 billion. These funds, together with the opportunity to monetise its tower and fibre assets, will enable Vodafone Idea to continue to invest and to participate fully in a potential industry recovery.

During the year we also made progress in securing regulatory and shareholder approvals for the merger of Indus Towers and Bharti Infratel, which will create India’s leading listed tower company. The Group’s stake in the combined business was worth approximately €3.2 billion at the end of March, as implied by the Bharti Infratel share price.

Good performance in most markets, with challenges in Spain and Italy

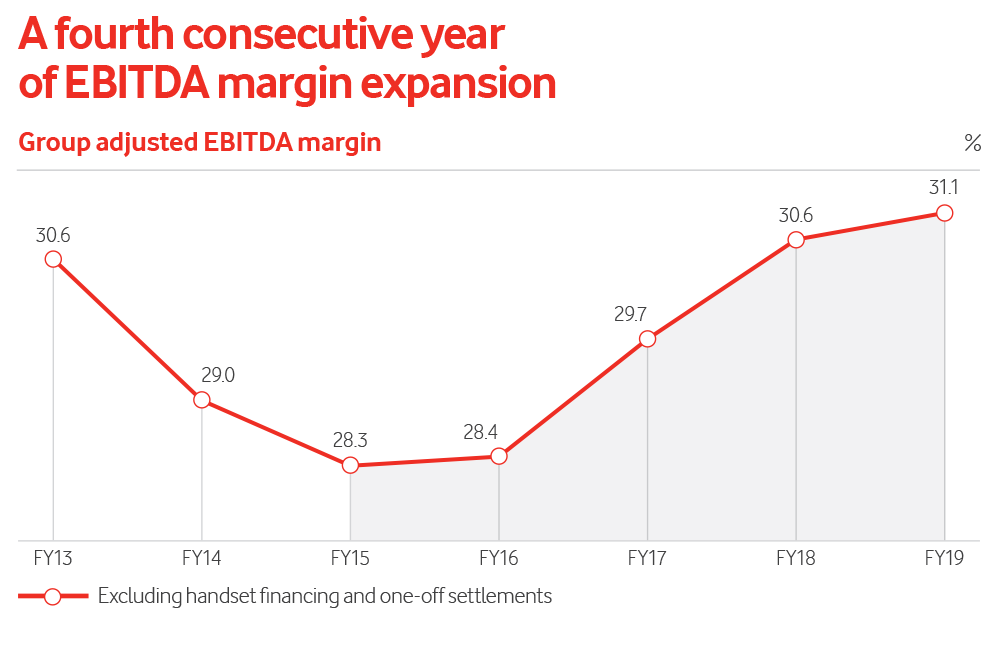

We maintained underlying organic growth with service revenues up 0.3%1, EBITDA up 3.1%1 and most importantly EBIT up 9.4%1 in the year.

On a reported basis our business declined due to the sale of Qatar, a lower benefit from handset financing in the UK and a number of settlements in the prior year.

This performance reflected good revenue and profit growth in Germany, UK and Other Europe, offset by earnings declines in Spain and Italy. In Spain we took action to commercially reposition the business given increased price competition in the value segment, while in Italy we faced a new entrant in the mobile market. South Africa also slowed in the second half, impacted by a weak macroeconomic environment and new data regulation.

Delivering ‘a better future’ requires regulators to play their part

One of Nick’s first decisions was to put the company’s refreshed purpose – ‘We connect for a better future’ – at the core of our strategy. We have committed to improve one billion lives and halve our environmental impact by 2025. This ambition to enable the digital society, support inclusion for all and protect our planet is part of our broader commitment to operating responsibly, recognising that over the long-term the success of our business is inextricably linked to the success of the communities in which we operate.

However, policy makers and regulators also need to play their part by ensuring a competitive environment that provides an adequate return on the substantial investments that will be needed to meet these important societal goals. This is especially important in Europe, where returns on capital have fallen to unsustainably low levels.

Improving return on capital and driving commercial and operational performance will be the top priorities for your Board and for the company, aiming to make Vodafone the best value proposition in our industry for customers and for shareholders.

Gerard Kleisterlee

Chairman

- Excluding UK handset financing and one-off settlements.